Behind Bitcoin’s steady price, a shift in exchange flows suggests whales are preparing moves that the broader market has yet to respond to.

Large crypto holders are once again shaping market behavior, with on-chain data showing a clear shift toward whale-dominated activity on centralized exchanges—particularly Binance—while buyer demand remains conspicuously absent.

Key Takeaways

Whale activity on exchanges has reached its highest level in roughly ten months.

Large Bitcoin and Ethereum inflows are concentrating on Binance.

Average deposit sizes are rising, while withdrawals into cold storage are declining.

The imbalance suggests increased sell-side risk rather than renewed accumulation.

Over the past several weeks, exchange flows have increasingly been driven by large transactions rather than retail participation. Metrics tracking the size and concentration of deposits indicate that whale influence has risen to its highest level in roughly ten months, coinciding with Bitcoin’s recovery above $92,000.

One of the clearest signals is the surge in the Bitcoin exchange whale ratio, which measures the share of top inflows relative to total deposits. That ratio recently climbed above 0.50, a level historically associated with elevated sell-side risk. Similar readings in the past have tended to appear near local tops or during periods when large holders prepare to distribute supply.

Binance becomes the focal point for whale activity

The bulk of this activity is flowing through Binance, which continues to act as the primary liquidity hub for large players. The exchange now holds more than seventy percent of all stablecoin balances across major platforms and has seen a sharp rise in the average size of Bitcoin deposits.

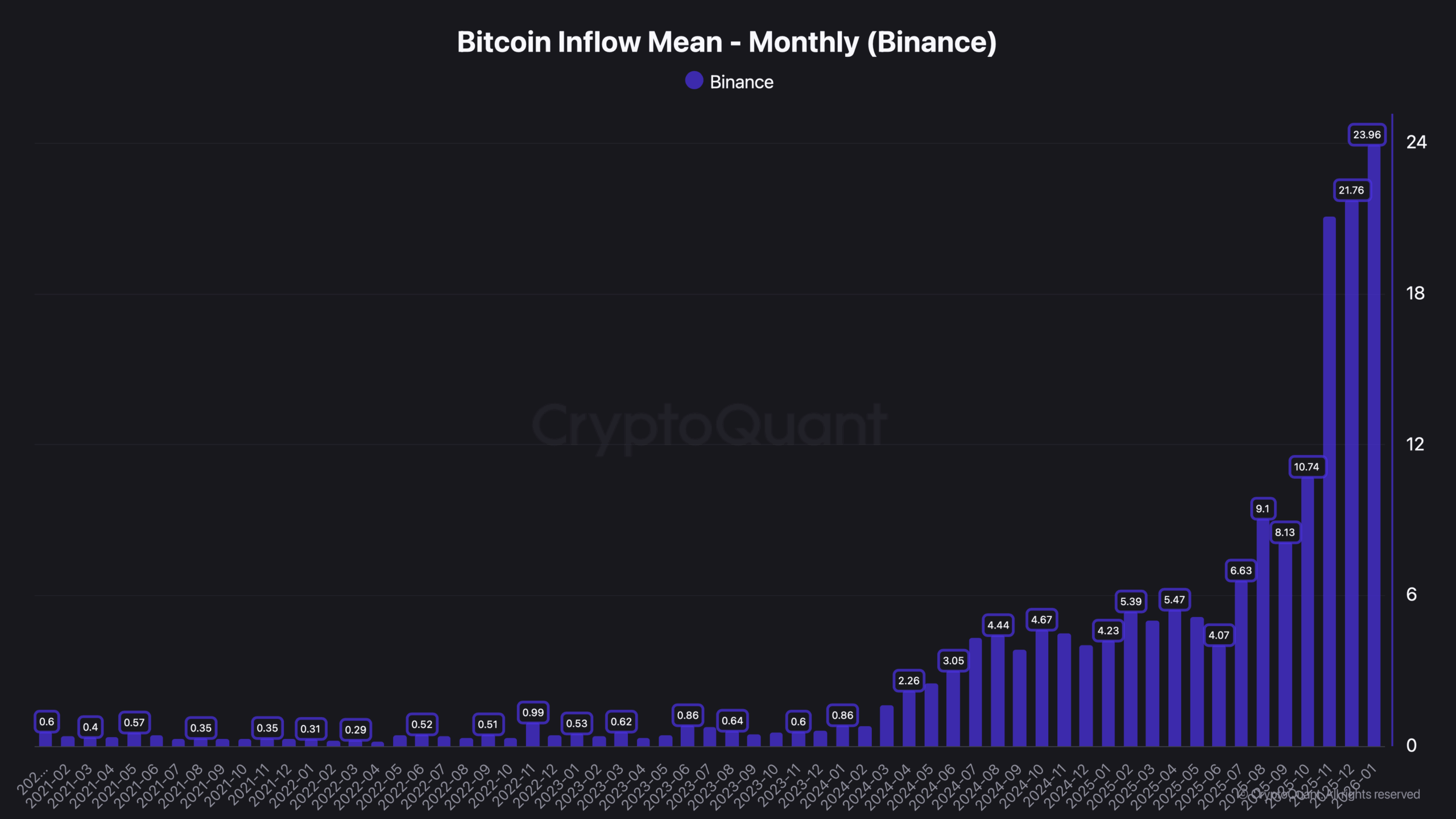

Data shows that whale-sized transfers to Binance have grown substantially since late last year. Average Bitcoin deposits have increased from single-digit amounts to well over twenty BTC per transaction, pointing to strategic positioning by large holders rather than organic retail trading.

Binance appears to be serving as a major venue for hedging, rebalancing, and short-term execution tied to institutional flows. At the same time, retail activity has increasingly shifted toward wallets, decentralized platforms, and in-app trading tools rather than centralized exchanges.

Inflows rise, but buyers fail to appear

While deposits are accelerating, the other side of the trade is notably weak. According to data shared with CryptoQuant, whales deposited roughly $2.4 billion worth of crypto to Binance over the past week, split almost evenly between Bitcoin and Ether.

Despite the size of those inflows, stablecoin balances—which typically signal fresh buying power—remained effectively flat.

That imbalance is raising concerns among analysts. Without a corresponding rise in stablecoin inflows, large deposits are more likely linked to preparation for selling, derivatives collateral, or short-term liquidity usage rather than accumulation.

Outflow data reinforces that caution. Withdrawals from Binance have declined both in size and frequency, suggesting fewer coins are moving into long-term storage. Historically, strong bull phases tend to show the opposite pattern, with whales pulling assets off exchanges after accumulation.

What it means for Bitcoin’s near-term outlook

The resurgence of whale activity does not automatically imply an imminent sell-off, but it does introduce friction. Large holders have a track record of taking profits during relief rallies and creating resistance as price moves higher. Similar flow patterns were observed during previous distribution phases in 2025, including periods that preceded notable pullbacks.

At the same time, the broader picture remains mixed. Bitcoin is still down roughly thirty percent from its cycle peak, and longer-term accumulation continues through new wallets, corporate treasuries, and ETF inflows. That underlying demand provides a counterbalance to short-term sell pressure from exchanges.

For now, Bitcoin has remained resilient, trading near $92,400 after briefly testing the $93,000 level as market activity picked up following the holiday slowdown. Price stability suggests that selling has not yet overwhelmed demand—but the absence of aggressive buyers means upside momentum may struggle to build without a shift in flows.

In short, whales are back in control of exchange activity, Binance has become their primary staging ground, and the market is once again navigating a familiar tension: large players are positioning, but conviction buying has yet to follow.