Bitcoin is up about 3% over the past few sessions, but the price action is sending mixed signals. While the broader structure still looks bullish, a pause now looks likely. That pause may frustrate bulls in the short term, but it could also complete a pattern that sets up a much larger move higher.

A potential cup-and-handle formation is taking shape on the daily chart. If it plays out fully, Bitcoin’s next move may be less about speed and more about structure.

A Consolidation Looks Likely?

Bitcoin’s recent structure resembles a rounded bottom, which forms the “cup” in a cup-and-handle pattern. This pattern appears when the price slowly recovers from a sell-off, stabilizes, and then pauses before the next breakout.

The latest daily candle closed green but with a long upper wick. That matters. Long wicks show sellers are active at higher levels, even if the price closes higher.

This often marks the start of consolidation rather than continuation. The consolidation, if it happens, could complete the handle formation as well.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bullish Pattern: TradingView

On-chain data supports this pause.

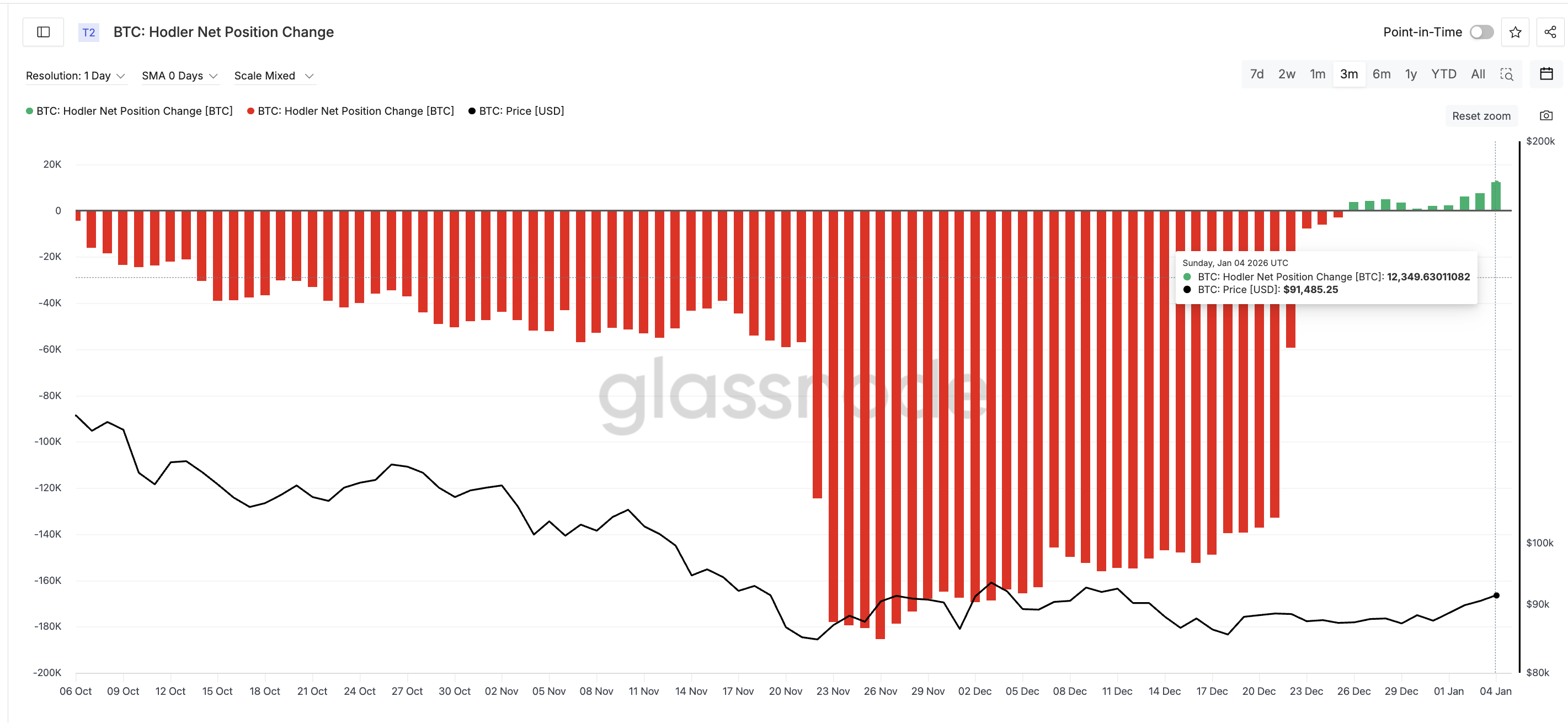

Hodler Net Position Change, which tracks whether long-term holders are accumulating or selling Bitcoin, shows buying has resumed but remains cautious. Since December 26, hodlers have consistently added BTC. However, the recent buying peak on January 4 was about 12,349 BTC. That is nearly 93% lower than the late-November selling peak of roughly 185,451 BTC.

Quiet HODLers: Glassnode

In simple terms, hodlers are buying again, but without urgency. That behavior aligns with a handle forming, not an immediate breakout.

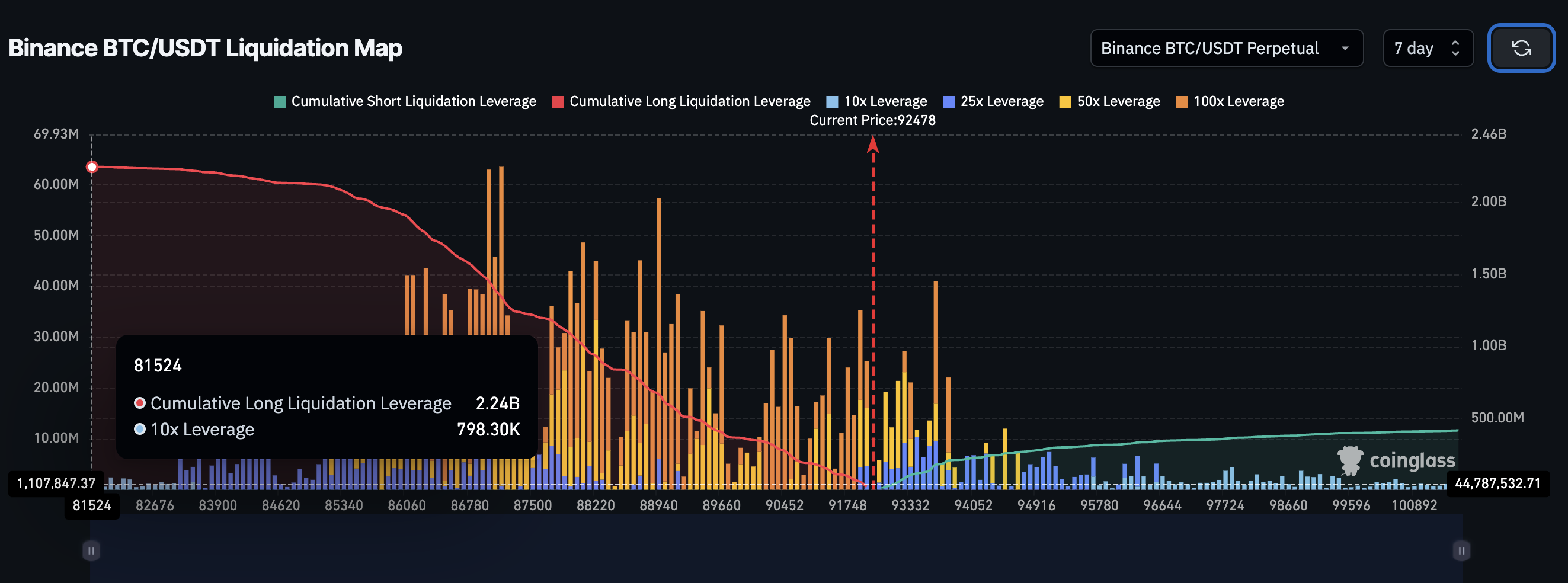

Derivatives positioning also argues for consolidation. On the Binance BTC/USDT perpetual liquidation map, long liquidation leverage sits near $2.24 billion, while short liquidation leverage is closer to $416 million. That means long exposure is roughly five times larger than short exposure.

BTC Liquidation Map: Coinglass

When long leverage becomes that heavy, even small pullbacks can trigger liquidations. That risk alone can keep price capped in the short term, helping the handle form fully.

So the question becomes: after this pause, what pushes Bitcoin higher?

Why the Bullish Case Still Holds After the Pause

Despite the risk of price consolidation, selling pressure underneath the surface continues to fade.

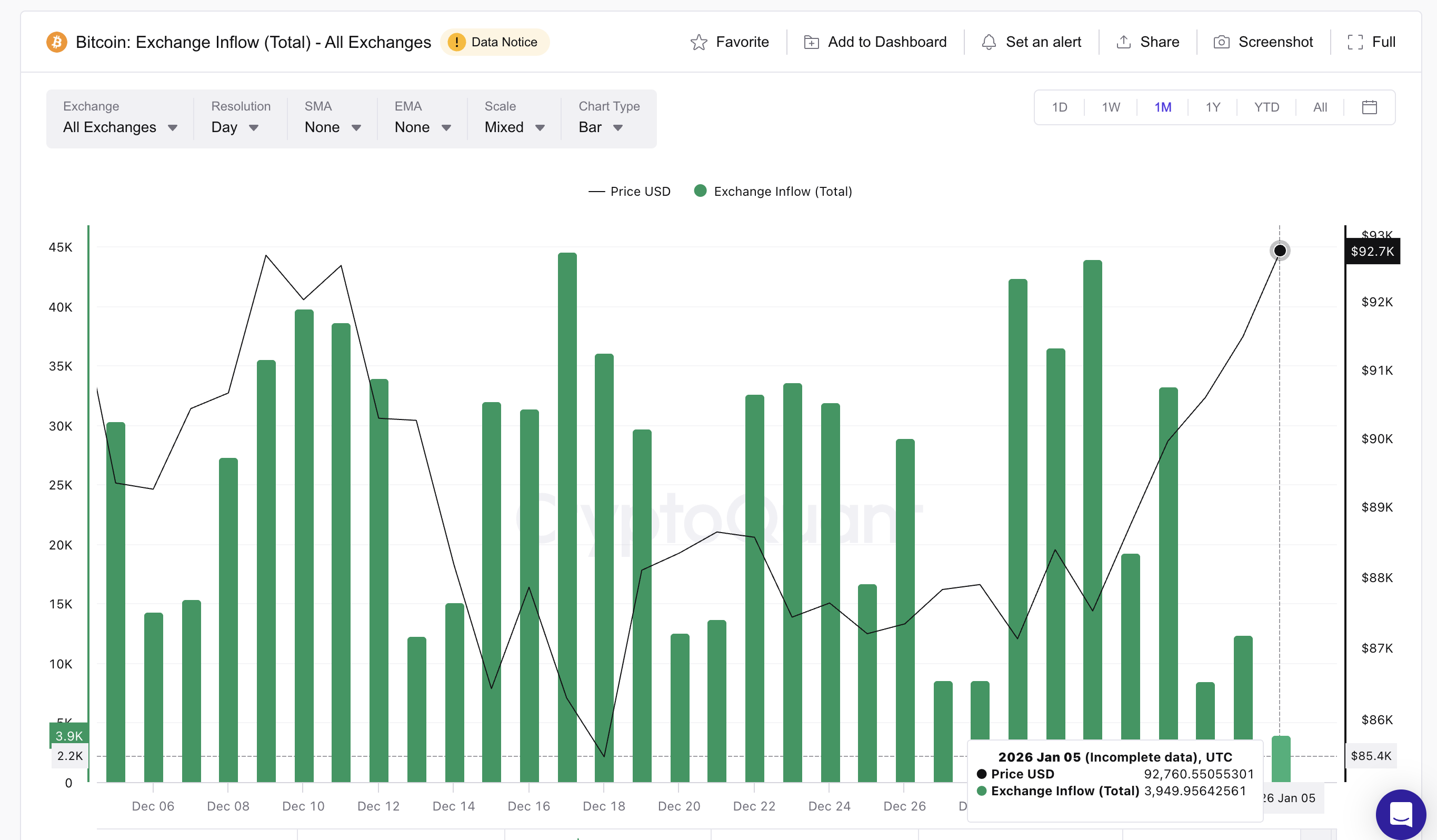

One key signal comes from exchange inflows, which track how much Bitcoin is sent to exchanges, often for selling. On December 31, total exchange inflows spiked near 43,940 BTC. By January 5, that figure dropped to roughly 3,970 BTC.

That is a decline of more than 90% in just a few days.

Exchange Inflows: CryptoQuant

This matters because Bitcoin has risen during the same period. When price moves higher while exchange inflows fall, it suggests traders are not rushing to sell into strength.

Another supportive signal comes from Spent Coins Age Bands, which measure how many coins of different ages are moving on-chain. High values mean more coins are being spent. Low values mean holders are staying put.

On December 31, spent coins activity sat near 28,033 BTC. As of January 5, it dropped to around 5,644 BTC, an 80% reduction in coin movement.

Coin Activity Drops: Santiment

Both young and old coins are moving less. That points to declining spot selling pressure, even as derivatives positioning remains crowded on the long side.

In short, leverage risk explains why Bitcoin may stall, but on-chain behavior explains why the broader trend still leans bullish.

Bitcoin Price Levels That Decide What Comes Next

If the BTC price consolidation holds, structure matters more than momentum.

As long as Bitcoin stays above $89,450, the broader bullish setup remains intact. A deeper breakdown below $84,320 would invalidate the pattern and reopen downside risk.

On the upside, the first level to watch is $93,560, which sits near the neckline of the developing handle. Breaking this level would strengthen the bullish hypothesis. A clean daily close above $94,710 would strongly confirm the breakout.

Bitcoin Price Analysis: TradingView

From that neckline itself, the measured move from the cup projects a Bitcoin price target near $104,000, roughly 12% higher. If momentum carries further, $107,460 becomes possible as the next resistance.

Bitcoin may frustrate bulls with sideways movement first. But if this consolidation completes the handle, the breakout that follows could be far harder for bears to handle.