Unverified intelligence claims and renewed legal pressure on Venezuela’s leadership have reignited debate around a potentially massive Bitcoin stockpile tied to the country - and why markets may be underestimating its impact.

According to multiple intelligence-linked reports circulating among macro and crypto analysts, the Venezuelan regime may have accumulated a large “shadow reserve” of Bitcoin and Tether over several years, primarily as a way to bypass sanctions and stabilize state finances.

Key Takeaways

Intelligence-linked reports claim Venezuela accumulated a massive Bitcoin reserve via gold swaps, oil trades, and USDT settlement.

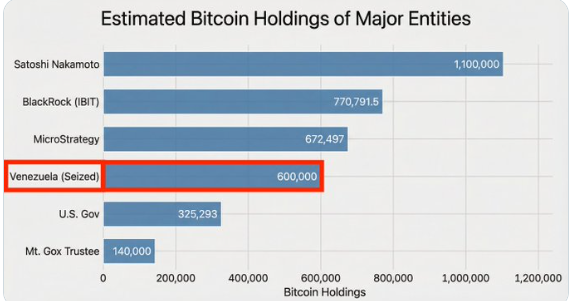

Estimates range from 600,000 to 660,000 BTC, potentially worth more than $55 billion at current prices.

If seized, the most likely outcomes involve frozen or long-term held assets rather than rapid liquidation.

A supply lock-up of this size could materially tighten Bitcoin’s liquid supply and support higher prices.

The speculation resurfaced after Nicolás Maduro pleaded not guilty in a New York federal court to narco-terrorism and cocaine trafficking charges, triggering fresh scrutiny of Venezuela’s offshore assets.

A shadow Bitcoin reserve built outside the system

The reports suggest Venezuela quietly began accumulating crypto around 2018, when access to traditional financial rails deteriorated and gold from the Orinoco Mining Arc was aggressively liquidated. Intelligence cited by market researchers claims gold swaps, oil-for-crypto trades, and mandatory USDT settlement for crude exports were used to move value outside the banking system.

Estimates vary, but some analyses put the combined Bitcoin and USDT holdings at more than $60 billion at current prices, implying roughly 600,000 to 660,000 BTC accumulated over time. A commonly cited tranche suggests roughly $2 billion in gold may have been converted into Bitcoin at prices near $5,000, which alone would now be worth more than $35 billion if still held.

As the state-backed Petro experiment failed, Venezuela reportedly leaned more heavily on Tether for oil transactions, later rotating portions into Bitcoin to reduce exposure to address freezes. Separate estimates also include proceeds from mining seizures and domestic crypto mining, which became widespread among citizens and institutions as the bolívar collapsed.

What happens if the U.S. gets the keys?

Speculation intensified around the possibility that U.S. authorities could gain control of part or all of these assets through seizures or cooperation deals. Analysts outline three broad scenarios, with very different market implications.

The most discussed outcome is a “frozen asset” scenario, where seized Bitcoin becomes tied up in litigation and effectively immobile for years. Even without liquidation, removing hundreds of thousands of coins from circulation would represent a meaningful reduction in liquid supply.

Another high-probability path is a strategic reserve approach. With the idea of sovereign Bitcoin holdings gaining traction globally, analysts argue the U.S. could choose to hold seized Bitcoin long-term rather than sell it. The stance of Donald Trump, who has publicly embraced Bitcoin reserves, has reinforced this narrative.

A rapid liquidation remains possible but is widely viewed as unlikely, especially given the political optics and the precedent of slow, controlled asset management by the U.S. Department of Justice.

Why markets may be missing the bigger picture

While headlines have focused on Venezuela’s oil reserves and geopolitical risk, analysts argue Bitcoin is the overlooked variable. A locked-up reserve of roughly 600,000 BTC would represent close to 3% of total circulating supply, creating a structural supply squeeze rather than a sell-off risk.

That dynamic could introduce short-term volatility as legal uncertainty plays out, followed by a longer-term bullish effect if those coins remain frozen or reclassified as sovereign assets. Some market participants already view the situation as supportive for Bitcoin-linked equities and long-term holders, particularly if the assets are removed from active circulation for years.