XRP price has surged nearly 33% from its December 31 lows and is up about 11% over the past 24 hours. The move marks one of XRP’s strongest short-term rebounds in months and comes after a prolonged consolidation phase.

The rally has improved the broader XRP price prediction, but confirmation is still incomplete. Technical momentum is strengthening, yet on-chain signals show the market entering a sensitive profit zone. Whether XRP can extend higher now depends on how the price behaves around one critical resistance area.

Price Prediction Strengthens as Crossover and Volume Signals Meet; But…

XRP’s rebound began after forming a triple bottom near the $1.77 level. This zone acted as support multiple times and now serves as the structural base of the rally.

Momentum indicators are turning supportive. The 20-day exponential moving average is closing in on the 50-day EMA. An EMA gives more weight to recent prices, so when a faster EMA moves above a slower one, it often signals a shift toward bullish momentum. A confirmed bullish crossover would historically support trend continuation rather than short-lived bounces.

XRP Price Chart: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Volume behavior supports this view, but cautiously. On-balance volume, which tracks whether volume flows into or out of an asset, has broken above a descending trendline. This suggests buyers are participating in the breakout. However, OBV has not yet made a clear high despite the XRP price trending higher, showing that buying pressure is improving, but not accelerating aggressively.

Volume Confirmation Needed: TradingView

Also, the OBV rise has slowed down a bit near the $2.41 zone, as highlighted on the chart. The long candle wick also shows that sellers might be returning at this level.

Together, these signals improve the XRP price prediction, but they still require price confirmation at higher levels.

On-Chain Data Shows Accumulation, but Profit Pressure Is Rising

On-chain data adds nuance to the setup.

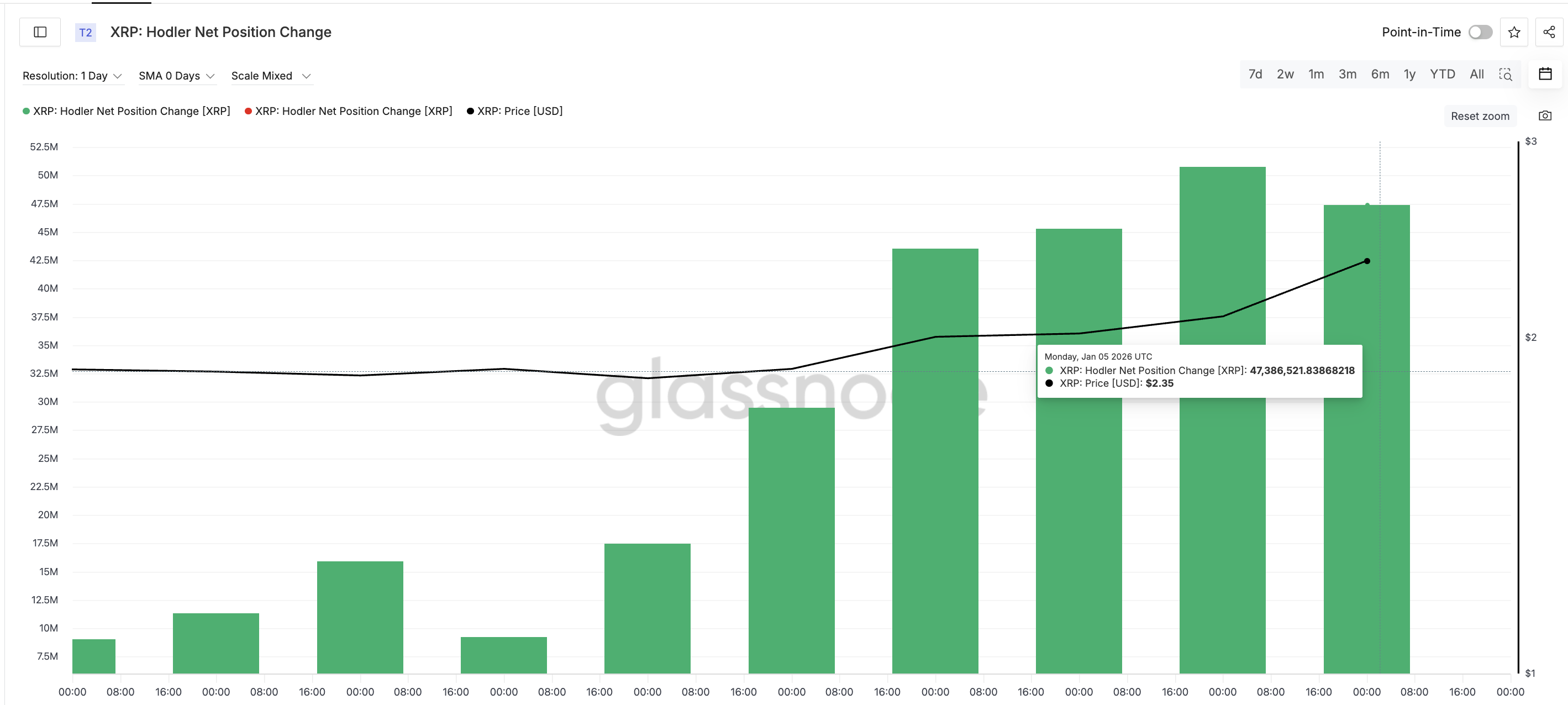

Long-term holders are still accumulating. Long-term holders are wallets that have held XRP for extended periods and historically sell less frequently. Since December 30, this group has increased its net holdings from roughly 9 million XRP each day to about 47 million XRP. That represents an increase of over 420% in net accumulation during the rally phase, confirming ongoing conviction.

HODLER Accumulation Continues: Glassnode

However, profit pressure is also rising. Long-term holder NUPL, which stands for net unrealized profit or loss, measures how much profit long-term holders are sitting on. NUPL has climbed back to levels last seen in early December.

At those levels around 0.48-0.49, XRP corrected by roughly 14% over the following nine days. This does not guarantee a repeat, but it shows that the market is again entering a zone where profit-taking historically increased.

Rising Profits: Glassnode

Importantly, hodler accumulation has slowed over the past two days, which is visible on revisiting the earlier metric. Long-term holders are still adding, but at a slower pace since January 4, suggesting that buyers are becoming more selective as prices and NUPL rise.

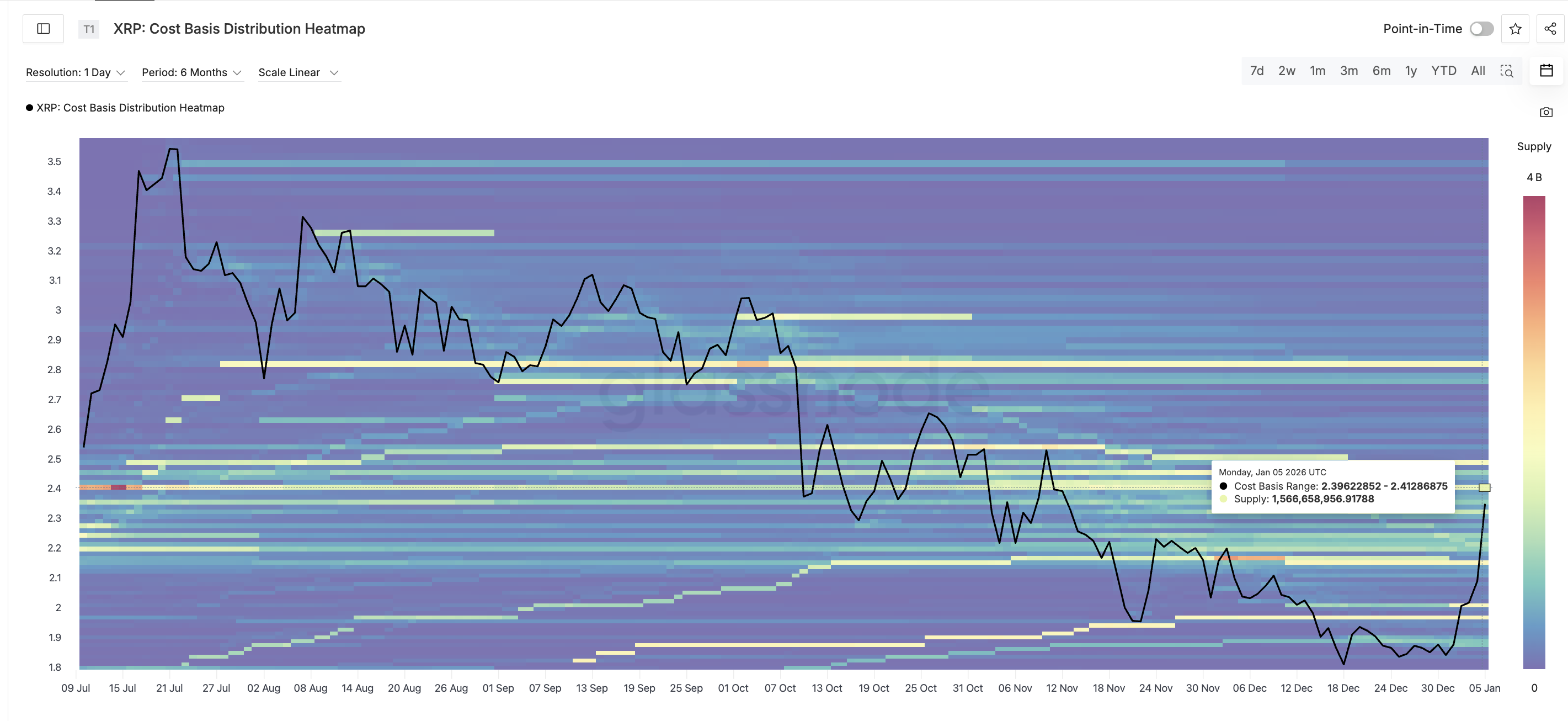

XRP Price Prediction Now Hinges on the $2.41 Cost-Basis Wall

All technical and on-chain signals converge near the $2.41 zone.

The cost-basis distribution heatmap highlights this area as a major supply cluster. Cost basis shows where coins were previously bought. Between $2.39 and $2.41, roughly 1.56 billion XRP were accumulated. When price revisits such zones, many holders sell to break even, creating resistance. The XRP price chart from earlier also highlights that resistance zone.

XRP Heatmap: Glassnode

This explains why XRP has stalled near $2.41 and why OBV has flattened while NUPL continues rising.

For the bullish XRP price prediction to remain valid, XRP needs a clean daily close above $2.41. If that happens, overhead supply weakens, and the next upside target sits near $2.69. That would represent an additional upside of about 13% from current levels.

If XRP fails to reclaim $2.41, downside risk increases. Initial support lies near $2.26, followed by a deeper support around $1.90. Even in a pullback scenario, the broader structure remains intact as long as the price holds above $1.77.

XRP Price Analysis: TradingView

XRP’s rally has momentum, but it is now entering its most important test. The next phase of the XRP price prediction depends not on indicators alone, but on whether buyers can decisively turn $2.41 from resistance into support.