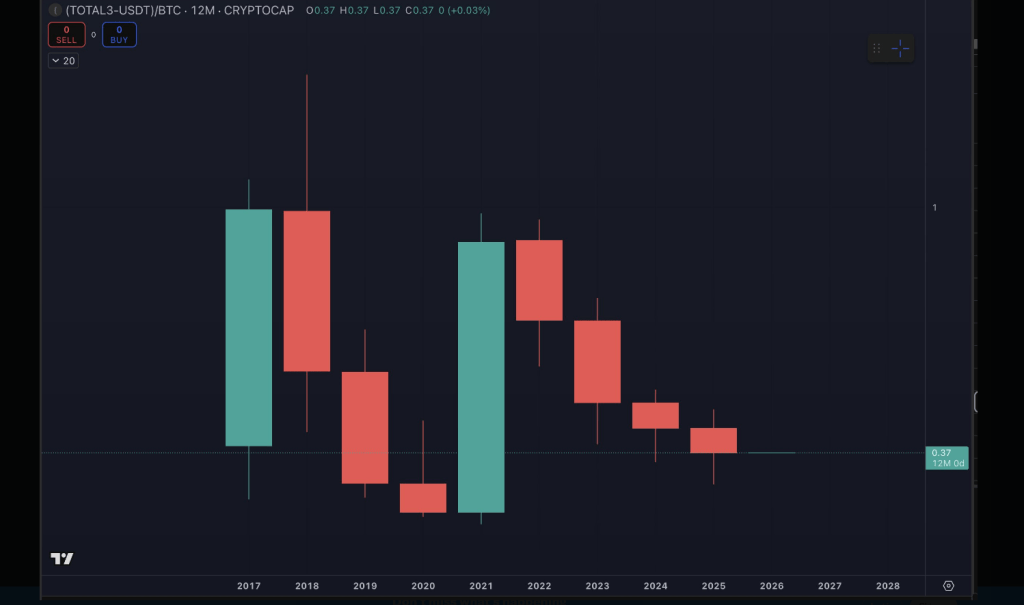

Altcoins closed 2025 weaker versus Bitcoin, marking a fourth consecutive year of underperformance. According to market data that tracks the TOTAL3/BTC ratio — which measures all altcoins excluding Bitcoin and Ethereum against Bitcoin — the ratio finished lower for calendar years 2022, 2023, 2024 and 2025. That streak has left traders and fund managers rethinking the old pattern where smaller tokens would often surge after Bitcoin rallies.

Altcoins Underperform Bitcoin

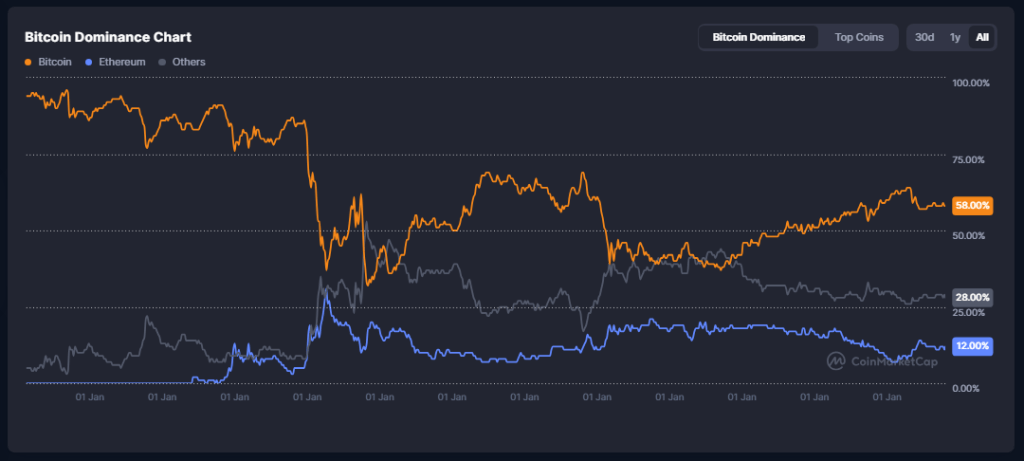

Market watchers say Bitcoin’s share of the overall crypto market has grown. Bitcoin dominance was reported at roughly 59–60% during the late 2025 selloff, a level that squeezed room for other tokens.

Based on reports, small-cap tokens hit their lowest point in four years as money flowed into larger, more liquid assets. Bitcoin itself slipped from an October peak and ended the year in negative territory, a development covered by major outlets that noted it was the first yearly loss for Bitcoin since 2022.

Widespread Losses And Heavy Market Moves

Several data providers found the median performance among the top 30 altcoins was negative for the year. Market value across the crypto sector fell sharply in late 2025, with some estimates saying more than $1 trillion was erased from total market capitalization during the downturn.

Traders described 2025 as a year that began with optimism but closed with broad losses, and many small tokens that rose earlier in the year gave those gains back when risk appetite faded.

What Analysts Are Saying

Some analysts argue that institutional flows and investor preference for liquidity were important drivers of this trend. Others point to macro pressures in the US and global markets that reduced appetite for speculative positions.

Reports note that for an altcoin rebound to beat Bitcoin again, fresh capital would need to rotate specifically into smaller tokens, rather than simply following Bitcoin’s moves. That shift has not been evident so far as 2026 unfurls.

The TOTAL3/BTC measure is being used by many traders to gauge altcoin strength versus Bitcoin. When that ratio falls year after year, it means a unit of Bitcoin buys more altcoin market cap than before.

Market trackers used by exchanges and analytics firms flagged the persistent downward trend across the last four calendar years, which is an unusual run relative to prior cycles when altcoins sometimes outpaced Bitcoin for parts of a market cycle.

Cautious Stance

Investors are staying cautious. Volatility remains high and liquidity can dry up fast in smaller tokens, which makes large moves possible both ways. Based on reports, any meaningful restoration of altcoin gains will likely require clear, sustained capital flows and improved market sentiment.

Until that happens, Bitcoin’s share of market capital will probably remain elevated, keeping pressure on smaller tokens.

Featured image from Unsplash, chart from TradingView