Crypto is seeing a shuffling of cards of sorts. Long-term holders of Bitcoin have eased up on selling after months of steady reductions, while large Ethereum wallets have been piling on more tokens, according to recent reports.

Traders remain careful as prices swing and data gives mixed signals about where money is moving next.

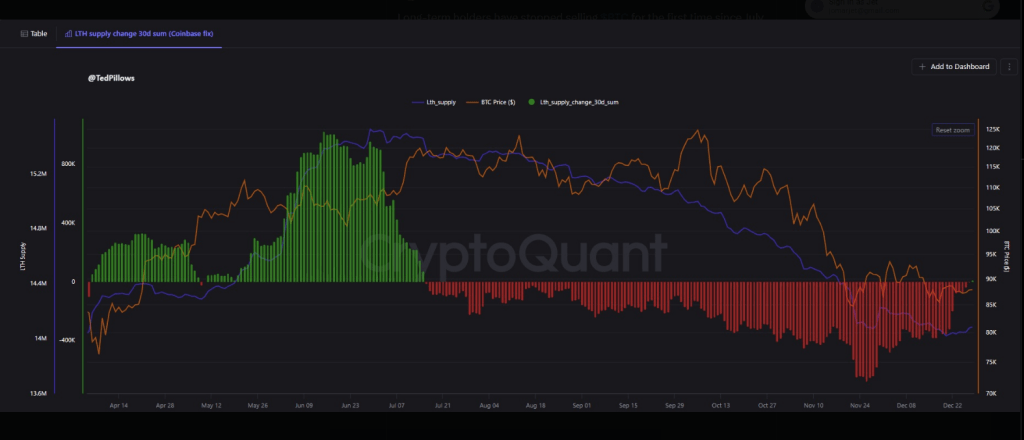

According to on-chain figures cited in market commentary, wallets that have held Bitcoin for at least 155 days cut their total from nearly 15 million coins in mid-July to a little over 14 million in December.

Ether Whales Increase Holdings

Based on reports quoting CryptoQuant and a crypto newsletter, addresses holding large amounts of ether have added around 120,000 ETH since Dec.26.

Analysts at Milk Road said wallets with 1,000+ ETH now control roughly 70% of the supply, and that share has been climbing since late 2024.

Heavy concentration can point to strong conviction from a few players, and it can also leave the market exposed if those same wallets move to sell. Both outcomes would shape liquidity and price swings.

Long-Term Bitcoin Holders Pause Selling

Crypto investor Ted Pillows was quoted on X saying long-term holders “have stopped selling Bitcoin for the first time since July 2025,” a point that market watchers flagged as a possible turning point in holder behavior.

That change in activity is often read as a sign of exhaustion after a long stretch of distribution. It can mean sellers are done for now, but it does not guarantee a fresh uptrend.

Capital Moves And Market Chops

Garrett Jin, formerly of exchange BitForex, suggested that some capital may be shifting from metals into crypto after a short squeeze in precious metals.

Reports referenced gains in silver and platinum as part of the backdrop. At the same time, bitcoin traded in a tight range recently, bouncing between $86,740 and $90,060 over seven days, a pattern that has kept many traders on edge.

Silver’s price rose by more than 1,570% this year, a figure that would represent an extreme move and which will need independent confirmation.

Meanwhile, bitcoin remains well below its record highs. Some analysts argue that lukewarm ETF demand and market mechanics, including derivatives and liquidity patterns, play a larger role in price action than headline sentiment.

Taken together, the data points to a market that is stabilizing more than rallying decisively. Large ether holders are buying, long-term bitcoin owners have paused selling, and US flows look soft.

Featured image from GaijinPot Blog, chart from TradingView