For years, the debate around digital assets was framed as a battle between crypto and traditional banking.

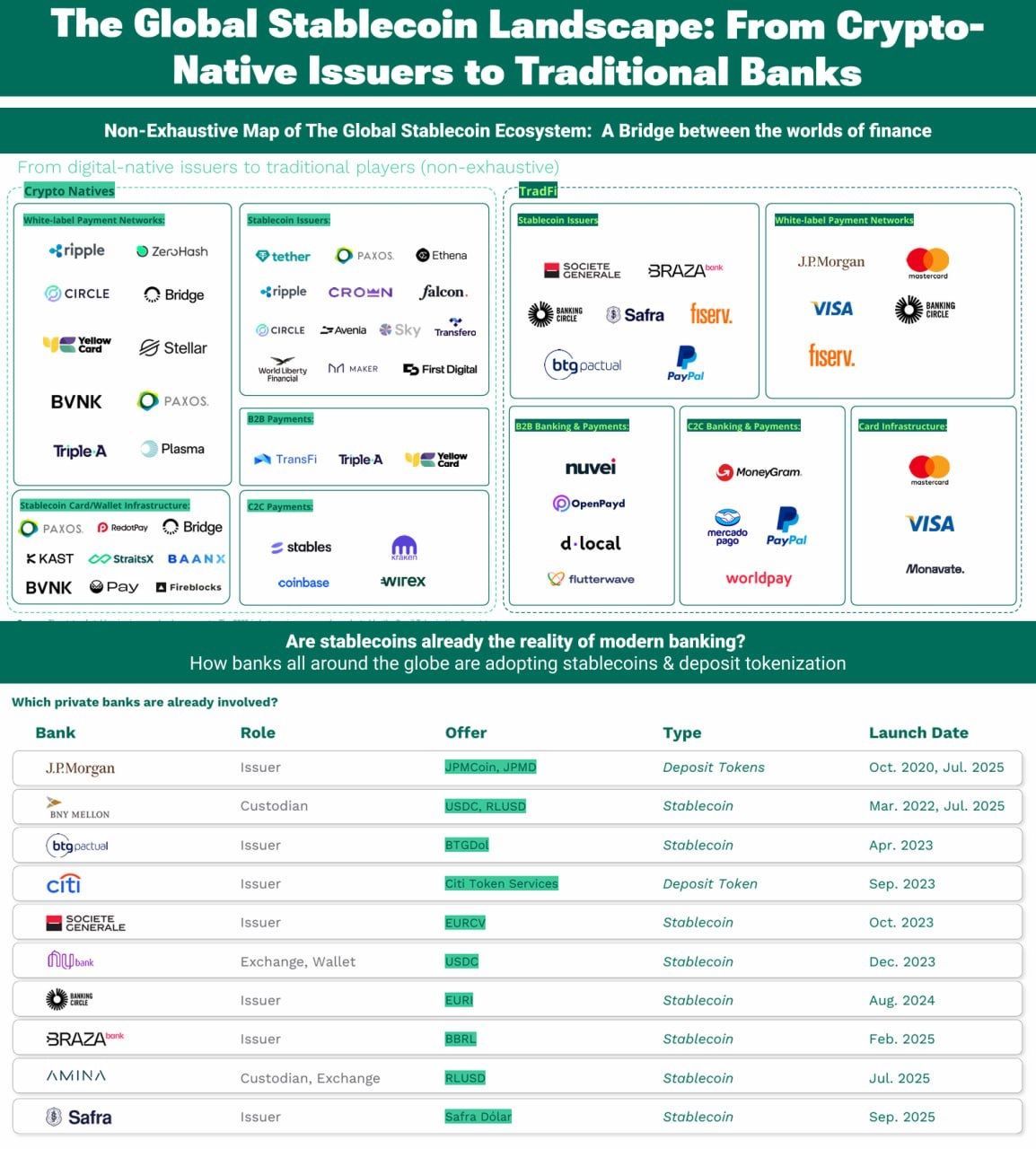

That framing is now breaking down. What’s emerging instead is a convergence, where blockchain-native firms and global financial institutions are moving toward the same goal: faster, always-on money movement built on tokenized infrastructure.

Key Takeaways

The divide between crypto and banks is fading as both adopt tokenized money infrastructure.

Stablecoins and deposit tokens are becoming core settlement tools, not speculative assets.

The real competition now is over interoperability and integration speed.

Crypto-native companies were first to prove that value could move globally, on-chain, and around the clock. Stablecoin issuers and blockchain payment networks showed that settlement didn’t need banking hours, multiple intermediaries, or days of delay. What began as an alternative system is now being adopted by the very institutions it was once positioned against.

Traditional Banks Step Into Tokenized Money

Major banks and payment networks are no longer experimenting at the edges. Many are already operating stablecoins or tokenized deposit products in live environments. Instead of resisting blockchain rails, institutions such as JPMorgan, Citi, Société Générale, PayPal, Visa, and Mastercard are integrating them directly into their payment and treasury systems.

These products are not designed for speculation. They are built for settlement, liquidity management, and cross-border flows. Tokenized deposits allow banks to keep funds on their balance sheets while gaining the speed and programmability of blockchains. Stablecoins, meanwhile, act as neutral settlement instruments that can move between institutions without friction.

The result is a hybrid model where regulated balance sheets coexist with blockchain-based execution.

Where Convergence Is Actually Happening

The overlap between crypto and banking is most visible in areas where existing infrastructure has long struggled. Settlement and clearing are moving closer to real time. Cross-border payments are becoming cheaper and easier to automate. Corporate treasuries are gaining new tools to manage liquidity across jurisdictions without relying on slow correspondent banking networks.

Tokenized deposits and stablecoins are also reshaping how liquidity moves inside financial institutions. Instead of batching payments or waiting for end-of-day reconciliation, value can move instantly, with smart contracts enforcing rules automatically.

Stablecoins as a New Settlement Layer

Stablecoins are not replacing national currencies. Their role is closer to that of a settlement layer that sits between institutions and payment systems. Banks still provide trust, regulatory oversight, and capital backing. Blockchains provide speed, programmability, and global interoperability.

For end users, the distinction barely matters. Whether the transaction runs through a bank-issued deposit token or a blockchain-native stablecoin is largely invisible. What matters is that payments arrive instantly, fees are lower, and systems work across borders without friction.

The Next Phase: Interoperability, Not New Tokens

The next stage of this evolution is not about launching yet another stablecoin. It’s about connecting systems. Banks, fintechs, and crypto networks are racing to integrate deposit tokens, stablecoins, and local currencies into unified payment flows that work seamlessly across platforms.

Interoperability is becoming the competitive edge. Institutions that can link traditional banking infrastructure with blockchain settlement rails stand to gain the most. The race is no longer ideological. It’s operational.

Those who integrate fastest and most effectively will define how money moves in the next decade.