In the dynamic landscape of decentralized finance (DeFi), the optimization of capital and the maximization of returns present inherent complexities. Kamino Finance emerges as a leading DeFi protocol, purpose-built on the high-performance Solana blockchain, designed to streamline and automate these intricate financial operations. Kamino has rapidly established itself as a foundational component of the Solana ecosystem, making sophisticated financial strategies accessible to a broad spectrum of users, from novices to seasoned crypto enthusiasts.

What is Kamino Finance?

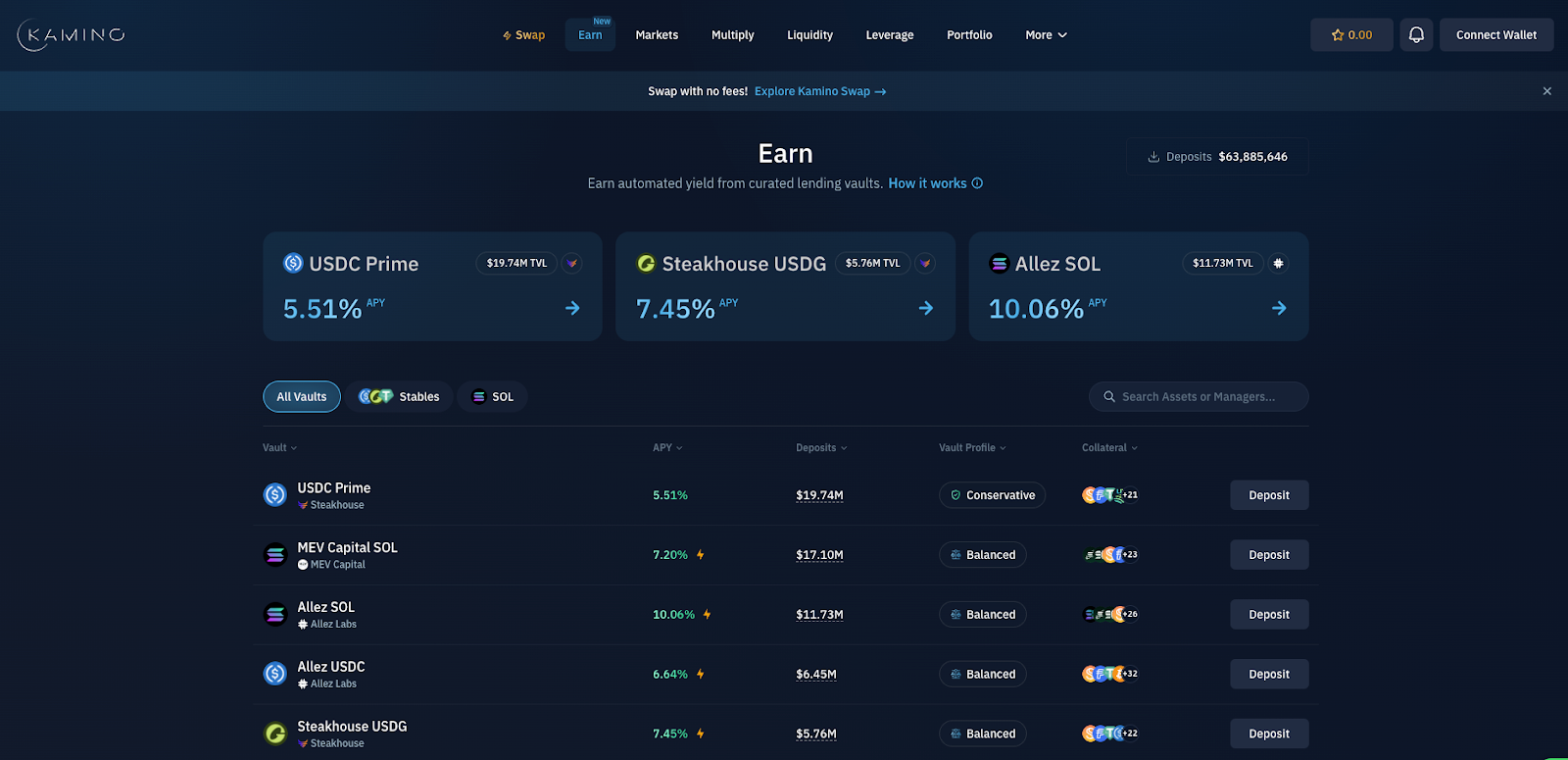

Kamino Finance is a decentralized finance platform on Solana that seamlessly integrates lending, liquidity provision, and leveraged trading within a comprehensive and accessible product suite. Kamino's central innovation resides in its automated and highly efficient concentrated liquidity management capabilities for Decentralized Exchanges (DEXs).

Traditionally, providing liquidity to DEXs necessitated the broad dispersion of assets across wide price ranges, often resulting in suboptimal capital utilization. Kamino mitigates this challenge by enabling Liquidity Providers (LPs) to strategically concentrate their liquidity within narrow price bands where trading activity is most prevalent. This approach significantly enhances capital efficiency and boosts potential fee earnings. Kamino further elevates this by automating the entire lifecycle of liquidity provision, including dynamic position rebalancing and the auto-compounding of accrued trading fees. This ensures that LPs consistently optimize their yields without requiring constant manual oversight.

Highlight Features of Kamino Finance

Kamino transcends the role of a mere concentrated liquidity manager; it functions as a comprehensive DeFi hub:

Automated Liquidity Vaults: These vaults constitute the backbone of Kamino, enabling users to seamlessly provide liquidity with automated rebalancing and auto-compounding. Depositors receive yield-bearing kTokens, which represent their proportional share and accumulated earnings within the liquidity pool.

Kamino Lend (K-Lend): This robust lending and borrowing protocol allows users to supply assets to earn interest or borrow against their collateral. K-Lend features "Elevation Mode" (eMode), which facilitates significantly higher Loan-to-Value (LTV) ratios for correlated assets, thereby enhancing capital efficiency.

Multiply Vaults (Leverage Farming): This feature empowers users to amplify their exposure to yield-bearing assets through leverage, potentially amplifying their returns. Kamino leverages Flash Loans—a mechanism for rapid, uncollateralized borrowing and repayment within a single transaction—and eMode to facilitate these advanced strategies.

Long/Short Vaults: Users can establish leveraged long or short positions on various crypto assets, enabling speculation on price movements without requiring direct asset ownership.

DIY Vault Creator: For advanced users, Kamino offers the flexibility to create and customize their own liquidity strategies.

User-Friendly Interface: Despite its sophisticated underlying mechanisms, Kamino prioritizes an intuitive user experience, rendering complex DeFi strategies accessible to a wider audience.

Robust Risk Management: The platform incorporates robust risk management features, including dynamic liquidation penalties, predefined deposit limits, and a sophisticated risk engine, all designed to safeguard user capital.

The Development Team Behind Kamino Finance

Kamino Finance, a significant entity within Solana's decentralized finance (DeFi) ecosystem, possesses a unique genesis, blending incubation by an established protocol with leadership from a dedicated founding team. Kamino Finance was initially incubated and launched by Hubble Protocol in August 2022. This foundational support from Hubble provided Kamino with an initial strategic advantage within the DeFi landscape.

The strategic development and operational oversight of Kamino, however, are independently driven by a distinct cohort of four co-founders: Gonzalo Parejo, Rodrigo Perenha, Benjamin Gleason, and Guto Fragoso.

At the helm, Gonzalo Parejo serves as the Chief Executive Officer. Rodrigo Perenha holds the dual roles of Director and Chief Technology Officer, guiding Kamino's technical vision. Henrique Netzka is also a pivotal member of the management team, specifically tasked with optimizing Kamino's product offerings and ensuring a premium user experience.

The project has successfully secured substantial financial backing, evidenced by a single seed funding round that raised $6.1 million. This round garnered support from a distinguished group of investors, including Ariel Patschiki, Clocktower Technology Ventures, David Arana, Flourish Ventures, and Gilgamesh Ventures.

In early 2024, Kamino further solidified community engagement through the launch of its Kamino Points Initiative Season 1. This three-month program was strategically designed to acknowledge and reward loyal existing users, while concurrently incentivizing the onboarding of new participants into the expanding Kamino ecosystem.

What is the KMNO Token?

The KMNO token serves as the native utility and governance asset of the Kamino Finance ecosystem. As an SPL token on the Solana blockchain, KMNO is integral to fostering decentralization and ensuring the long-term sustainability of the protocol.

The primary utilities of KMNO include:

Governance: KMNO token holders possess the authority to influence the future trajectory of the Kamino protocol. This includes the ability to vote on critical proposals such as protocol upgrades, modifications to the fee structure, and the strategic allocation of treasury funds.

Incentivization: KMNO tokens serve to incentivize active participation across the Kamino ecosystem. Users can earn KMNO by providing liquidity, borrowing, and interacting with the platform's various products.

Staking Rewards: Staking KMNO tokens provides users with "loyalty boosts" during ongoing points seasons, which directly correlates with enhanced allocations in subsequent token distributions or airdrops.

Fee Discounts and Access: In the future, KMNO may offer fee discounts for various platform services or unlock access to exclusive features.

Token Allocation and Tokenomics

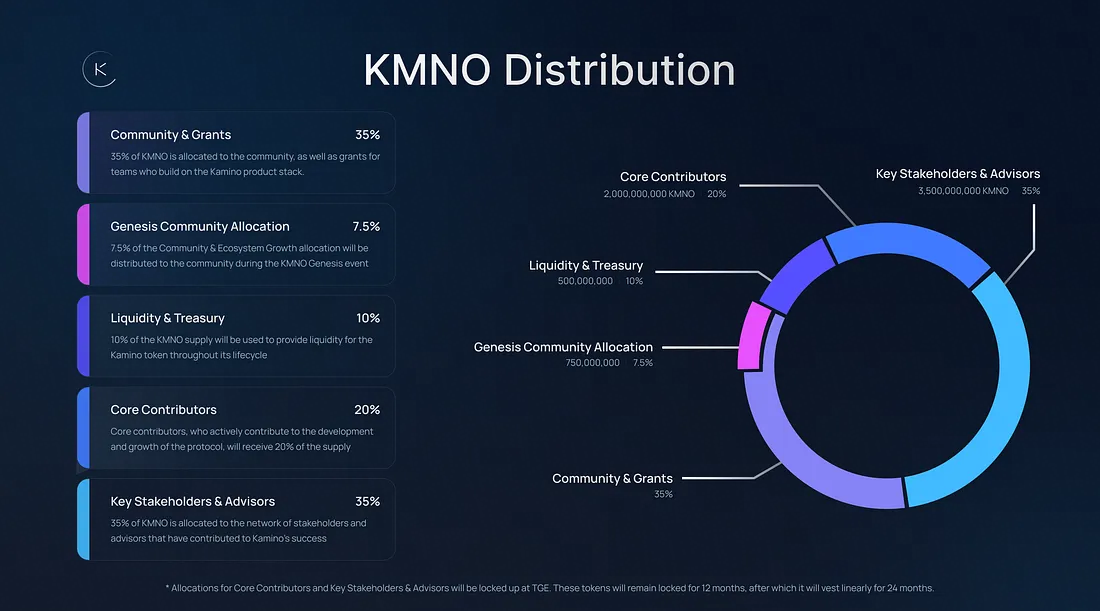

The total supply of KMNO tokens is capped at 10,000,000,000 KMNO. Its distribution strategy is meticulously designed to foster robust community growth, reward early adopters, and ensure long-term alignment among core contributors and stakeholders. While precise percentages may be subject to minor adjustments based on ongoing programs, the general allocation is structured as follows:

Community & Grants: A substantial portion (approximately 35%) is earmarked for community initiatives, future airdrops, and grants, serving to incentivize both developers and active users.

Key Stakeholders & Advisors: Approximately 35% is allocated to strategic partners and advisors, recognizing their contributions to Kamino's development and success. These allocations are typically subject to rigorous vesting schedules (e.g., a 12-month lock-up period followed by linear vesting over 24 months) to ensure sustained commitment.

Core Contributors: An estimated 20% is designated for the core development team and contributors, likewise subject to comparable vesting schedules.

Liquidity & Treasury: Approximately 10% is reserved for liquidity provision across various exchanges and for the protocol's treasury, facilitating future development and operational requirements.

Genesis Community Allocation: A segment (e.g., 7.5% of the total supply) was distributed to users through genesis airdrop events.

This comprehensive tokenomics model is designed to cultivate a robust and decentralized ecosystem, where KMNO holders actively participate in the protocol's evolution. This framework underscores Kamino Finance's commitment to community-driven growth and the sustainable creation of value on the Solana blockchain.