Positive sentiment shows signs of returning to the market in the first week of January, pushing altcoins toward a recovery. However, doubts remain over whether this rebound can last.

Several altcoins could trigger large liquidations as their derivatives data approach danger zones that caused liquidations in the past. Which altcoins stand out?

1. Ethereum (ETH)

Many bullish factors support long positions in Ethereum (ETH) this week. The number of new ETH holders has surged recently. The Ethereum staking entry queue has surpassed the exit queue. On-chain Ethereum transactions have reached their highest level in a decade.

As a result, traders have increased capital and leverage on long positions. This has pushed potential long liquidations far above short liquidations.

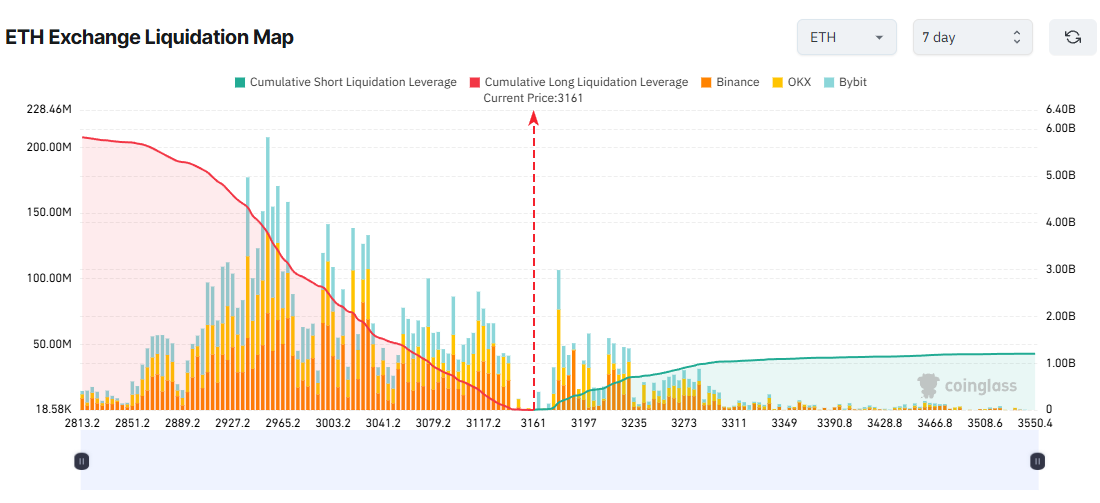

ETH Exchange Liquidation Map. Source: Coinglass

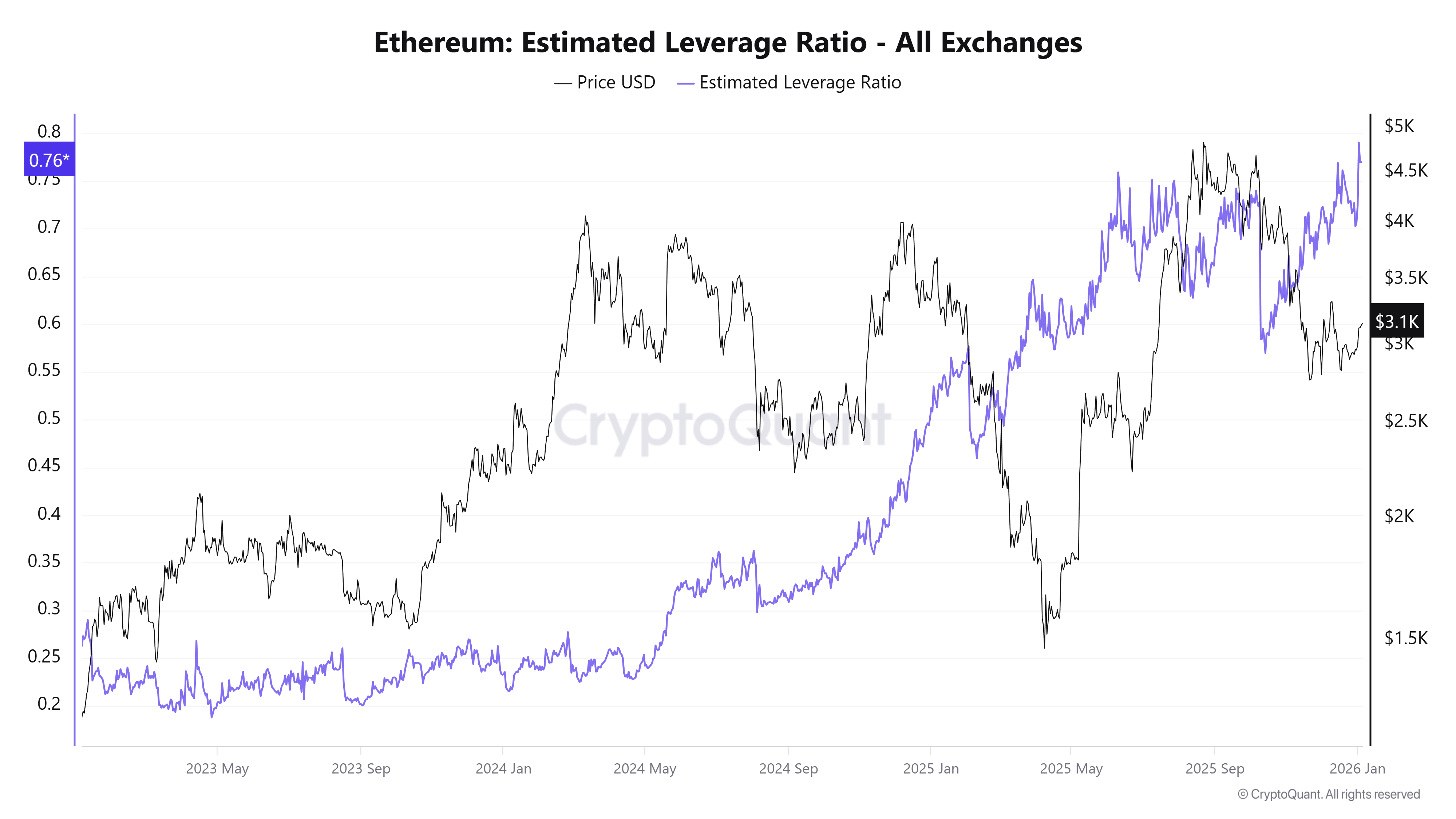

However, one concerning metric has emerged. ETH’s estimated leverage ratio has reached an all-time high.

This ratio equals an exchange’s open interest divided by its coin reserves. It reflects the average leverage used by traders. Rising values indicate that more investors are taking high-leverage risks in derivatives trading.

Ethereum Estimated Leverage Ratio. Source: CryptoQuant.

Long-term traders may see short-term gains as bullish factors unfold. Still, rising leverage serves as a serious warning. A major liquidation event could occur at any time for ETH.

If ETH drops to the $2,800 zone this week, potential long liquidations could exceed $5.8 billion.

2. Bitcoin Cash (BCH)

Veteran investor Peter Brandt recently mentioned Bitcoin Cash in his latest outlook. He suggested that BCH is approaching the key $650 resistance level. A breakout there could set a higher price range.

A recent BeInCrypto report also highlighted several factors supporting further upside for BCH.

Derivatives traders appear to share this bullish view. They are allocating more leveraged capital to long positions than to shorts.

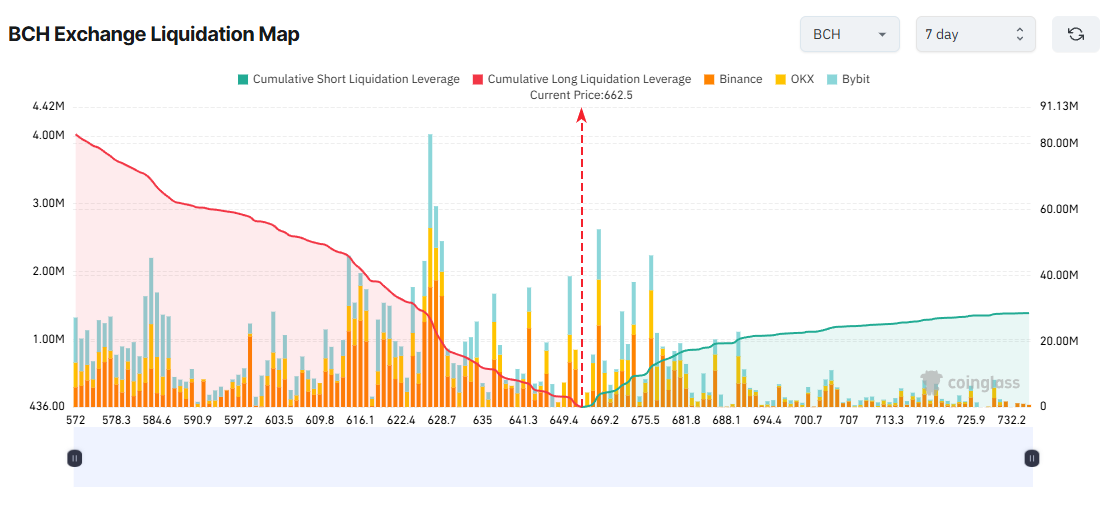

BCH Exchange Liquidation Map. Source: Coinglass

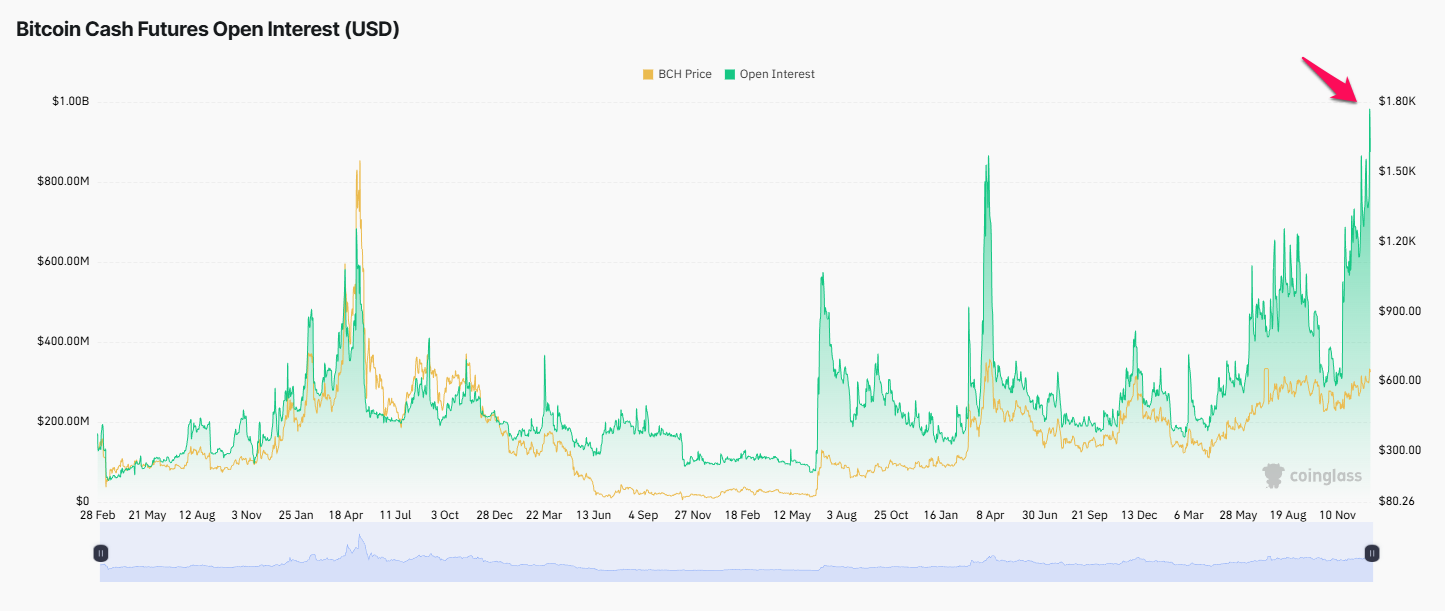

However, Coinglass data reveals another major concern. BCH open interest has reached $980 million, the highest level on record.

Historically, when BCH open interest rose above $600 million, a sharp and prolonged price correction followed.

BCH Open Interest. Source: Coinglass

Additionally, BCH is trading near the strong $650 resistance level. This increases the likelihood of profit-taking pressure emerging at any moment.

If BCH falls to the $570 level this week, cumulative long liquidations could exceed $80 million.

3. Pepe (PEPE)

Early January capital flows indicate a shift towards meme coins. This has revived hopes for a new meme coin season.

Recently, predictions that PEPE’s market cap could reach $69 billion in 2026 have further boosted positive sentiment around the token.

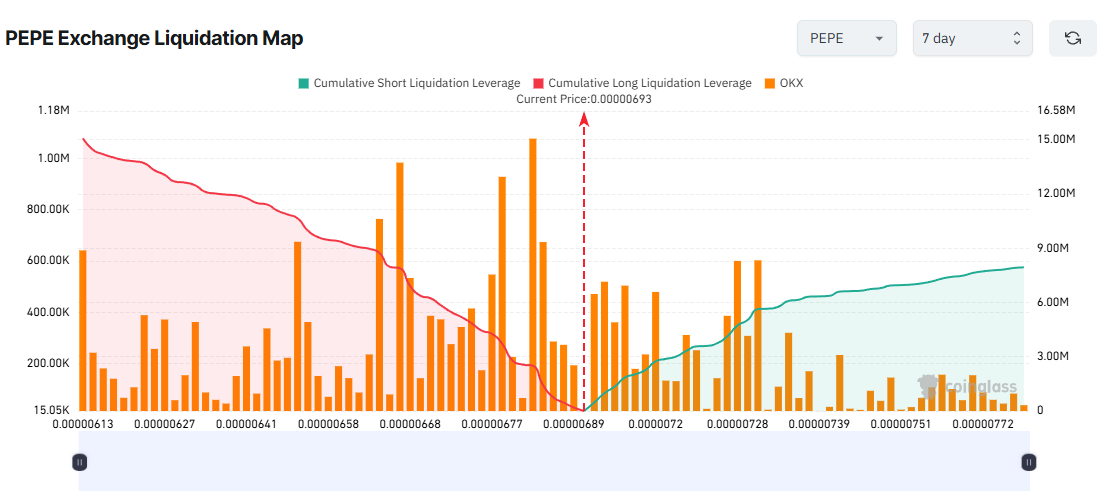

PEPE’s liquidation map shows that long liquidations could exceed $15 million if the price drops to $0.00000613. This would represent a decline of around 10% from current levels.

PEPE Exchange Liquidation Map. Source: Coinglass

This scenario remains plausible. PEPE has surged more than 70% since the start of the year. Early buyers are now sitting on profits and may choose to take gains while market skepticism persists.

Moreover, analysts have warned of a potential Elliott Wave correction. They suggest that PEPE may have already completed its third upward wave.

The crypto market is likely to face continued volatility in the coming days as geopolitical tensions rise. Without learning from the mistakes that led to over $150 billion in liquidations in 2025, similar losses could repeat in 2026.