Prediction markets are emerging as one of the most significant growth narratives in crypto heading into 2026. Once a niche corner of decentralized finance (DeFi), these platforms are now attracting billions in trading volume, growing institutional interest, and increasing regulatory clarity.

These conditions could significantly benefit low-cap altcoins tied to the sector’s infrastructure and marketplaces.

Low-Cap Altcoins Set to Benefit From 2026 Prediction Market Growth

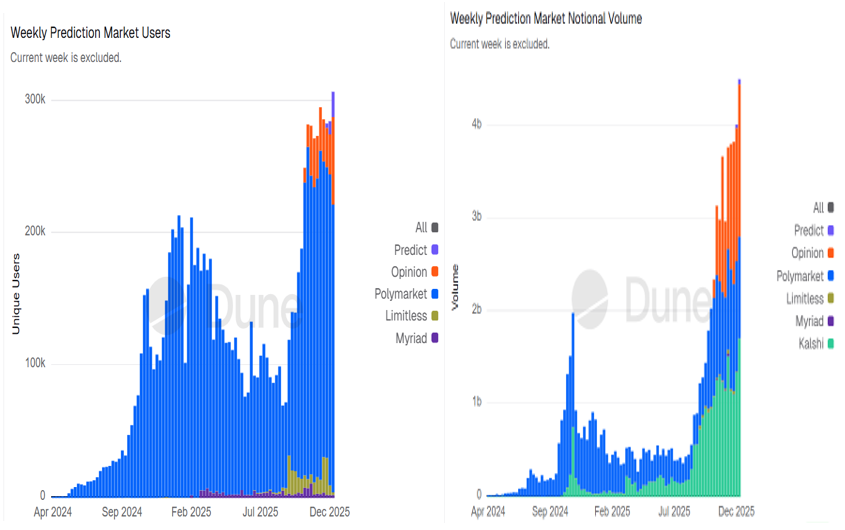

By late December 2025, prediction markets recorded more than $4.5 billion in weekly notional volume, setting a new industry record. It marked a roughly 12.5% week-on-week increase.

According to industry commentator Martins, the Kalshi prediction platform alone accounted for over $1.7 billion, representing nearly 38% of total weekly activity.

The surge highlights how fast prediction markets are scaling beyond their experimental roots.

This growth builds on momentum seen throughout 2025. In November, prediction markets reached a monthly trading volume of $9.5 billion, decisively surpassing meme coins and NFTs.

While meme coins generated roughly $2.4 billion and NFTs about $200 million during the same period, traders increasingly shifted toward outcome-based platforms that offer clearer utility and informational value.

From Speculation to Utility-Focused Markets

The renewed interest in prediction markets reflects a broader shift in crypto behavior. Instead of chasing hype-driven narratives, traders are engaging with platforms that monetize forecasting across politics, sports, macroeconomics, and crypto events.

Dune data shows nearly 279,000 weekly active users, over $4 billion in weekly notional volume, and 12.67 million transactions, highlighting sustained engagement rather than short-lived speculation.

Prediction Markets’ Record High Weekly Market Users and Notional Volume. Source: Dune

Institutional momentum is also accelerating adoption. Coinbase is reportedly preparing to launch prediction markets, while Gemini’s affiliate has secured regulatory approval to offer them in the US.

Trump Media & Technology Group has also signaled plans to enter the space. Together, these moves suggest prediction markets are transitioning from fringe DeFi tools into regulated financial instruments.

As the sector grows, demand is increasing for front-end platforms as well as for reliable backend infrastructure, particularly oracles that resolve outcomes accurately. Against this backdrop, several low-cap altcoins are drawing attention.

UMA

With a market capitalization of roughly $63 million, UMA plays a foundational role in the prediction market ecosystem. It secures Polymarket, one of the leading decentralized prediction platforms.

UMA’s optimistic oracle design assumes data submissions are correct unless disputed, a model that has proven effective at scale.

According to UMA, around 99% of assertions have gone undisputed since 2021, with dispute rates declining as integrations improve.

This same dispute-resolution mechanism is now being used beyond prediction markets, including in intellectual property protection systems such as Story Protocol.

As of this writing, UMA trades around $0.71, up modestly on the day. While price action has been relatively muted recently, UMA’s leverage to prediction market growth lies in infrastructure demand rather than retail speculation.

UMA Protocol (UMA) Price Performance. Source: CoinGecko

This makes it a potential long-term beneficiary if volumes continue to expand in 2026.

Limitless

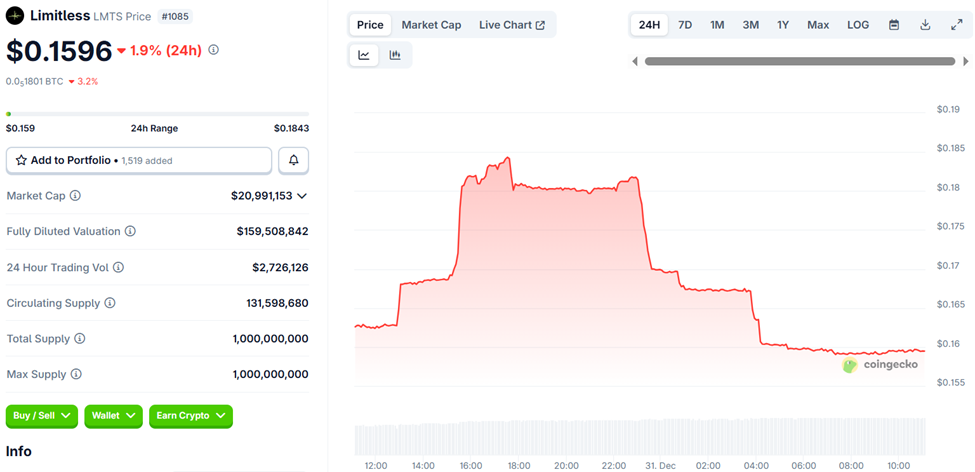

Limitless is another low-cap project gaining traction, with a market capitalization of about $21 million. In December alone, the platform recorded over $760 million in notional trading volume, a significant increase from roughly $8 million in July.

Community commentary highlights consistent growth in monthly active traders and expanding market coverage, including sports.

The LMTS token, which powers the ecosystem, is down slightly on the day, but adoption metrics suggest increasing real-world usage rather than hype-driven activity.

Limitless (LMTS) Price Performance. Source: CoinGecko

If prediction markets continue scaling in 2026, platforms like Limitless could benefit from being early movers with proven user engagement, despite their relatively small valuations.

Predict.fun

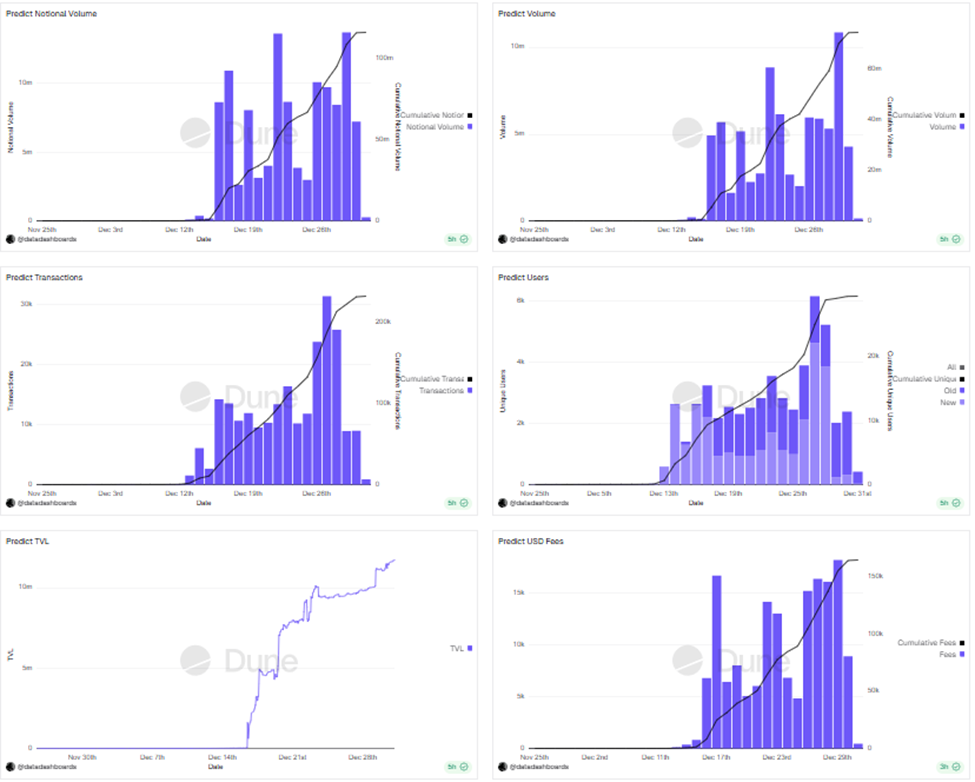

Predict.fun, built on BNB Chain, is a newer entrant but has quickly captured attention. Despite its recent launch, the platform has surpassed $100 million in notional volume, reached over 30,000 daily transactions, and attracted more than 6,000 unique users at peak activity. Total value locked recently exceeded $11 million.

Predict.fun Metrics. Source: Duna Analytics

Backed by YZi Labs, Predict.fun is distributing weekly airdrops through its Predict Points system to incentivize liquidity provision and active participation.

Early data suggest that the platform has already captured around 1% of the total prediction market volume, an impressive figure for a newcomer.

Prediction Market Outlook Into 2026

Prediction markets are no longer just experimental betting tools. They are becoming data-driven financial products with institutional relevance.

As volumes grow and regulation stabilizes, low-cap altcoins tied to this sector may see outsized opportunities alongside elevated risk.

Projects like UMA, Limitless, and Predict.fun highlight different ways investors can gain exposure to this trend. If current momentum holds, 2026 could mark a defining year for prediction markets and the low-cap tokens building behind the scenes.