On January 5, several crypto publications reported that the US Department of Justice (DOJ), through the US Marshals Service (USMS), sold roughly 57.55 BTC forfeited by Samourai Wallet co-founders Keonne Rodriguez and William Lonergan Hill.

The original news argued that such a sale could violate President Donald Trump’s Executive Order 14233. The order directs federal agencies to retain forfeited Bitcoin as part of the US Strategic Bitcoin Reserve.

However, a review of publicly available on-chain data shows that while the Bitcoin was transferred into Coinbase Prime custody, the blockchain does not establish that the Bitcoin was sold.

Understanding the On-Chain Data

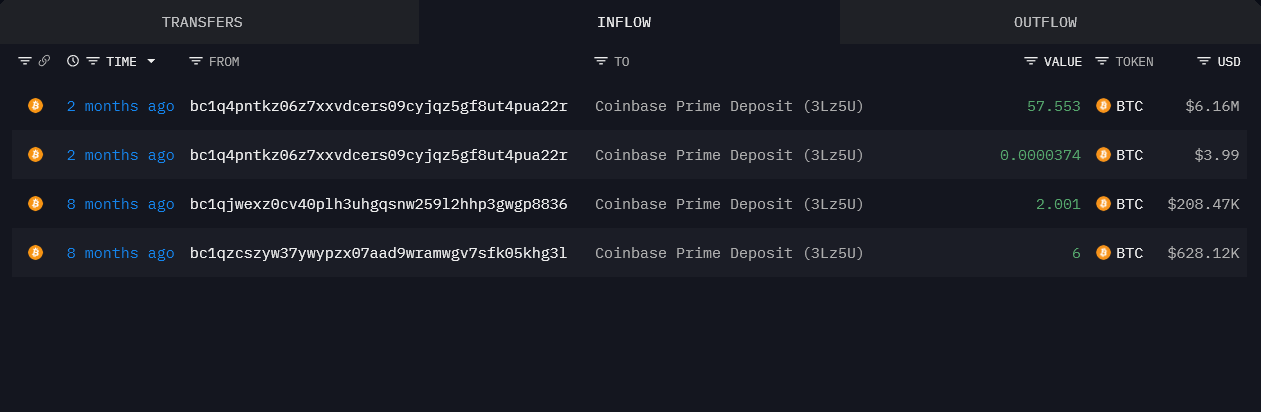

On November 3, 2025, approximately 57.553 BTC was transferred from a bech32 address associated with the Samourai forfeiture to a wallet labeled Coinbase Prime Deposit (3Lz5U).

Inbound transfer of 57.553 BTC from a Samourai-linked address to a Coinbase Prime deposit wallet on November 3, 2025. Source: Arkham.

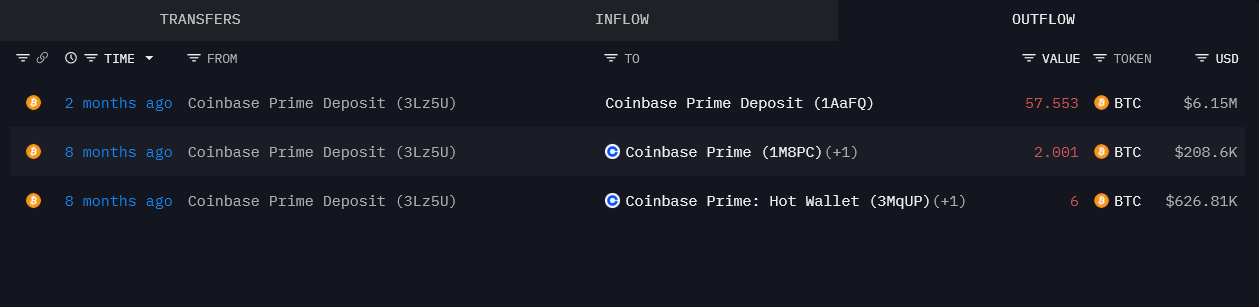

Shortly afterward, the funds were swept from the 3Lz5U address into another wallet labeled Coinbase Prime Deposit (1AaFQ).

Such sweeps are standard operational behavior within Coinbase Prime and do not, on their own, indicate a sale.

The 57.553 BTC was swept internally from one Coinbase Prime deposit address to another, a standard custody operation within Coinbase Prime infrastructure. Source: Arkham

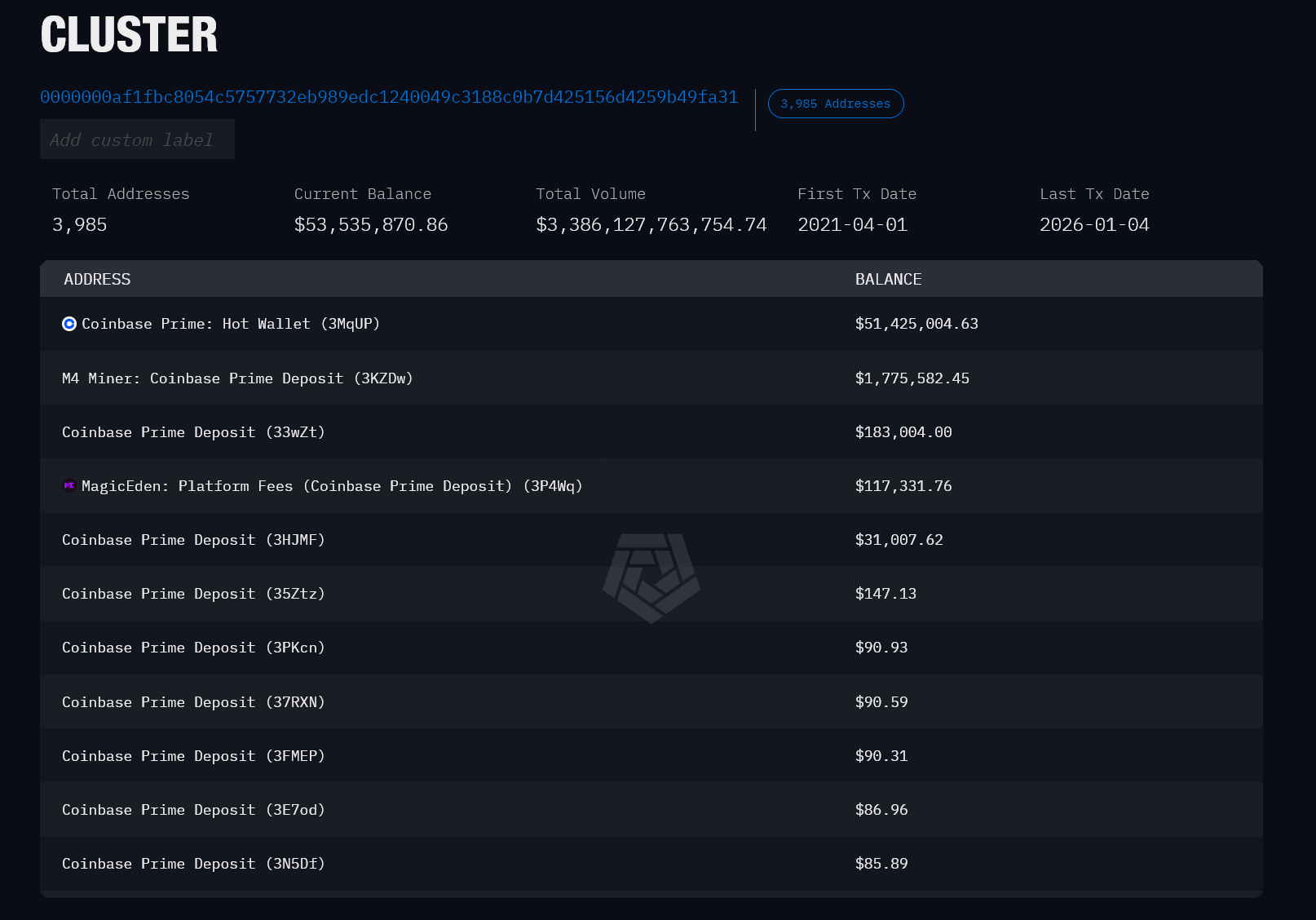

Further on-chain analysis shows that the Bitcoin was consolidated into the broader Coinbase Prime cluster, which includes thousands of addresses used for custody, settlement, and internal accounting.

At no point does the blockchain show the Bitcoin leaving Coinbase-controlled infrastructure.

Cluster view of Coinbase Prime wallets on Arkham, showing the funds consolidated within Coinbase-controlled custody rather than transferred to an external entity. Source: Arkham

No On-Chain Evidence of a Bitcoin Sale from the DOJ

The blockchain does not provide evidence that the Bitcoin was liquidated. There is no on-chain indication that the funds:

Moved to a non-Coinbase entity,

Fragmented into multiple outputs typical of trade execution,

Flowed into known exchange settlement wallets, or

Were distributed in a pattern consistent with a completed sale.

A zero balance at the original Coinbase Prime deposit address does not imply liquidation. It only indicates that the address was swept, which is standard practice for custodial platforms.

Bitcoin-to-USD conversion on Coinbase Prime occurs off-chain.

As a result, the blockchain cannot show whether a sale occurred, whether proceeds were credited to the USMS, or whether the Bitcoin was retained in custody.

Did the DOJ Violate Trump’s Executive Order on the Bitcoin Reserve?

Executive Order 14233 restricts the sale of “Government BTC” held in the US Strategic Bitcoin Reserve.

Whether the Samourai forfeited Bitcoin was ever formally transferred into Reserve-designated Treasury accounts is not something that can be determined from blockchain data alone.

Confirming a violation of the order would require:

Court-issued forfeiture or disposition orders,

USMS asset management records, or

Coinbase Prime execution and settlement documentation.

None of these records are visible on-chain.

The forfeited Samourai Wallet Bitcoin was transferred into Coinbase Prime custody and consolidated within Coinbase-controlled infrastructure.

Overall, the blockchain does not confirm that the Bitcoin was sold.

This does not rule out the possibility of liquidation. It means that, without off-chain documentation or court authorization records, claims of a confirmed sale go beyond what on-chain data can support.

For now, the question of whether the DOJ complied with Executive Order 14233 remains a matter of documentation and governance.