ZKSync (ZK) went vertical, riding the high from its recent Upbit listing. The addition to the South Korean exchange boosted ZK for a vertical rally to a one-month high.

ZK, the native token of ZKSync, went vertical on Tuesday, rising to a one-month peak. ZK reacted to its Upbit listing, managing to bounce off its yearly lows.

The recent listing and added liquidity may become a factor for ZK to return as a more active asset. In the past year, the token fell from a high of $0.26. ZK remained volatile and risky following a long-awaited airdrop, where recipients created immense selling pressure.

The ZK token listed on Upbit is the native asset of the Elastic network. The project had also launched ZK Lite and ZK Era as L2 chains, betting on the zero-knowledge technology.

ZK to reach 10M traders

The Upbit listing shows that South Korean traders can still deliver liquidity to altcoins, boosting the short-term price.

ZK rallied by over 25% in a single day, rising to $0.04. Upbit is cautious in listing new assets, often leading to price anomalies for coins and tokens while Western markets are mostly inactive.

Before the Upbit listing, Binance and Bybit were the main trading venues for ZK. The asset continued trading with over 16% of volumes against the Korean won, based on its Bithumb listing. The currency’s influence may increase, adding ZK to a list of tokens with an alternative source of liquidity.

The Upbit listing arrives more than a year and a half after the ZK asset launch. For now, the short-term rally has not translated into full momentum, as the project trades close to its all-time lows.

ZK open interest returned on derivative markets

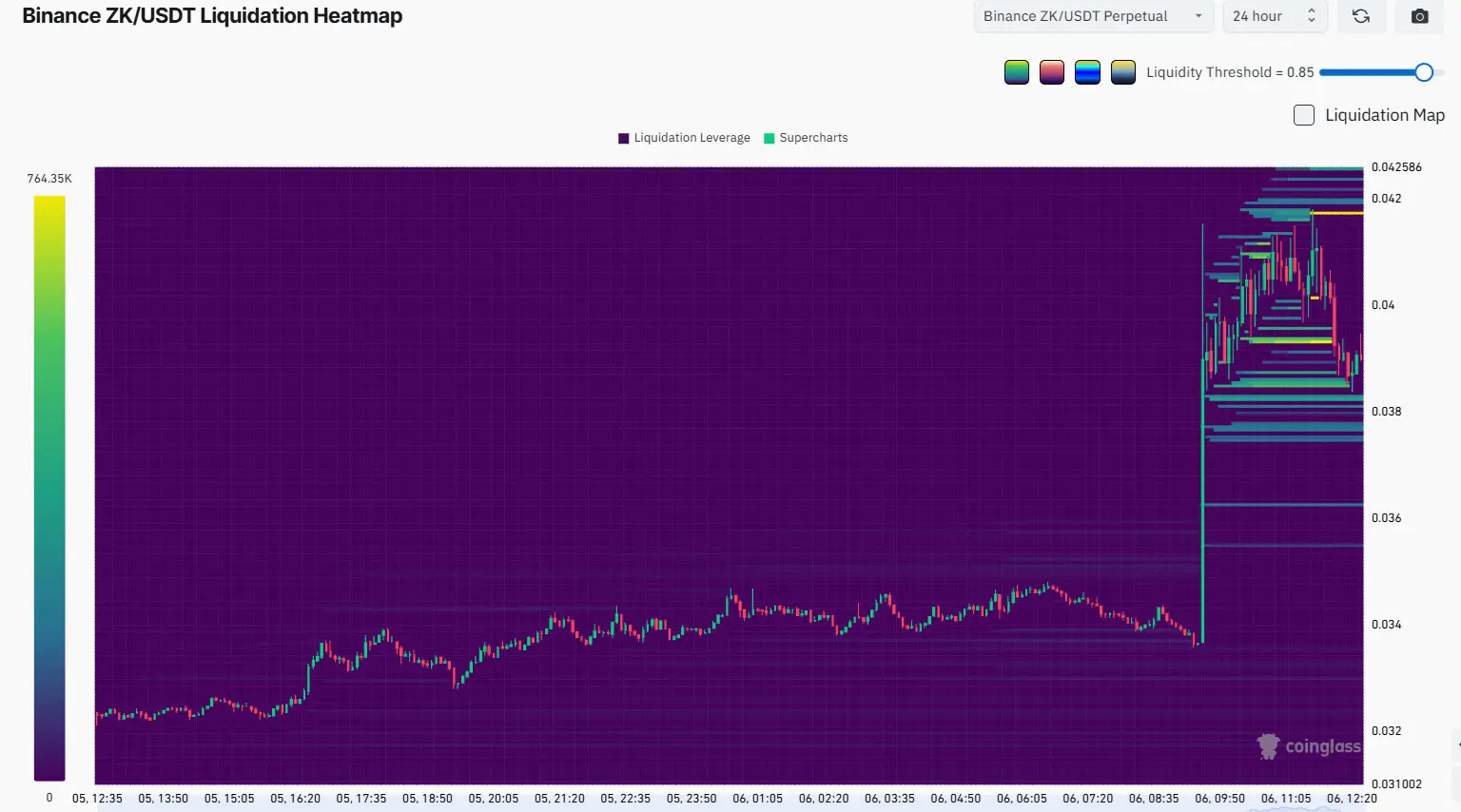

The recent listing and liquidity injection led to an immediate pickup in ZK open interest. Positions bounced from a recent low of $14M up to $42M, returning to levels from November 2025.

This time, ZK traders did not short the token aggressively. The recent rally only liquidated short positions up to $0.042, indicating the end of the climb. ZK is also not traded on Hyperliquid, and the price effects may be limited to centralized exchanges.

ZK was one of the assets to lose support as the altcoin season failed to materialize in 2025. The asset is still in the top 200 coins and tokens, yet to regain visibility. ZK is watched for a potential bull run in the coming months.

The Upbit listing only led to a 27% mindshare expansion, signaling slightly increased attention without hype. The ZKSync project aims to turn into a more active DeFi hub through its Elastic Network. The chains also aim to grab a share of the tokenization market. ZKSync lagged behind other L2 chains, also feeling pressure from the slowing EVM chain economy.

Join Bybit now and claim a $50 bonus in minutes