Bittime - New projects continue to emerge to address important gaps in the blockchain ecosystem.

One such project is RedStone (RED) Coin, an innovative oracle platform designed to provide fast, accurate, and decentralized data to blockchain applications.

This article will discuss what RedStone is, its key features, use cases, its tokenomics, and its future potential

RedStone (RED) Listing Premarket in Binance

Binance has introduced Premarket RED on February 28, 2025. Redstone's pre-market providing an early opportunity for traders to buy and sell RED/USDT before the official listing.

During this phase, Binance sets price limits to stabilize volatility, with a gradual increase in the maximum price limit up to March 3, 2025, when all restrictions will be removed.

With the RedStone premarket, it has clearly increased the enthusiasm of its fans, which indicates that the RedStone listing will be coming soon.

Read also: RedStone (RED) Will List on Binance! Pre-Market Opens February 28, Get Ready to Watch!

What is RedStone (RED)?

RedStone is a cross-chain oracle network that provides high-frequency data for decentralized applications (dApps).

Oracles play an important role in connecting real-world data with blockchain networks, ensuring smart contracts can function accurately.

RedStone differentiates itself through advanced architecture, security measures, and cost-effective solutions designed for the DeFi, NFT, and DEX sectors.

Main Features and RedStone Advantages

Providing High-Frequency Real-Time Data

RedStone offers real-time data flow, enabling DeFi protocols and other blockchain applications to operate with accurate and up-to-date information.

Cross-Chain Compatibility

The platform is designed to function seamlessly across multiple blockchains, including Layer 1 and Layer 2 networks such as Ethereum, Solana, and Avalanche. Additionally, RedStone supports cutting-edge technologies such as ZK-rollups and Optimistic rollups.

Modular Architecture

RedStone's modular framework makes it possible customizable oracle solutions, making it flexible for various blockchain needs. Developers can easily integrate new data types and functions.

Security and Transparency

To ensure data integrity, RedStone implements public verification mechanism in Arweave. This network also includes staking mechanism that punishes bad actors, thereby ensuring reliable data delivery.

Supports Various Blockchain Needs

Decentralized Finance (DeFi): Give accurate price feeds and liquidity metrics which is important for the borrower protocolan, stablecoin, dan platform yield farming.

NFT Marketplace: Provide real-time price data to determine asset valuation, ensuring fair and transparent transactionsn.

Decentralized Exchanges (DEXs): Increase trading efficiency with real-time token price updates, mengureliminate slippage, and improve order execution.

Cost Effective

By using optimized data delivery techniques, RedStone minimizes transaction fees, making it an economical choice for developers.

Easy Integration for Developers

RedStone provides Complete documentation and dedicated support, making it easier for projects to adopt its oracle services.

Tokenomics RedStone (RED)

The RED token plays an important role in the RedStone ecosystem, with various functions:

Payment Mechanism: dApps pay for RedStone oracle services using RED tokens.

Staking & Security: Data providers stake RED tokens as collateral to ensure data accuracy.

Governance: Token holders can participate in the decision-making process, influencing future protocol improvements.

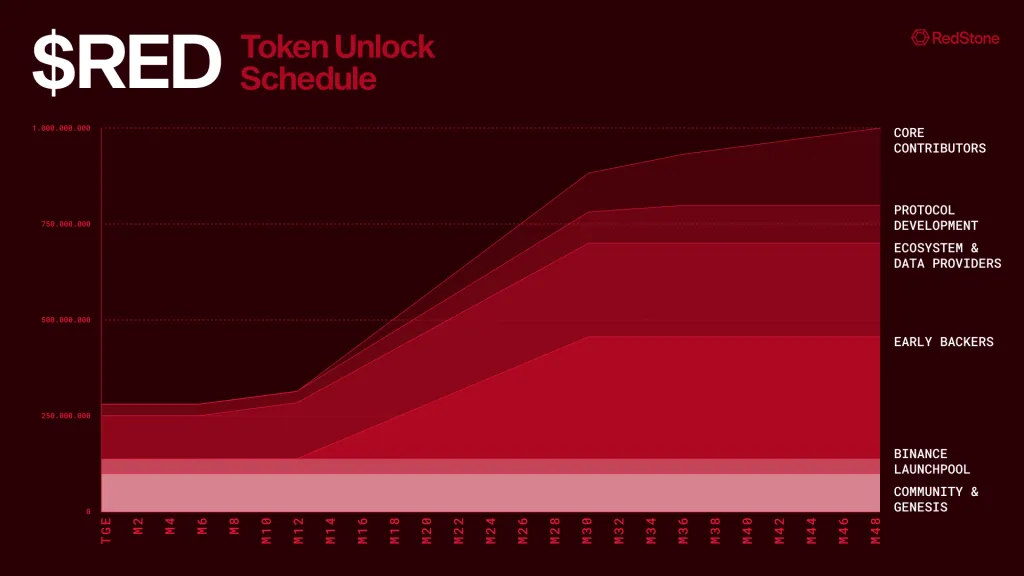

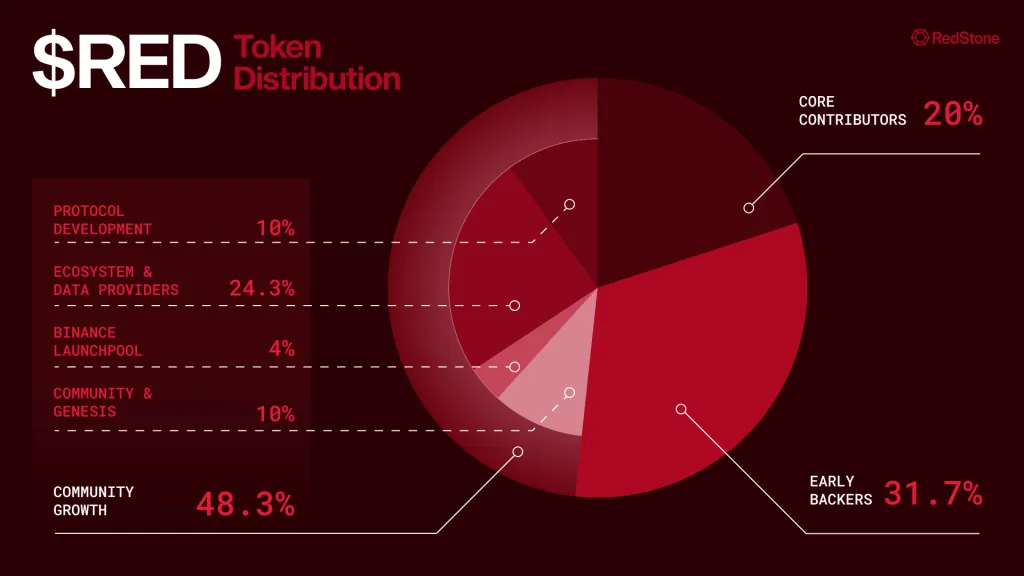

RED Token Distribution

Community & Genesis: 10.00%

Protocol Development (Partially Locked): 10.00%

Core Contributors (Locked): 20.00%

Binance Launchpool: 4.00%

Ecosystem & Data Providers (Partially Locked): 24.30%

Early Investors (Locked In): 31.70%

Total: 100%

Conclusion: Is RedStone a Good Investment?

RedStone brings a strong value proposition to the oracle market, with innovative technology and a growing ecosystem. As DeFi, NFTs, and DEXs expand, the demand for secure and efficient oracles will increase.

However, as with any crypto investment, conducting thorough research before investing is essential. Reviewing its roadmap, team and partnerships can provide further insight into its long-term potential.