One of the projects that have received considerable attention in crypto news circles is Mutuum Finance. The team behind the project has revealed that its lending and borrowing model has gone through a thorough audit by Halborn Security. In addition, all the audit recommendations have been implemented, and the project’s first version is set to debut on testnet, marking a major step in the evolution of the platform from an idea to a functional DeFi project.

Currently, the MUTM token is being offered at a $0.04 in presale, with a total raise of $19,550,000. The token has attracted a good number of participants, with 18,650 people registered as holders. Specialists are measuring the potential price that the token might take up in the future, using its actual utility in place of speculation. Among the top cryptos that people consider investing in currently, Mutuum Finance is one that has a solid structure in place.

Presale Mechanics For MUTM

The current stage at which Mutuum Finance is selling its token is Phase 7, and the price at which the token sells has been set at $0.04. However, this price has shown a rise of 300% from Phase 1, when the price per token was set at $0.01. The price increment may appear very low and aims at creating value for the investors. For example, when buying at $0.04, an investment of $300 will give an investor a total of 7,500 tokens. However, if the price rises to $0.60 within the short span, the investment will rise to $4,500.

Launch to Growth

The token will be launched with a price of $0.06. This might allow a possible return of around 440% for those who are purchasing it right now. But according to experts, this is only the starting point. The project is building a complete DeFi platform with a focus on lending and borrowing. The further it advances with usage, the more the demand for the token is expected to rise as MUTM solidifies its place as the top crypto to buy.

Comparisons to AVAX

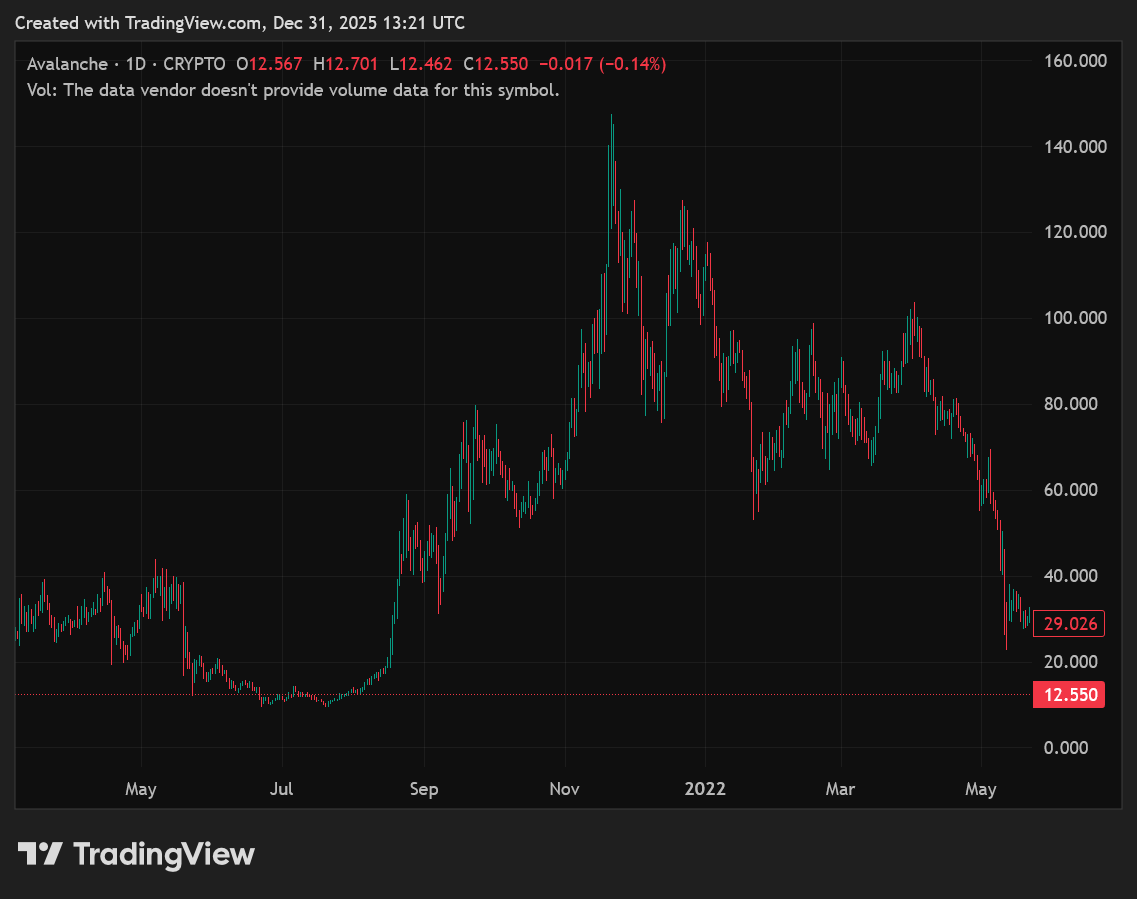

A way to make clear how a price of $15 in 2027 is possible for the price of the MUTM token in the future will use the example of Avalanche (AVAX) in the years of 2020-2021.

At the end of 2020, the price of AVAX was in the vicinity of $2.80, but in November of 2021, its price jumped to the vicinity of $146, a rise of well over 5,000% in a little more than a year as per crypto news. This kind of growth will come as Mutuum Finance develops to maturity, when the network is widely in use.

MUTM’s Illustrative Gains

Specialists use simple examples to illustrate possible results. With a price of $0.04, an investment of $500 will buy 12,500 tokens. Once the price increases to $15, the investment will be worth $187,500. A current investment of $1,000 could increase to $375,000, and even an investment of $100 could increase to $37,500. Such examples illustrate why Mutuum Finance is believed to be an attractive option for long-term investors rather than short-term traders.

Mutuum Finance has been cautious in that they subjected the project’s lending and borrowing smart contracts to a security audit by Halborn Security. This process has been completed and its recommendations integrated in the platform. This will avert threats associated with scaling up within a stipulated timeframe that is central to predictions that indicate a considerable increase over a long period.

So far in the benchmarking of success in the form of AVAX, the key takeaway is to get in early before the mass market does. AVAX shows that legitimate use and subsequent growth are able to drive serious ROI within a relatively short time frame. Entry prices are attractively low in MUTM, and it clearly offers a legitimate purpose through DeFi that in and of itself offers potential to hit the target of $15 by 2027.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance