Canton Coin is slipping at a critical moment. After briefly breaking back into its consolidation zone of a bullish pattern, the token has corrected nearly 16% over the past seven days and now sits about 22% below its all-time high, set just a week ago. The move has put a widely watched bullish structure at risk.

The broader setup still points to a large upside if conditions improve. But weakening volume and capital flow suggest the window for that breakout may be closing faster than expected.

Cup-and-Handle Breakout Faces Pressure Near Key Support

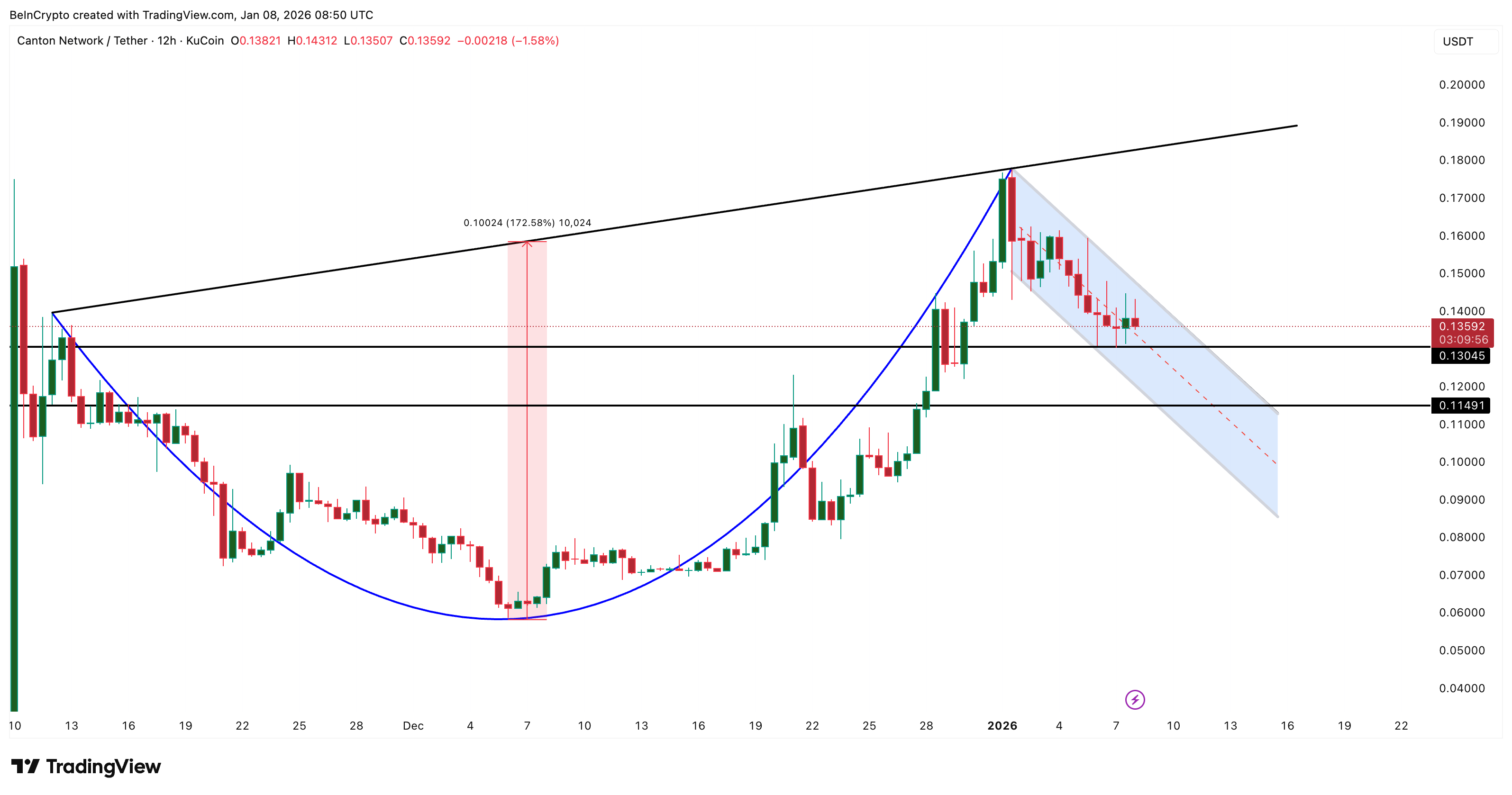

On the 12-hour chart, Canton has been forming a cup-and-handle pattern, a structure that often precedes strong continuation moves. The handle phase represents a pause after an advance, where the price consolidates before attempting a breakout.

For Canton, that breakout projection remains aggressive. If price can reclaim strength and clear the resistance neckline, the measured move still points to a potential 172% upside. However, the problem is where the price is trading now.

Bullish Pattern: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Canton is hovering just above the handle support zone, making the downside risk more immediate than the upside reward. A sustained 12-hour close below $0.13 would weaken the structure.

This imbalance matters. The neckline is far above the current price, while invalidation sits uncomfortably close. That makes the pattern fragile in the near term.

Rising Social Interest Keeps Breakdown at Bay, for Now

One factor preventing a sharper sell-off is rising attention. Social dominance, which tracks how much a token is discussed relative to the rest of the crypto market, has climbed sharply in recent days.

Since January 3, Canton’s social dominance has risen from roughly 0.05% to about 0.56%, a more than tenfold increase in under a week, even as the price has fallen. That rise stands out, especially given the weak weekly performance.

This relationship has mattered before. In mid-December, when social dominance formed a local peak, Canton’s price rallied 57% within a few days. A second local peak appeared near December 28, when social dominance reached roughly 0.74% and price traded around $0.12. That surge in attention was followed by a continuation move toward $0.17, Canton’s all-time high.

Rising Social Chatter: Santiment

In Canton’s short trading history, spikes in social dominance have consistently aligned with local price expansions. That makes the current rise in attention notable. It may be the main reason the CC price has not yet broken down despite broader weakness.

But attention alone cannot sustain a breakout.

Weak Volume and Capital Flow Undercut the Bullish Case For Canton Price

While social interest has increased, participation has not. On-balance volume (OBV), which tracks whether volume confirms price direction, has continued to trend lower on the 12-hour chart. Since mid-November, Canton’s price has pushed higher, but OBV has moved in the opposite direction. And it continues to weaken.

Volume Weakens Throughout: TradingView

That divergence indicates that rallies have been driven by thin trading volume rather than by expanding demand. It explains why the price is now struggling to follow through, thereby extending the consolidation period.

Capital flow data adds to the concern. Chaikin Money Flow (CMF), which measures whether big capital is entering or leaving an asset, dropped below the zero line on January 5. That move signals net outflows. Although CMF briefly stabilized and avoided a breakdown after a small bounce on January 7, it remains weak and close to rolling over again.

Big Money Avoids Canton Coin: TradingView

When both OBV and CMF trend lower, it suggests larger players are not committing fresh capital. Without that support, bullish patterns often fail before reaching their breakout zones.

From a price perspective, the levels are clear. The Canton price needs to hold above $0.13 to keep the bullishness intact. A move back above $0.15 would be the first sign of regained strength. A sustained push above $0.19 would be required to trigger the 172% breakout scenario.

Canton Price Analysis: TradingView

On the downside, a loss of $0.13 followed by $0.11 (near the handle support) would confirm that the bullish structure has weakened considerably.

For now, Canton is being held up by rising attention, not by volume or capital. That imbalance explains the tension in price action. Unless buying participation and money flow improve soon, the bullish setup risks giving way before it ever gets a chance to play out.