Top-charting trends on the prediction market Polymarket largely center on US politics and broader global political developments. These markets attract activity ranging from hundreds of thousands to tens of millions in transaction volume.

Because Polymarket facilitates wagers primarily through stablecoins, the rapid growth of prediction markets could catalyze a significant expansion of crypto usage in 2026.

Political Bets Fuel Prediction Market Surge

The exponential rise of prediction markets as a dominant narrative has already been cemented in the first week of the year. Events tied to American political developments and broader geopolitical tensions have consistently led the charts.

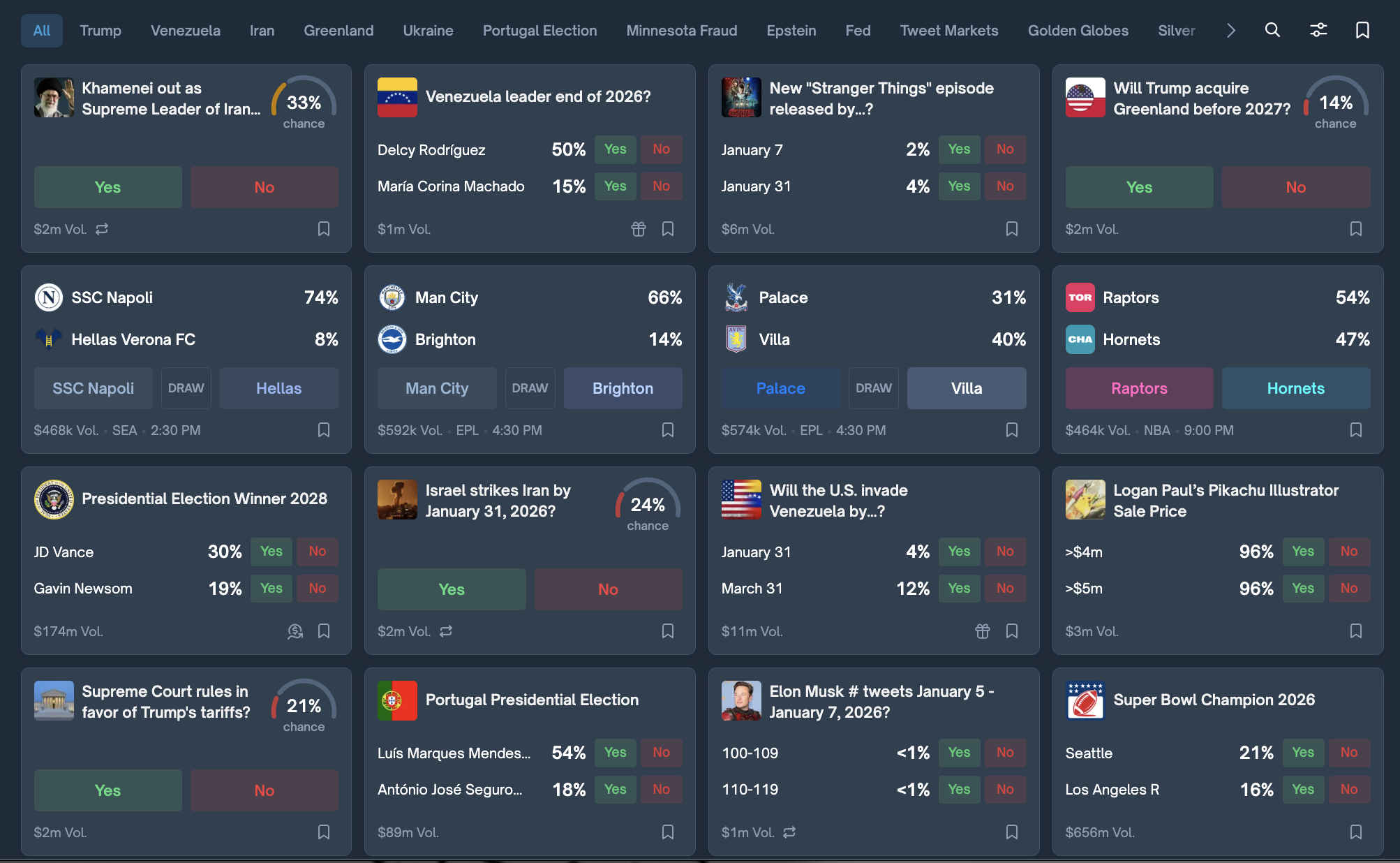

Polls centered on presidential elections and leadership transitions in countries such as the United States, Iran, Portugal, and Venezuela have topped rankings.

Top trending polls on Polymarket. Source: Polymarket.

Trading volume across these polls alone ranges from lows near $1 million to highs of $174 million, highlighting the rapid expansion of wagering activity on the platform.

At the same time, bets linked to major geopolitical flashpoints have gained momentum. Some focus on escalating US-Venezuela tensions, while others speculate on the likelihood of the US taking control of Greenland before the end of the year.

The scale of activity across these markets makes clear that prediction platforms are far from losing relevance. The way users place these bets may also lead to a renewed boom in crypto, particularly stablecoins.

Stablecoins Anchor Mainstream Betting Adoption

Polymarket is widely recognized for its deep integration with digital assets. Users can transfer crypto across multiple networks, including Ethereum, Polygon, Base, and Arbitrum.

Deposits are supported in a wide range of cryptocurrencies, as well as stablecoins such as USDT and USDC.

As wagering volumes continue to grow exponentially, crypto assets and stablecoins will expand in tandem.

Several major upcoming events may also accelerate this trajectory.

With the 2026 World Cup set to take place in North America in June, sports-related betting is likely to surge.

In this context, stablecoins could play a central role in driving broader adoption of prediction markets, thanks to their ease of use for non-crypto users and their close alignment with fiat currencies, particularly the US dollar.