XRP is on the verge of a 28% breakout to $3.00, supported by increasing risk appetite from retail and institutional investors.

XRP ETF inflows surge to $46 million on Monday, rising in tandem with futures Open Interest.

XRP bulls maintain an edge over the bears, backed by a MACD buy signal, while key moving averages offer support.

Ripple (XRP) is showing strength, trading at $2.36 at the time of writing on Tuesday. The cross-border remittance token has maintained a steady uptrend for six consecutive days, underscoring steady inflows into XRP spot Exchange Traded Funds (ETFs).

A break above a multi-month trendline could boost XRP’s chances to extend the trend toward the pivotal $3.00 level, especially with retail demand making a comeback.

XRP gains ground as ETF inflows persist

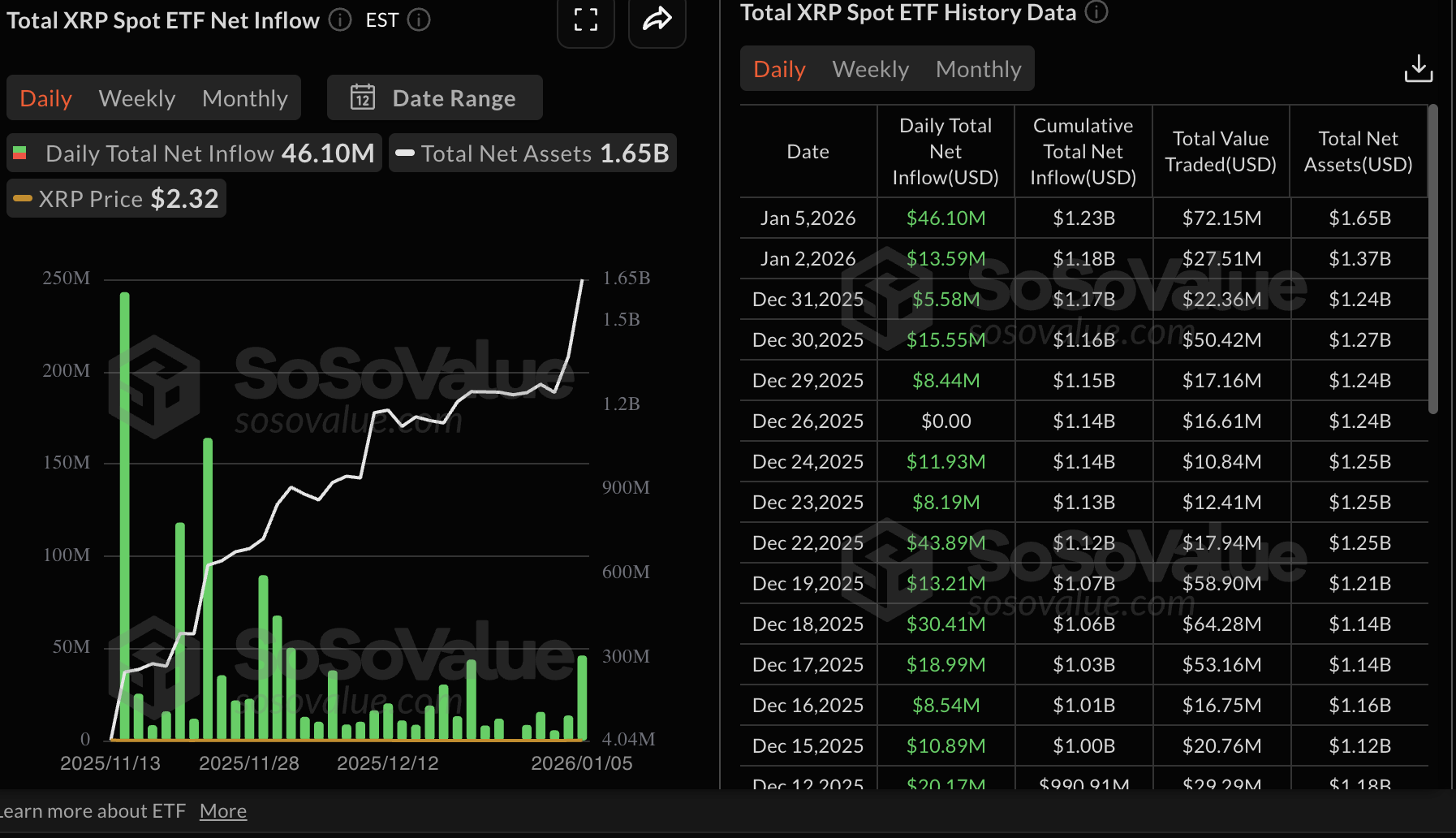

Inflows into spot XRP ETFs listed in the United States (US) surged to $46 million on Monday, extending the bullish streak from approximately $13.6 million on Friday. SoSoValue data shows that interest in the five XRP ETF products remains steady, with the cumulative inflow at $1.23 billion and net assets at $1.65 billion.

The XRP derivatives market, on the other hand, is also experiencing a resurgence in retail demand, which has spurred growth in futures Open Interest (OI). CoinGlass data shows the OI, which represents the notional value of outstanding futures contracts, averaging $4.55 billion on Tuesday, from $3.77 billion on Monday.

When retail and institutional demand increase simultaneously, the odds of a steady uptrend surge. A steadily rising OI indicates that traders are increasing risk exposure, leaning on optimism for short-term growth in the XRP price.

Technical outlook: XRP eyes potential breakout to $3.00

XRP is trading above the 200-day Exponential Moving Average (EMA), which sits at $2.35 at the time of writing on Tuesday. Although a descending trendline from the record high of $3.66 caps the immediate upside, key technical indicators, including the Moving Average Convergence Divergence (MACD) on the daily chart, support XRP’s bullish outlook.

The blue MACD line has maintained a positive divergence above the red signal line since Wednesday, while the expanding green histogram bars signal increasing bullish momentum.

A close above the 200-day EMA and by extension the descending trendline would support the uptrend’s continuation toward $3,00. Such a breakout would mark a 28% increase from the prevailing market level.

Still, the Relative Strength Index (RSI) at 75 on the same daily chart indicates that XRP is mildly overbought, which could prompt investors to take profits.

A decline in the RSI into the bullish region could trigger a surge in overhead pressure, potentially sending XRP to test the 100-day EMA at $2.22 and the 50-day EMA at $2.07. Further movement below these moving averages could resume the downtrend, targeting November and April lows of $1.77 and $1.66, respectively.