Imagine a cryptocurrency that takes crypto rollups to the next level, offering high security, decentralization and interoperability. This is where AltLayer comes in!

AltLayer, also known by the market ticker ALT, is an open and decentralised protocol for rollups which facilitates the launch of native and Restaked Rollups with both Optimistic and ZK Rollup stacks.

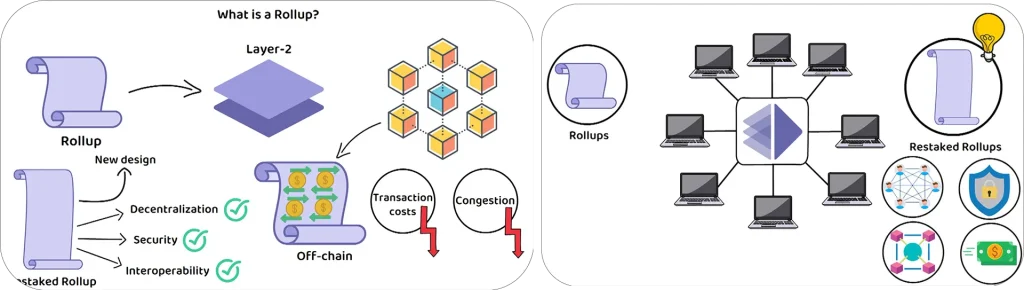

But what exactly is a Rollup?

A Rollup is a layer-2 scaling solution for blockchains that processes multiple transactions away from the main blockchain to reduce transaction costs and congestion on the main chain.

On the other hand, a Restaked Rollup is a new design that solves challenges related to decentralization, security, and interoperability faced by normal Rollups.

At its core, AltLayer is an open and decentralised protocol for rollups and the pioneer of ‘Restaked Rollups’ which takes existing rollups and provides them with enhanced security, decentralisation, interoperability, and a fast transaction finality.

But what exactly does this all mean, and how does it all work?

Today, we find out!

What is AltLayer?

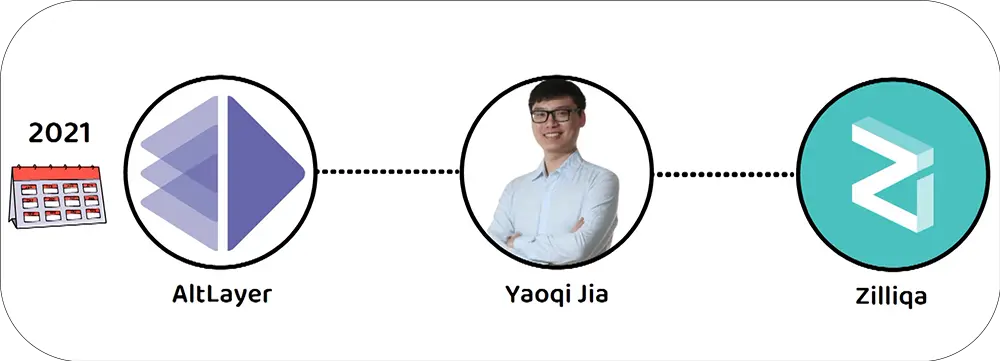

AltLayer was founded by Yaoqi Jia in 2021, with Jia having previously been a co-founder of the blockchain Zilliqa.

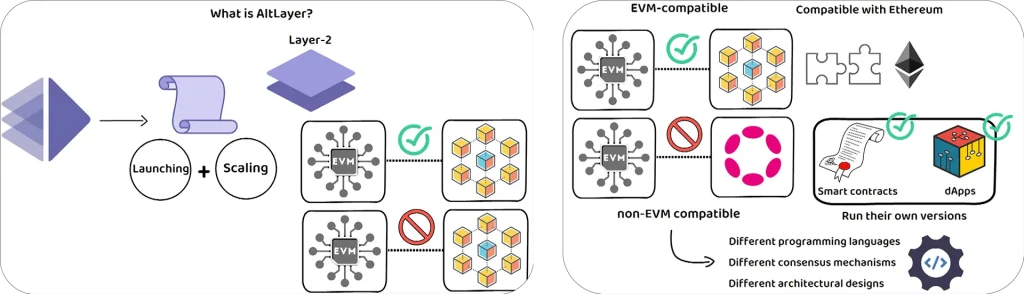

In short, AltLayer is a protocol for launching and scaling rollups, which are Layer 2 solutions for both EVM and non-EVM compatible blockchains.

For clarity, EVM-compatible refers to compatibility with the Ethereum network, and non-EVM compatible refers to blockchains that do not adhere to the standards and specifications set by Ethereum’s EVM for running smart contracts or decentralised applications, but instead run their own versions.

Typically, they often use different programming languages, have different consensus mechanisms, or differ in their architectural designs.

A good example would be Polkadot, which runs smart contracts and decentralised applications but does not obey the standards set by Ethereum.

But I digress, AltLayer is a system of highly scalable application-dedicated execution layers that derive security from the underlying Layer-1 blockchain.

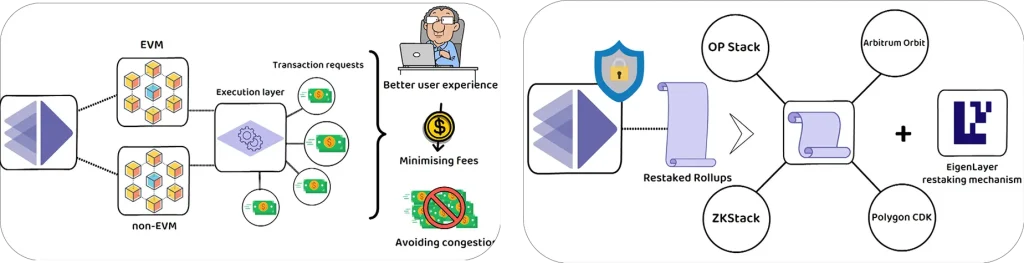

AltLayer equips both EVM and non-EVM chains with an on-demand execution layer that can handle surges in processing transaction requests.

Ultimately, this allows for a better overall user experience while also minimising fees and avoiding congestion on the Layer 1 blockchain.

To achieve this feat, AltLayer pioneered Restaked Rollups, which combines the ease of using a pre-made rollup stack, such as from OP Stack, Arbitrum Orbit, ZKStack, Polygon CDK, and others, and combining this with EigenLayer’s restaking mechanism to increase network security.

But, that leads us to the question. How does this all work?

How does AltLayer work?

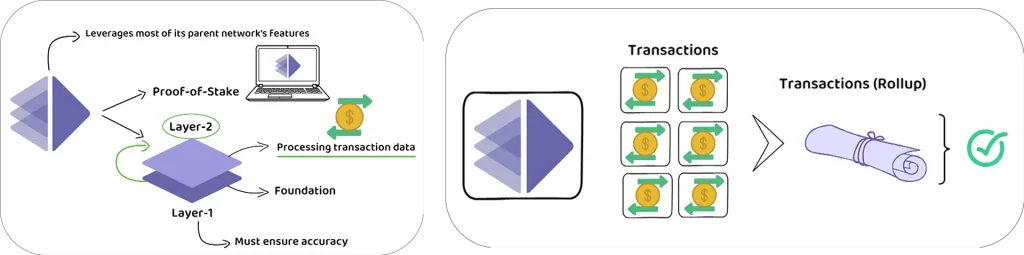

AltLayer is a Proof-of-Stake based, Layer-2 application that sits on top of its Layer-1 parent to assist with the processing of transaction data.

For context, Layer-1 blockchains are usually the foundation from which everything else is built.

Meaning, a Layer-2 application sits on top of the Layer-1 to aid in a specific task, which in the case of AltLayer is to help process transactions.

This means AltLayer leverages most of its parent network’s features, but the Layer-1 still must check the work Layer-2s like AltLayer provide to ensure accuracy.

So, how is this quicker than the parent network just verifying the transactions itself?

In short, because AltLayer “rolls up” multiple transactions into one bundle, which only requires one verification for the entire bundle to be verified.

This is where Restaked Rollups come into play.

What makes AltLayer unique?

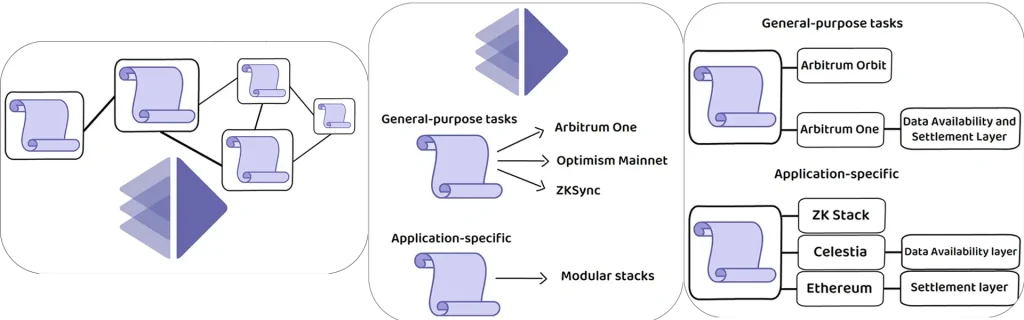

AltLayer believes the future involves a world where thousands of rollups work in tandem, with some designed for general-purpose tasks such as Arbitrum One, Optimism Mainnet, or ZKSync, and others designed for application-specific use cases built using modular stacks.

As an example, one rollup could be built using Arbitrum Orbit, while using Arbitrum One as the Data Availability and the Settlement Layer, while another could be built using ZK Stack using Celestia as the Data Availability layer and Ethereum as the Settlement Layer.

However, AltLayer’s most unique offering are Restaked Rollups, which are a set of three vertically integrated Actively Validated Services, or AVS, created on-demand for a given rollup that works with any underlying rollup stack.

In short, these Actively Validated Services work together to offer three key services to rollups.

These are the verification of rollups’ state correctness, providing faster finality, and decentralised sequencing.

These are provided via three of AltLayer’s modular components known as VITAL, which is the AVS for decentralised verification of rollup’s state.

MACH, which is the AVS for fast finality, and finally SQUAD, which is the AVS for decentralised sequencing.

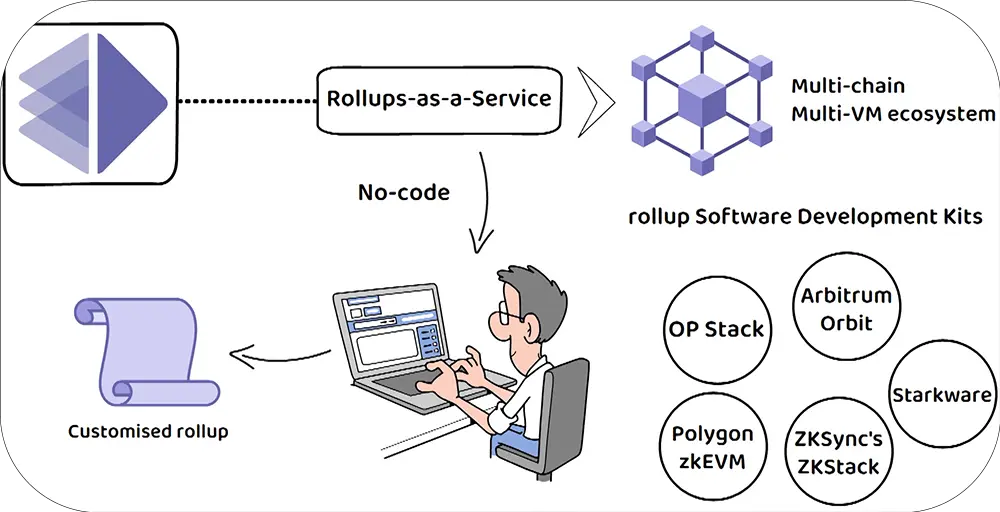

Built on top of this protocol, AltLayer also offers a versatile, no-code Rollups-as-a-Service that allows developers, or anyone even with little to no coding experience, to load up a customised rollup within 2 minutes and deploy them live.

The Rollups-as-a-Service is designed for a multi-chain and a multi-VM ecosystem and also supports multiple different rollup Software Development Kits such as OP Stack, Arbitrum Orbit, Polygon zkEVM, and ZKSync’s ZKStack and Starkware.

In addition, it also provides different shared sequencing services such as Espresso and Radius as well as different Data Availability layers such as Celestia, EigenLayer or Avail, and many more modular services at different layers of the rollup stack.

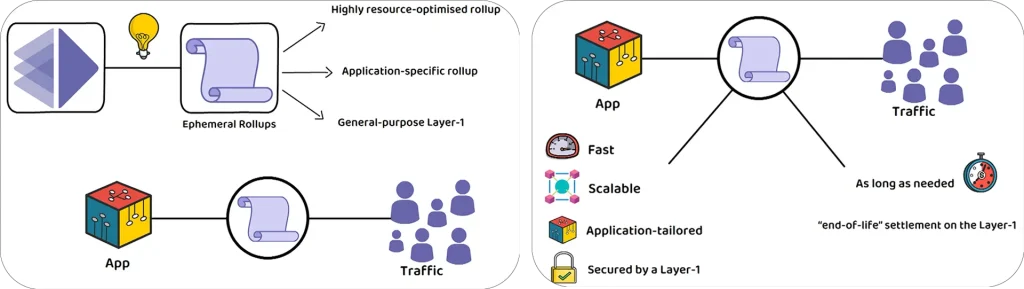

But, as if not impressive enough, another key innovation that AltLayer brings to the rollup design space is the idea of Ephemeral Rollups.

To explain, Ephemeral Rollups are a highly resource-optimised rollup that gives developers the best of an application-specific rollup and a general-purpose Layer-1.

With Ephemeral Rollups, an app developer expecting an increase in demand for their application could enable multiple approaches to deal with the incoming traffic.

For example, the developer could either quickly spin up a fast and scalable application-tailored rollup secured by a Layer-1, or use the rollup for as long as needed before then disposing of the rollup by doing an “end-of-life” settlement on the Layer-1.

ALT Tokenomics

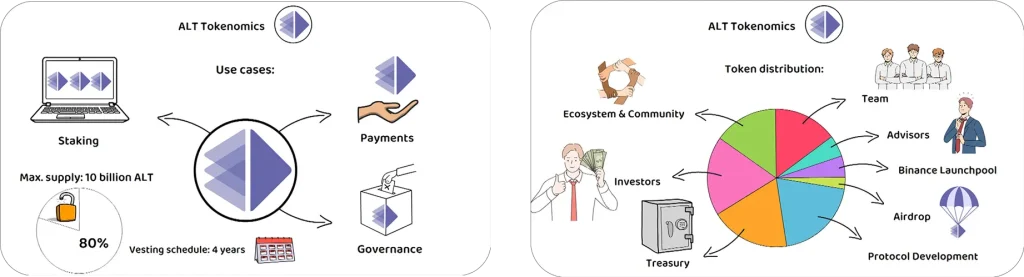

Like most Proof-of-Stake cryptocurrencies, ALT can be used for the classics of payments, staking, and governance.

In total, there will only ever be 10 billion ALT tokens, of which less than 20% have been unlocked according to their vesting schedule.

The total length of the vesting schedule is 4 years, and by January 2028 the total supply will have been distributed as follows:

20% will have gone towards Protocol Development, 18.5% towards the treasury, another 18.5% to Investors, 15% towards the Ecosystem & Community, 15% to the Team, and 5% towards Advisors.

Additionally, there is also a further 5% which has already gone towards the Binance Launchpool and a final 3% which was given away in the airdrop, both of which are fully unlocked with no vesting period.

In Conclusion

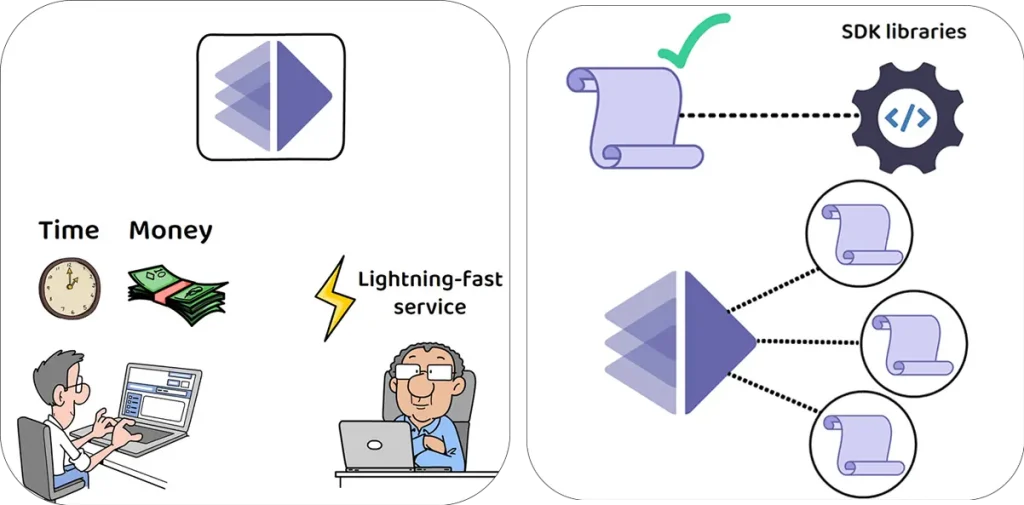

In short, the AltLayer protocol aims to save time and money for developers and provide a lightning-fast service for the end users.

If you want a fully complete, already coded rollup, their SDK libraries will have you covered, but if you also want to integrate AltLayer’s services with other rollup alternatives, they allow you the freedom to mix and match as well.

AltLayer appears to have provided a fully modular, highly interoperable scaling solution that can integrate with multiple platforms and other existing rollup solutions.

Consequently, barring any major mishaps in management, it seems likely AltLayer’s best days still lay ahead.

Though, as always, nothing is ever guaranteed in crypto, of course.

How to create an AltLayer wallet

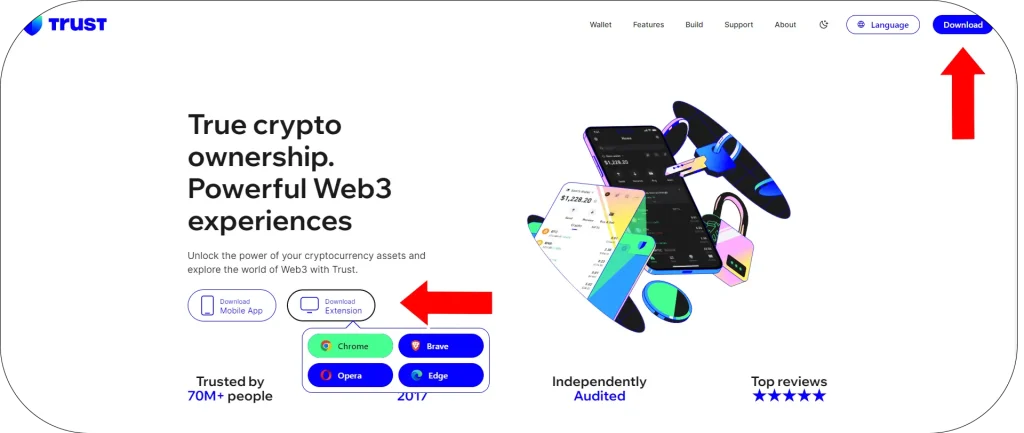

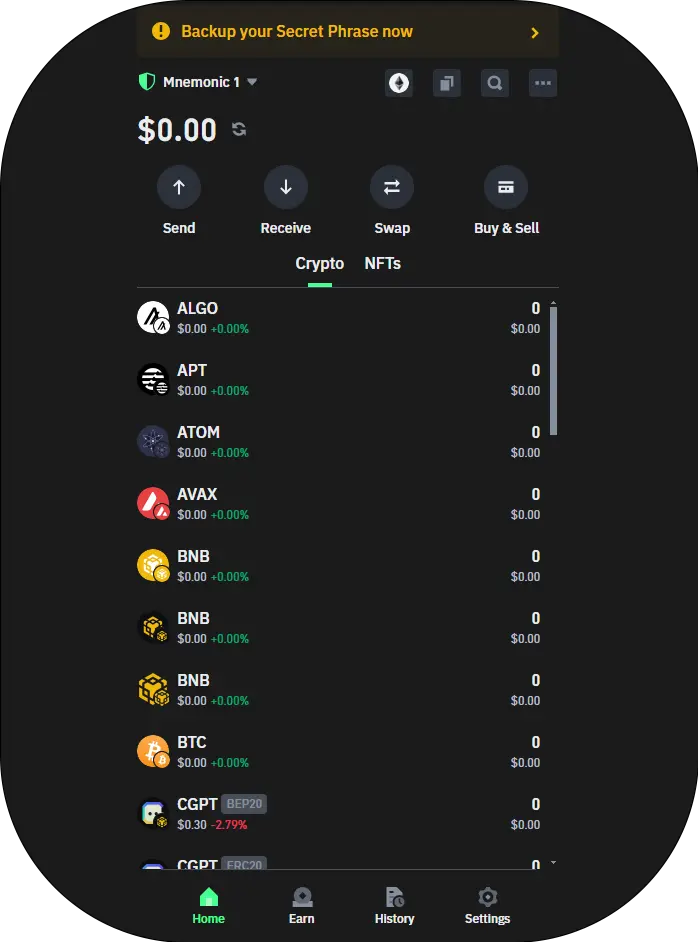

Step 1: Visit https://trustwallet.com If you already have a Trust Wallet, skip to Step 5.

Step 2: Download and install Trust Wallet from your mobile app store or your browser.

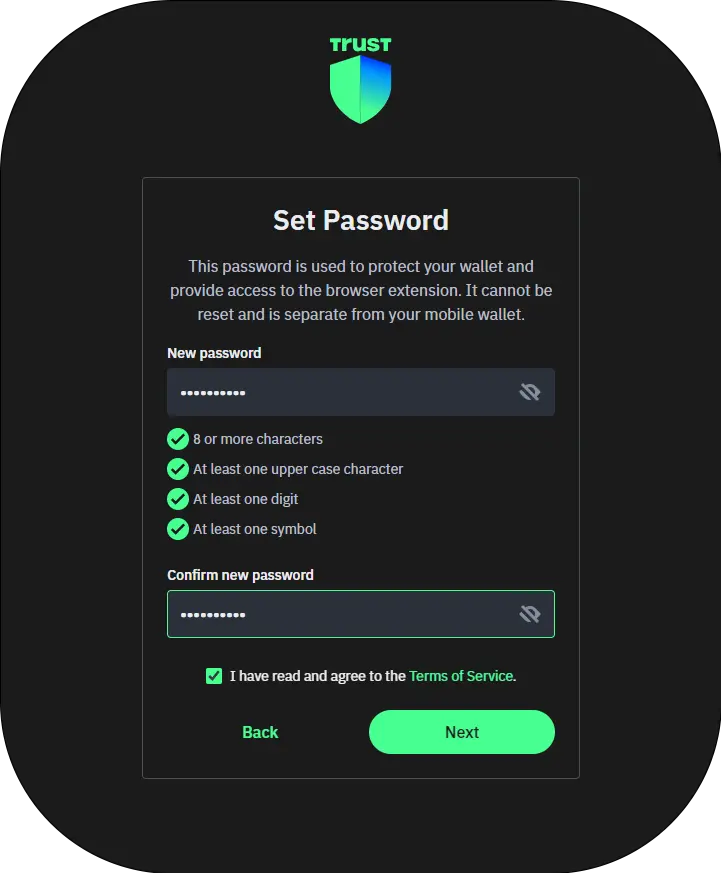

Step 3: Open Trust Wallet and create a new wallet or import an existing one.

Step 4: Once your wallet is set up, tap on the “Add Token” button.

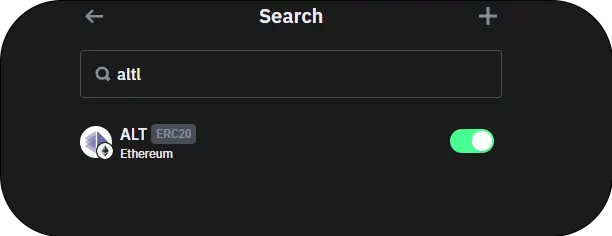

Step 5: In the search bar, type “ALT” to find the token.

Step 6: Tap on the ALT token and select “Add to Wallet” to add it to your Trust Wallet.

After adding ALT to your Trust Wallet, you will be able to view your ALT balance and perform transactions with the token.