Key Notes

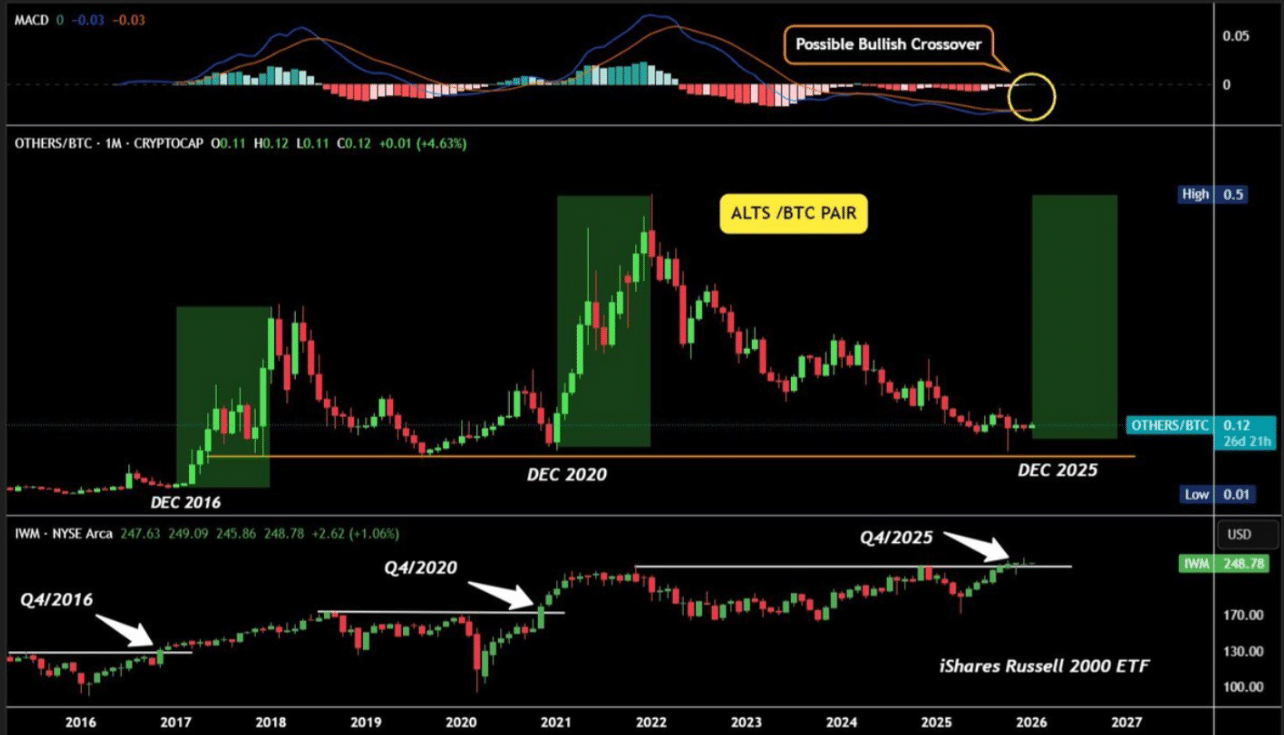

OTHERS/BTC appears to have bottomed in Q4 2025.

Similar setups were seen before the 2017 and 2021 alt cycles.

The monthly MACD has flipped bullish for the first time in 22 months.

The Altcoin-to-Bitcoin ratio (OTHERS/BTC) could be setting a major bottom in Q4 2025, as per market analysts. Interestingly, the same structure has played out twice before with altcoin prices rocketing in both cases.

In Q4 2016, OTHERS/BTC bottomed after a long decline. The breakout followed soon after, and altcoins strongly outperformed Bitcoin through Q1-Q2 2017. The pattern repeated in Q4 2020. OTHERS/BTC bottomed, broke its downtrend, and the 2021 alt cycle followed.

Others/BTC monthly MACD has flipped bullish for the first time since March 2024.

It seems like a strong rally in alts could happen if $BTC holds well. pic.twitter.com/EwLhdMXotg

— Ted (@TedPillows) January 5, 2026

In both cases, the sequence was clear: bottom first, then breakout, then an explosive altcoin breakout.

MACD Turns Green after Nearly Two Years

The monthly moving average convergence/divergence (MACD) on OTHERS/BTC has now turned bullish for the first time in roughly 22 months. The last time MACD turned positive was March 2024, and it failed to follow through.

MACD bullish crossover on OTHERS/BTC | Source: Bull Theory on X

However, this time, the context is different. The pullback has lasted almost four years. Relative Strength Index (RSI) is at its most oversold level on record and selling pressure has been extreme.

With the current MACD histogram now green and a bullish crossover forming, the structure indicates a cycle low approaching. If confirmed, this could turn into an explosive price surge for altcoins relative to Bitcoin.

Risk Appetite via Equities

According to crypto research entity Bull Theory, altcoin cycles have never started in isolation but have followed demand shifts. The Russell 2000 broke out above prior highs in Q4 2016, months before altcoins surged in 2017. The same sequence occurred in late 2020, ahead of the 2021 alt cycle.

WILL ALTSEASON FINALLY HAPPEN IN 2026 ?

Yes, it’s possible. Let me explain.

1) The historical cycle most people forget

Altcoin cycles don’t start randomly.

They usually start after OTHERS/BTC bottoms and break out.In Q4 2016, ALT/BTC bottomed.

The breakout came soon after,… pic.twitter.com/J2nAEGE4Pt— Bull Theory (@BullTheoryio) January 5, 2026

This setup has appeared again. The Russell 2000 broke out and held above resistance in Q4 2025. This breakout came one year later than many expected, but it finally arrived.

Small-cap strength has historically preceded capital rotation into higher-risk crypto assets.

Why This Cycle Was Delayed

Many expected an alt season in 2024. The structure was there, but conditions were not. Liquidity was tight. The Federal Reserve balance sheet was still contracting. Risk appetite remained weak.

Those constraints only started easing toward the end of 2025, explained Bull Theory. The setup did not fail. It shifted forward. Now, OTHERS/BTC bottoming, improving liquidity, and equity risk-on signals are aligning at the same time.

Although it is important to note that none of these signals guarantee an alt season. They only define the conditions. For continuation, Bitcoin must make a close above the 6-12 month holder cost basis, which currently sits at the $100,000 price tag.