Introduction

Automated market makers (AMMs) were one of the initial big breakthroughs in the decentralized finance (DeFi) space, enabling users to trade on-chain without the need for an intermediary. Bancor was the first to do it in 2017, and Uniswap popularized it, among other dominant AMMs such as Curve Finance. Today, AMMs are a key piece of infrastructure and the lifeblood of any healthy DeFi ecosystem.

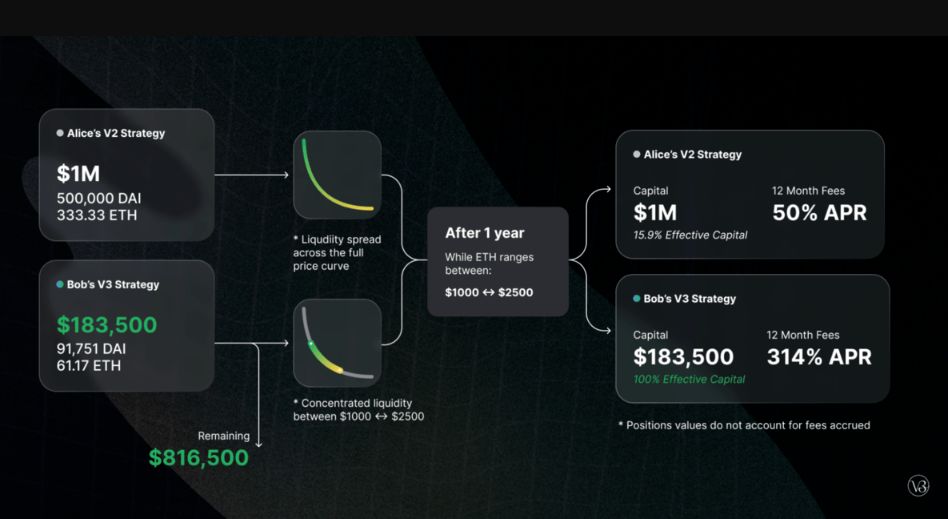

The major step forward for AMMs was concentrated liquidity. Introduced in Uniswap V3, concentrated liquidity granted liquidity providers a greater degree of control over their deposited assets, enabling them to specify the price ranges where their liquidity would be put to work.

This significantly increased the capital efficiency of Uniswap V3, providing deep liquidity to their users, without having to increase total value locked (TVL) on the protocol.

Source: Uniswap Blog (link)

Launched on March 8, 2023, Maverick Protocol seeks to take concentrated liquidity strategies one step further, to provide even greater control over users’ liquidity positions through custom pool ranges and the automation of liquidity provision within predetermined parameters. The DEX currently has around $25M in total value locked (TVL) and over $2B in volumes across Ethereum mainnet and ZkSync Era.

What Is Maverick Protocol?

Maverick Protocol is a novel DeFi protocol on Ethereum and zkSync Era, aiming to provide the most liquid trading platform for all users via a unique AMM design, known as the Dynamic Distribution AMM. The Dynamic Distribution AMM model seeks to target the three main issues that Maverick identified with existing concentrated liquidity solutions.

The first issue is that most concentrated liquidity solutions require a high degree of active management. While users made more fees when the price traded in the range they supplied in, they made nothing at all when price traded above or below their supplied range.

Similar to the first issue, the second problem was the implicit bias towards sideways markets in concentrated liquidity provision. Liquidity providers profited the most when price traded exactly within their range, which is characteristic of a range bound market. In a trending market, users would have to constantly shift their position to optimize their earnings.

Finally, most concentrated liquidity solutions spread liquidity provided uniformly over the selected range. This limits the flexibility that users have in determining how their assets are utilized.

How does Maverick Protocol aim to solve these issues?

Maverick’s Directional LPing — Liquidity Modes

To target the issues of active liquidity pool management, Maverick provides users with four liquidity management strategies to manage their positions based on their expectations of the price movement in their deposited assets.

Source: Maverick Protocol Docs (link)

Mode Right

This expresses a bullish opinion on the base asset in the liquidity pool. The strategy works by shifting the price range of the liquidity provided towards the right as the value of the base asset rises against the other, keeping the high end of the range at the current price. As price increases are rarely linear, retracements in price generate fees for the liquidity provider as it retraces within the range. The bullish bias also ensures that the liquidity provider minimizes their impermanent loss and reaps the gains of the upward price movement while earning on trading fees. If the bullish prediction is wrong and the price falls instead, this strategy does not chase after the price, and instead keeps the range as it is.

Mode Left

This takes the opposite approach, expressing a bearish opinion on the base asset in the pool. Similar to Mode Right, it tracks the price of the base asset as it declines, keeping the bottom of the price range at the current price. In doing so, the position is able to capitalize on trades occurring in the supplied range when the price of the base asset bounces or retraces upwards. Just like Mode Right, it does not chase the price to right, and will leave the price ranges as they are if the base asset appreciates in value instead.

Mode Both

This combines the above two solutions into one, forming an automated liquidity management strategy that tracks the price of the base asset in both directions, as opposed to in a single direction for the above two strategies. The aim of this strategy is to maximize fees earned by the liquidity provider by keeping the range as close to the current price as possible.

Mode Static

The final option on Maverick, this keeps your liquidity in the range specified, much like a standard concentrated liquidity protocol. The catch here is that Maverick enables custom distribution of liquidity within the supplied price range. This means that users can select from a variety of distributions: exponential, flat or single bin, depending on their strategy.

Source: Maverick Protocol Docs (link)

Exponential allows liquidity to be concentrated around the current price with decreasing liquidity provided in bins further away from the current price, while single bin concentrates all provided liquidity into the active price bin. Flat functions like other concentrated liquidity platforms, dividing liquidity uniformly across the selected range.

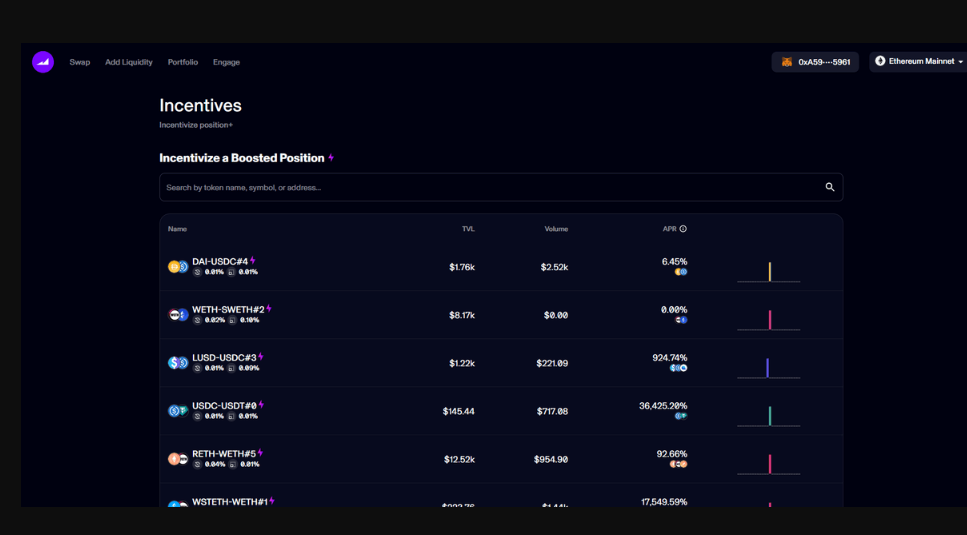

Boosted Positions

On top of Maverick’s liquidity modes, Maverick has also recently introduced boosted positions to the platform. Boosted positions allow users to incentivize specific price ranges (or “positions”) to encourage specific behavior from liquidity providers.

For example, a new protocol with a token, ABC, wanted to bootstrap liquidity for their token. A traditional ABC-ETH liquidity pool could work, but would not be the most optimal as 50% of all liquidity being deposited would be in the ABC token, which the ABC team already owns plenty of. Instead, they can choose to create a boosted position with only ETH in an ABC-ETH pool. Hence, users are incentivized to deposit ETH into this boosted position to earn both incentives and trading fees from their position.

Source: Maverick Protocol Docs (link)

Incentives can be paid out in any ERC-20 token and can even be paid by users other than the creator of the pool themselves. Moreover, the user will also determine the period across which the rewards are distributed over. So for the previous example of protocol ABC, they can incentivize a boosted position in the ABC-ETH pool with 10,000 USDC over a period of eight weeks if they wished to.

Maverick Team

The Maverick team comprises of developers who have collectively worked on numerous unique infrastructures for crypto, including a swap aggregator, Ethereum layer2, PoS public blockchain, DEX, decentralized storage networks, crypto lending, a crypto debit card, and quantitative digital asset investment. The team consists of members and advisors who were previously from MetaMask, BitTorrent, Abra, TrueFi, Paxful and LedgerPrime.

Maverick Investors

On Feb. 15, 2022, Maverick announced a $8 million fundraising round led by Pantera Capital. Other investors include Altonomy, Circle Ventures, CMT Digital, Coral DeFi, Gemini Frontier Fund, GoldenTree Asset Management, Jump Crypto, LedgerPrime, Spartan Group, Taureon and Tron Foundation.