Since the start of the year, Virtual (VIRTUAL)—a protocol that allows users to create and own AI agents—has surged by 70%. Although the AI agent narrative has cooled, VIRTUAL’s price rally has brought renewed attention to the project.

What forces are driving this rise, and how do analysts view VIRTUAL’s outlook for 2026?

Why Do Many Analysts Hold a Positive View on Virtual in 2026?

Recently, the project introduced three new agent launch mechanisms: Pegasus, Unicorn, and Titan.

This move represents a notable and bold overhaul. Virtual abandoned a single, unified token launch mechanism and replaced it with differentiated models tailored to specific use cases.

These mechanisms aim to optimize the development and deployment of AI agents on blockchain networks. Each model fits a different stage of project growth, from experimentation to scaling.

Pegasus (Early distribution and testing): Designed for builders who want to launch quickly and validate market demand.

Unicorn (Trust, capital, and accountability): Built for builders seeking funding while maintaining transparency.

Titan (Large-scale launches for reputable teams): Intended for projects with existing products, backing, or real-world deployment.

This launch framework gives investors additional reasons to maintain confidence in VIRTUAL. The token had previously declined by more than 75% at its lowest point.

Another factor supporting the recovery is a strategic investment by Virtuals Ventures into PredictBase.

This partnership creates significant opportunities for AI agents on VIRTUAL to interact with PredictBase. Use cases include participating in predictions, executing automated trading strategies, and optimizing liquidity.

This move is particularly significant, given that experts predict the prediction market will boom in 2026.

Additionally, VIRTUAL’s long-term catalyst may stem from the x402 trend. x402 is an emerging micropayment protocol that gained traction late last year.

According to an analysis from Layergg on X, x402 aligns closely with the era of the AI agent. The protocol enables autonomous agents to make small payments for services such as shopping, market forecasting, and even robotics.

Within this trend, VIRTUAL plays an important role. The project functions as both an AI agent launchpad and a platform that supports x402-based payments.

“Launchpads moved like levered beta. AI agents are waking up again. x402 still early, but clearly being bid,” analyst 0xJeff said.

VIRTUAL’s rebound does not stand alone. It is part of a broader recovery across AI-related tokens. For example, Render (RENDER) gained 80% over the past seven days, while Artificial Superintelligence Alliance (FET) rose more than 45% over the same period.

Retail investors appear to be prioritizing the AI sector in early 2026.

On-Chain Data Still Shows No Clear Improvement

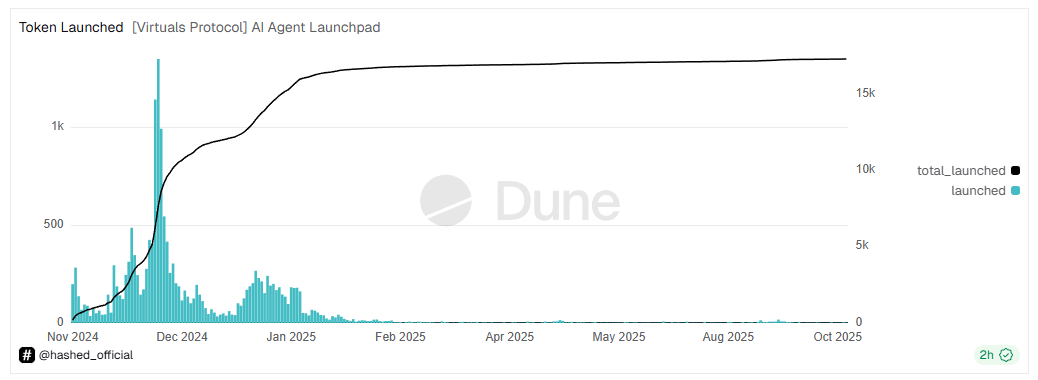

Despite these expectations, the outlook remains speculative. VIRTUAL’s price recovery has not been accompanied by a resurgence in new token creation on the platform.

Data from sources such as Dune Analytics shows that only a handful of tokens launch each day in early 2026. Only 1 or 2 tokens are launched daily.

The Number of Tokens Launched on the Virtual Daily. Source: Dune

Moreover, tokens launched on the platform have failed to generate the same traction and visibility as certain meme tokens on Pump.fun.

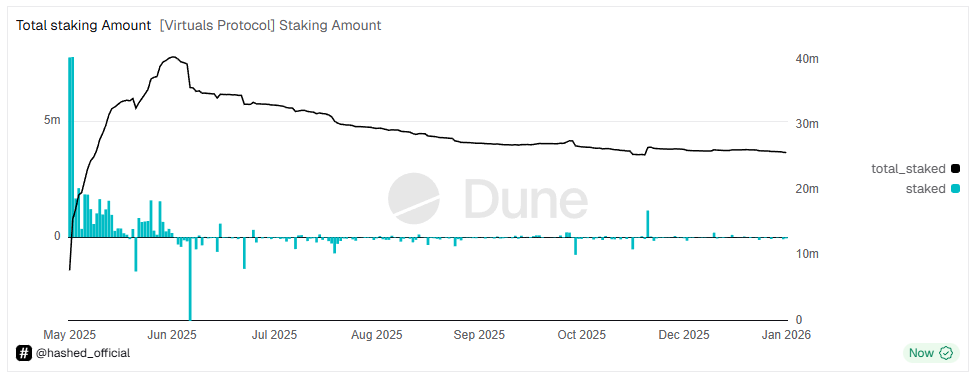

In addition, the amount of VIRTUAL staked has declined from more than 40 million since mid-last year to 25.8 million currently.

Total Staking Amount on Virtual Protocol. Source: Dune

Staking VIRTUAL allows holders to earn rewards by staying continuously engaged with ecosystem activity. However, staking levels have yet to show any signs of recovery.

Without a clear recovery in real demand, VIRTUAL’s price rally may struggle to remain sustainable over the long term. In that case, optimistic forecasts would amount to little more than hype.