Key takeaways:

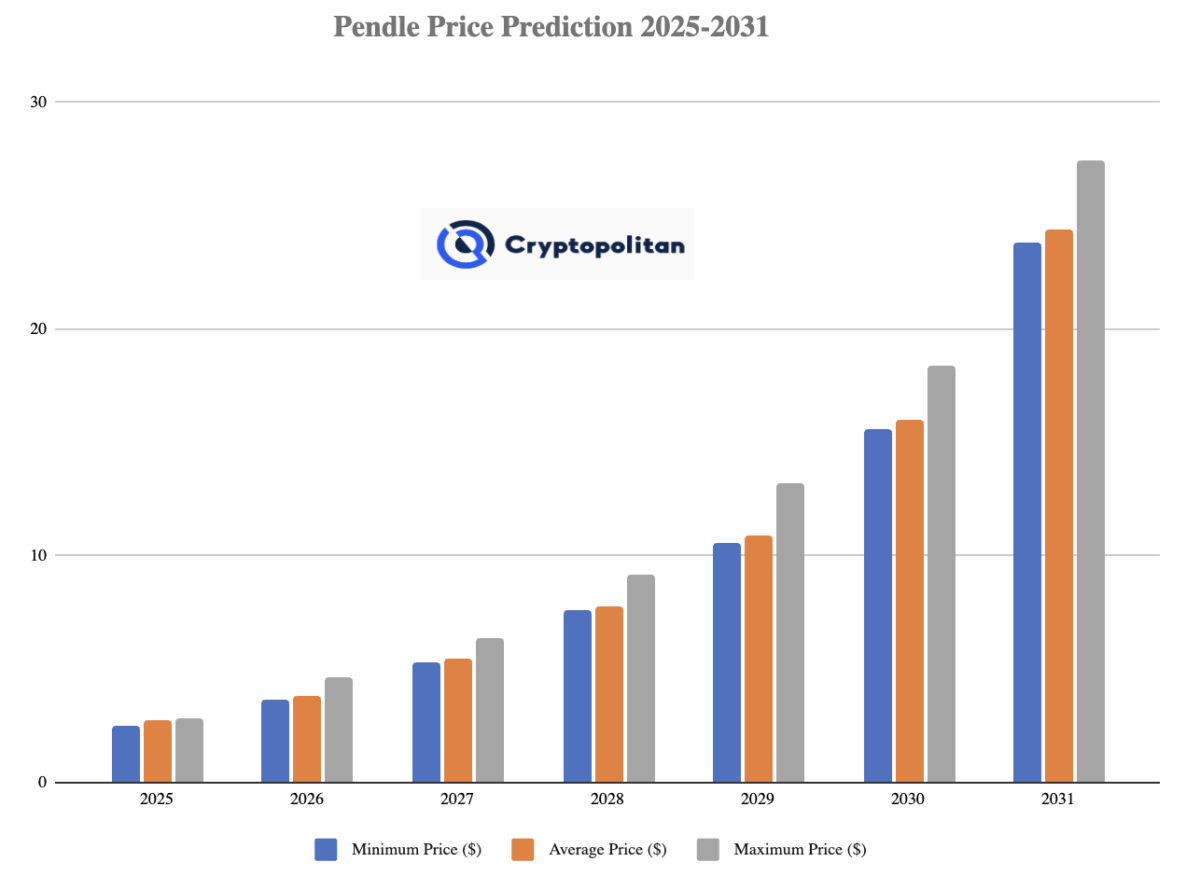

Pendle’s price is projected to reach a maximum of $2.86 by the end of 2025

By 2028, Pendle’s price is expected to reach an average of $7.8

In 2031, the price of Pendle is predicted to reach a maximum of $27.38

Pendle (PENDLE) innovates the DeFi space by enabling future yield trading. This unique approach helps users maximize returns through advanced smart contracts and seamless integration with other DeFi platforms.

Pendle’s recent progress, such as smart contract updates and strategic partnerships, marks its growth and commitment to innovation. Will these developments increase the value of $PENDLE? Is Pendle worth investing in?

Let’s dive into the Pendle price prediction for 2025-2031.

Overview

| Token | PENDLE |

| Price | $1.85 |

| Market Cap | $306.27M |

| Trading Volume (24 hour) | $30.74M |

| Circulating Supply | 281.52M PENDLE |

| All-time High | $7.52 (Apr 11, 2024) |

| All-time Low | $0.03349 (Nov 10, 2022) |

| 24-hour High | $1.92 |

| 24-hour Low | $1.84 |

Pendle price prediction: Technical analysis

| Metric | Value |

| Price Prediction | $ 1.86 (0.65%) |

| Volatility | 14.41% (Very High) |

| 50-day SMA | $ 2.29 |

| 14-Day RSI | 40.41 (Neutral) |

| Sentiment | Bearish |

| Fear & Greed Index | 23 (Extreme Fear) |

| Green Days | 11/30 (37%) |

| 200-Day SMA | $ 3.43 |

Pendle price analysis

TL;DR Breakdown:

Pendle remains in a broader downtrend with price trading below key moving averages and struggling to reclaim major resistance

Momentum is weak as RSI stays below neutral and MACD shows limited bullish confirmation

Selling pressure dominates near the $1.90–$1.93 zone keeping short term recovery attempts capped

PENDLE/USD 1-day chart

According to the daily chart on Dec 30, PENDLE is consolidating around $1.86 after a steady decline from late November. Price sits below the 20-day SMA and Bollinger midline near $1.92, keeping the short-term bias bearish, while the upper band at $2.25 marks the first major recovery ceiling. The lower band at $1.59 is the wider downside reference if support gives way. Today’s range ($1.84–$1.89) shows buyers defending $1.84, but follow-through is limited. RSI near 40 signals weak demand, not yet oversold. MACD is still negative, but momentum improves if PENDLE reclaims $1.92 and holds firmly.

PENDLE/USD 4-hour chart

On the 4-hour chart, PENDLE remains in a short-term downtrend but is attempting to stabilize above $1.85 after a prolonged sell-off from the $2.60 region. Price is compressing between the 20-period moving average near $1.88 and lower Bollinger support around $1.84, reflecting tightening volatility and indecision. The upper Bollinger band at $1.93 represents immediate resistance. MACD is recovering from deeply negative territory and is close to a bullish crossover, suggesting weakening bearish momentum. However, the Balance of Power remains negative, showing sellers still dominate. A sustained break above $1.90 could trigger a broader relief bounce toward $2.00.

Pendle technical indicators: Levels and action

Daily simple moving average (SMA)

| Period | Value ($) | Action |

| SMA 3 | 2.91 | SELL |

| SMA 5 | 2.54 | SELL |

| SMA 10 | 2.38 | SELL |

| SMA 21 | 2.18 | BUY |

| SMA 50 | 2.29 | SELL |

| SMA 100 | 3.02 | SELL |

| SMA 200 | 3.43 | SELL |

Daily exponential moving average (EMA)

| Period | Value ($) | Action |

| EMA 3 | 2.09 | BUY |

| EMA 5 | 2.33 | SELL |

| EMA 10 | 2.90 | SELL |

| EMA 21 | 3.67 | SELL |

| EMA 50 | 4.20 | SELL |

| EMA 100 | 4.20 | SELL |

| EMA 200 | 4.06 | SELL |

What can you expect from PENDLE price analysis next?

PENDLE’s next move is likely defined by a battle between fading bearish momentum and emerging consolidation strength. Price is holding above the $1.84–$1.86 support zone, which has acted as a short-term base on the 4-hour chart. Volatility is compressing inside the Bollinger Bands, often a precursor to a directional breakout. The MACD is gradually improving from negative territory, hinting that selling pressure is weakening. If buyers manage a clean break above the $1.90–$1.93 resistance region, a recovery toward $2.00–$2.10 becomes probable. Failure to hold $1.84 would expose downside toward $1.75, keeping the broader bearish trend intact.

Is PENDLE a good investment?

Investing in Pendle coin offers a unique opportunity in the DeFi sector. Pendle’s approach to tokenizing and trading future yields allows for the flexible management of yield-bearing assets, enhancing investment portfolios. Conducting their research is crucial for potential investors to understand the Pendle market cap and the dynamics of its price movement.

Pendle’s ecosystem shows strong community trust, with impressive TVL, market cap growth, and endorsements from industry veterans like Arthur Hayes. These factors and high yields make Pendle a compelling investment in innovative DeFi projects.

Why is Pendle down today?

Pendle is down today mainly due to persistent technical weakness and lack of strong buying momentum. On the daily chart, price remains below key moving averages, signaling that the broader trend is still bearish. The recent rebound attempts failed near the $1.90–$1.93 resistance zone, triggering renewed selling pressure. RSI remains below the neutral 50 level, reflecting weak bullish conviction, while the MACD has not produced a decisive bullish crossover, confirming fading upside momentum. Additionally, overall market uncertainty and reduced trading volume are limiting risk appetite among traders. With no strong breakout catalyst, short-term participants continue to sell rallies, keeping Pendle under pressure for now.

Will Pendle reach $50?

Pendle’s current price is around $2.74. Given its recent market trend, predictions suggest that by 2032, Pendle’s maximum price could surpass the $50 mark.

Will Pendle reach $100?

Pendle price is likely to reach $100 in the foreseeable future.

Is Pendle a safe investment?

Pendle cryptocurrency offers innovative yield management features, making it appealing for investors. However, it carries risks like market volatility and potential technological issues. Investors should conduct thorough research and consider their risk tolerance before investing in Pendle.

Does Pendle have a good long-term future?

PENDLE has shown volatility and recent downward movement. Its short-term outlook appears uncertain. However, its long-term future could be positive if the project innovates, gains wider adoption, and maintains strong community and developer support.

Recent news/opinion on Pendle

Pendle announced the return of the ETH meta by listing two new Lido stETH-based pools managed by Mellow Protocol and Veda Labs. The vaults aim to earn optimized DeFi rewards through deployments on leading platforms including Aave Ethena and Uniswap signaling growing demand for structured yield strategies in the Ethereum ecosystem.

ETH meta is back!! Pendle has listed two 2 pools from @LidoFinance, stRATEGY vault managed by @mellowprotocol, and GGV vault managed by @veda_labs.

— Neo Nguyen (@Neoo_Nav) December 3, 2025

FYI, these 2 vaults aim to earn curated DeFi rewards centered around stETH through deployment on bluechip DeFi protocols like… pic.twitter.com/bizZEAaP0D

Pendle price prediction December 2025

In 2025, the Pendle price is forecast to reach a low of $2.54. It could get a maximum of $2.97, with the average expected price around $2.78.

| Pendle price prediction | Potential Low | Average Price | Potential High |

|---|---|---|---|

| Pendle price prediction December 2025 | $2.54 | $2.78 | $ 2.97 |

Pendle price prediction 2025

Pendle’s 2025 forecast of $2.54–$2.97, with an average of $2.78, is driven by its growing role in yield tokenization, allowing users to trade future yield streams. Rising DeFi adoption, strong TVL growth, and integrations with major Ethereum Layer-2s strengthen demand. Market-wide consolidation, however, limits extreme volatility, keeping Pendle within this range.

| Pendle Price Prediction | Potential Low | Average Price | Potential High |

|---|---|---|---|

| Pendle Price Prediction 2025 | $ 2.54 | $2.78 | $2.97 |

Pendle price prediction 2026-2031

| Year | Minimum price | Average price | Maximum price |

|---|---|---|---|

| 2026 | $3.69 | $3.8 | $4.66 |

| 2027 | $5.32 | $5.47 | $6.34 |

| 2028 | $7.58 | $7.8 | $9.19 |

| 2029 | $10.59 | $10.9 | $13.16 |

| 2030 | $15.56 | $16 | $18.39 |

| 2031 | $23.76 | $24.4 | $27.38 |

Pendle Price Prediction 2026

In 2026, the price of Pendle is predicted to reach a minimum level of $3.69. It can also reach a maximum level of $4.66 and an average trading price target of $3.8. This is expected due to an expanding adoption of yield tokenization as institutional players and DeFi protocols increasingly integrate fixed-yield products. Higher TVL, cross-chain growth, and broader Ethereum scaling solutions are expected to boost utility. At the same time, market corrections may cap extreme gains, keeping prices within range.

Pendle price prediction 2027

Pendle’s 2027 forecast of $5.32–$6.34, averaging $5.47, is fueled by growing TVL, stronger cross-chain integrations, and institutional interest in fixed-yield products. Demand should rise steadily.

Pendle price prediction 2028

The PENDLE price prediction for 2028 projects a minimum price of $7.58 for the token. According to the analyst forecast, the token could reach a maximum price of $9.19 and an average trading price of $7.8.

Pendle price prediction 2029

The price of Pendle is predicted to reach a minimum value of $10.59 in 2029. Per the predictions, holders can expect a maximum price of $13.16 and an average trading price of $10.9

Pendle price prediction 2030

The Pendle price forecast for 2030 projects has a minimum price of $15.56, a maximum price of $18.89 and an average forecast price of $16

Pendle price prediction 2031

Pendle’s price is expected to reach a maximum price of $27.38, with a minimum price of $23.76. The average trading price is expected to be $24.4

Pendle market price prediction: Analysts’ $PENDLE price forecast

| Firm | 2025 | 2026 |

|---|---|---|

| DigitalCoinPrice | $5.86 | $6.94 |

| Coincodex | $ 2.69 | $2.72 |

Cryptopolitan’s PENDLE price prediction

In 2025, Cryptopolitan projects that $PENDLE could experience notable price fluctuations, with a potential low of $3.66, and a possible high of $3.20.

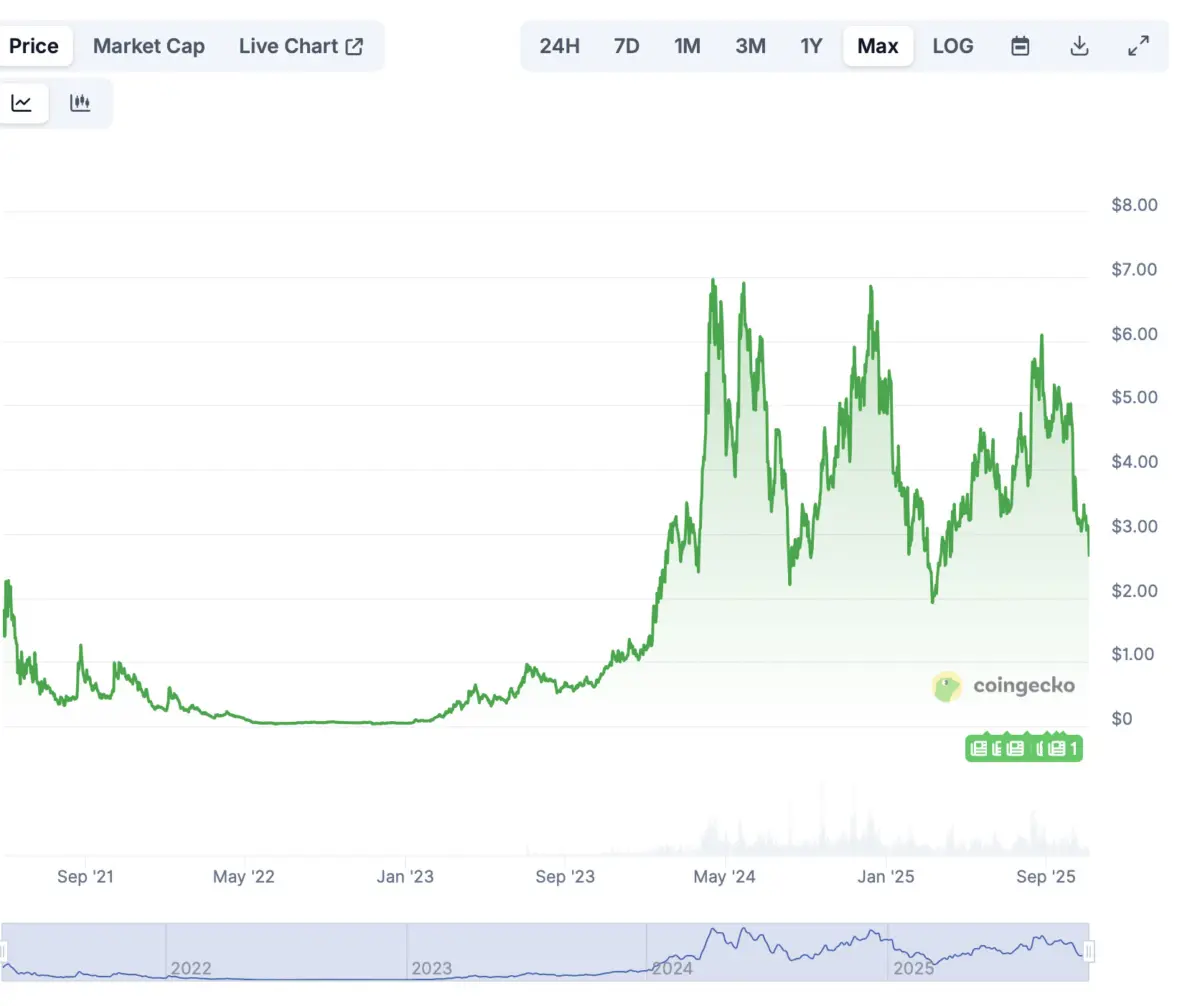

Pendle historic price sentiment

Pendle traded below $1 from its 2020 launch until late 2023 when it rose to around $1.20

In 2024, the token rallied strongly to $7.52 in April before correcting and closing the year at $5.07

Early 2025 saw a sharp decline below $2 amid US-China tensions before recovering above $3 by April

Between July and August 2025, Pendle fluctuated between $3.74 and $6.00, showing both volatility and resilience

Since early September, Pendle has stabilized between $4.70 and $5.30 with steady demand driven by DeFi and yield tokenization growth

In early November the price ranged around $2.70–$3.05, dipping mid-month toward the $2.10–$2.30 range as the token retraced.

By late November to early December Pendle recovered modestly, climbing back into the $2.60–$2.75 zone — around $2.64 on Dec 3 — suggesting the token stabilized after mid-month weakness