Bittensor started 2026 with strong momentum as the TAO price surged sharply during the first trading week. The rally followed Grayscale’s filing to launch the first Bittensor-focused ETF in the US.

With altcoin ETFs becoming a dominant narrative, this development acted as a major catalyst, drawing renewed attention to decentralized AI assets.

TAO’s price jump reflects improving sentiment, and institutional exposure through regulated products has historically boosted liquidity and credibility.

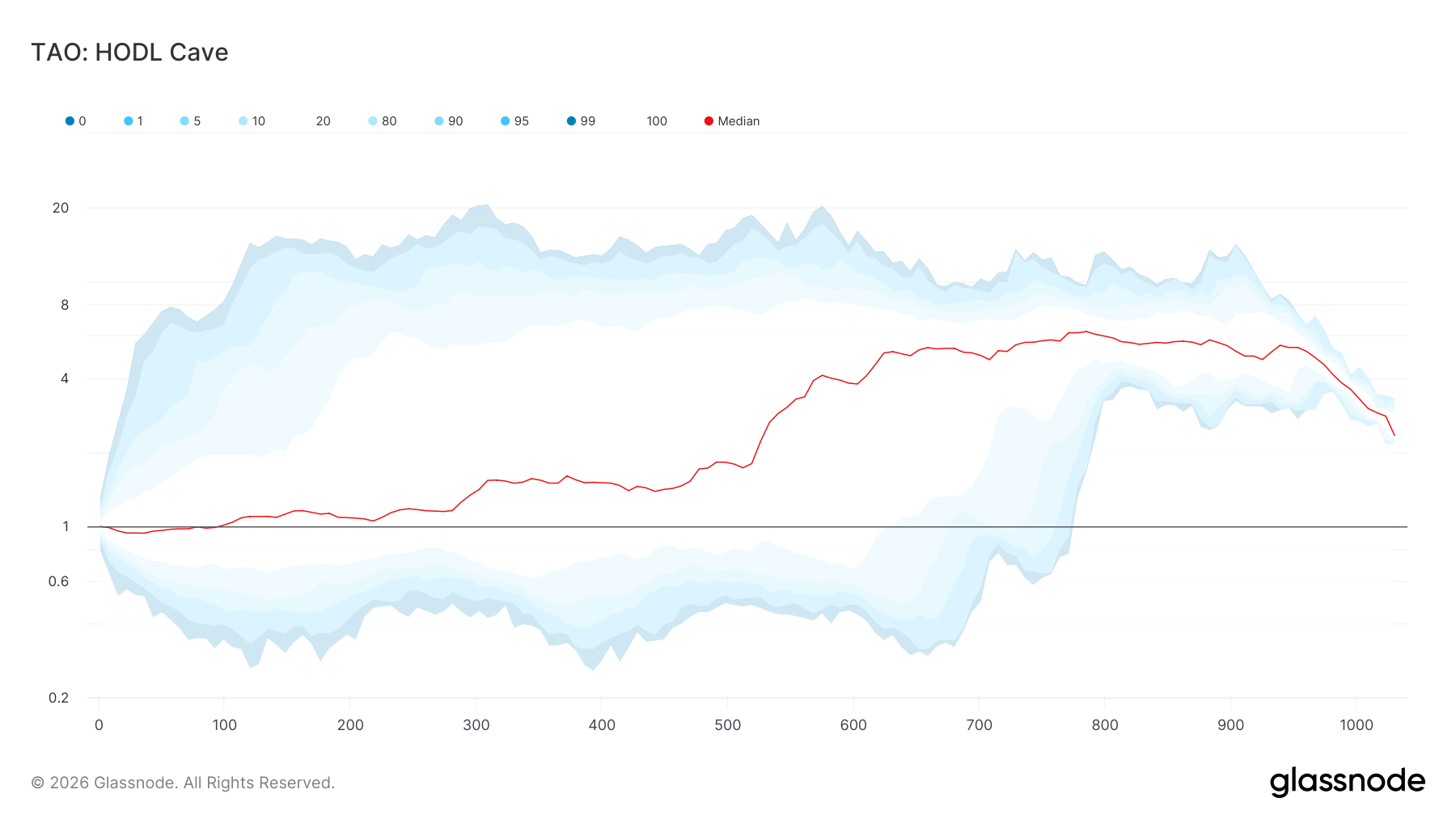

Bittensor Holders’ Profit Is Rising

Holder behavior remains supportive despite the recent 27% weekly gain. HODL Caves data indicates investors will likely not rush to sell into strength. Most wallets that accumulated TAO within the last seven months remain underwater or only marginally profitable at current levels.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

TAO HODL Cave. Source: Glassnode

This cost basis structure reduces near-term selling incentives. Investors typically delay distribution until meaningful profits materialize. As a result, supply pressure remains muted, giving TAO room to recover without facing aggressive profit-taking during the early stages of the rally.

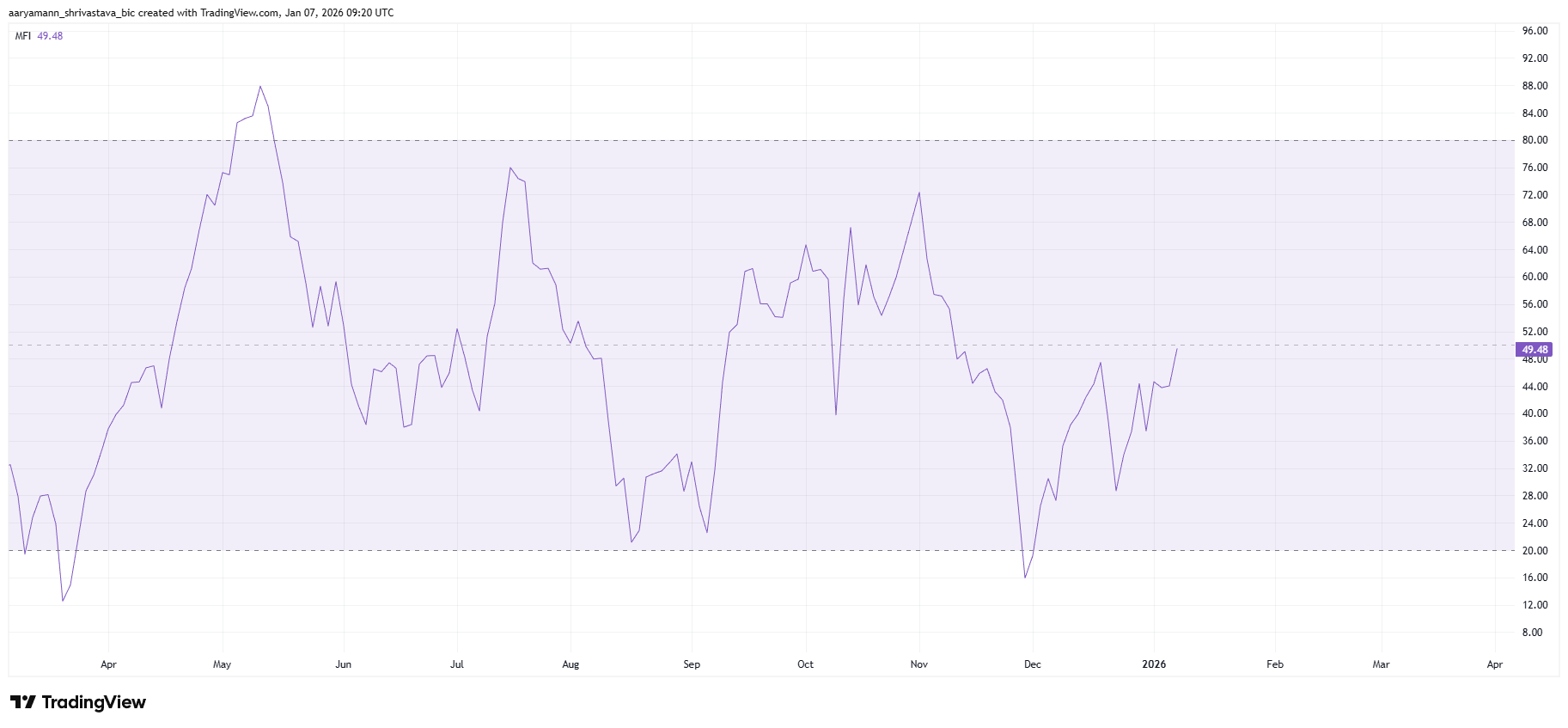

TAO Is Noting Potential Buying Pressure

Momentum indicators suggest improving conditions but stop short of full confirmation. The Money Flow Index, which tracks buying and selling pressure using price and volume, is approaching the neutral threshold. A sustained move above this level would confirm rising demand.

Crossing the neutral line would indicate that buyers are regaining control after consolidation. For TAO, this shift is critical. Increased capital inflows would strengthen liquidity and support higher price discovery during the current cycle.

TAO MFI. Source: TradingView

Macro momentum often precedes directional moves. If MFI turns decisively positive, it would align with supportive holder behavior and ETF-driven optimism. Together, these factors could sustain the rally beyond short-term resistance levels.

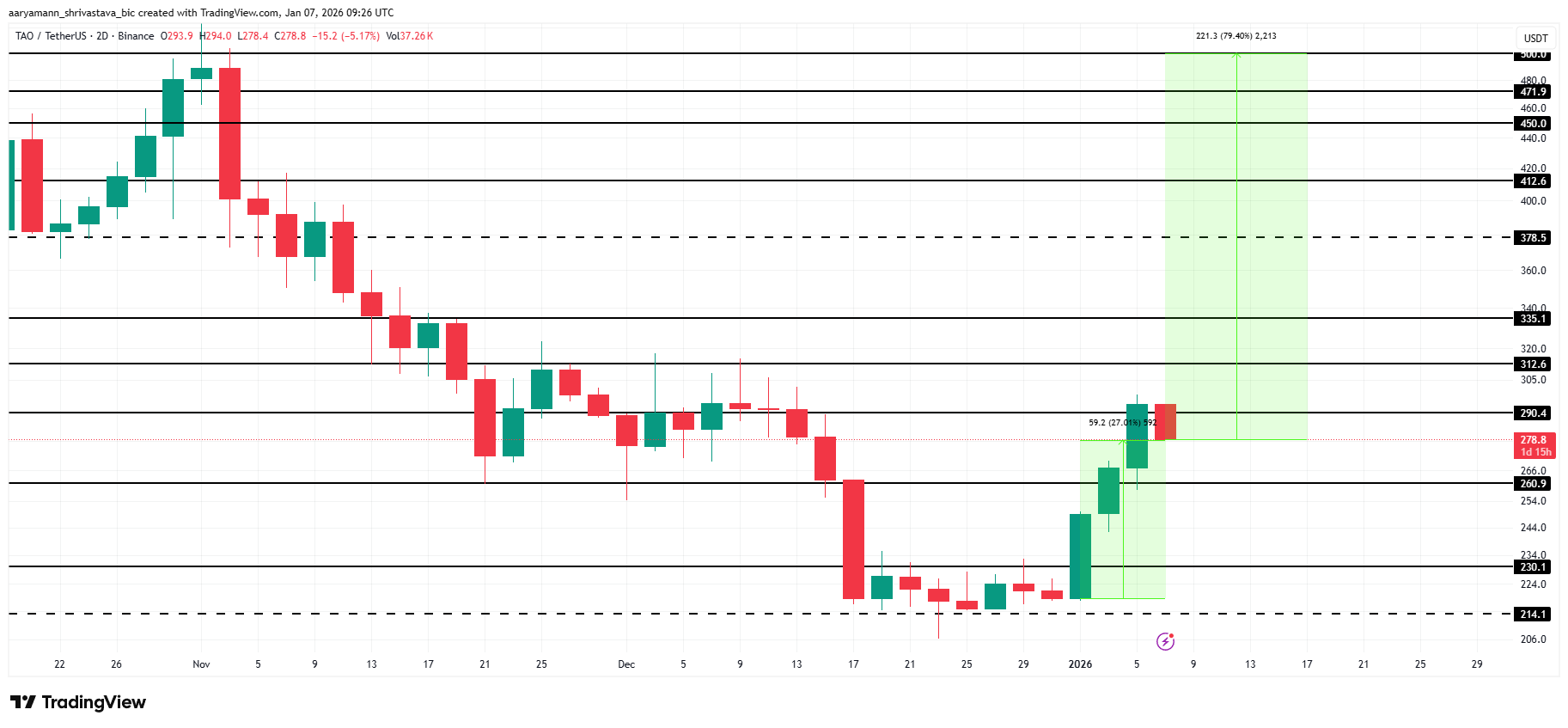

What Does TAO’s Past Highlight?

Historical price behavior strengthens the bullish case. TAO has repeatedly staged recoveries after testing the $217 support zone. In previous cycles, rebounds from this level led to advances that either approached or exceeded the $500 mark.

This recurring pattern reflects long-term confidence among holders. When TAO maintains an uptrend supported by accumulation, upside extensions have followed. Current conditions resemble those of the prior phases, albeit within a different macro environment.

TAO Price Past Performance. Source: TradingView

If investors continue holding rather than distributing, TAO may replicate its historical trajectory. Strengthened by institutional interest and reduced selling pressure, the token retains a realistic pathway toward higher cycle targets.

TAO Price Has A Long Way To Go

TAO trades near $278 at the time of writing after a brief 5% pullback over the last 24 hours, bringing the week-long rise to 27%. The immediate resistance sits at $312. This level has capped recent advances and represents the first hurdle for renewed upside momentum.

While the broader cycle outlook favors a move toward $500, short-term confirmation remains necessary. TAO must reclaim $312 and convert it into support. Establishing $335 or $412 as higher support zones would signal trend continuation. This is necessary for TAO’s push to $500, which the altcoin is 79.4% away from.

TAO Price Analysis. Source: TradingView

Downside risk persists if sentiment shifts. A rise in selling pressure could push TAO below $263. A deeper decline toward $217 would erase recent gains and invalidate the bullish thesis, resetting the recovery attempt.