XRP fights to hold above the 100-day EMA amid intensified selling pressure around the $2.42 resistance band.

The SOPR metric has reset after a steady rise since January 1, suggesting profit-taking is increasing.

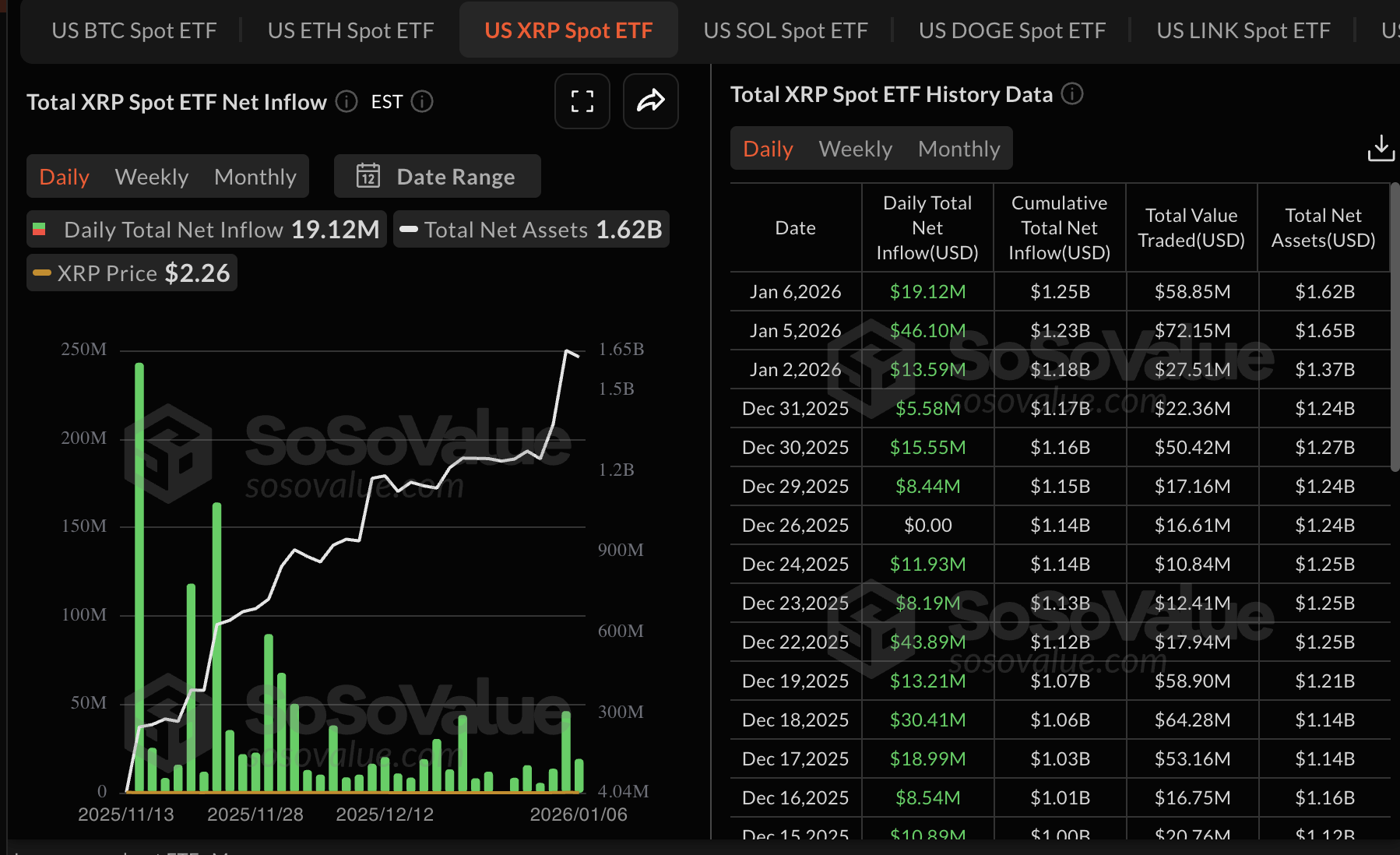

Institutional interest continues to shape XRP’s bullish outlook, with ETFs recording $19 million in inflows on Tuesday.

Ripple (XRP) is trading downward but holding support at $2.22 at the time of writing on Wednesday, as fear spreads across the cryptocurrency market, reversing gains made from the start of the year. Profit-taking appears to be center stage, as confidence in XRP’s ability to sustain the uptrend falters.

A break above a multi-month descending trendline could set XRP toward the $3.00 target. However, a close below a short-term support level at $2.22 could test demand at $2.00, potentially leaving XRP vulnerable to an extended slump.

XRP SOPR metric resets amid profit-taking

The Spent Output Profit Ratio (SOPR) on-chain metric, computed by dividing realized value (price sold) and the value of XRP at creation (price paid), is resetting. Glassnode data shows the metric at 1.05 as of Tuesday, down from 1.08 the previous day.

As the SOPR declines, it indicates that investors are selling and realizing profit, and in the process adding to the headwinds. Further decline below the mean line at 1.00 would mean XRP is oversold, creating fresh opportunities for investors to lean into risk.

XRP ETFs, on the other hand, saw inflows of approximately $19 million on Tuesday, a significant drop from the $46 million recorded on Monday.

Despite the decline in volume, interest in US-listed XRP ETFs has steadied since their debut in November, boosting cumulative inflows to $1.25 billion and related net assets to $1.62 billion.

Technical outlook: XRP holds key support

XRP is trading down but holding onto a short-term support provided by the 100-day Exponential Moving Average (EMA) at $2.22 at the time of writing on Wednesday. The correction follows an early-year rally that signalled a bullish shift, but it encountered resistance around the 200-day EMA at $2.34 and a descending trendline on the daily chart.

The Relative Strength Index (RSI) has fallen to 64 on the same chart from a brief ascent into overbought territory, indicating fading bullish momentum. A further decline toward the midline could keep the trend bearish and increase the odds of XRP sliding below the 100-day EMA at $2.22.

Closing below this moving average will likely trigger an extended correction that could test the 50-day EMA at $2.07.

Still, traders may lean on the Moving Average Convergence Divergence (MACD) indicator, which continues to show positive divergence on the same chart, as a buy signal amid optimism for a larger breakout above the descending trendline.