Zcash price action remains constructive despite short-term weakness. ZEC is still up nearly 40% over the past 30 days, reflecting a strong recovery from early December lows. However, momentum has cooled recently. Over the past 7 days, Zcash has been down close to 8%, even as Bitcoin has pushed higher. That divergence matters. It highlights Zcash’s negative correlation with Bitcoin, a factor that has repeatedly slowed near-term breakouts in past cycles.

Despite this pullback, the broader bullish structure has not broken. What follows is a closer look at why the setup remains intact, and why near-term pressure is still building.

Bull Flag Holds, but CMF Signals Capital Outflow Risk

Zcash continues to consolidate after a strong impulse move beginning in early December, forming a bull flag rather than a topping pattern. The broader breakout trend with an 85% projection remains bullish as long as the price respects the pattern.

Momentum beneath the surface, however, is weakening. The Chaikin Money Flow (CMF), which tracks whether large capital is flowing into or out of an asset, has trended lower even as the price held up. Between December 24 and January 5, the ZEC price moved higher while the CMF turned lower.

Zcash Breakout Pattern Holds: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This divergence signals cooling buying pressure. CMF is now approaching the zero line, a key threshold. A break below zero would indicate capital outflows, often a precursor to short-term price weakness.

That signal gains relevance following the recent unshielding of roughly 202,000 ZEC, equivalent to nearly 1.2% of the circulating supply. While unshielding does not always guarantee selling, it increases near-term supply visibility and can amplify downside pressure if demand softens.

For now, the structure holds. But $404 remains the critical level. A decisive break below it would invalidate the bull flag and weaken the bullish thesis.

Derivatives Show Short-Term Pressure, Long-Term Support

Derivatives positioning explains why the ZEC breakout may be delayed rather than cancelled.

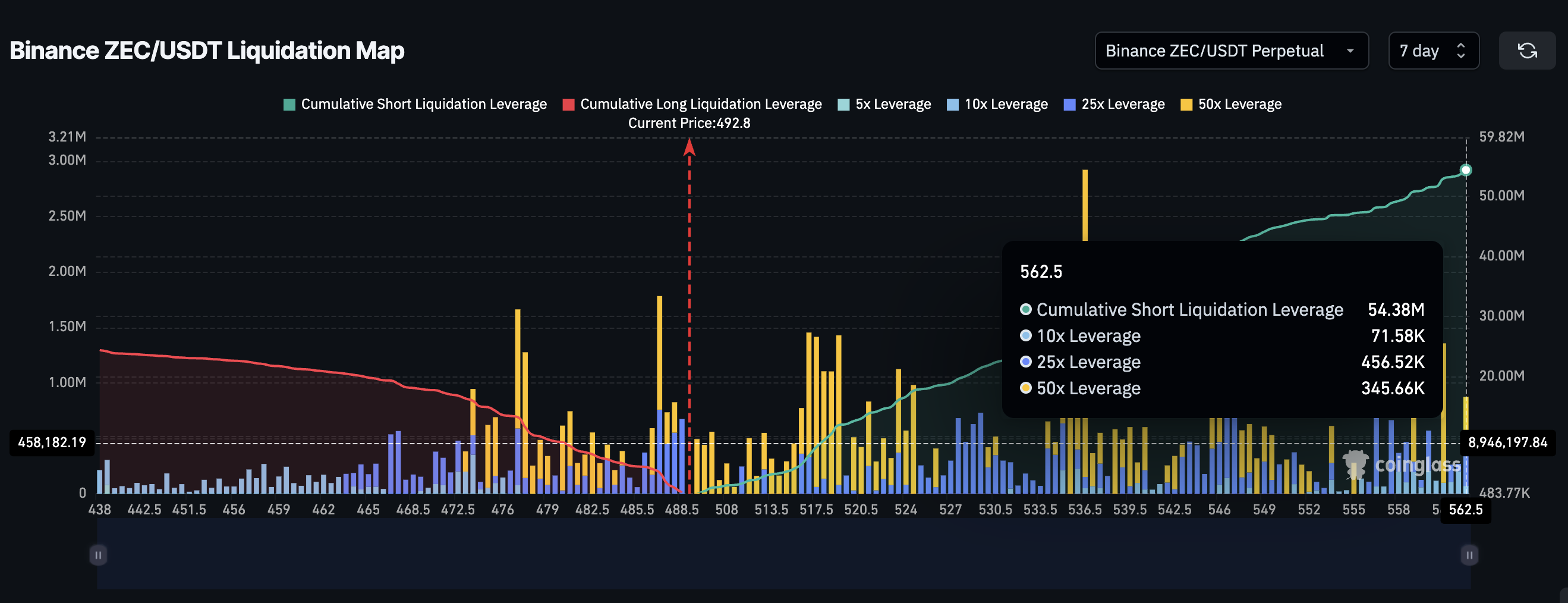

On the 7-day Binance ZEC/USDT liquidation map, short liquidation leverage stands near $54.38 million, while long liquidation leverage sits around $24.41 million. That puts short exposure more than 120% higher than longs in the near term, increasing the risk of volatility and pullbacks. The 7-day view, therefore, leans bearish.

Short-Term Bias: Coinglass

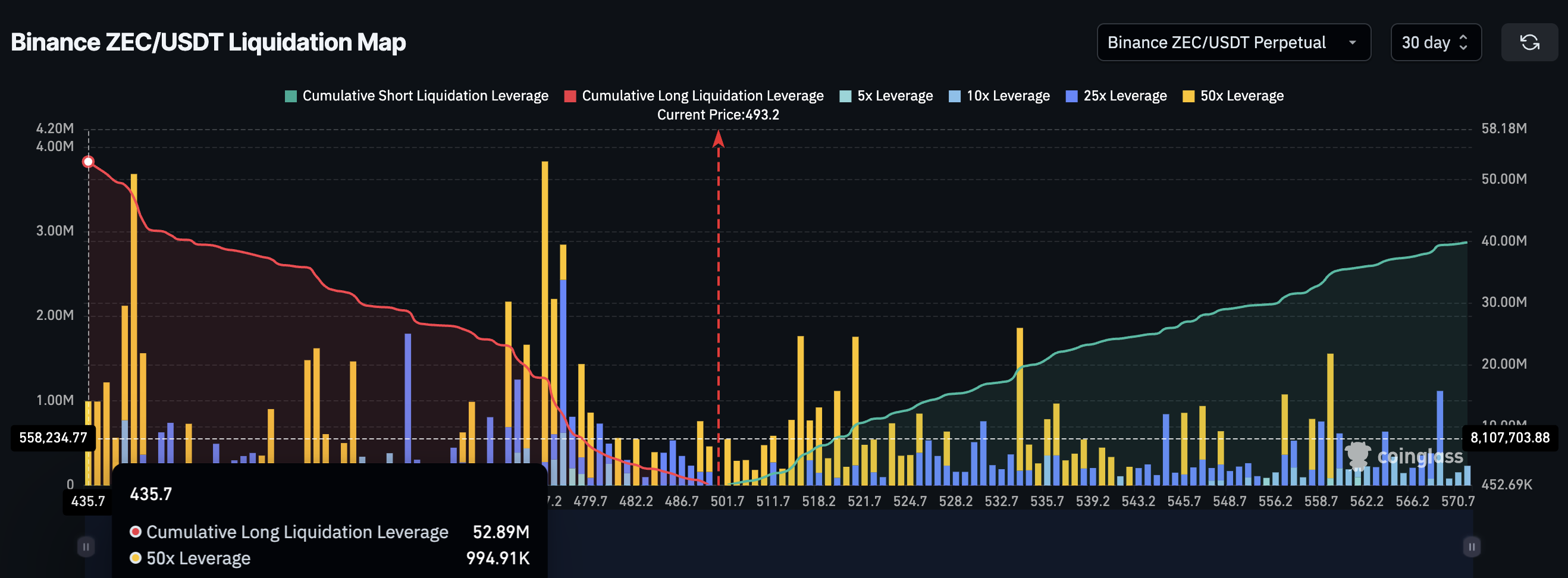

The 30-day view tells a different story. Long liquidation leverage rises to $52.89 million, while short leverage drops to $39.84 million, giving longs roughly a 33% advantage. This suggests longer-term traders are still positioned for upside continuation.

Mid-Term Bias: Coinglass

In short, short-term traders are cautious, while longer-term participants remain constructive.

Bitcoin Correlation Now Decides the Zcash Price Breakout Timing

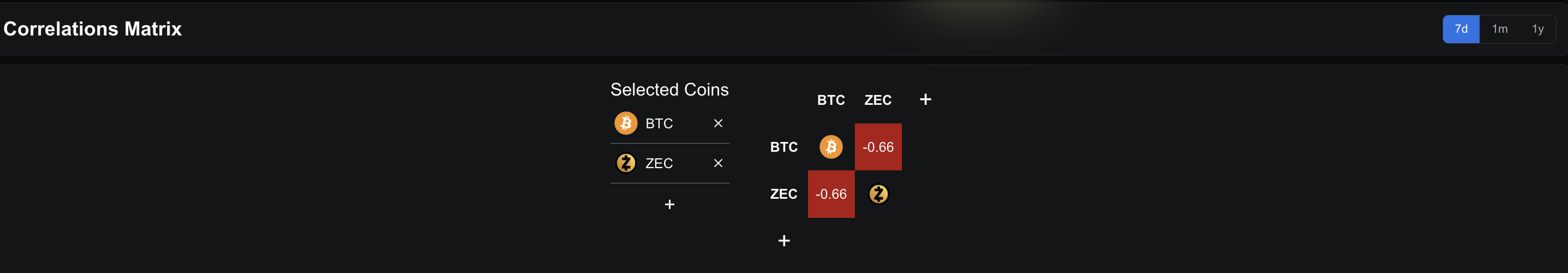

Zcash’s negative correlation with Bitcoin remains a key antagonist to the rally. Correlation measures how closely two assets move together. Over recent cycles, ZEC has often weakened when Bitcoin consolidates or trends higher. Currently, on a weekly timeline, the correlation stands at -0.66, showing that they mostly move in opposite directions.

ZEC-BTC Correlation: DeFillama

That pattern is playing out again. Bitcoin’s strength over the past week has coincided with Zcash’s underperformance, reinforcing near-term hesitation.

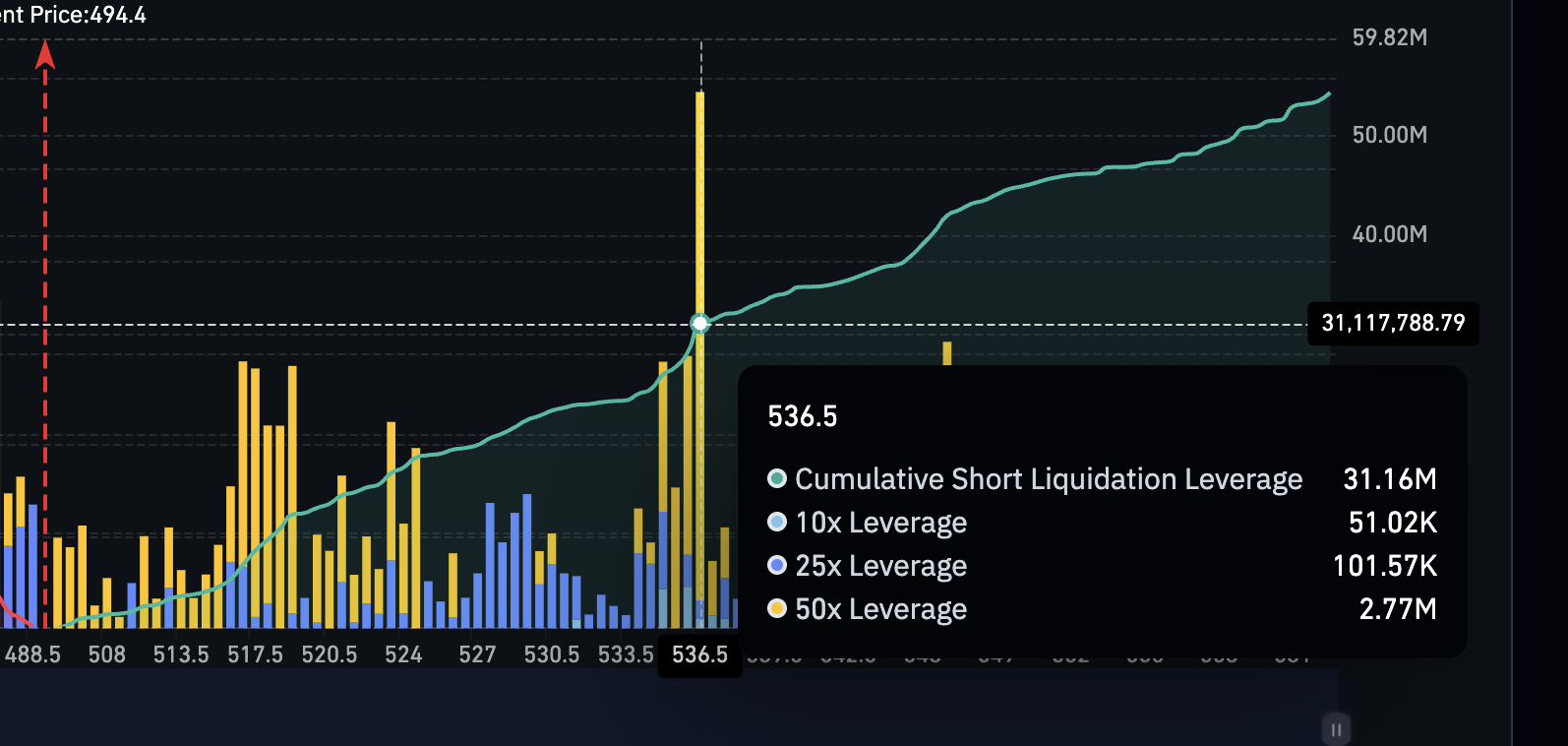

From a structural perspective, confirmation is still missing. A move above $519 would signal a clean break from consolidation. Clearing $541 could trigger heavy short liquidations, accelerating upside momentum.

Short Liquidation Cluster: Coinglass

Such an aggressive move on the upside would then open the path for the 85% breakout projection.

Until then, downside risk stays defined. Losing $404 would invalidate the bullish structure and suggest a deeper reset before continuation.

Zcash Price Analysis: TradingView

Zcash remains bullish on structure and longer-term positioning. But short-term bias, capital outflow signals, and Bitcoin’s influence suggest the breakout may need more time to develop.