XRP (XRP) has surged by 12.3% the past day, further solidifying its position as the fourth largest cryptocurrency by market capitalization.

As the optimism builds, market watchers are closely watching for the asset’s next moves. While experts remain cautious, others believe the asset has the potential for strong upside.

XRP Records Strong January Gains, Yet Some Experts Remain Cautious

The crypto market has started 2026 on a positive note, with the total market capitalization rising 8.2%. Major assets, such as Bitcoin (BTC) and Ethereum (ETH), have posted strong gains, and XRP has not been left out.

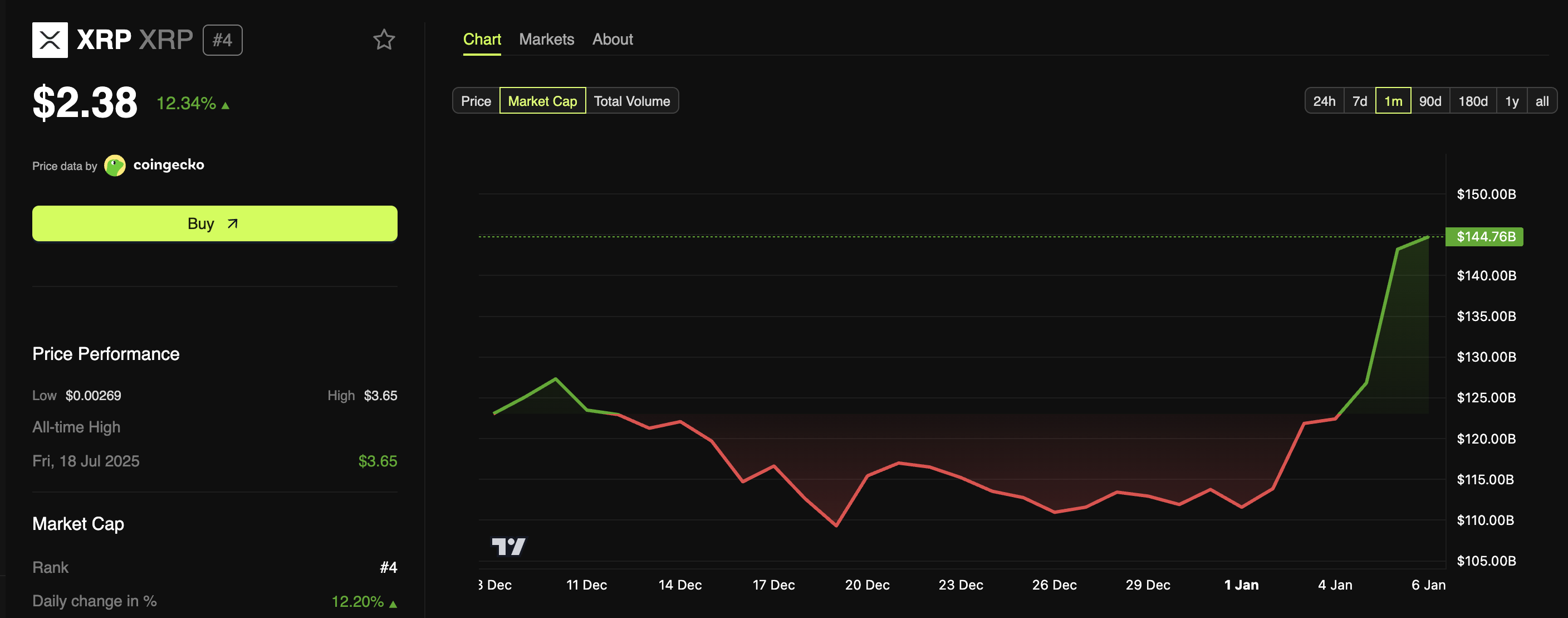

BeInCrypto Markets data showed that the altcoin’s value has appreciated by nearly 30% in January. Its market capitalization also exceeded that of BNB’s and further crossed $140 billion today. At the time of writing, XRP was trading at $2.38, marking a rise of 12.3% over the past day.

XRP Price Performance. Source: BeInCrypto Markets

As January progresses, the market outlook on XRP differs quite a bit. John Bollinger, creator of the Bollinger Bands technical indicator, shared his view on XRP’s price action compared to major cryptocurrencies. His analysis points to XRP as more reactive than market-leading.

“And ripple, strong lift, but the pattern is weaker. BTC > ETH > XRP for now,” he wrote.

Bollinger’s comment suggests that XRP’s price moves are still influenced by broader market dynamics rather than establishing its own trend.

Meanwhile, Peter Brandt is cautiously observing XRP within a price range of $1.5 to $3.5. He has not provided specific commentary, but based on his typical analysis, the price will likely continue its trend once it breaks either the upper or lower boundary of this range.

XRP Price Prediction: The Bullish Case Gains Traction

Despite both analysts presenting a cautious outlook, others in the market are leaning more bullish. According to an analyst, the XRP/BTC trading pair is showing signs of a potentially significant bullish shift.

“Its about to break above the monthly Ichimoku cloud for the first time since 2018 which means XRP is about to massively outperform BTC,” the post read.

Another market watcher described XRP as “one of the best-looking charts,” forecasting a potential price range between $4.5 and nearly $7, while others believe a move toward $3 is increasingly likely.

XRP Draws Rising Institutional Interest

While opinions on XRP’s price trajectory remain split, XRP ETFs continue to gain traction. The products have maintained uninterrupted inflows, highlighting sustained institutional interest even as broader crypto funds faced periodic capital withdrawals late last year. This steady streak has pushed total net assets to $1.65 billion.

Data from CoinShares further highlights the shifting institutional space. Global crypto fund inflows reached $47.2 billion in 2025. However, the composition of those inflows suggests a clear shift away from Bitcoin dominance.

Bitcoin inflows fell 35% year over year to $26.9 billion, while Ethereum attracted $12.7 billion, marking a 138% increase. XRP saw a dramatic growth, with inflows surging 500% to $3.7 billion, up from roughly $600 million in 2024.

Thus, XRP’s recent gains reflect the broader market’s strength and renewed investor interest, although opinions on its near-term trajectory remain divided. While technical analysts point to key levels that could define the next move, sustained institutional inflows indicate continued attention from larger market participants.

Whether this translates into a sustained trend will likely depend on broader market conditions and confirmation from price action.