Bitcoin closed the year slightly in the red, marking a rare break in the long-observed four-year cycle pattern of one red year followed by three green years. The annual decline was modest—around 6%—and negligible compared to historical drawdowns seen in prior bearish years. Yet despite its limited magnitude, the red close carries symbolic weight, suggesting a shift in market behavior rather than outright weakness.

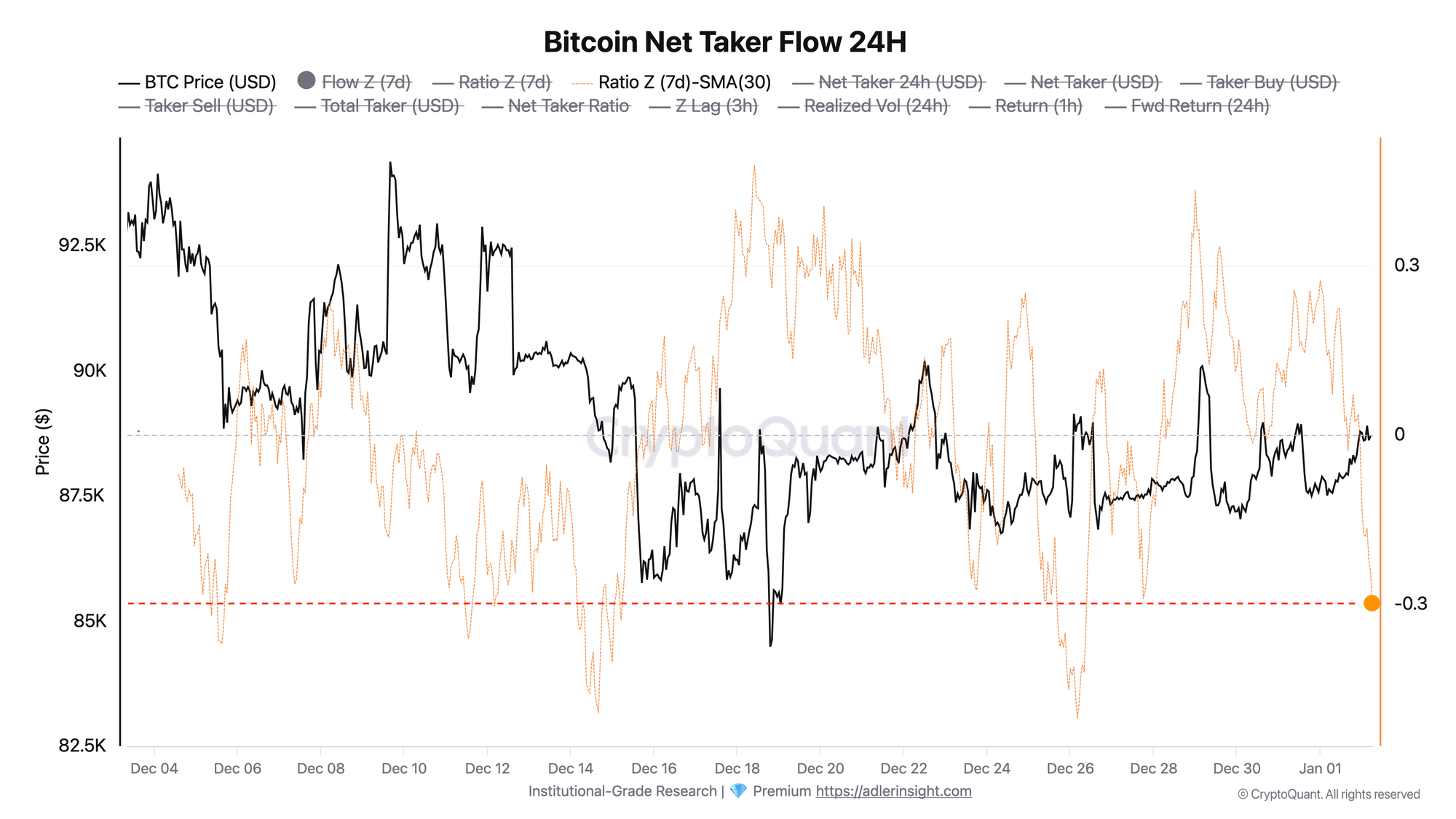

Recent on-chain analysis from Axel Adler adds important context to this change. Data tracking cumulative Net Taker Flow shows that aggressive buying peaked around the New Year before fading. Since then, the balance of market aggression has tilted toward sellers, though not in an extreme way.

The indicator currently sits in a moderate negative range, signaling that sell-side pressure has increased but remains far from capitulation levels.

Historically, similar conditions have tended to coincide with heightened downside sensitivity rather than immediate trend reversals. In practical terms, this suggests that Bitcoin is vulnerable to further weakness if demand fails to recover, but it is not yet displaying the stress typically associated with deeper bear phases.

The key takeaway is nuance. Bitcoin is not collapsing, but it is no longer behaving like an asset in a clean, momentum-driven expansion. The shift toward moderate sell pressure, combined with a rare red yearly close, points to a market transitioning into a more complex and selective phase rather than following its familiar cycle script.

Derivatives Momentum Turns Cautious as Sell-Side Pressure Aligns

Adler’s analysis highlights a growing shift in short-term market behavior through the Bitcoin Net Taker Flow momentum metric, which tracks how aggressively traders are positioning on the long or short side. Unlike cumulative flow, this indicator is designed to react quickly to sentiment changes, offering an early read on shifts in trader behavior rather than longer-term positioning.

In recent sessions, this momentum gauge has rolled over decisively. After holding positive territory in late December, the smoothed reading has slipped into negative levels, now hovering around -0.3. While this does not yet reflect extreme stress, it places the market firmly in a moderate bearish pressure regime. The timing is notable: the momentum downturn occurred alongside a deterioration in cumulative Net Taker Flow, reinforcing the signal rather than contradicting it.

This alignment matters. When both cumulative pressure and short-term momentum weaken together, it reduces the likelihood that the move is driven by noise or isolated positioning. Instead, it points to a broader shift in trader aggression toward the sell side. Adler notes that deeper downside risk would emerge if momentum continues to weaken, particularly if readings push beyond the -0.4 threshold.

Conditions suggest controlled but persistent selling pressure. Bitcoin is not yet in capitulation territory, but the synchronized signals indicate that bearish forces currently have the upper hand, increasing sensitivity to any loss of price support.

Bitcoin Holds Key Support As Momentum Remains Fragile

Bitcoin is consolidating around the $88,000–$90,000 zone after a sharp pullback from its recent highs. Reflecting a market caught between stabilization and lingering downside risk. Price remains below the short-term and medium-term moving averages, signaling that bullish momentum has not yet been reclaimed.

The 50-period moving average has turned into dynamic resistance, while the 100-period average is flattening, reinforcing the idea of a broader compression phase rather than an immediate trend reversal.

Importantly, Bitcoin is still holding well above the 200-period moving average, which continues to slope upward. This suggests that, from a higher-timeframe perspective, the broader structure has not fully broken down. However, the loss of the $100,000–$105,000 region earlier marked a clear regime shift from expansion to distribution. Increasing sensitivity to sell-side pressure.

Volume has notably declined during the recent sideways movement, indicating a lack of conviction from both buyers and sellers. This supports the view that the market is digesting prior excesses rather than aggressively repricing lower. Still, repeated failures to push back above the $92,000–$95,000 range highlight weak demand at higher levels.

As Bitcoin holds the $85,000–$88,000 support band, consolidation remains the dominant scenario. A breakdown below this area would likely open the door to deeper retracements.

Featured image from ChatGPT, chart from TradingView.com