Bitcoin price edges below $92,000 on Wednesday after failing to break through a key resistance zone the previous day.

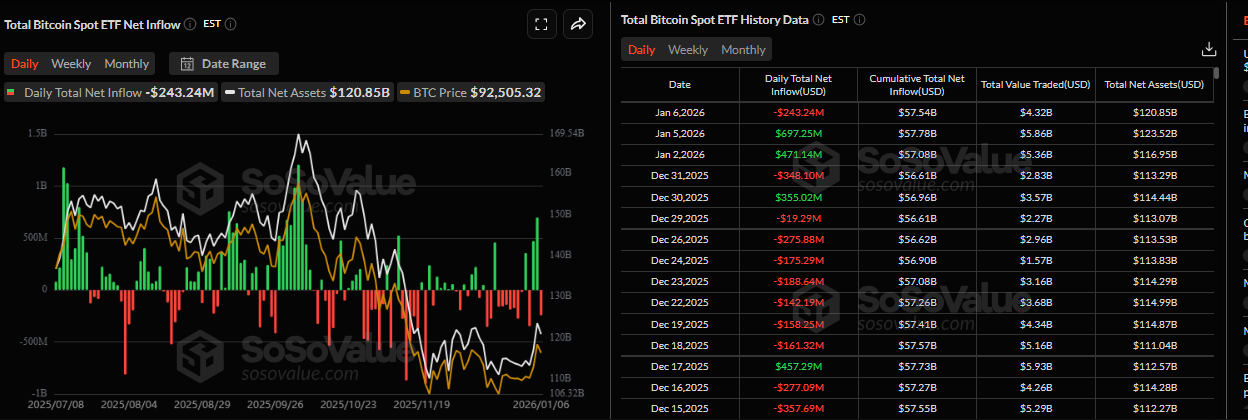

US-listed spot Bitcoin ETFs record an outflow of $243.24 million on Tuesday, following recent inflows, highlighting mixed institutional demand.

Derivatives sentiment remains cautious, with CME traders staying passive, futures premiums muted, and open interest subdued, signaling weak bullish conviction.

Bitcoin (BTC) slides below $92,000 at the time of writing on Wednesday after falling to close above the key resistance earlier this week. Institutional demand shows mixed sentiment with alternating inflows and outflows this week. Meanwhile, on the derivatives front, sentiment remains cautious, signaling weak bullish conviction.

Mix sentiment among institutional demand

Institutional flows reflect mixed sentiment so far this week, with Bitcoin spot ETFs seeing alternating inflows and outflows: inflows of $697.25 million on Monday contrast with outflows of $243.24 million on Tuesday, according to SoSoValue data. This highlights indecision among institutional investors, as fluctuating ETF flows suggest a cautious approach toward the largest cryptocurrency by market capitalization.

CME traders stay on the sidelines

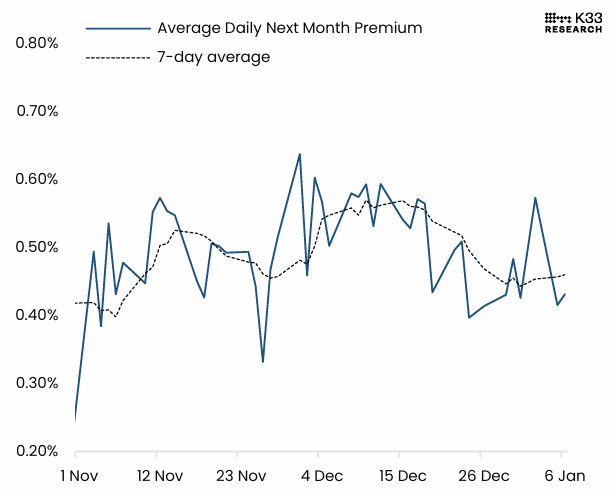

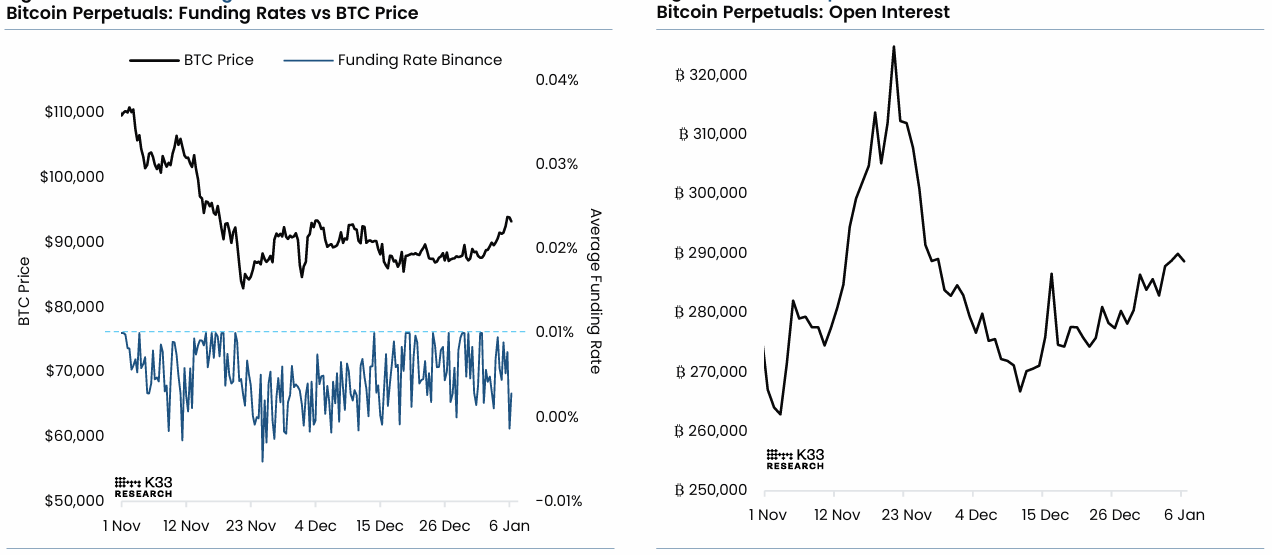

A K33 Research report on Tuesday stated that there are no signs of optimism in derivatives markets. The report explains that Chicago Mercantile Exchange (CME) positioning remains largely passive, with year-end leverage declining to deeper lows, but has seen a modest recovery in the first days of this year.

Futures premiums, as shown in the chart below, have trended up over the past few trading days, reflecting slightly improved sentiment. However, a 11% rebound in CME open interest from late-December lows, alongside stronger BTC prices, leaves it well below levels seen in most of 2024 and 2025, underscoring cautious participation.

The analyst concluded that BTC funding rates remain subdued and turned negative, signaling defensive positioning, even as notional open interest has gradually risen to six-week highs, indicating a measured, structurally healthy buildup in exposure.

Bitcoin Price Forecast: BTC pullback after retesting key resistance

Bitcoin price closed above the upper consolidation range of $90,000 on Saturday. BTC rose nearly 4%, retesting the 61.8% Fibonacci retracement level (drawn from the April low of $74,508 to October's all-time high of $126,199) at $94,253 on Monday. However, the rally paused on Tuesday as BTC struggled to close above this resistance level. As of Wednesday, BTC is trading slightly down at around $91,900.

If BTC closes above the $94,253 on a daily basis, it could extend the rally toward the key psychological $100,000 level.

The Relative Strength Index (RSI) is 56, above the neutral 50 level, indicating bulls remain in control of momentum. In addition, the Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover and rising green histogram bars above the neutral level, further supporting the bullish outlook.

However, if BTC corrects and closes below the 50-day Exponential Moving Average (EMA) at 91,745 on a daily basis, it could extend the decline toward the key support at $90,000.