Pepe has witnessed a sharp rally over the past week, but a cryptocurrency analyst has warned it could turn out to be a setup for another move down.

Pepe Has Shot Up Over The Past Week

PEPE has taken off to start 2026 as the memecoin’s price has gone up by more than 60%, significantly outperforming all cryptocurrencies in the top 50 by market cap list. At the height of the rally, the asset touched $0.00000725 on Sunday, but it has since seen some retrace back to $0.00000676.

Other meme-based tokens have also witnessed rallies recently, with Dogecoin and Shiba Inu being up 17% and 15% over the past week, respectively. But clearly, these pale in comparison to the 62% profits that Pepe has managed in the same window. Though the memecoin’s rally has been impressive so far, technical analysis (TA) may actually point toward a bearish outcome.

PEPE Approaching A Retest Of Head-And-Shoulders Breakdown Level

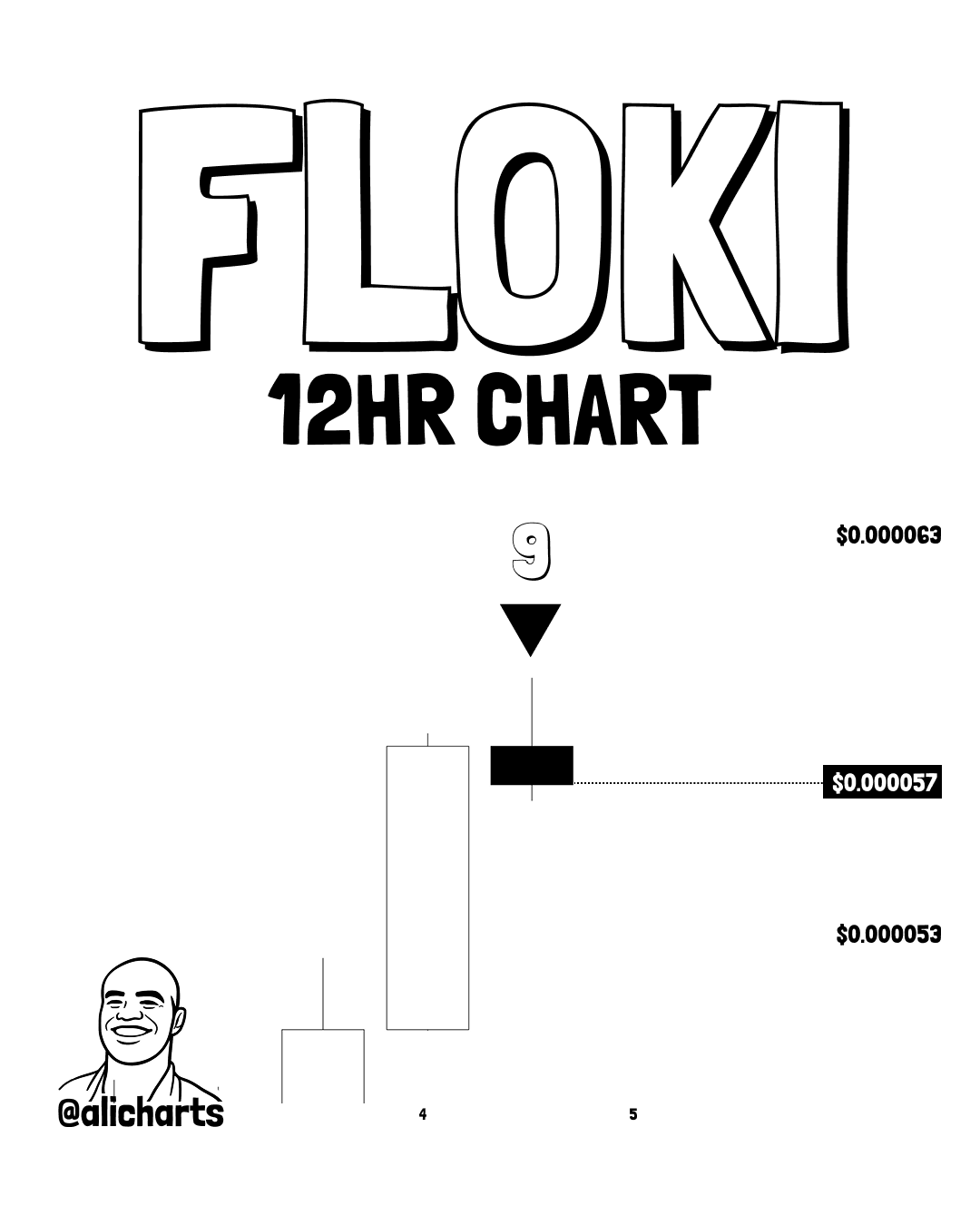

In a new post on X, analyst Ali Martinez has talked about the recent PEPE price action from a TA perspective. As the chart shared by Martinez shows, the memecoin was earlier forming a Head-And-Shoulders pattern.

The Head-And-Shoulders is a pattern that’s characterized by a series of three price peaks. The first and third peaks are of a roughly similar height and form the “shoulders,” while the central peak stands out as the largest and is known as the “head.”

The pattern involves one more element, a horizontal line that’s called the “neckline.” Between the peaks, the price retests this level and finds support at it. Once the right shoulder has formed, however, the next retest is considered likely to lead to a bearish breakdown.

As is visible in the graph, the daily Pepe price saw a fall below the neckline of its Head-And-Shoulders pattern last year. This led to a period of sustained bearish action, culminating in a low in December. With the rally that has occurred in the cryptocurrency’s price in 2026 so far, however, it has closed back the distance to the neckline. While the development looks bullish, the analyst thinks a different outcome could follow for the coin.

As Martinez noted, “this could be a simple retest of the breakdown before a move to $0.0000015.” It now remains to be seen how the retest of the level, if one follows, will go, and whether it will result in another rejection for PEPE.

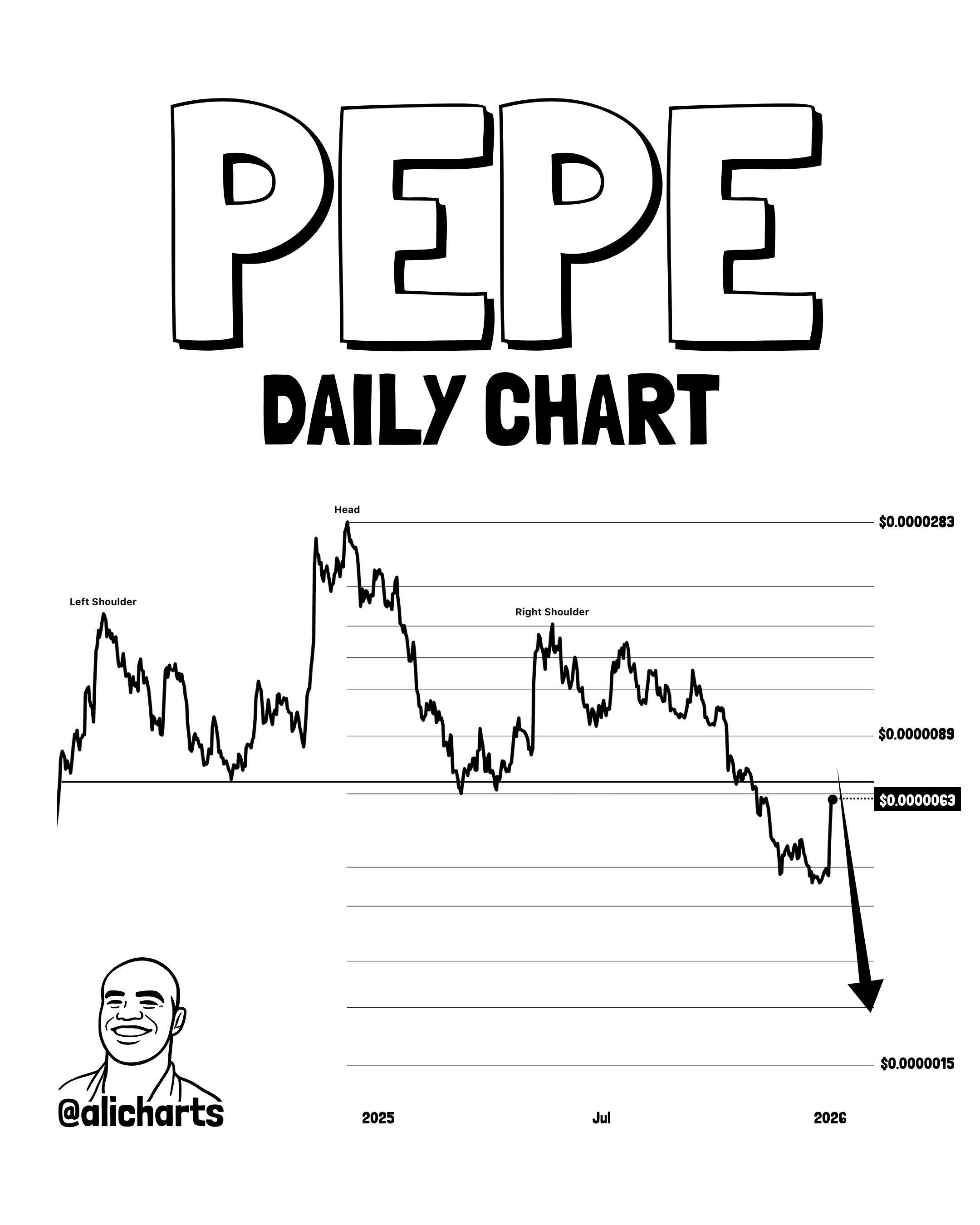

Pepe isn’t the only memecoin that has seen bearish developments in TA recently. As the analyst has highlighted in another X post, Floki, which has enjoyed a surge of over 40% in the past week, has seen a sell signal on the Tom Demark (TD) Sequential.