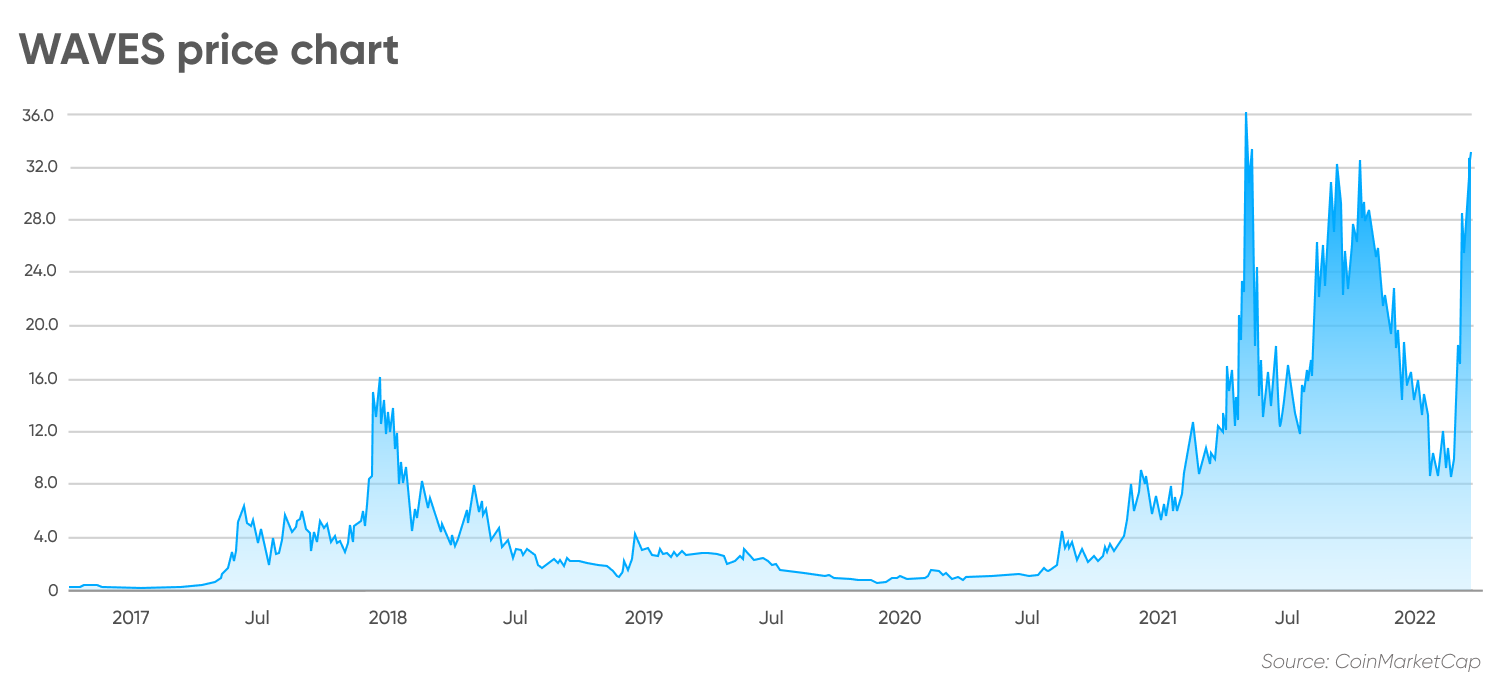

April saw it initally dive off the edge and then continue to gently slide downwards so that it has lost 74% of its value since the end of March. Today (27 April) another 3% has been trimmed off bringing the price down to $16. It started 2022 at $14.8.

The pattern of the price chart for the last few weeks is unusual even for a cryptocurrency and the founder of Waves, Sasha Ivanov was blaming short sellers.

The coin, which launched in June 2016, had broken out of the broader market trend as the project has announced major upgrades and cryptocurrency users have moved money into Ukrainian and Russian developed coins. Waves was created by Ukrainian scientist Sasha Ivanov.

What is the WAVES coin and what does its recent outperformance suggest for the future?

In this article, we look at the project’s development and some of the latest Waves price predictions.

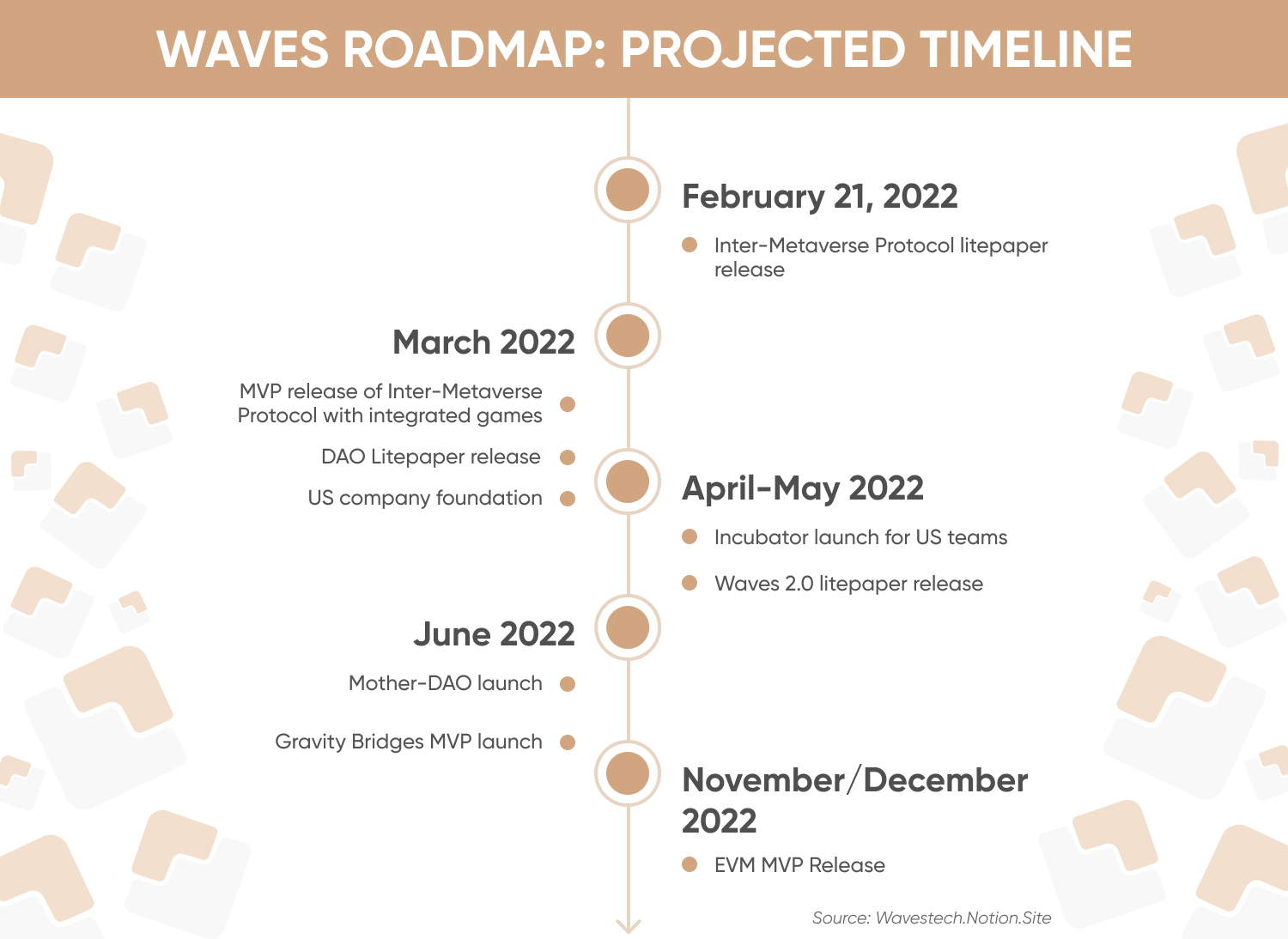

Waves plans major upgrade

Launched in June 2016 with one of the first initial coin offerings (ICOs), Waves initially intended to improve on the original blockchains by offering increasing speed and utility in a user-friendly way. The project has since added new features and made various changes. Its focus now is on providing an open-source platform for decentralised applications (DApps) using Proof-of-Stake (PoS) consensus to process transactions with a low carbon footprint.

Before Waves, Ivanov launched the now-defunct Coinomat exchange and the indexing site Cooleindex. He also created CoinoUSD, an early US dollar pegged stablecoin.

“Waves’ technology stack can benefit in any use cases that demand security and decentralisation – open finance, personal identification, gaming, sensitive data and many others,” according to the project’s website.

“The Waves blockchain started 2022 with more than two million user wallets and a vibrant community across successful projects such as Waves.Exchange, Vires.Finance and WavesDucks.com. With 100k+ transactions in the mainnet daily and more than 250 validators, Waves boasts a throughput of thousands of transactions per second,” the website states. “The current total value locked (TVL) in the network is $2bn and about 80% of tokens are locked in staking. All of these have been achieved without any VC funding in the last five years.”

The Waves blockchain supports decentralised finance (DeFi) apps such as Vires.Finance, a peer-to-contract money market protocol launched in 2021 that uses a pool-based strategy for loans. In March 2021, Waves chose Singapore-based fintech company Tokenomika to become the operator of the Waves Enterprise mainnet to develop its hybrid blockchain approach.

On 10 February, the development team announced plans to transition to Waves 2.0 using Practical Proof-of-Stake Sharding (PPOSS) consensus and providing support for Ethereum Virtual Machine (EVM).

According to a Twitter thread announcing the updates, “gravity bridges will be built for users and applications to access assets on any EVM-compatible chains (Ethereum, Avalanche, Binance Smart Chain, etc.), Bitcoin and Solana”.

“$150m fund and an incubation program will soon be started for the US teams, building products on Waves. The US is a key market to drive mass adoption in 2022.”

And on 21 February, cross-chain token bridge Allbridge announced it is taking the opportunity the upgrade offers to integrate with Waves.

“With the imminent consensus update to Practical Proof-of-Stake Sharding, Waves infrastructure will support the integration of various DeFi features and become more accessible to the external teams. That’s why we thought it would be a great opportunity to integrate Waves with Allbridge. Our goal is to create a unique bridge between Waves and supported EVM as well as non-EVM chains, such as NEAR Protocol, Solana and Terra.”

Waves price analysis: Coin outperforms crypto markets

The WAVES coin chart shows that the coin launched at $1.33 in June 2016 and climbed to $18.07 when cryptocurrency markets rallied in December 2017. The price then fell to $6.68 in the January 2018 sell-off and briefly moved below $1 towards the end of the year.

Waves traded between $0.50 and $4 until November 2020, when the price began to climb along with other cryptocurrencies, led by bitcoin. The price soared to $41.33 on 4 May 2021 but dropped back to $12 by the end of the month. The coin then bottomed out with the rest of the markets on 21 July, trading down to $11.68 before rising to $34.81 on 9 September. After a dip to $21.03 towards the end of the month, the price spiked again to $34.56 in mid-October.

With the cryptocurrency markets under pressure since late last year, the coin’s price retreated and dropped to $7.64 on 24 January. But it has soared again since 24 February, from the $8 level back above $34 on 19 March. It peaked at $59.13 on 30 March. It then went into sharp decline falling below $16 on 27 April.

In addition to the Waves upgrades, Russia’s invasion of Ukraine has increased the use of cryptocurrencies as a way for people to move their funds outside of the traditional banking system. As well as using bitcoin and ether, some have opted to support coins created by local developers, such as Ivanov. Some cryptocurrency investors have also bought coins with Ukrainian connections as a show of support.

What is the outlook for the WAVES coin’s future? Below, we look at some of the latest forecasts.

Waves crypto price prediction: Forecasts point to rising coin value

The short-term outlook for the WAVES coin was bearish at the time of writing (27 April), with 10 technical analysis indicators giving bullish signals and 22 with bearish signals, according to CoinCodex. With the price at $16, there was technical support at $14.39 with resistance also at $16.71, the data showed. CoinCodex predicted that the WAVES coin value could fall 10% to $14.46 by 2 May.

The longer-term WAVES coin price prediction from Wallet Investor was also bullish, with the algorithm-based forecasting site projecting that the price could rise to $30.2 in 12 months' time and climbing to $82.2 in 2027.

The WAVES crypto prediction from DigitalCoin was bullish, too, expecting the price to average $24.05 in 2023, up from $21.41 in 2022, and rise to an average of $32 in 2025 and $75 by 2030.

The WAVES coin forecast from PricePrediction was more subdued for 2022 at $39.78 but expects the price to rally at an accelerated pace in the coming years, averaging $123 in 2025 and soaring to $790 in 2030.

The WAVES token price forecast from Gov Capital also saw the price moving higher over the coming years. Based on deep-learning technical analysis, the site predicted that the coin could rise from $30.8 in 12 months and $130 by April 2027.

When looking to trade WAVES, it’s important to keep in mind that cryptocurrency markets remain extremely volatile. That makes it difficult to accurately predict what a coin’s price will be in a few hours, and even harder to give long-term estimates. As such, analysts and algorithm-based forecasters can and do get their predictions wrong.

If you are considering investing in cryptocurrency tokens, we recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision.

Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.