Key Takeaways

OM suffered a historic 90% crash in April 2025, wiping out over $5 billion in market cap within hours and triggering panic in the community.

Mantra DAO responded quickly with damage control measures: announcing a major token buyback and burn, launching a $108 million ecosystem fund, and hosting community calls to regain trust.

Short-term outlook remains bearish, with OM trading below $1 and strong resistance near $1.00. The token may retest lows around $0.35–$0.40 if no positive catalyst appears.

A 30–40% relief rally is possible if the team takes proactive steps or the broader market sentiment improves.

Once sell pressure subsides, OM could bounce sharply – similar to past cases like LUNA and FTT, before entering a new accumulation phase.

Mantra OM$0.07, the native token of the MANTRA DAO ecosystem, recently experienced a historic crash in April 2025, plunging over 90% in just a few hours. This event not only sent OM’s price tumbling from multi-dollar highs to below $1 but also severely shook investor confidence in the project.

This article will provide a comprehensive analysis of the crash’s impact, assess OM’s price trends across short to medium-term timeframes, examine key influencing factors (overall market conditions, macroeconomic news, tokenomics, and the development team), and offer insights into the risks and investment opportunities surrounding OM at this critical juncture.

OM’s April 2025 Crash and the Damage to Investor Confidence

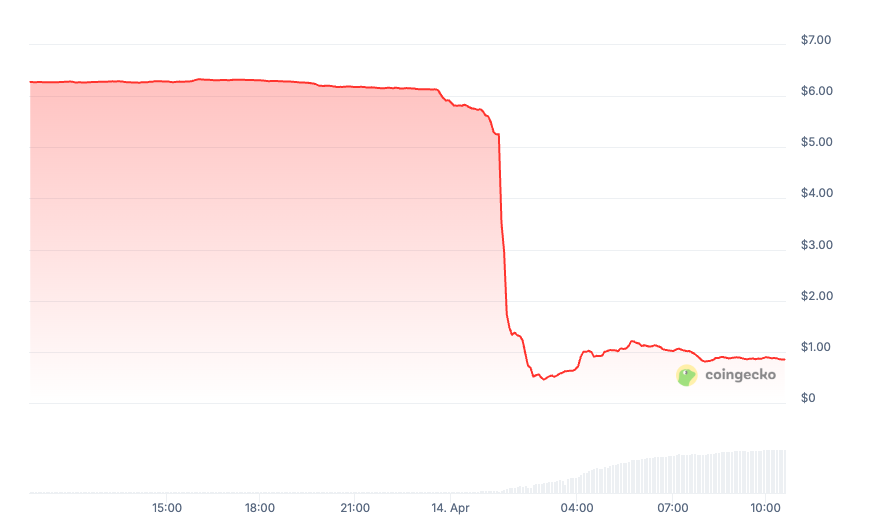

Around April 13–14, OM’s price plummeted from ~$6.30 to below $0.50, wiping out over 90% of its market value overnight. OM’s market cap collapsed from roughly $6 billion to under $700 million.

The crash drew immediate comparisons to the LUNA/UST meltdown of 2022, triggering widespread fear and speculative rumors. Rumors circulated that the team had sold off 90% of the total token supply, leading some traders to suspect an insider manipulation or rug pull.

OM crashed in 2 hours – Source: CoinGecko

In response to growing backlash, the Mantra DAO team moved quickly to reassure the community. John Patrick Mullin, Mantra’s co-founder, denied any rug pull and stated that the drop was triggered by “forced liquidations” on a centralized exchange (CEX).

He explained that one exchange – unnamed but confirmed not to be Binance, unexpectedly froze and liquidated OM positions during a period of low market liquidity.

To restore confidence, the team announced a series of corrective measures. Mullin revealed a plan to buy back and burn a large amount of OM, reducing circulating supply.

He also unveiled a $108 million ecosystem fund to support technology development, partnerships, and marketing.

These actions were considered an effort to “atone” and restore investor trust using the project’s remaining resources. In addition, community calls were held to provide transparency around the incident and outline the recovery roadmap.

Still, the psychological damage from a 90% crash runs deep. A clear sign: even after the positive announcements, OM’s price only saw a weak bounce and has continued to trade below $1.

Technical and Fundamental Analysis by Timeframe

Short-Term (1-3 Months)

The technical outlook for OM remains bearish. After hitting a bottom around $0.38–$0.50 during the major sell-off, OM briefly rebounded to the $0.80–$1.00 range, but was quickly sold off again. As of mid-April, the token is trading sideways between $0.60 and $0.80.

The $0.68–$0.70 zone is emerging as a short-term psychological support level, acting as a temporary “floor” following the crash.

However, $1.00 has now flipped into a strong resistance zone – previously a key support level, and OM has failed to reclaim it decisively, highlighting weak buying momentum.

Looking ahead over the next 1 – 4 weeks, downside risk remains elevated. If overall market sentiment does not improve, OM may retest its recent bottom near $0.35 – $0.40, which many technical indicators now flag as a potential breakdown zone.

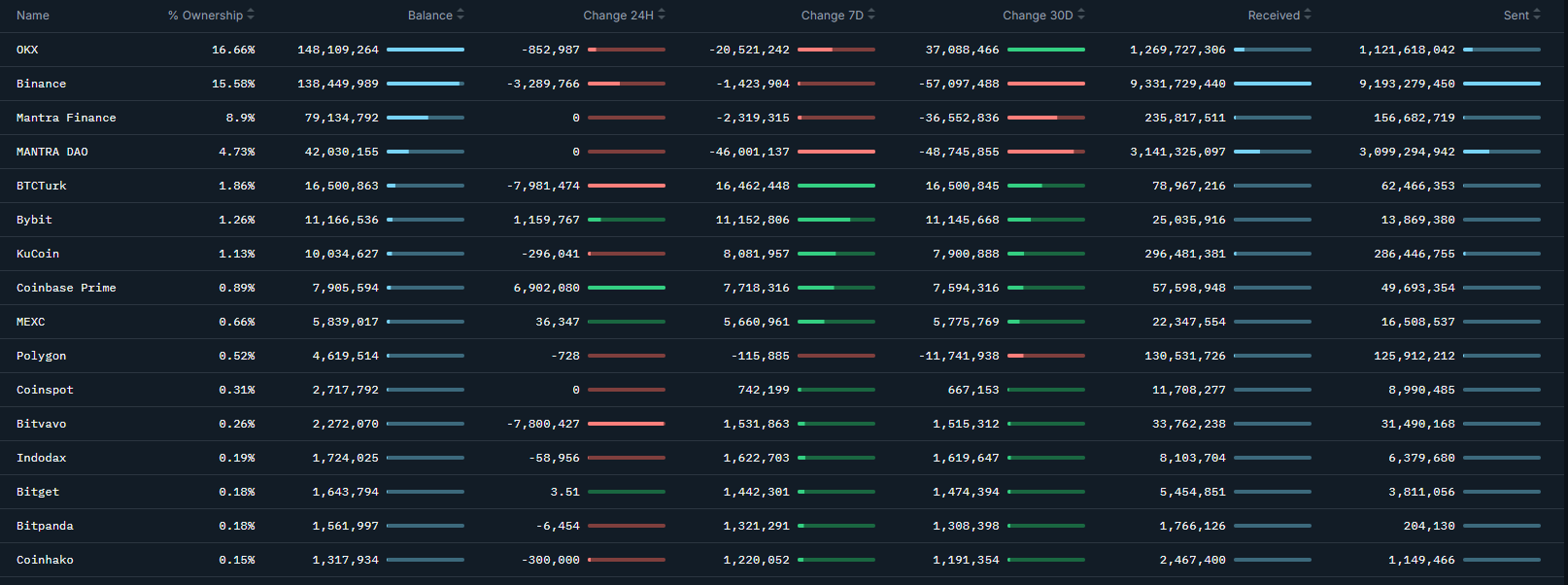

Inflow and outflow of OM -Source: Nansen

There is also a risk that OM could dip further to around $0.32–$0.36 before finding strong buying interest.

Conversely, OM may show signs of reduced selling pressure. At this stage, it’s likely that the token will trade within a narrow range and gradually decline until the situation stabilizes.

Middle-Term (3-6 Months)

In the medium term, OM is entering a critical “trust-testing” phase. A few months will be enough for the market to evaluate whether the project is genuinely delivering on its promises to recover.

The overall trend remains bearish to neutral until a clear reversal signal appears. On the weekly chart, trend indicators have turned negative: the Supertrend, which had shown a buy signal for several months, has now flipped to sell following the crash. Additionally, a death cross has formed between the long-term EMAs, with the EMA12 crossing below the EMA26 on the weekly timeframe.

Source: TradingView

These signals suggest that OM’s medium-term trend remains weak. OM could slide further toward the $0.32 support zone.

However, given how fast OM has already dropped, a sideways accumulation phase may unfold in the coming weeks or months, as selling pressure gradually subsides. In that case, OM could trade within a narrower range, possibly between $0.50 and $1.00, as the market attempts to establish a new price floor.

In a more optimistic scenario, if strong demand re-emerges, OM could rally back to around $2.18, where it would encounter significant resistance.

On the fundamental side, the focus in this timeframe will be on execution. The community will closely monitor whether the Mantra team follows through with its token burn commitments and utilization of the $108 million ecosystem fund. If OM buybacks and burns begin in earnest within the next 3-6 months, it could help stabilize the price and gradually restore investor confidence.

Like LUNA or FTT, OM could bounce hard once sell pressure fades before a new accumulation phase. With the right catalyst or team action, OM could see a 30–40% rebound from current levels.

High-risk phase, but short-term rebounds possible if market calms or surprise catalysts appear.

Conclusion

The recent crash of Mantra (OM) was a painful event, but it doesn’t necessarily mark the end of the project. If trust returns, OM could deliver outsized gains from its current fear-driven price level.

On the flip side, this remains a highly speculative investment, and losses could deepen if existing risks materialize. Therefore, investors should proceed with caution and closely monitor the team’s next steps in the coming months.