ZTC Tokenomics Signal Q1 2026 Zenchain Airdrop Listing, Mainnet, TGE

The wait is finally over! The Zenchain airdrop listing date Q1 2026 is quickly gaining attention as the team officially revealed $ZTC tokenomics today, January 6, 2026.

With the public release of the full $ZTC token plan, with over 19 million transactions already happening on their test system, the project is ready to become the bridge that connects Bitcoin’s famous security with Ethereum’s smart technology.

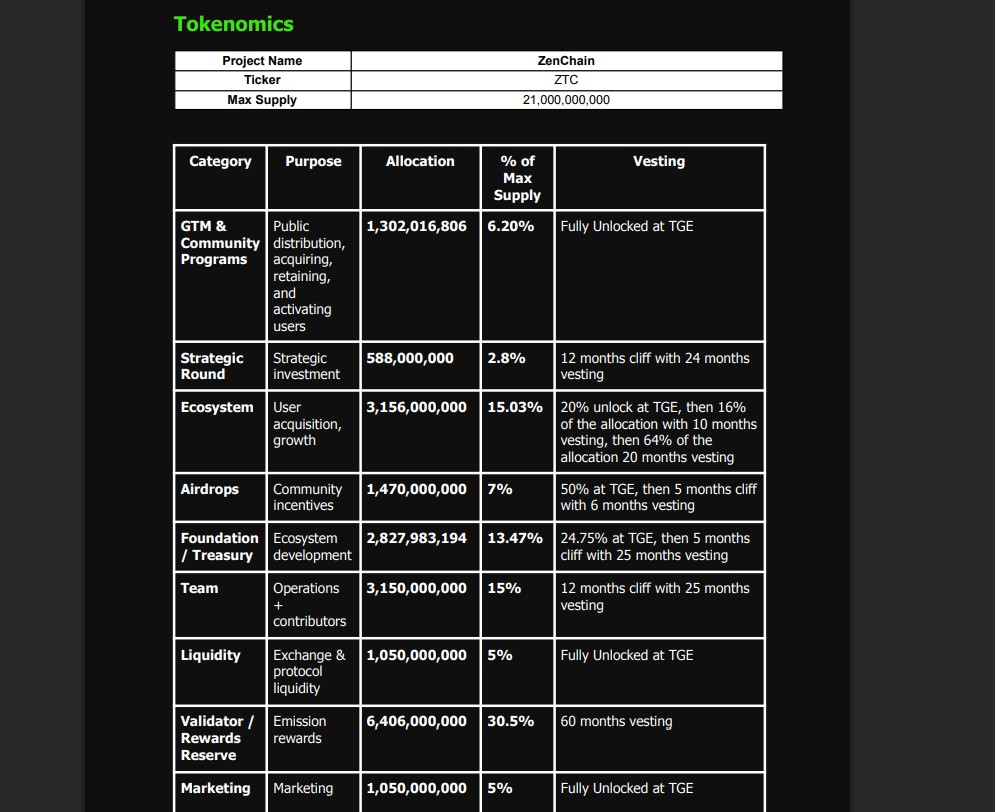

$ZTC Tokenomics: Built to Be Rare Like Bitcoin

The asset is designed to honor Bitcoin. There will only ever be 21 Billion tokens total supply—no more will ever be made. This makes the token "inflation-resistant," meaning its supply is fixed.

As per project’s official website litepaper, the team has split the distribution into different buckets to make sure the network grows healthy and stays secure.

How the tokens are shared:

Validator & Rewards Reserve (30.50%): This big slice will go to the network’s people.

Ecosystem (15.03%): Used to build new apps and tools

Team & Core Contributors (15.00%): These tokens are locked for a long time so the team stays focused on the project.

Zenchain Airdrop Listing (7.00%): Free tokens for the community who helped test the network early.

Foundation / Treasury (13.47%): Saved for the future development of the project.

Traders should note that reward tokens will be claim-based, with official guidelines to be released closer to launch. This approach supports $ZTC token listing price stability.

When is Zenchain Mainnet and TGE? Signals To Q1 2026

On December 17, 2025, the team teased its roadmap with a post asking, “Who is ready for Q1???” This message, combined with the tokenomics reveal strongly suggests that the big launch is officially set for Q1 2026.

Source: Zenchain Official X Account

Based on the new "Litepaper v2" released on January 5, 2026, experts believe this new crypto listing might start trading on exchanges between mid-January and late March 2026.

What is the project solving? Well, for a long time, if users had Bitcoin, they just had to hold it and wait, without really using it. This asset changes that with a simple four-step plan: Bridge, Stake, Earn, and Build.

Basically, users can now move $BTC onto Zen-Chain. Once it's there, it can interact with NFTs, lending apps, and even AI-powered security.

Metrics and Partnerships Fuel Exchange Listing Expectations

On-chain data strengthens ZenChain price prediction potential.

The network has processed over 19 million transactions, supports more than 7 million wallets, and has recorded over $587 million in volume.

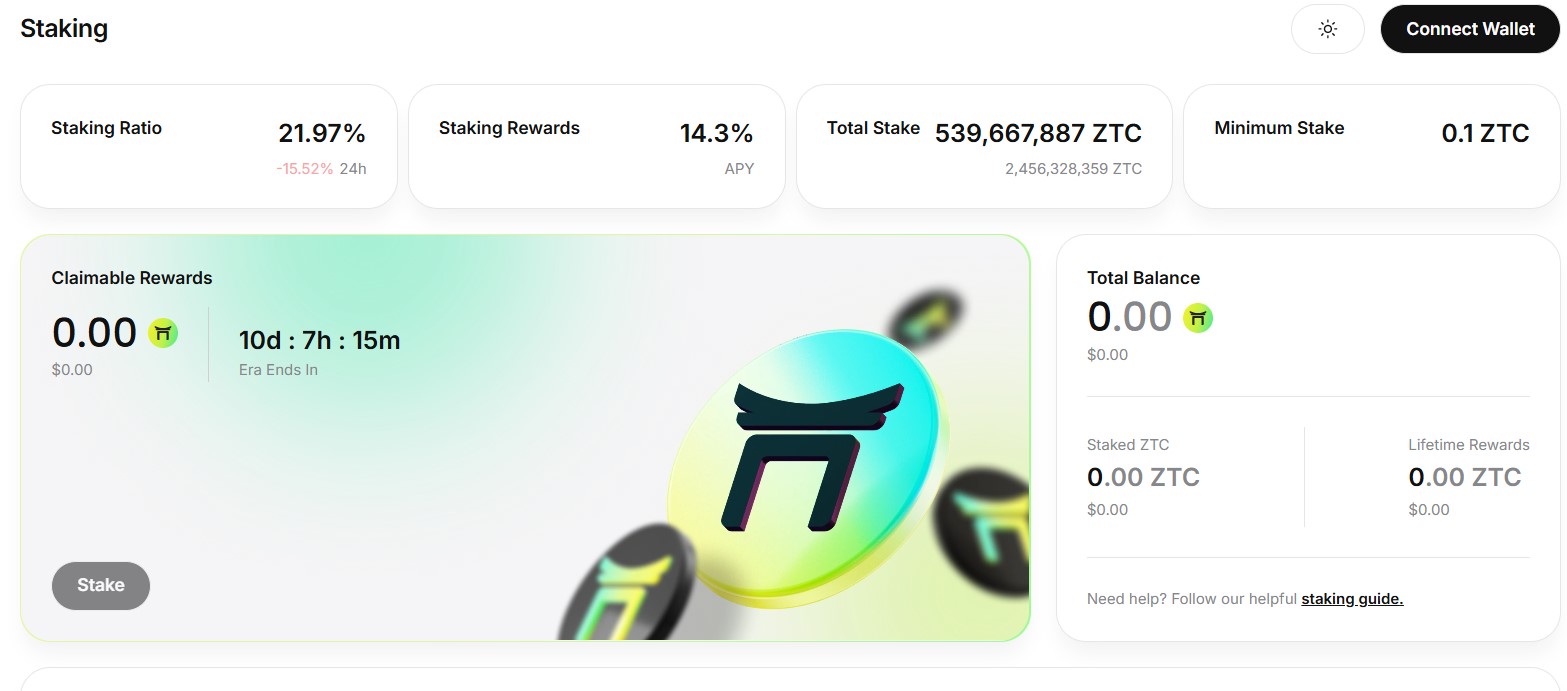

As the Zenchain airdrop listing date is getting closer, roughly 590 million ZTC is already staked, with a staking ratio near 22% and an average APY of 14.3%. If you want to join, keep in mind that the current rewards era ends in just 10 days.

THe project already works with big crypto exchange platforms like Bybit, KuCoin, Gate.io, HTX, MEXC, CoinDCX, LBank, and Uniswap. Because of these partnerships, Coingabbar analysts believe it could get listed on these major exchanges.

Note: Binance and some other top exchanges have not confirmed anything yet, but these real partnerships are keeping $ZTC news in the community’s spotlight today.

Conclusion: The Road to the Q1 2026 Launch

The reveal of the $ZTC tokenomics today means the network is in the final phase of mainnet launch. By bringing Bitcoin and Ethereum together, strong staking incentives, and growing adoption metrics, the Zenchain Airdrop Listing date is shaping up as a key Q1 2026 event.

If you’ve been testing the network, keep an eye out—the rules for how to claim the free new airdrop listing tokens are coming very soon.

YMYL Disclaimer: This article is just to give you news and is not financial advice. Always do your own research (DYOR) and consult an expert before making any investment decision in the cryptocurrency industry.