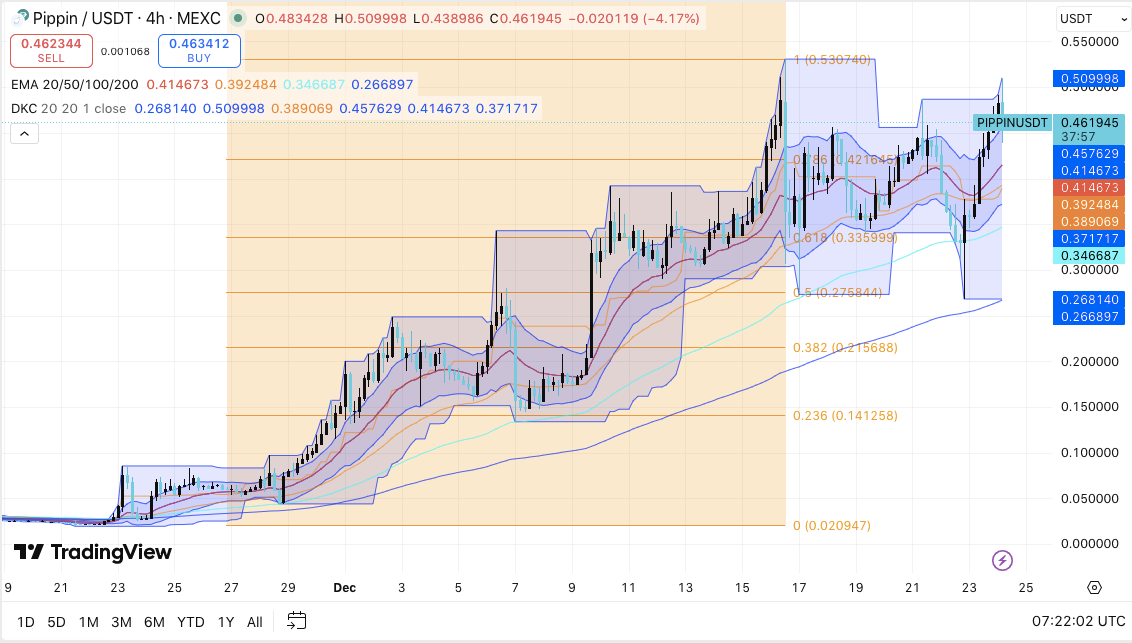

PIPPIN continues to draw market attention as traders assess whether recent strength can extend into another upside phase. On the 4-hour chart, the token maintains a clear medium-term uptrend, despite a sharp pullback earlier this month.

Buyers responded quickly to that decline, reinforcing confidence that dip demand remains active. Consequently, market participants now focus on whether momentum and derivatives positioning can support another push higher.

Price Structure Holds Above Key Trend Levels

PIPPIN continues to print higher highs and higher lows on the 4-hour timeframe. Hence, the broader trend remains intact. Price trades above the 50-period and 100-period exponential moving averages, reinforcing short-term support. Additionally, the 200-period EMA sits well below current price, confirming the broader bullish structure.

Volatility expanded during the recent selloff, but selling pressure faded near dynamic support. Consequently, price rebounded sharply, signaling strong buyer interest near the lower band. Analysts now view the $0.457 to $0.462 zone as immediate support. A deeper pullback could test the $0.414 to $0.420 area, where moving averages converge.

On the upside, resistance between $0.510 and $0.531 remains critical. A decisive move above that range could open room for trend continuation, especially if volume expands. However, a loss of $0.414 would shift attention toward deeper defenses near $0.39 and $0.35.

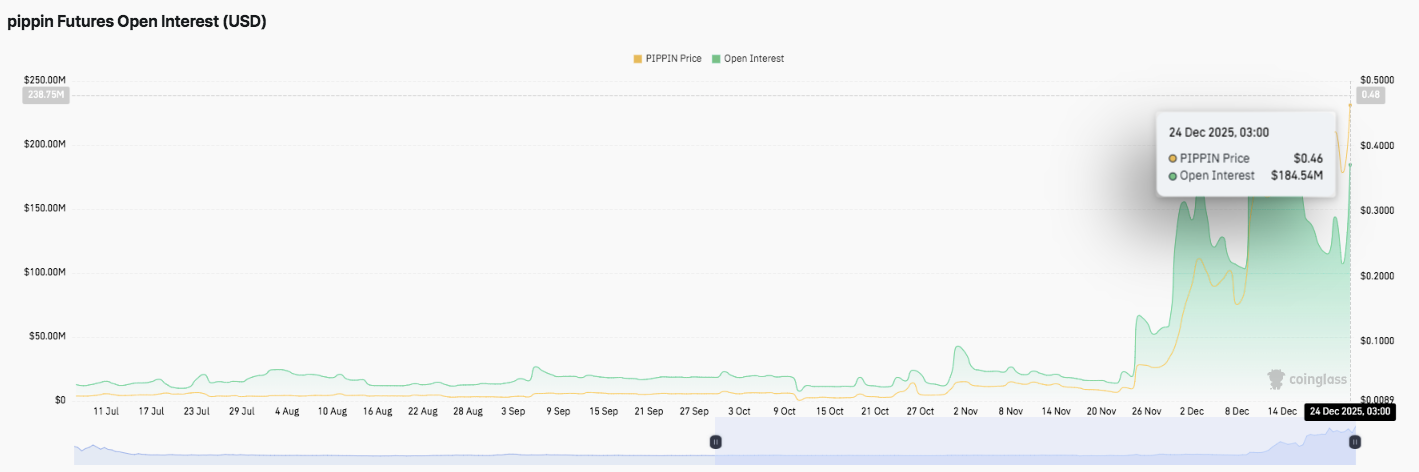

Open Interest Shows Shift in Trader Behavior

Futures data reveals a clear change in market participation. From July through mid-November, PIPPIN futures open interest stayed subdued, reflecting cautious and low-leverage positioning. Additionally, price discovery remained orderly during that phase, with limited speculative pressure.

In late November, open interest expanded sharply as traders increased leveraged exposure alongside rising prices. The build accelerated into December, pushing open interest above $180 million by December 24. Hence, current fluctuations suggest active position rotation rather than widespread deleveraging, increasing short-term volatility risk.

Whale Positioning Favors Long Exposure

Data highlighted by CryptonautX adds further context to the derivatives picture. The analyst noted a growing dominance of whale-sized long positions across PIPPIN futures markets. According to shared figures, 77 whales now hold long positions valued near $22.11 million.

$PIPPIN Update,,, Whales Game is Now getting interesting ??

— CryptonautX (@CryptonautX_) December 24, 2025

Long position Whale are Now dominating the market Without hesitation,,,, Just see The data Guy's.

According to position size Short position looks like a Ant infront of an elephant (long position size) This is Just… pic.twitter.com/lelKOtDKCF

Meanwhile, 50 whales hold short positions worth roughly $2.17 million. Moreover, long exposure stands nearly eleven times larger than short exposure, reflecting aggressive directional conviction. This imbalance raises the probability of short-side stress if price resumes upward momentum.

Technical Outlook for PIPPIN Price

PIPPIN’s technical structure remains clearly defined as price trades within a broader bullish framework. The token continues to respect higher-timeframe support while consolidating below recent highs, suggesting compression ahead of a directional move.

Upside levels: Immediate resistance sits at $0.510–$0.531, which marks the recent swing high zone. A confirmed breakout above this range could open upside continuation toward higher trend extension levels, especially if volume and open interest expand alongside price.

Downside levels: Initial support remains firm at $0.457–$0.462, the current consolidation area. Below that, $0.414–$0.420 stands as a critical EMA cluster and prior breakout base. A deeper pullback could test $0.389–$0.392, aligned with the 100 EMA. Major trend support rests between $0.346–$0.371, near the 200 EMA and a historical demand zone.

Trend structure: PIPPIN continues to trade above key moving averages, keeping the medium-term trend constructive. Price action suggests tightening ranges following the recent pullback and rebound, pointing to volatility compression. Consequently, a decisive break from this range could trigger an expansion move in either direction.

Will PIPPIN Go Higher?

The near-term outlook depends on buyers defending the $0.414 level while building momentum toward the $0.51–$0.53 resistance band. Sustained strength above this ceiling would reinforce bullish continuation.

However, failure to hold EMA support could shift focus toward deeper trend defense zones. For now, PIPPIN remains in a pivotal technical zone, where positioning, volatility, and follow-through will define the next leg.