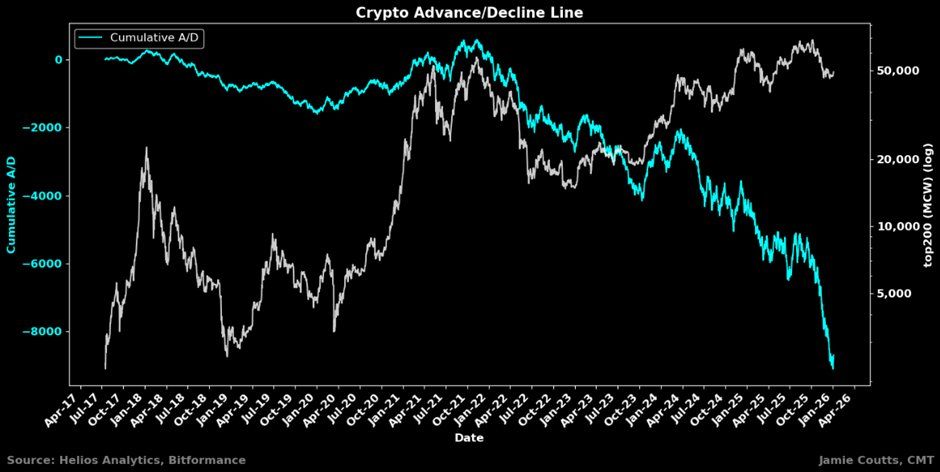

Bitcoin and select top cryptocurrencies are rising, but most altcoins are in decline—a sharp divergence marked by a falling cumulative Accumulation/Distribution (A/D) line for the broader crypto market, even as the top 200 assets maintain growth.

This “K-shaped” market pattern reflects deepening differences across crypto sectors. Winners are compounding gains, while many assets quietly lose value. The same trend is evident across the broader US economy and traditional markets, highlighting growing polarization.

Market Breadth Declines as Capital Focuses on Leaders

The crypto market now sees performance driven by fewer assets. Analyst Jamie Coutts noted that altcoins have been in a bear market since 2021. The A/D indicator, developed by Marc Chaikin, measures money flow through price and volume. It shows this divergence with clarity.

Although the A/D line for all cryptocurrencies is declining, the top 200 assets display stable, upward patterns. This shift suggests institutional and retail capital are increasingly consolidating into established projects. As a result, chains and applications lacking adoption struggle with supply pressure and reduced incentives.

Chart showing declining breadth in crypto markets. Source: Jamie Coutts

“Breadth has been collapsing for years. Fewer assets are doing the work. Most are quietly bleeding out. If a chain or app doesn’t have real adoption, it won’t survive,” Jamie Coutts posted.

These metrics highlight a transformation in crypto markets. Projects built on narratives and token incentives in the 2021 bull run now face challenges as liquidity shifts to assets with straightforward utility. This process clearly distinguishes which projects remain sustainable and which fade under speculation-driven models.

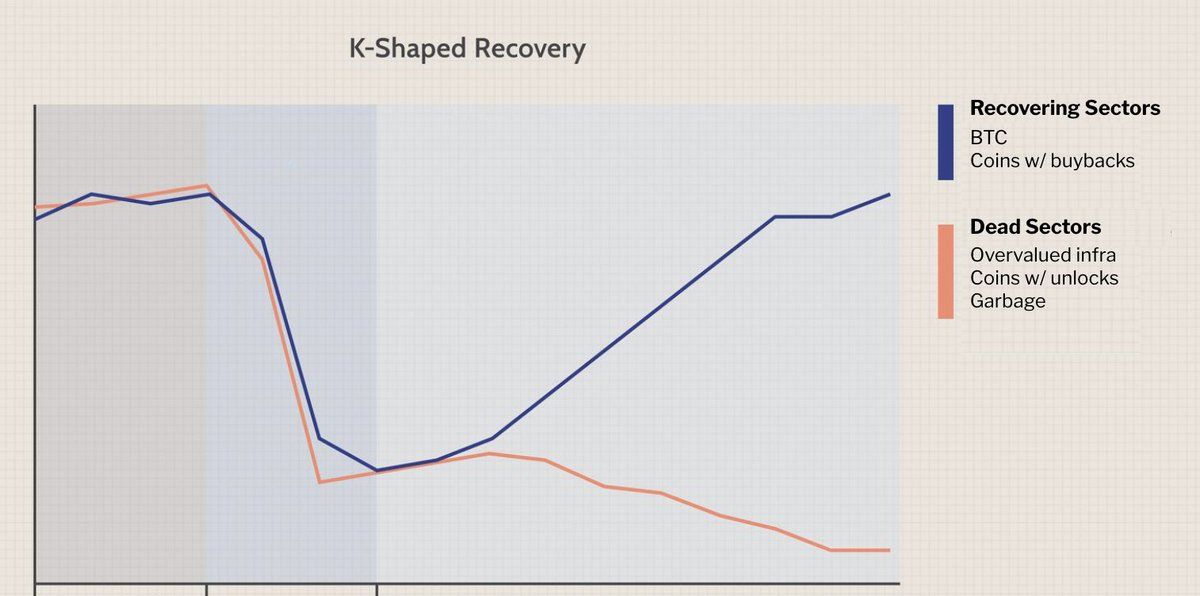

Defining Winners and Losers in a K-Shaped Market

This pattern affects more than just asset rankings. Analyst Taiki Maeda described the recovery as K-shaped. Bitcoin and cryptocurrencies with buyback models form the rising branch, benefiting from scarcity and strong incentives.

Visual representation of K-shaped recovery in crypto markets, attributed to Taiki Maeda

Meanwhile, infrastructure tokens with heavy unlocks and those lacking a value proposition move downward. This shift signals market maturity, with users seeking assets based on utility rather than hype. The artificial intelligence sector draws notable investment and developer attention, further separating successful projects from the rest.

Tokenization and real-world asset sectors are also gaining traction. Traditional financial institutions are exploring blockchain solutions, offering use cases that link legacy finance with decentralized tech. Still, most altcoins remain outside these trends and struggle as capital allocates more selectively.

The A/D indicator remains a powerful trend-spotting tool. Technical analysis guides explain that it tracks where price closes during each period, making it more reliable than volume-only metrics for identifying actual buying and selling pressure. A rising A/D line signals accumulation, while a falling line marks distribution. When price and A/D diverge, reversals may follow.

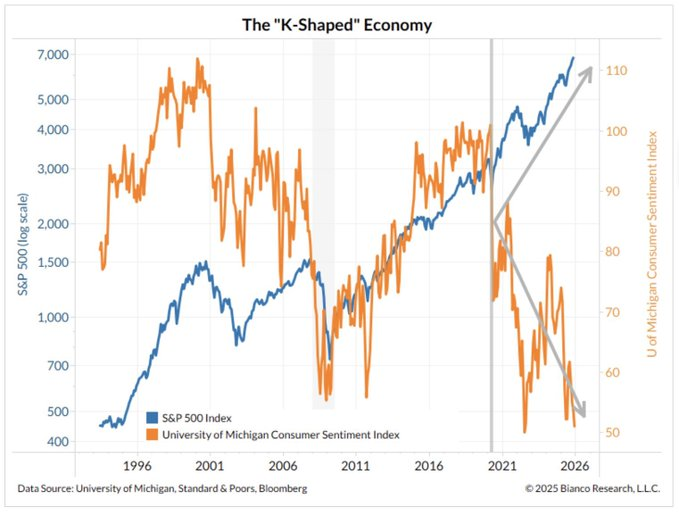

Macro Factors Deepen Crypto Divide

This K-shaped pattern also reflects global macroeconomic trends. In the US, the S&P 500 has risen since 2021, yet the Consumer Sentiment Index has fallen, suggesting asset owners are prospering as sentiment weakens.

Divergence between S&P 500 and consumer sentiment, attributed to PolymarketMoney

“We’re living in a K-shaped economy. Asset owners keep compounding while consumer sentiment collapses which means the rich economy is booming while the lived economy is struggling,” PolymarketMoney posted.

This environment directly shapes digital assets. Cryptocurrencies are seen as stores of value or inflation hedges, attracting capital seeking refuge from currency risk. In contrast, speculative tokens without clear value face losses as investors demand real utility rather than mere stories.

As sector correlations change, broad altcoin diversification no longer shields portfolios. Investors now favor concentration in assets with proven fundamentals, a shift from earlier cycles when wide exposure fueled gains. Market rotation is accelerating, and only robust projects maintain momentum.

By January 2026, the main question for investors is how long this K-shaped divergence will persist. The forces behind this split show few signs of fading. Whether this supports a healthier ecosystem by narrowing focus or risks stifling innovation through resource concentration remains to be seen. Continued monitoring throughout the year will be crucial for anyone active in these markets.