XRP is quietly entering a phase that long-term market participants tend to watch closely: scarcity.

Onchain data shows that the amount of XRP held on centralized exchanges has dropped to levels last seen in 2018, sharply reducing the supply immediately available for sale.

Key takeaways

XRP balances on exchanges have fallen to multi-year lows, signaling reduced sell-side pressure

Large outflows suggest accumulation rather than distribution by major holders

Price continues to defend a long-standing demand zone that has held throughout 2025

Tightening liquidity increases the potential impact of future demand surges

This shift in supply dynamics is unfolding while XRP continues to hold above a price region that has repeatedly acted as a structural floor over the past year—an alignment that could become increasingly important as the market looks toward 2026.

Exchange Supply Is Drying Up

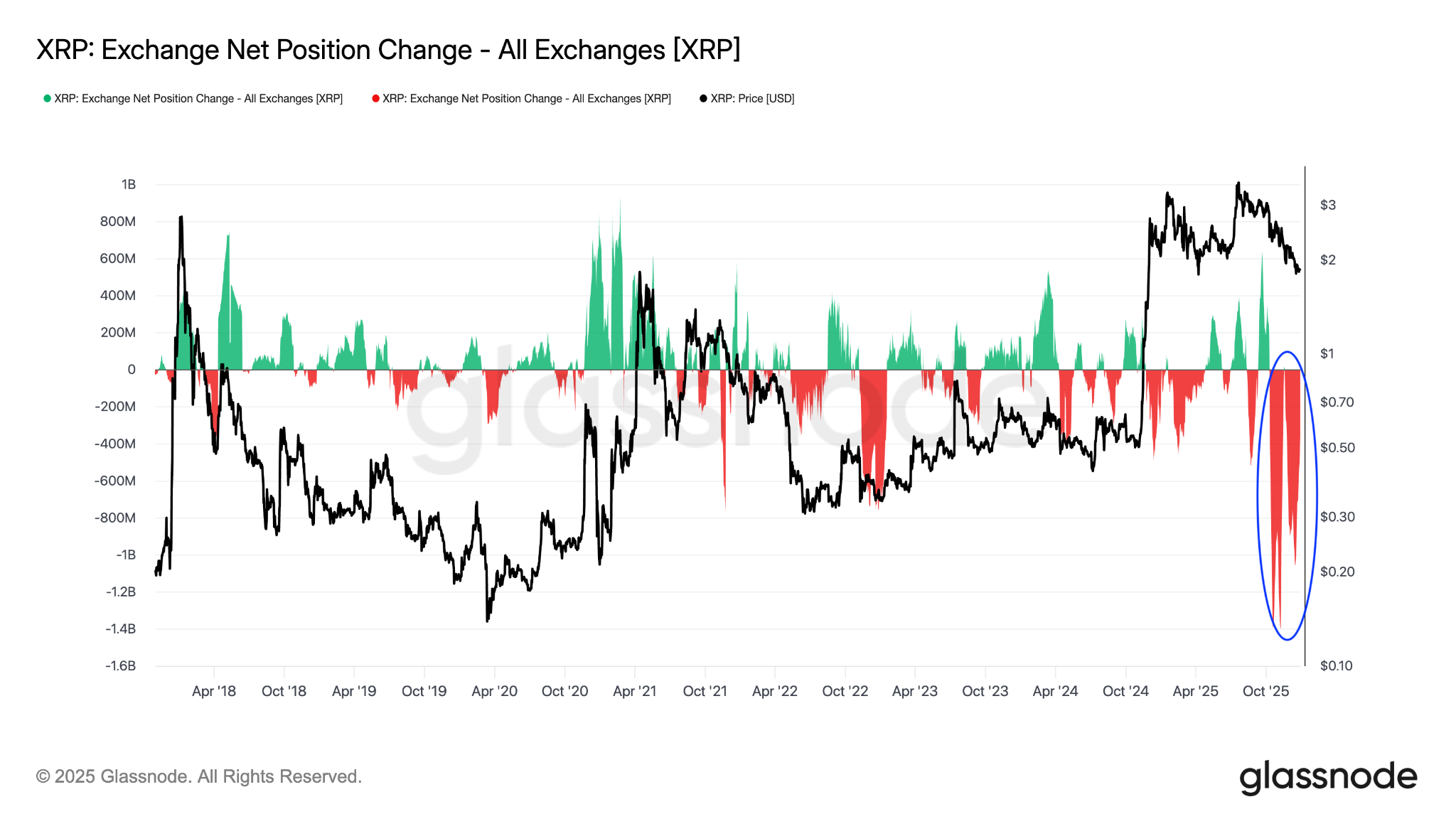

Over the last two months, billions of XRP have been withdrawn from exchanges. Total exchange balances have fallen from nearly four billion tokens in early October to roughly one and a half billion today, marking one of the steepest liquidity contractions in the asset’s history.

Such large-scale withdrawals typically reflect a behavioral shift among holders. Instead of positioning tokens for sale, investors appear to be moving XRP into long-term storage, custody solutions, or investment vehicles, effectively sidelining supply. This reduces immediate selling pressure and makes the market more sensitive to new inflows.

The timing is particularly notable, as the decline coincided with the largest net exchange outflow XRP has ever recorded—evidence of active accumulation rather than passive movement.

XRP Price Action Holds a Critical Zone

At the time of writing, XRP is trading near $1.86, showing modest intraday gains while remaining range-bound on higher timeframes. Market capitalization stands above $113 billion, with daily trading volume hovering around $1.7 billion, indicating steady—but not speculative—participation.

Importantly, price continues to hold above the $1.78–$1.80 region, an area that has consistently attracted buyers throughout 2025. Onchain cost-basis data shows a large concentration of supply was accumulated in this range, making it a key support zone. As long as XRP remains above it, downside momentum appears contained, while any renewed demand could push price into higher discovery zones due to thinning exchange liquidity.

A Market Shifting Toward Structural Accumulation

Liquidity contraction is often a prerequisite for meaningful trend changes. With fewer tokens available on exchanges, even moderate demand can have an outsized effect on price—especially if that demand originates from institutions or long-term holders rather than short-term traders.

Some analysts argue this dynamic marks a transition in XRP’s market structure. As liquid supply diminishes, price behavior becomes less dependent on speculative churn and more responsive to directional positioning, a setup that historically precedes extended moves rather than short-lived rallies.

Looking Ahead to 2026

Taken together, falling exchange balances and resilient price support suggest XRP may be entering a consolidation phase focused more on supply tightening than rapid price appreciation. While a confirmed uptrend has yet to emerge, the underlying conditions appear to be shifting.

Supply-driven rallies rarely announce themselves in advance. They tend to form quietly, as liquidity drains and holders grow increasingly reluctant to sell. If demand returns under those conditions, price reactions can be swift.

For now, XRP appears to be consolidating time rather than price—defending key levels, reducing liquid supply, and laying the groundwork for a potential change in market dynamics as the cycle progresses.