While Ethereum (ETH) price action in December has shown a narrowing range around the $3,000 level, appearing poised for a potential breakout, on-chain data has recorded unusual signals.

What are these signals, and do they carry positive or negative implications for the ETH price?

Ethereum Transaction Count Surges Sharply in December

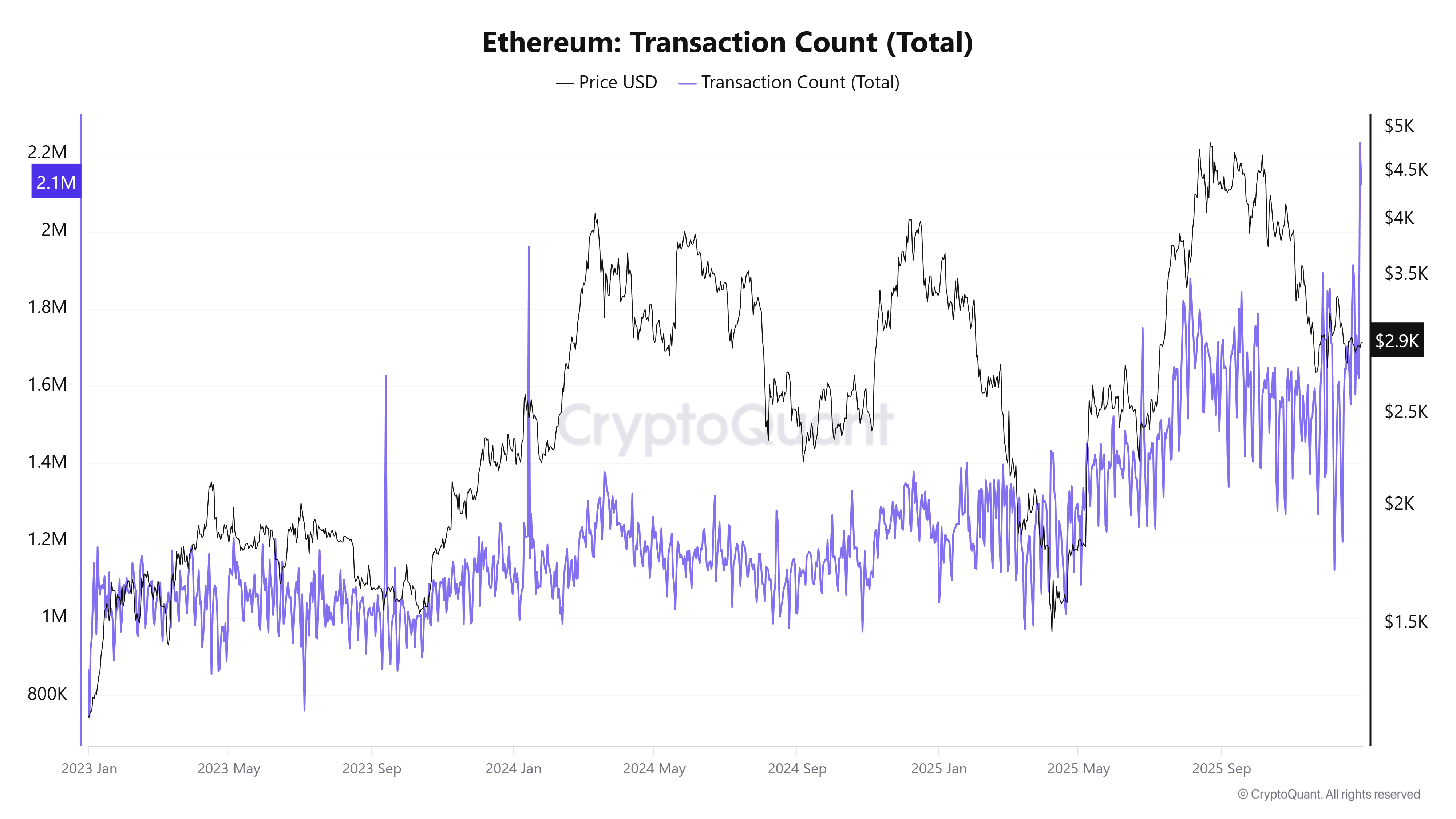

CryptoQuant data shows that in the final days of December, the number of transactions on the Ethereum network spiked sharply. Daily transactions exceeded 2.1 million. This marked the highest level recorded since 2023.

Etherscan data shows that this is also a record number for the past decade.

Ethereum Transaction Count (Total). Source: CryptoQuant

Notably, this surge occurred despite ETH correcting heavily from above $4,500 to around $2,900. The data highlights a clear divergence between price action and on-chain usage.

The spike may also reflect large-scale ETH circulation. It suggests that holders could be preparing for a specific strategy.

“Ethereum just processed 2,230,801 transactions in a single day, the highest in its 10-year history. Fees were under $0.01. Finality stayed stable. No congestion. No drama. After years of scaling work, usage is moving back to L1. Performance brings users home,” investor BMNR Bullz commented.

Analysis from a CryptoQuant author suggests that such spikes signal panic selling when they appear during downtrends. However, when supported by positive fundamentals, they reflect growth potential for ETH.

If the signal is neutral, it may still lean positive. Two additional indicators support this view.

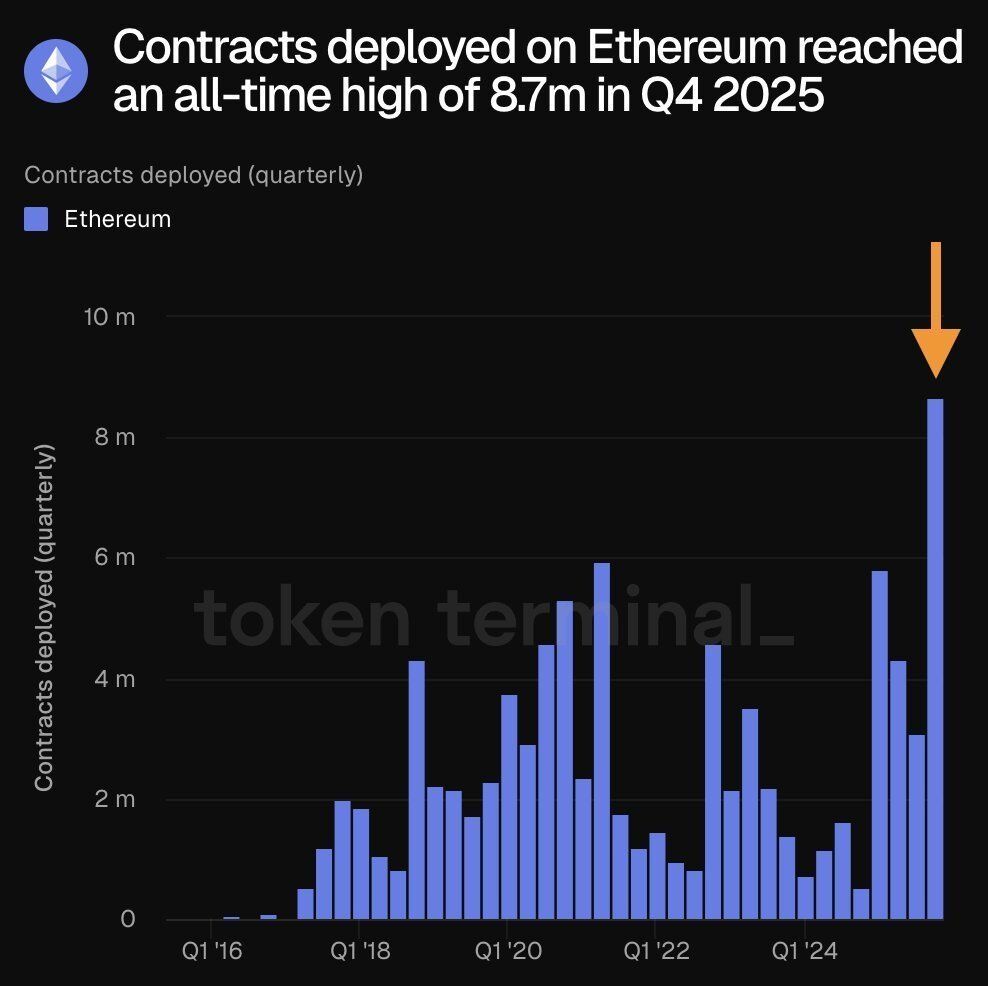

First, the number of smart contracts deployed on Ethereum has reached a record high. In Q4 2025, more than 8.7 million new contracts were deployed. This marked the highest level ever recorded.

Contracts Deployed on Ethereum in Q4/2025. Source: Token Terminal

The figure significantly exceeded previous quarters, signaling strong ecosystem expansion. It also helps explain the rising demand for ETH transfers.

Developers increasingly use Ethereum as a settlement layer. Growth is driven by real-world asset tokenization (RWA), stablecoin activity, and the development of core infrastructure.

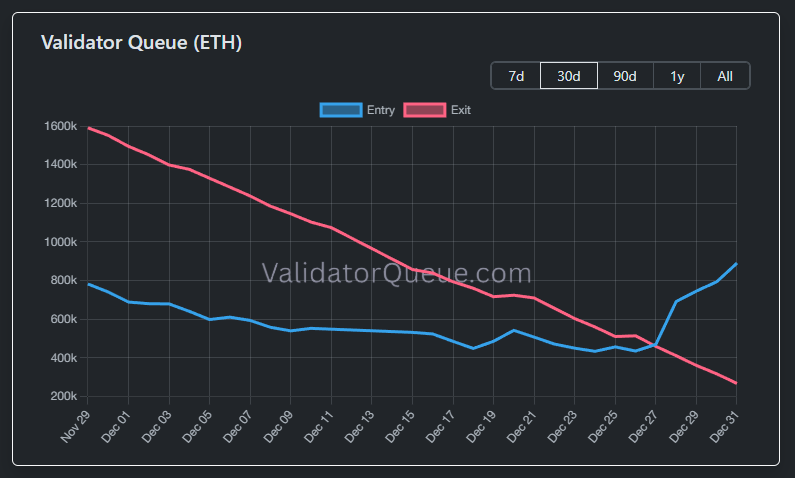

The second factor is the increase in ETH within the staking queue. On the final day of December, the validator entry queue continued to grow, with a total of 890,000 ETH queued. Bitmine’s ETH staking activity may have fueled this sharp rise.

Validator Queue (ETH). Source: Validator Queue

The increase in ETH entering the staking queue coincided with the period of unusually high network transfers. This timing further explains the observed surge.

Despite these positive on-chain signals, the ETH price remains stuck near the $3,000 level. Recent analysis from BeInCrypto suggests that ETH is forming a bearish setup, combined with selling pressure from US-based investors.