XRP is sending mixed signals to start 2026. Exchange reserves on South Korea’s Upbit and Bithumb have dropped sharply, echoing a pattern that preceded XRP’s 560% rally in late 2024. Whale transactions on the XRP Ledger hit a three-month high of 2,802. Yet on January 7, US spot XRP ETFs recorded their first net outflow since launching in November—$40.8 million exiting in a single day.

The divergence between Korean exchange activity and softening institutional demand complicates the outlook for XRP’s next move.

Korean Exchange Outflows Mirror Previous Rally Pattern

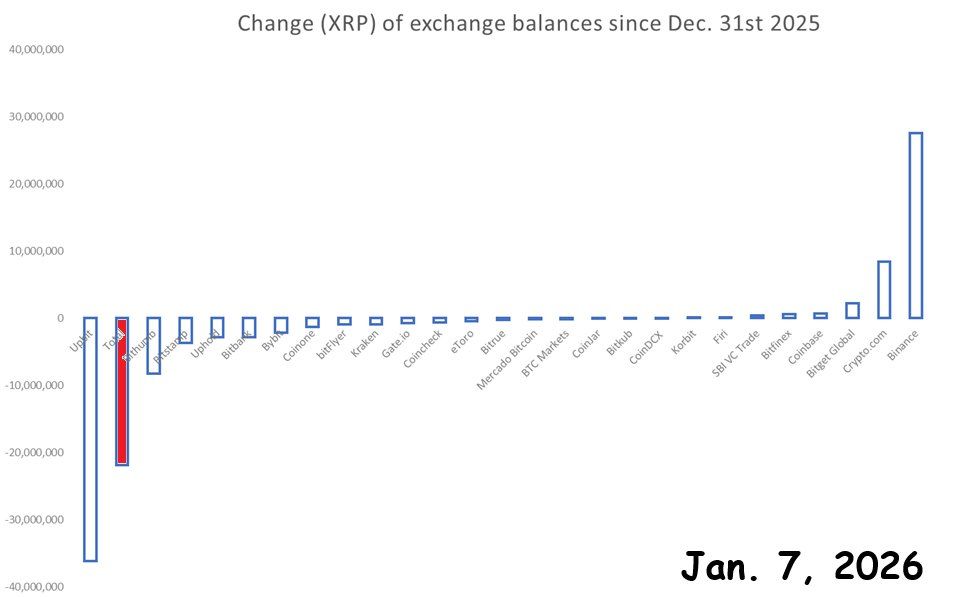

XRP balances on major South Korean exchanges dropped substantially during the first week of 2026. Manual analysis of wallets holding over 1 million XRP shows reserves dropped by about 22 million tokens—0.14% of total supply—since December 31, 2025. Upbit lost around 40 million XRP, Bithumb about 20 million, while Binance gained 25 to 30 million in the same period.

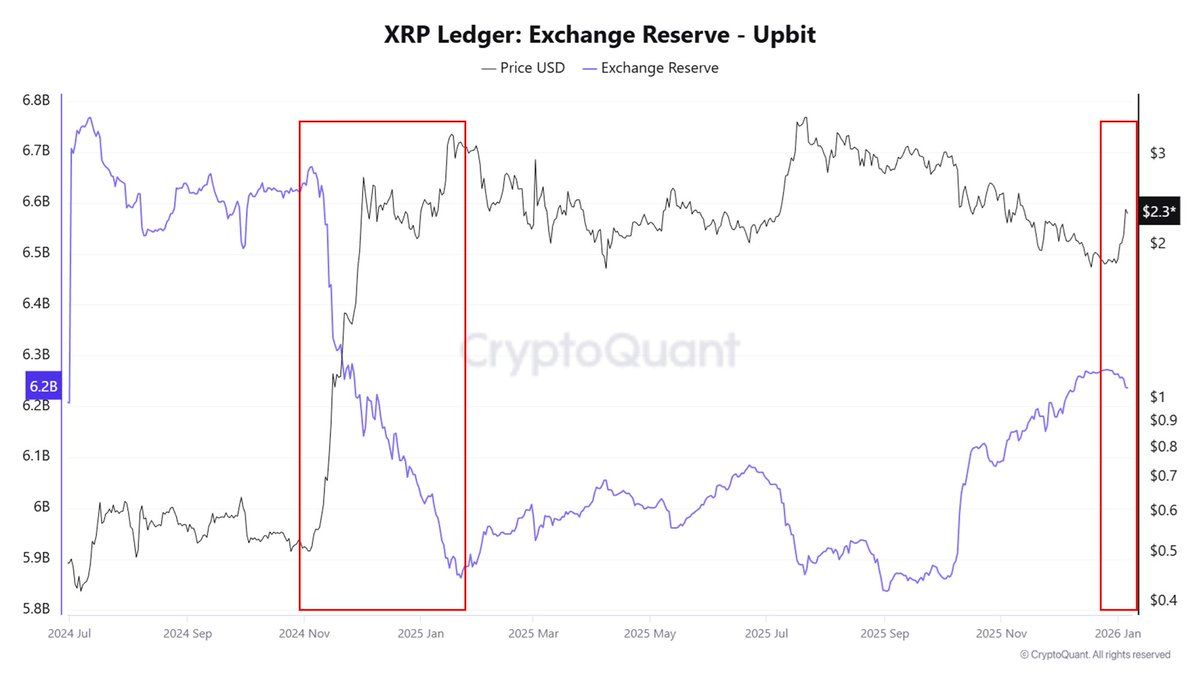

CryptoQuant chart showing XRP reserves on Upbit declining alongside price increases from November 2024 to January 2026. Source: CryptoQuant via CW8900

The pattern draws attention because of its history. When XRP began leaving Upbit in November 2024, the price rose from $0.50 to $3 over the following months. South Korean exchanges remain among XRP’s largest trading hubs, meaning reserve changes there can influence global price discovery.

Exchange outflows can signal that investors are moving assets into long-term private storage rather than for immediate sale. Research from major exchanges shows large outflows often reflect accumulation by long-term holders. That often results in a supply shortage on trading platforms, reducing short-term selling pressure.

Exchange balance changes since December 31, 2025, showing major outflows from Upbit and Bithumb. Source: Leo Hadjiloizou

Large on-chain activity has intensified in early January. The XRP Ledger logged 2,170 whale transactions—transfers worth $100,000 or more—on January 5. The next day, that figure jumped to 2,802, the highest in three months.

The 29% spike within a day suggests active positioning by large holders, often a precursor to heightened volatility.

XRP ETFs Record First Outflow Since Launch

US spot XRP ETFs broke their inflow streak on January 7, recording a net outflow of $40.8 million—the first since products launched in mid-November 2025. The 21Shares XRP ETF (TOXR) led the withdrawals at $47.25 million, while Grayscale’s GXRP was the only fund to post an inflow at $1.69 million.

XRP ETF flow data showing first net outflow on January 7, 2026. Source: SoSoValue

The outflow follows weeks of consistent institutional buying. Cumulative net inflows still stand at $1.2 billion, with total assets under management at $1.53 billion. But the reversal raises questions about whether institutional appetite is cooling just as Korean retail investors appear to be moving assets off exchanges.

Not All Outflows Lead to Rallies

CryptoQuant data for Binance show reserves hit similar lows in mid-2024, yet prices stayed range-bound around $0.50 for months. The rally that began in November 2024 came only after reserves had climbed back above previous levels—not at the moment of tightest supply.

Some analysts also note that commonly cited exchange data may understate total available supply. Broader tracking across 30 platforms shows roughly 14 billion XRP on exchanges, far above figures from sources monitoring fewer platforms.

XRP reserves on Binance from 2024 to 2026. Source: CryptoQuant

Outlook

XRP traded near $2.30 in early January 2026, well off its July 2025 peak of $3.65. The token surged from $0.50 to over $3 between November 2024 and January 2025, then spent much of 2025 in consolidation.

The current setup presents conflicting signals. Korean exchange outflows and surging whale activity mirror patterns seen before XRP’s late-2024 rally. But the first ETF outflow and historical precedent suggest these indicators alone don’t guarantee upside. Whether retail activity in Korea can offset softening institutional flows remains the key question heading into the rest of January.