While Bitcoin dominance has continued to rise recently, altcoins have struggled to gain traction.

However, there are a crypto that have managed to stay afloat in this environment.

That crypto is Maple Finance’s Syrup Coin.

Let’s take a comprehensive look at what it is, how to buy it, and who the investors are.

Contents

1. What is Syrup coin?

1.1. Introduction

In the fast-moving world of decentralized finance (DeFi), innovation never sleeps. One of the latest names making quiet but meaningful noise is Syrup Coin — a token born from the evolution of Maple Finance, a project that initially focused on undercollateralized institutional loans in crypto.

1.2. From MPL to SYRUP: A Rebrand with Purpose

Maple Finance originally launched with its governance token, MPL. The project provided unsecured loans to institutions via on-chain lending pools, acting almost like a decentralized version of private credit funds. While the concept was solid, MPL faced limitations in utility and investor traction.

In late 2023, the team announced a strategic overhaul. That included:

Upgrading the lending protocol.

Introducing Syrup Coin as a new token with updated utility and tokenomics.

Burning a portion of the MPL supply to tighten the economy.

1.3. Who’s Behind Maple Finance?

Maple Finance was co-founded by Sidney Powell (not Jerome Powell!), a former investment banker at National Australia Bank, and Joe Flanagan, a product specialist.

According to its Crunchbase profile, Maple Finance has raised over $45M in funding, backed by notable investors like BlockTower Capital, Framework Ventures, and Polychain Capital.

Searches for “maple crypto” and “maple finance crunchbase” have surged in 2025 as institutional DeFi narratives picked up again.

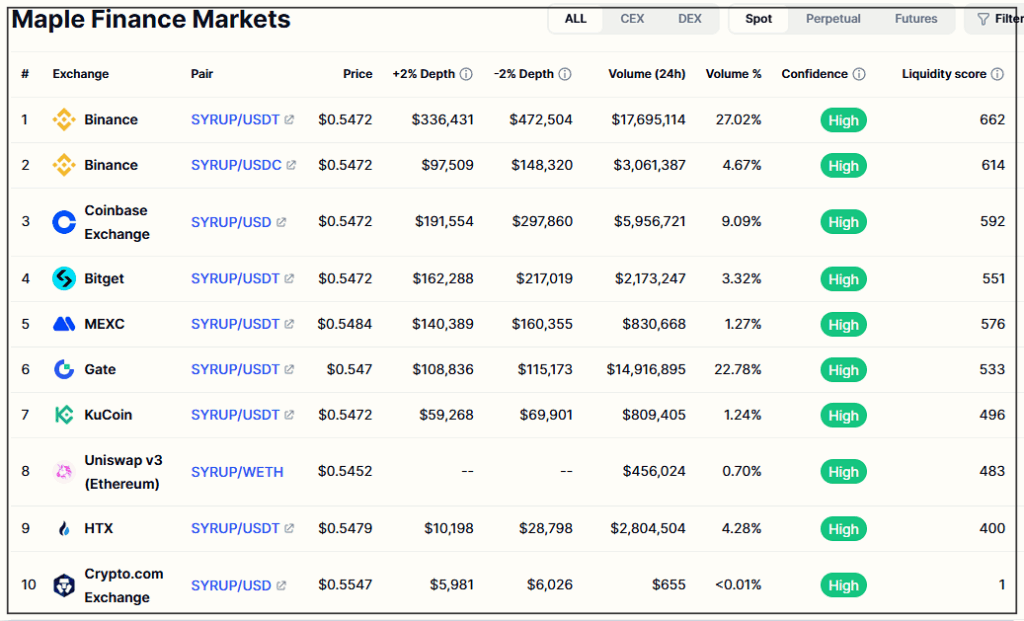

2. How to Buy

Due to its popularity, Syrup coin can be traded on most popular crypto exchanges. Among them, we recommend the following exchanges that have high trading volume and are safe.

If you click on the exchange names below, you will be taken to their respective detailed review pages with benefit links.

Binance

Bitget

Mexc

Gate

3. SWOT analysis

Strengths

Real institutional use case

Revenue-sharing model (I think it is very important)

Strong VC backing

Weaknesses

Low retail awareness

Relatively low liquidity compared to top DeFi tokens

Opportunities

Expansion into Real World Asset (RWA) lending

Institutional DeFi growth

Integration with LayerZero and other L2s

Threats

Competitor protocols with larger user bases

Possible defaults from borrowers

Macroeconomic instability (like inflation or tariff war)

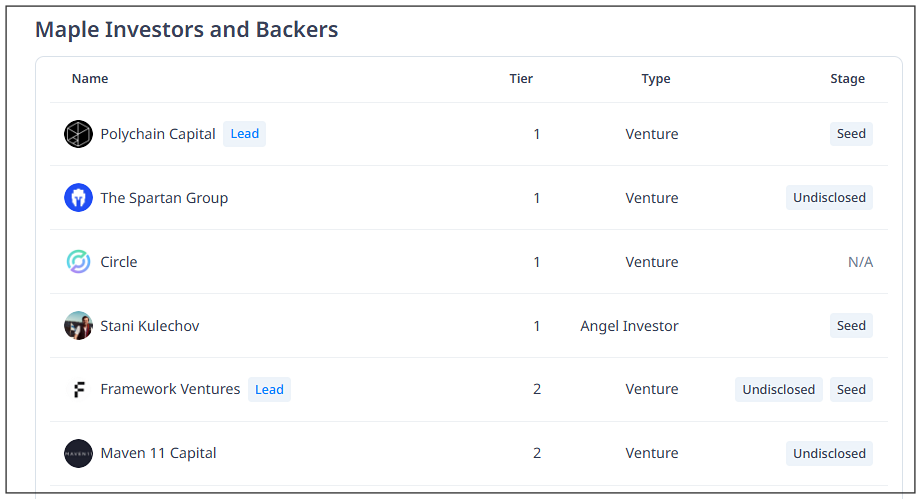

4. Who Invested in Syrup Coin?

Syrup Coin — and its parent project Maple Finance — has gained notable attention not just from users, but from some of the most respected names in venture capital.

Polychain Capital

One of the largest crypto-native investment firms, Polychain Capital participated in Maple Finance’s earlier funding rounds. Their involvement adds deep credibility, particularly given their focus on protocol-level infrastructure and DeFi primitives.

Framework Ventures

Known for investing in projects with strong tokenomics and protocol utility, Framework backed Maple early on and has continued to support the transition from MPL to Syrup.

The Spartan Group

Based in Asia, they’ve helped Maple expand into the APAC market, where crypto lending is growing rapidly.

5. Comparison with Similiar Coins

Aave (AAVE)

Feature : Lending + flash loans

Advantages : Popular, high TVL, proven track record

Drawback : Heavy reliance on over‑collateralization

Compound (COMP)

Feature : Credit markets on-chain

Advantages : High liquidity, transparent governance

Drawback : Prone to liquidations in volatility

Centrifuge (CFG)

Feature : RWA-backed loans

Advantages : Direct real‑world asset exposure

Drawback : Regulatory risk, limited scalability

6. Price Forecast & Future

Expert Price Forecasts

Messari (Q1 2025 Report): “Syrup could outperform other DeFi governance tokens in the next cycle due to its tighter tokenomics and actual fee distribution mechanism. $SYRUP to $5–7 range in a bull case.”

Delphi Digital (May 2025): “Maple Finance’s pivot to revenue-based tokens is timely. If DeFi recovers, SYRUP could attract yield-seekers. Target: $4.50 by Q4 2025.”

Pantera Capital (in an internal memo): “We believe in Maple Finance’s dual model of TradFi and DeFi. If executed well, Syrup can become the primary DeFi credit token.”

My Opinion

The institutional DeFi narrative is regaining traction. As regulators show interest in RWA-based finance and crypto credit solutions, protocols like Maple are gaining legitimacy. Its model, which aligns incentives between token holders and borrowers, is closer to how equity markets operate than traditional DeFi.

Personally, I believe Syrup Coin has long-term potential — not just because of price speculation but due to its strong token mechanics. It’s still under-the-radar, which makes it an interesting candidate for asymmetric bets.

7. Investment Points

Here are three reasons I believe Syrup Coin deserves attention:

Real Revenue: Unlike many DeFi tokens, it shares actual fees from lending activities.

Tokenomics Upgrade: The transition from MPL to Syrup tightened supply and improved utility.

Institutional Tailwinds: Maple sits at the intersection of TradFi and DeFi — a sector poised for massive growth.