Zcash price has maintained an apparent uptrend, fueling expectations of an impending breakout. ZEC continues to print higher highs, suggesting strength on the surface.

However, closer analysis of investor behavior and derivative positioning reveals weakening demand, raising doubts about the sustainability of the current upward structure.

Zcash Holders Are Showing Skepticism

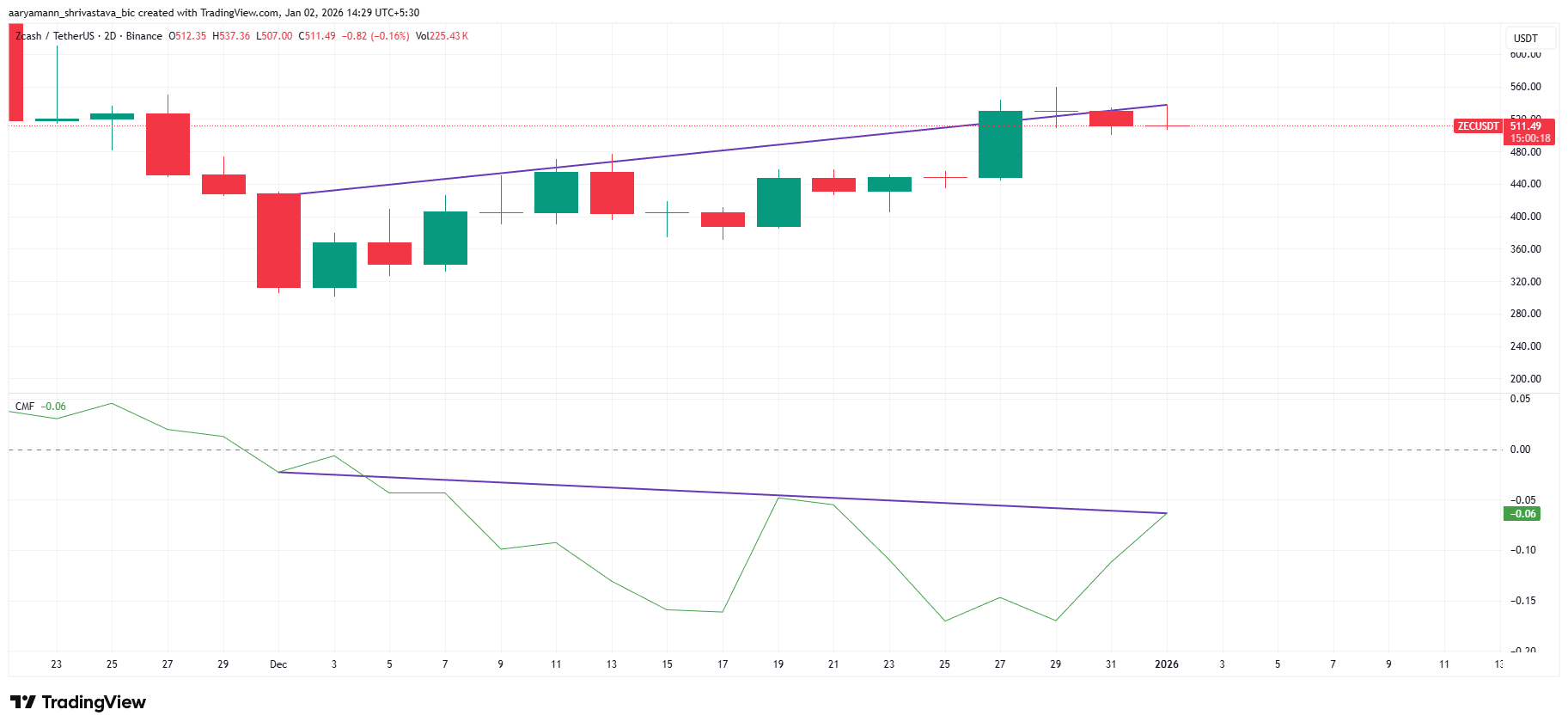

The Chaikin Money Flow is signaling caution for Zcash price. On the two-day chart, CMF is forming a lower high while the ZEC price records higher highs. This bearish divergence indicates declining capital inflows despite rising prices.

Such divergences often reflect distribution occurring beneath the surface. Investors may be selling into strength rather than accumulating. When buying pressure weakens during an uptrend, the price becomes vulnerable to reversal, especially if broader sentiment fails to improve.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ZEC CMF Bearish Divergence. Source: TradingView

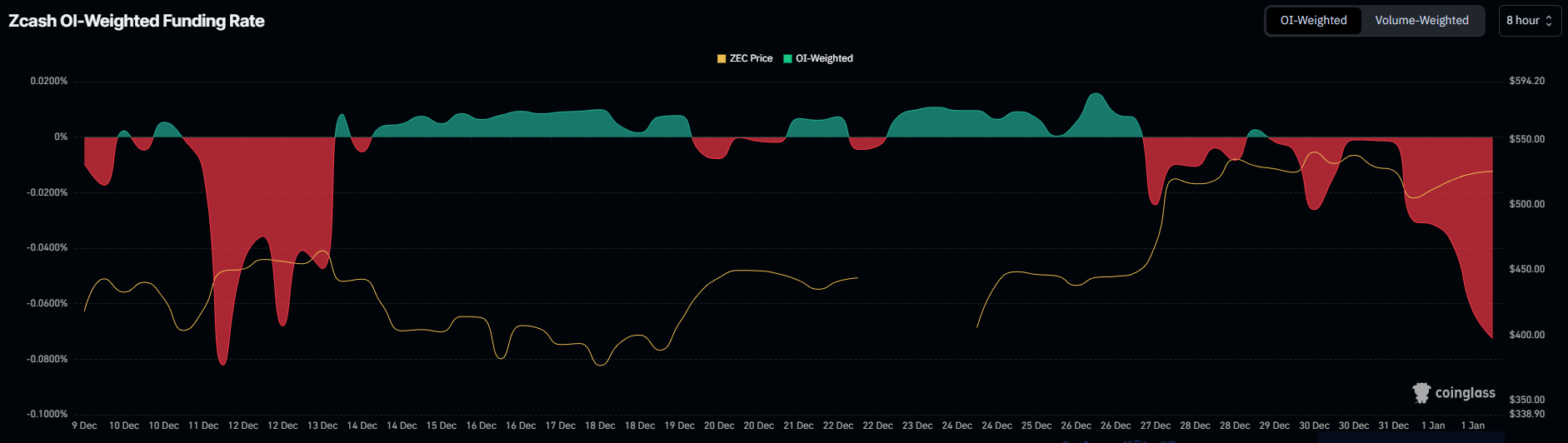

Macro indicators reinforce the bearish outlook. Zcash funding rates are deeply negative across major derivatives platforms. This imbalance shows short contracts significantly outweigh long positions, reflecting strong downside expectations among traders.

Negative funding rates suggest traders are paying a premium to maintain short exposure. This positioning indicates anticipation of a near-term price drop. Sustained negative rates often coincide with declining spot demand and reinforce broader bearish sentiment toward the asset.

Zcash Funding Rate. Source: Coinglass

ZEC Price May Witness Correction

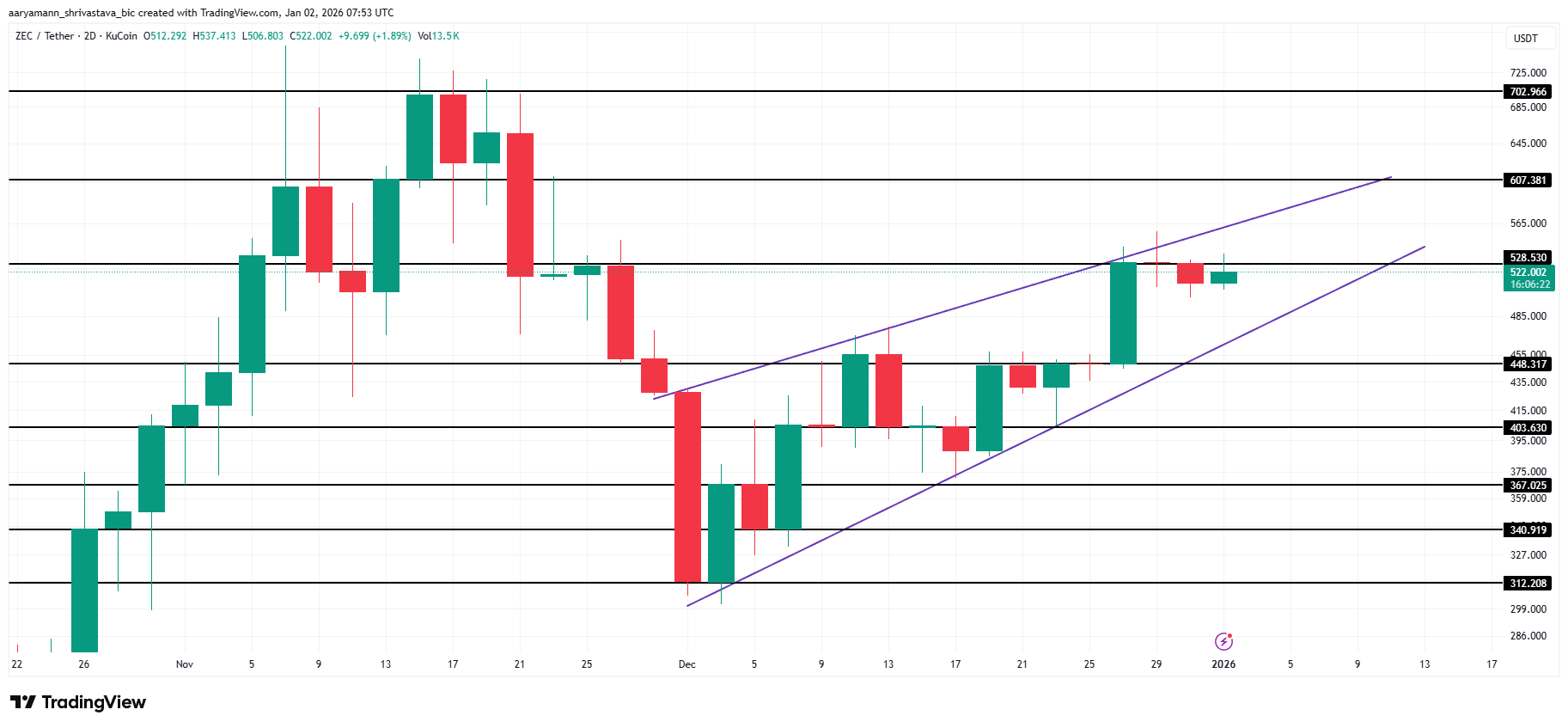

ZEC price is currently forming an ascending wedge, a pattern that can precede sharp moves. The cryptocurrency trades near $522 at the time of writing, remaining below the $528 resistance. While the structure hints at a breakout, confirmation remains absent.

Despite the wedge, weakening CMF, and negative funding rates, the breakdown risk rises. If selling pressure accelerates, ZEC could drop toward the $448 support. A loss of this level would likely extend the decline toward $403, confirming a bearish reversal.

ZEC Price Analysis. Source: TradingView

A bullish scenario remains possible under improved macro conditions. If buying momentum strengthens, ZEC could break above $528. A confirmed breakout may drive price toward $607, with $702 emerging as an extended target, fully invalidating the bearish thesis