Stablecoins ended 2025 on a high note, with peak address activity. Ethereum-based stablecoins showed activity signaling a cycle peak, far surpassing previous activity spikes.

Stablecoins on Ethereum reached peak activity at the end of 2025. Activity levels at the end of the year were not an anomaly; instead, they extended a trend of steep growth over the past few months.

Active addresses moved to new record levels on several occasions in 2025. In the past days of 2025, around 593K daily active users moved stablecoins.

The year saw stablecoins behave in ways not seen during previous market cycles, both in terms of total supply and the scale of usage. Over $314B in stablecoins was in circulation in 2025, with much more diverse destinations compared to previous market cycles.

During the early 2022 market peak, active stablecoin addresses reached 285K per day, the highest for the entire expansion cycle.

Stablecoins remained active even below market price records

Crypto valuations at the end of 2025 have deflated below their peak levels, while stablecoin users retained the high activity levels. Ethereum activity shows a structural shift in digital asset activity, independent of the BTC and ETH price cycle.

Stablecoins have multiple use cases, including arbitrage, P2P movements, lending, and settlements between whales or even institutions. During previous cycles, spikes in stablecoin activity were short-lived, while the activity in 2025 remained at a high baseline, with sustained growth.

Stablecoin transfers became one of the key avenues for positioning capital. The high activity may also signal repositioning, seeking out the best venues of liquidity. Stablecoins were used as lending collateral, DEX trading pairs, and other active allocations, instead of being used to park value. The availability of yield also greatly expanded stablecoin turnover.

During past crypto cycles, high stablecoin activity signaled accumulation rather than distribution. Despite the slide of BTC from its highs, stablecoin activity showed the market was still searching for opportunities.

Ethereum becomes a high-value stablecoin hub

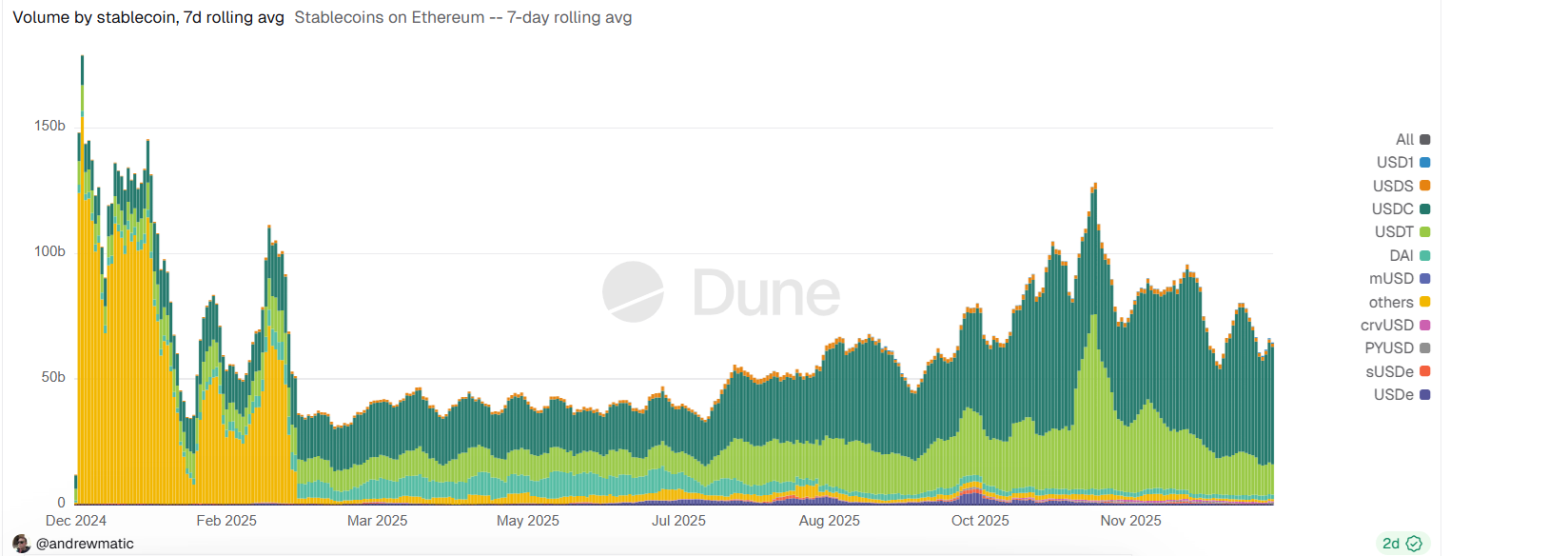

Ethereum became a hub for high-value transfers, with USDT and USDC among the top 5 smart contracts on the network. Stablecoins were also among the chief reasons for Ethereum’s recent transaction record, as Cryptopolitan reported. The top three stablecoins on Ethereum remain USDT, USDC, and DAI, the legacy stablecoin of the Sky ecosystem.

USDT has a 54.77% dominance, with around 37% for USDC based on transaction levels. Both tokens expanded their transaction activity at a near-exponential rate in the last months of 2025.

However, USDC is becoming the value leader, carrying higher volumes despite having lower activity.

The prevalence of USDC transfers for high-value activities shows another shift in 2025. Over the past 12 months, USDC activity increased, as traders shifted to the fully regulated and accepted token. USDC can be used with no restrictions by US and European traders, while USDT retains its international role outside those markets.

The smartest crypto minds already read our newsletter. Want in? Join them.