Altcoin Daily host Austin Arnold used a Jan. 1 video titled “Top 6 Crypto Altcoins To Invest In For 2026” to lay out what he framed as three “first-time” catalysts for crypto in 2026 and a corresponding list of six altcoins he says he’d “buy and hold” into that backdrop, spanning smart-contract platforms, AI infrastructure, and tokenization-focused plays.

Arnold opened with the claim that crypto sits at the center of “two mega trends”: digital assets and the tokenization of financial assets and argued the combination of macro policy, US legislation, and SEC posture could drive “trillions of dollars” of new inflows.

The 3 Bullisch Crypto Catalysts

First, Arnold pointed to what he described as a monetary-policy regime shift, including the resumption of “reserve management purchases,” and framed it as supportive for risk assets broadly. “We’re starting to see significant stimulus,” he said, adding that markets were already seeing “quantitative easing light” as “the Fed is starting to buy its own bonds,” while suggesting demand for government debt could fall alongside lower rates.

Second, he argued crypto-specific regulation could function like a green light for institutional capital. He singled out the market structure focused Clarity Act, saying its passage would be “like a starter gun for ETH and SOL to run into trillions of dollars of value,” and noted discussion of a US Senate markup date of Jan. 15 with hopes of movement by late January or February.

Third, Arnold highlighted what he called a tokenization push led by SEC chair Paul Atkins, describing “Project Crypto” as an effort to “bring all of traditional finance on the blockchain.”

He paired that theme with a distribution angle around spot crypto ETFs, leaning on a quote he cited about how unusual the early ETF growth was: “These were the single best-selling product in the world and no one was allowed to make a phone call to sell it or advertise it,” he said.

Top 6 Crypto Altcoins To Invest In For 2026

Arnold’s first pick is Ethereum. He frames it as the primary beneficiary of stablecoin growth and added that stablecoins are “mostly on the Ethereum blockchain,” and tied the thesis to regulation via the Genius Act, citing a view that Treasury Secretary Scott Bessent expects the sector to grow “10x in the next few years.”

Arnold also said Ethereum’s stablecoin share rose to 53% from the high-40s “just a few months” earlier, and argued the link to ETH value accrual runs through fees: “30% of all fees on Ethereum are actually stablecoin revenue,” he said. “So as this is 10x’es the amount of fees, the amount of Ethereum being burned should be 10x to match.”

Arnold’s second pick was Solana, which he portrayed as a usage leader relative to its market value versus Ethereum. He argued Solana is “already one of or if not the most used chain in crypto,” and claimed that through 2025 it was “more used than the entire rest of the industry combined times 2 to three.” He also cited a real-world asset milestone, saying Solana “RWA holders…have surpassed 125,000 holders.”

Cardano is next, which Arnold said had a weak 2025 but could benefit from founder Charles Hoskinson’s push around Midnight. Arnold played a longer excerpt in which Hoskinson argued privacy could be the wedge that changes user behavior:

“They can go through Midnight to Cardano and they get privacy. They do something new and different,” Hoskinson said. “Midnight my view will be through hybrid applications… private prediction markets, private DEXes, private stable coins… maybe… those Bitcoin people are going to want to trade on a private DEX instead of a public DEX.”

Arnold then shifted to AI infrastructure with Bittensor (TAO), calling it “decentralized AI” plumbing and noting it had a recent “halving” and a fixed supply model he compared to Bitcoin’s. He also pointed to early-2026 ETF momentum, saying Grayscale filed an S-1 for a TAO product and Bitwise followed with a Bittensor ETF filing.

For tokenization exposure, Arnold highlighted Ondo Finance (ONDO) ahead of what he described as an Ondo Summit on Feb. 3, where “world leaders, investors, policy makers” would reconvene, and closed his list with Propy, a real-estate-focused project he said is “US licensed” for title and escrow closing and “backed by Coinbase,” positioning it as a bet on bringing home buying and selling “on-chain.”

Arnold closed his list with Propy, explicitly flagging it as the most speculative end of the spectrum and pairing it with a warning that lower-cap exposure can mean “these altcoins go to zero.”

The Altcoin Daily host described it as “essentially real estate on-chain.” He emphasized operational and regulatory positioning as part of the pitch, saying Propy is “US licensed title and escrow closing,” and also highlighted its backers: “They’re backed again by Coinbase.”

The investment thesis, as Arnold presented it, is straightforward tokenization logic applied to housing: bringing parts of the buying and selling process onto rails that can be settled and recorded on-chain, with Propy positioned as a project already operating within the US compliance perimeter he expects to matter more in 2026.

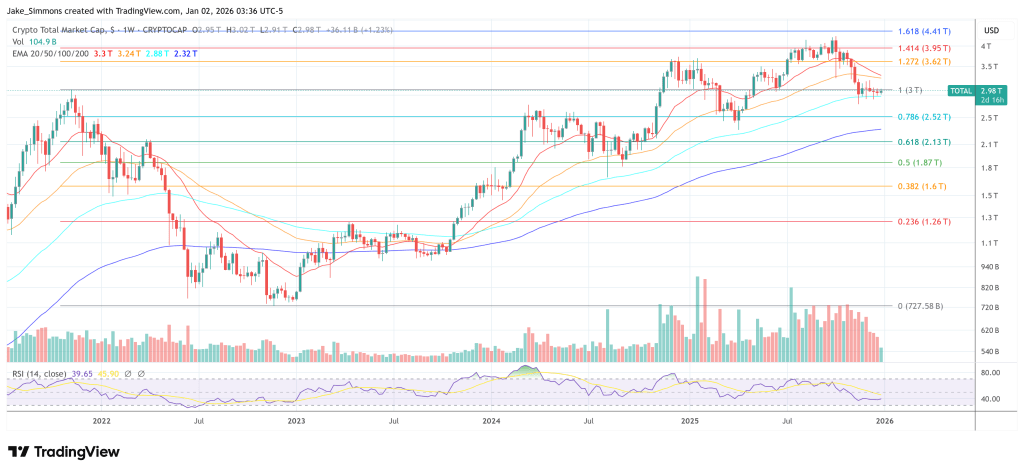

At press time, the total crypto market cap stood at $2.98 trillion.