Bitcoin price is consolidating after a shallow 1% day-on-day pullback, even as a bold macro prediction from Farzam Ehsani, CEO of VALR, draws attention.

His thesis points to major upside once capital rotation shifts from precious metals. For now, Bitcoin must clear a few short-term pressure zones before that scenario can unfold.

Why the VALR CEO Thinks Upside Is Delayed, Not Denied

Ehsani’s view centers on capital rotation rather than direct chart patterns. This is what he said in an exclusive bit to BeInCrypto:

“Aggressive price growth in Bitcoin and Ethereum is likely to begin after the rally in precious metals fades,” he emphasized

He ties Bitcoin’s sideways action directly to where global capital has gone:

“Over the past year, gold prices have risen by 69%, while silver has surged by 161%… As a result, the upside momentum in the leading crypto assets has somewhat stalled,” he highlighted

This relationship is visible in the data. Bitcoin’s short-term correlation with gold currently sits near −0.11, showing the two assets moving slightly in opposite directions. Capital chasing metals during geopolitical stress and tight liquidity has possibly reduced urgency in crypto.

BTC-Gold Correlation: Coinglass

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Crucially, Ehsani does not see this as a structural weakness:

“Long-term Bitcoin holders have stopped selling for the first time since July,” he mentioned.

That removes a major source of supply. He describes the current phase as:

“A calm before the storm, typically followed by a broader crypto market rally,” he said

His base-case scenario assumes a shift in metal dynamics:

“In the first quarter of 2026, Bitcoin could rise to $130,000… but this scenario is unlikely without a shift in the price dynamics of gold and silver,” he further added

The macro thesis is clear. Bitcoin’s upside is postponed by capital allocation, not undermined by fundamentals. Yet, there are a couple of on-chain hurdles as well.

Short-Term Holders Are Creating the First Real Test

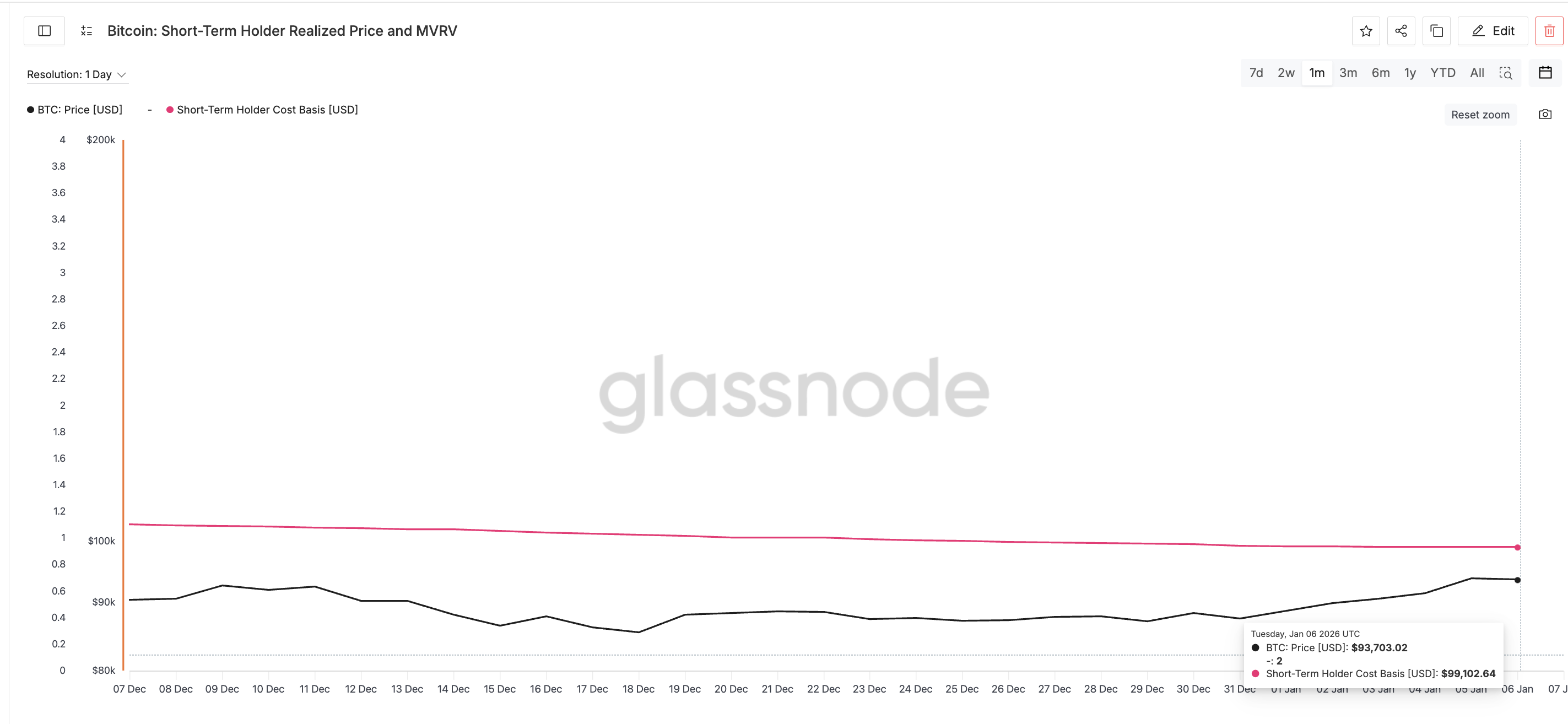

While long-term holders have stepped back from selling, as Ehsani highlights, short-term holders now control near-term price behavior. Short-term holders are wallets that acquired Bitcoin within roughly the last 155 days and tend to react strongly around break-even levels.

That break-even level is the short-term holder realized price, currently near $99,100. This is the average cost of recent buyers. Around this zone, behavior changes. Below it, the holders are underwater. Near it, they seek relief. And that could trigger a sell wave, provided offsetting capital rotation does not come in.

STH Realized Price: Glassnode

This pressure shows up in short-term holder NUPL (Net Unrealized Profit/Loss). On December 18, short-term NUPL dropped to around −0.18, signaling heavy losses. Since then, it has risen toward −0.05, meaning losses are shrinking.

Rising NUPL: Glassnode

When NUPL approaches zero, selling often increases, not because markets turn bearish, but because traders want to exit without losses. This explains why Bitcoin might hesitate near $99,100 even as macro signals improve.

Bitcoin Price Levels That Decide Whether the Prediction Holds

Bitcoin’s price chart structure puts these pressures into focus.

The BTC price is consolidating inside a cup-and-handle pattern, a bullish continuation structure, after rebounding from resistance near $95,180. For this pattern to resolve higher, Bitcoin must clear two key hurdles, provided the neckline breakout above $95,180 happens first.

The first sits near $99,400, closely aligned with the short-term holder realized price. A clean daily close above this zone would signal that break-even selling pressure has been absorbed.

The second hurdle is near $101,600, which aligns with the 365-day moving average. This moving average tracks Bitcoin’s long-term trend over a full year. Reclaiming it often marks the transition from consolidation to expansion.

Bitcoin Price Analysis: TradingView

If price reclaims both levels, with a daily close, Bitcoin’s structure supports continuation toward higher targets, aligning with Ehsani’s macro thesis. The first key target, then, would be $108,000 per the chart extension.

On the downside, the bullish setup remains intact above $91,900, the lower boundary of the handle. A deeper break below $84,300, the base of the cup, would invalidate the structure and delay upside, though it would not negate the broader thesis.

Bitcoin’s long-term narrative remains constructive. The short term is simply asking for proof beyond the short-term walls. Clearing near-term holder pressure is the final step before capital rotation can do the rest.