As onchain derivatives infrastructure continues to develop, a growing number of platforms are experimenting with different execution and custody models for perpetual futures trading. Lighter is a perpetual futures exchange that combines off-chain execution with on-chain verification, with Ethereum serving as the settlement layer.

This article outlines how Lighter is structured, how trading and verification work on the platform, how its points program is used, and what is currently known about a potential Lighter token based on publicly available information.

What Is Lighter?

Lighter is a perpetual futures exchange that operates using a non-custodial trading model, where user assets remain in smart contracts rather than under the control of a centralized exchange operator.

The platform supports perpetual futures trading for a range of participants, including retail traders, market makers, and liquidity providers. Trades are executed off-chain for performance, while verification and settlement are anchored on Ethereum.

How Lighter Works: Perpetual Futures Trading Explained

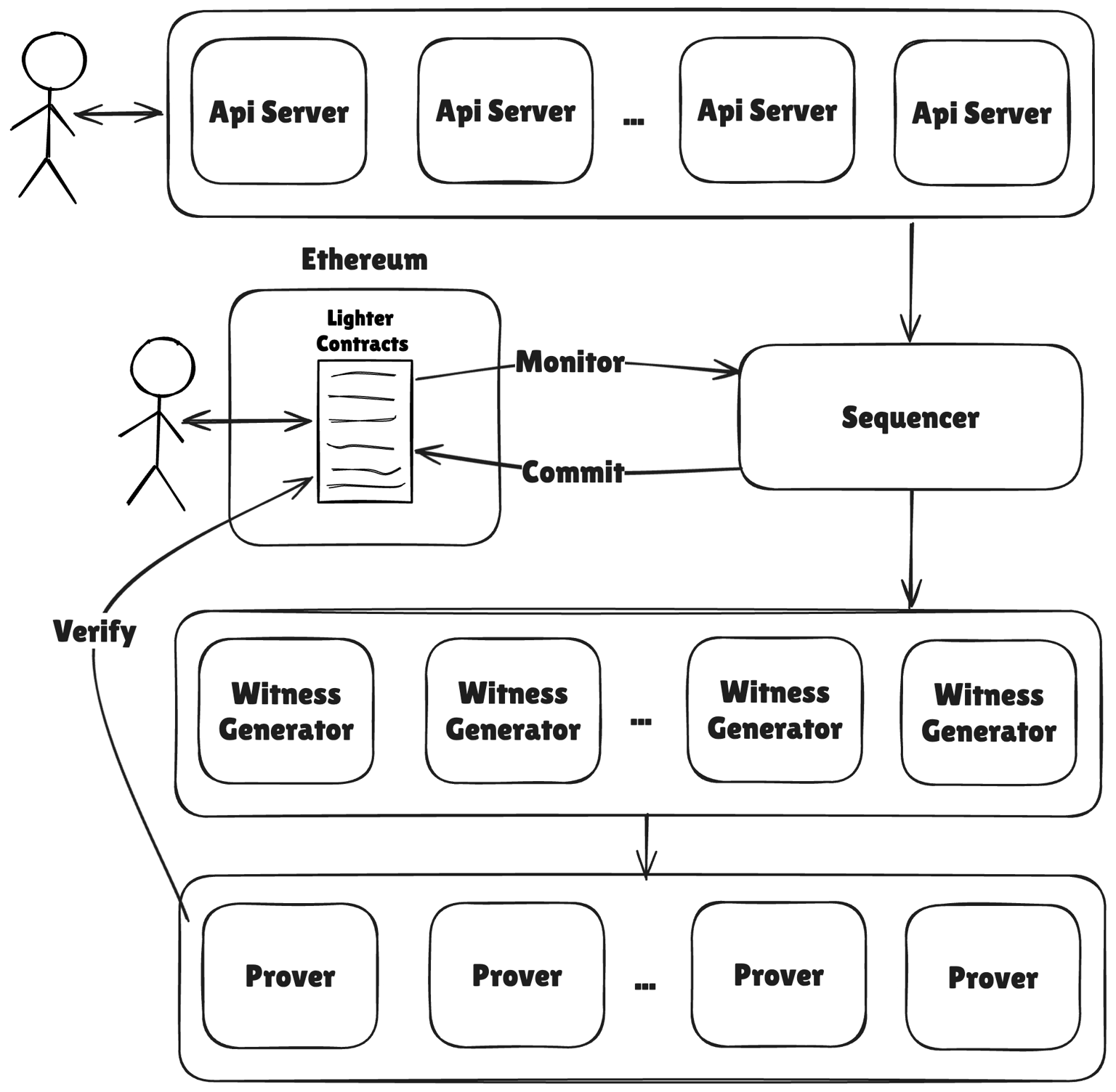

Lighter uses a trading model that separates trade execution from settlement and verification, combining off-chain performance with on-chain enforcement.

At a high level, the workflow operates as follows:

Users connect a wallet and deposit assets into non-custodial smart contracts on Ethereum

Trades are submitted as signed transactions via the user interface or API

Orders are matched and executed off-chain to reduce latency

Executions follow predefined, deterministic rules

Exchange state updates are periodically verified on Ethereum using cryptographic proofs

Lighter supports both retail and professional participants, including market makers, through standard trading interfaces and programmatic APIs.

Lighter Core Architecture

Lighter operates on a technical stack known as Lighter Core, which supports off-chain execution alongside on-chain verification.

Key architectural elements include:

Off-chain execution for order matching and trade processing

Cryptographic proofs generated for batches of executed transactions

Verification of state updates on Ethereum before finalization

Ethereum acting as the settlement and exit layer

User funds are held in Ethereum smart contracts, without reliance on custodial bridges or intermediaries.

Lighter also includes an escape mechanism. If certain off-chain components fail to process critical user requests within a predefined timeframe, on-chain data can be used to reconstruct account states and enable withdrawals directly on Ethereum.

Lighter Token: What We Know So Far

As of now, Lighter has not officially launched a native token, and the team has not published tokenomics or distribution details.

Despite this, market attention around a potential Lighter token has increased.

Prediction Market Activity

Across several prediction markets, participants are currently pricing in the possibility of a Lighter token launch toward late December. These markets reflect how traders are positioning around a potential event based on publicly available signals.

Coinbase Roadmap Inclusion

Market attention increased further after Coinbase added Lighter to its asset roadmap, a transparency initiative that highlights assets under review or observation.

Note: Any confirmed details related to a token launch would be communicated through official Lighter channels.

Lighter Points Program

Lighter operates a points program designed to reward active and organic participation on the platform. The program focuses on incentivizing real trading behavior rather than artificial or farmed activity.

The points system is organized into seasons. Season 1 ended on September 30, 2025, and Season 2 is currently active, with points distributed on a weekly basis. The Lighter team may adjust distributions as needed to maintain fairness and platform health.

Points can be earned through legitimate trading and market-making activity. Self-trading, sybil behavior, and other forms of farming do not earn points.

Lighter vs Hyperliquid: Key Differences

Lighter and Hyperliquid are both well-known perpetual futures platforms, but they differ in system design and execution models.

| Feature | Lighter | Hyperliquid |

|---|---|---|

| Core architecture | Off-chain execution with on-chain verification | Purpose-built high-performance chain |

| Asset custody | Non-custodial, secured on Ethereum | Secured on Hyperliquid’s native chain |

| Verifiability | Cryptographic verification of state updates | Protocol-level transparency |

| Settlement layer | Ethereum | Hyperliquid chain |

| Exit model | Independent Ethereum-based exits | Dependent on chain operation |

| Incentives | Points-based participation | Live token ecosystem |

Broadly, Hyperliquid emphasizes speed and liquidity through a dedicated chain, while Lighter takes an approach centered on Ethereum-based settlement and non-custodial exits.

Security and Asset Protection on Lighter

Lighter’s design places asset custody and execution verification on Ethereum.

Key characteristics include:

These components describe how custody, execution, and exits are handled within the system.

Risks and Considerations

As with any derivatives platform, there are factors users should consider:

Derivatives trading risk: Perpetual futures involve leverage and can result in rapid gains or losses.

Evolving protocol and incentives: Features, points programs, and incentive structures may change over time.

Operational complexity: Advanced features such as market making and API trading may not be suitable for all users.

Users should evaluate whether Lighter aligns with their risk tolerance and trading experience.

Final Thoughts

Lighter is one example of how onchain perpetual futures infrastructure can be structured using off-chain execution and Ethereum-based verification. Its design choices reflect broader industry trends around non-custodial trading, cryptographic verification, and independent exits.

As the platform continues to develop, traders evaluating Lighter may find it useful to understand how its architecture, incentive mechanisms, and positioning compare with other perpetual futures venues in the market.