A single XRP transaction involving nearly 70 million tokens has triggered renewed attention across the crypto market, as traders assess whether the movement reflects potential selling pressure or routine exchange operations. The transfer, flagged by Whale Alert, involved 69,999,999 XRP valued at roughly $131 million at the time of execution, with the assets moving between two initially unidentified wallets.

? ? ? ? ? ? 69,999,999 #XRP (131,219,756 USD) transferred from unknown wallet to unknown wallethttps://t.co/hnPmNrQYol

— Whale Alert (@whale_alert) December 30, 2025

The timing of the transaction added to market sensitivity, with XRP trading near $1.86 and remaining range-bound after several weeks of consolidation. Large on-chain movements of this size often attract scrutiny due to Ripple’s historical role as a significant XRP holder and distributor, making wallet activity a frequent focal point for short-term market sentiment.

Exchange Wallet Rebalancing Identified

Shortly after the transaction was detected, the XRP-focused analytics account XRPWallets attributed the movement to an internal Binance subwallet transfer. According to the account, the routing pattern was consistent with exchange-level wallet management rather than distribution to external counterparties. Such transfers are typically associated with liquidity management, hot and cold wallet rebalancing, or operational housekeeping within centralized exchanges.

Internal Binance 10 Subwallet transfer https://t.co/baZjdyQhko

— XRP_Liquidity (ETF 1Y 39.8B = Max 54.4B) (@XRPwallets) December 30, 2025

These internal transfers can appear opaque when first reported, as they often register as unknown-wallet-to-unknown-wallet movements on blockchain trackers. However, they do not necessarily signal tokens entering circulation or being prepared for sale on spot markets. Market participants appeared to acknowledge this clarification, with no immediate spike in volatility following the explanation.

Market Context and Price Stability

XRP has remained relatively stable despite heightened attention around the transfer. Trading activity has stayed within a narrow band, suggesting that participants are treating the transaction as isolated noise rather than a shift in supply dynamics. Historically, confirmed exchange inflows tied to large holders have had clearer and more immediate effects on short-term pricing, particularly when accompanied by broader risk-off conditions.

Ripple’s XRP supply movements have drawn close monitoring in the past, especially during periods when tokens were transferred to exchanges or distributed from escrow. In recent quarters, Ripple has emphasized greater transparency around its XRP holdings and sales practices, publishing regular reports on token circulation and escrow activity.

Broader Implications for On-Chain Monitoring

The episode highlights the challenges of interpreting blockchain data in real time, particularly when large transactions surface without immediate context. While on-chain transparency allows market participants to track asset flows, distinguishing between operational transfers and genuine distribution remains a key analytical task.

For XRP holders and traders, the incident reinforces the importance of corroborating on-chain alerts with follow-up analysis before drawing conclusions about market impact. As XRP continues to trade within established ranges, attention is likely to remain focused on confirmed exchange inflows, broader market conditions, and regulatory developments that carry longer-term implications for the asset and the wider digital asset ecosystem.

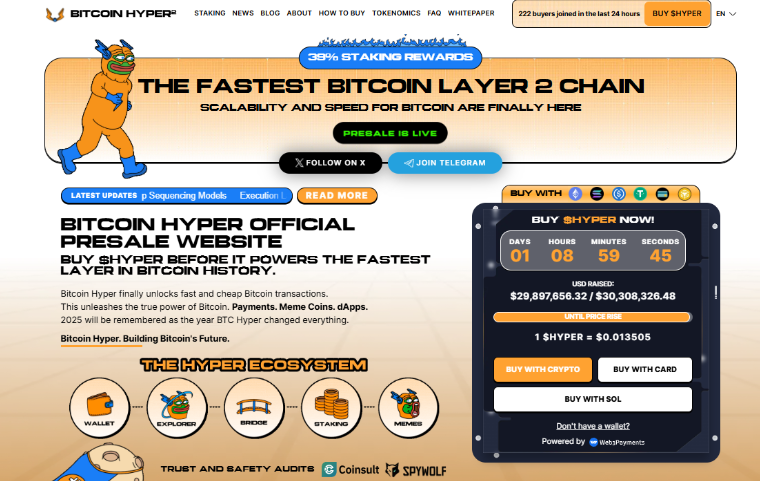

Bitcoin Hyper – Close to $30 Million Milestone

In parallel with XRP price discussions that frequently reference on-chain activity and evolving holder behavior, a separate area of interest has been developing around Bitcoin-focused infrastructure aimed at expanding its role in decentralized finance. Bitcoin Hyper (HYPER) fits within this trend, describing itself as a Solana-based Layer-2 that facilitates smart contract execution and higher transaction throughput, with final settlement anchored to the Bitcoin blockchain.

The project is framed within the BTCFi narrative, which examines ways to extend Bitcoin’s use cases without modifying its underlying protocol. Public disclosures indicate the Bitcoin Hyper presale has reached approximately $29.96 million in funds raised so far.