Bitcoin has shown limited directional strength in recent sessions, reflecting a muted close to 2025. Price action has remained tight, reducing the likelihood of sudden volatility as the year ends.

While stability offers predictability, some investors express frustration with the lack of momentum after months of uneven performance.

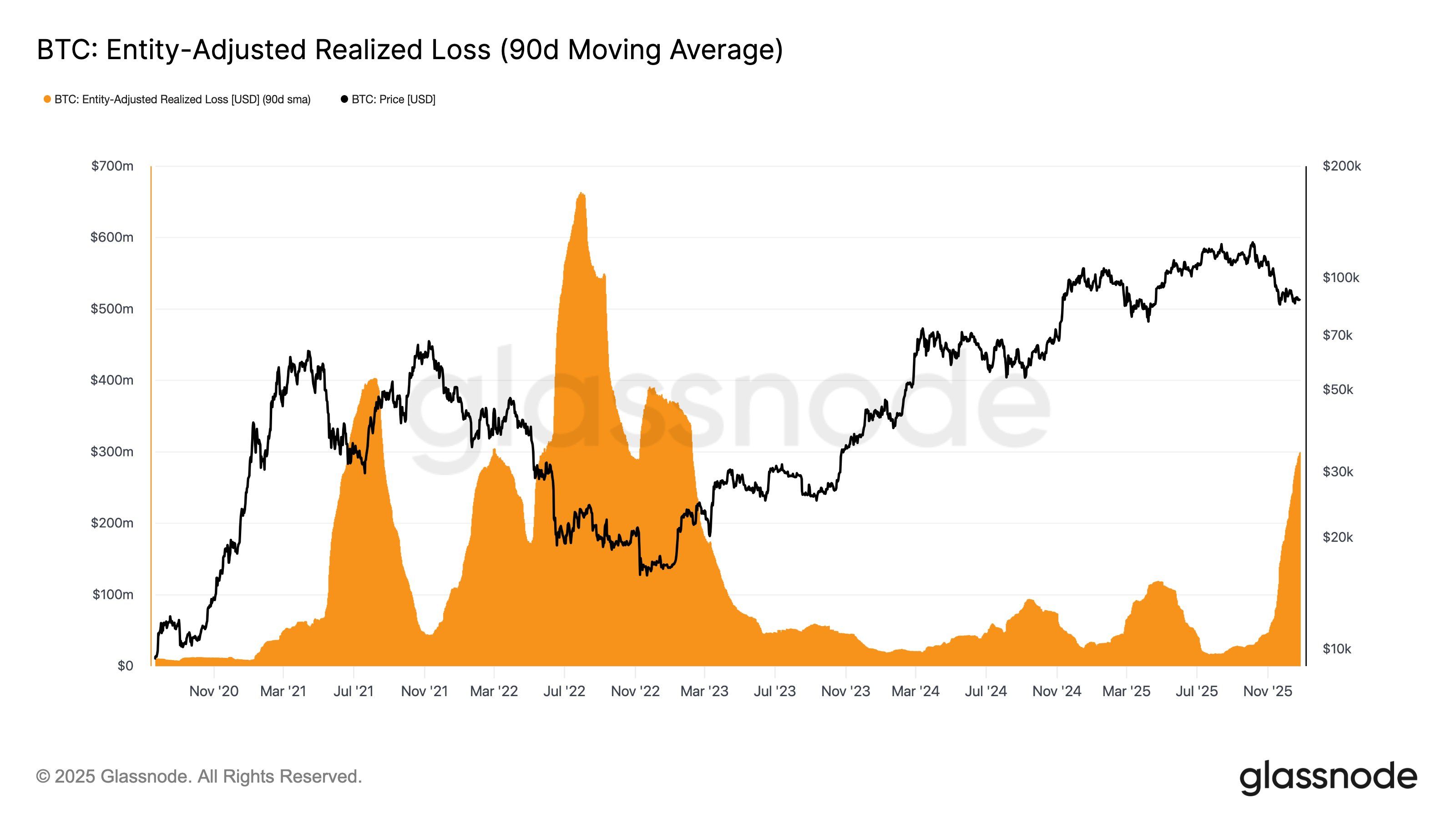

Bitcoin Holders Are Selling At Loss

Trading activity has slowed notably during the final weeks of 2025. Flat price movement, combined with seasonal holidays, has drawn traders away from active participation. Volumes across major exchanges have declined, reflecting reduced speculative interest and cautious positioning.

Without an unexpected price catalyst, Bitcoin and broader altcoin markets are experiencing their quietest two-week stretch since the same period last year. This behavior suggests investors are managing expectations conservatively, preferring patience over aggressive positioning amid uncertain near-term signals.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Trading Volume Crypto Token. Source: Santiment

On-chain data indicates persistent selling pressure despite price stability. Realized loss volume, adjusted to exclude internal transfers and smoothed using a 90-day moving average, now stands near $300 million per day. This metric highlights ongoing capitulation among certain market participants.

Bitcoin remains above the True Market Mean of $81,000, yet selling at a loss has not meaningfully declined. Investors who entered near local highs appear increasingly impatient. As a result, their distribution continues to tilt macro momentum toward mild bearishness, limiting recovery potential in the short term.

Bitcoin Realized Loss. Source: Glassnode

BTC Price Vulnerable To Volatility

Bitcoin trades at $88,410, holding above the key $88,210 support level. Despite this stability, BTC is down approximately 5.5% year-to-date, closing 2025 in negative territory. As 2026 approaches, traders anticipate renewed volatility after an extended consolidation phase.

Technical indicators reinforce this view. Bitcoin’s Bollinger Bands are tightening, signaling suppressed volatility. Historically, such compression often precedes sharp price movement. Thus, a breakout could emerge if selling pressure eases and broader macroeconomic conditions remain supportive for risk assets.

Bitcoin Price Analysis. Source: TradingView

Failure to trigger a volatility-driven move would maintain the current range. Under that scenario, Bitcoin price may continue consolidating near $88,210 in 2026. However, increased selling could also push the price toward $86,247 or lower, invalidating any bullish outlook and extending the prevailing period of uncertainty.