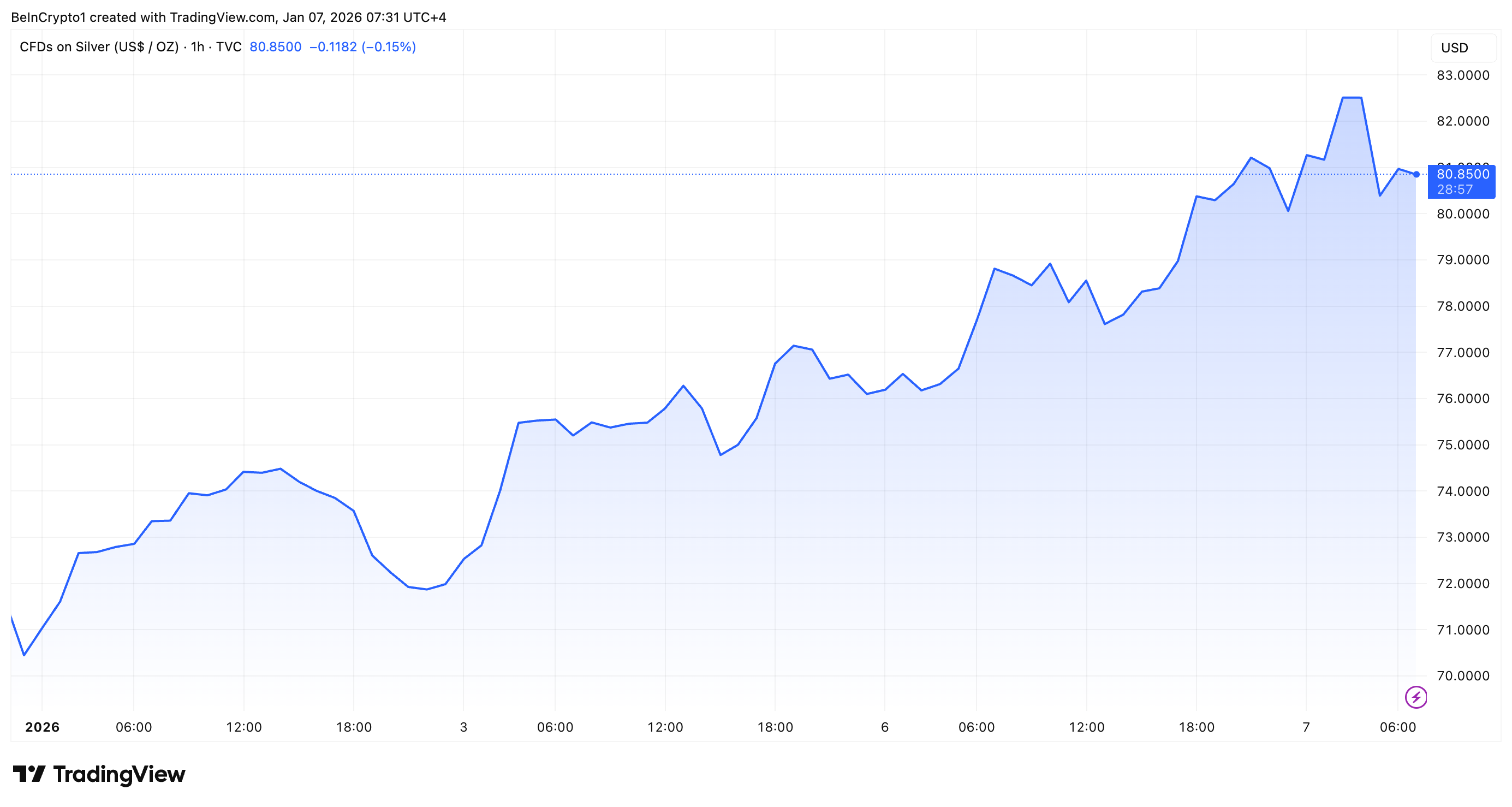

Silver surged to $82.7 per ounce in early Asian trading hours, nearing its recent all-time high (ATH). The precious metal briefly overtook NVIDIA to become the world’s second-largest asset by market capitalization.

The move has drawn significant attention across financial markets. Analysts are increasingly comparing silver to Bitcoin, with some suggesting the cryptocurrency could be poised for a similar breakout.

Precious Metal Rally Elevates Silver Above Tech Giant

Following a modest correction from its previous all-time high, silver extended its gains beyond $80 per ounce, reaching a high of $82.7 today. The latest rally pushed silver’s market capitalization above NVIDIA’s $4.55 trillion.

At press time, the precious metal was trading at $80.8, up nearly 12% year to date. These gains even outpace gold, which has risen around 3.2% so far in 2026.

“This is likely silver’s best start to a year ever,” economist Peter Schiff wrote.

Silver Price Performance. Source: TradingView

Silver’s outperformance is not a recent development. Even in 2025, the metal exceeded gold’s advance, rising approximately 176% over the year, compared with a 70.3% gain in gold.

Market observers attribute silver’s strength to its dual role. Investors buy it as a monetary or safe-haven asset, similar to gold.

On the other hand, silver plays a critical role in industrial applications, particularly in electronics, solar panels, artificial intelligence hardware, and electric vehicles. BeInCrypto recently highlighted that industrial demand accounts for approximately half of global silver consumption.

“Silver is the much more interesting metal these days, with the combination of investors buying it for monetary reasons plus the industrial demand for electronics, solar, AI, EVs and more,” Wall Street Mav stated.

According to the analyst, a persistent supply-demand imbalance has fueled silver’s rally. The Silver Institute reported that the global silver market saw its fifth straight annual deficit in 2025. Annual demand stands at approximately 1.2 billion ounces, while mine production and recycling only supply around 1 billion ounces.

This structural shortfall has helped sustain upward momentum, with many market participants forecasting that silver could reach triple-digit prices in 2026.

“$100 silver is now firmly on the table for January,” analyst Sunil Reddy stated.

However, when demand consistently exceeds supply, prices typically rise until consumption begins to decline, a process known as demand destruction. In silver’s case, higher prices could eventually make certain industrial uses uneconomic.

“So the silver price needs to rise until there is demand destruction. And nobody seems to know what that price is. I have seen estimates that at $135 silver, most of the solar industry is losing money manufacturing solar panels. We will see what happens,” Wall Street Mav added.

Bitcoin Analysts See Silver Parallels

Silver’s record rally has prompted many cryptocurrency market analysts to examine Bitcoin’s chart. Merlijn The Trader observed that silver completed a multi-year cup-and-handle formation ahead of its surge.

The post suggests Bitcoin is now in a similar phase, quietly building the same structure on the weekly chart. The implication is that, as with silver, once this pattern completes, Bitcoin could break out sharply to the upside.

“BITCOIN IS QUIETLY BUILDING A CUP & HANDLE ON THE WEEKLY. Long base. Slow accumulation. Maximum boredom. Silver did this for years… then exploded. When this structure resolves…It rarely resolves gently,” the analyst remarked.

Analyst Crypto Rover added that gold and silver surged sharply after breaking out of their monthly accumulation zones. According to the analyst, Bitcoin has yet to confirm a similar breakout, but once it does, it could trigger a powerful catch-up rally.

Market participants are also watching for a potential capital rotation from precious metals into Bitcoin. When and if such a shift materializes remains to be seen.