MSTR stock has rebounded since early January, rising about 13% as fears of an MSCI removal faded. Confidence around future S&P inclusion has also helped stabilize sentiment.

But beneath the bounce, the data shows a clear split. Dip buying is returning to MicroStrategy, yet larger capital flows are still moving out. That tension raises a key question. Is dip buying, possibly from retail, the right strategy here, or does MSTR still face meaningful downside risk?

Dip Buying Returns After MSCI Reprieve, but Conviction Remains Cautious

MicroStrategy’s rebound began in early January and continued as concerns around its MSCI status eased.

Since January 2, the stock has climbed steadily, reflecting renewed confidence following the reprieve and ongoing optimism from Michael Saylor around long-term S&P index inclusion.

That confidence is visible in momentum data. The Money Flow Index, or MFI, which measures whether buyers or sellers dominate trading pressure, has broken above its descending trendline. This suggests dip buying has returned after weeks of hesitation. Investors are stepping in on pullbacks rather than chasing highs.

However, the strength of that buying remains measured. MFI has not yet reclaimed the 56.36 level, which would signal a stronger shift toward aggressive accumulation.

Dip Buying Exists: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

That hesitation likely reflects one key factor. MSTR’s correlation with Bitcoin remains modest at around 0.21. That means, even a bullish BTC price structure might not fully guarantee a change of fate for this BTC-focused company.

Weak BTC Correlation: Portfolio Slab

Because of that imbalance, buyers appear selective. Dip buying exists, but it is careful. This supports short-term stabilization, not a strong upside breakout.

Capital Flow Tells a Different Story as CMF Stays Weak

While MFI shows improving dip buying, capital flow paints a more concerning picture. The Chaikin Money Flow, or CMF, tracks whether large capital is entering or leaving an asset. For MSTR, CMF has continued to trend lower even as the price rebounded 13% since January 2.

Weak Capital Flows: TradingView

This divergence matters. CMF turning down while price rises usually signals distribution rather than accumulation. In simple terms, smaller buyers may be stepping in, but larger money is still reducing exposure.

This behavior aligns with the broader trend since early October, when MSTR stock entered a sustained downtrend. Capital outflows have persisted through the downtrend (barring a few spikes in between), suggesting institutions remain cautious.

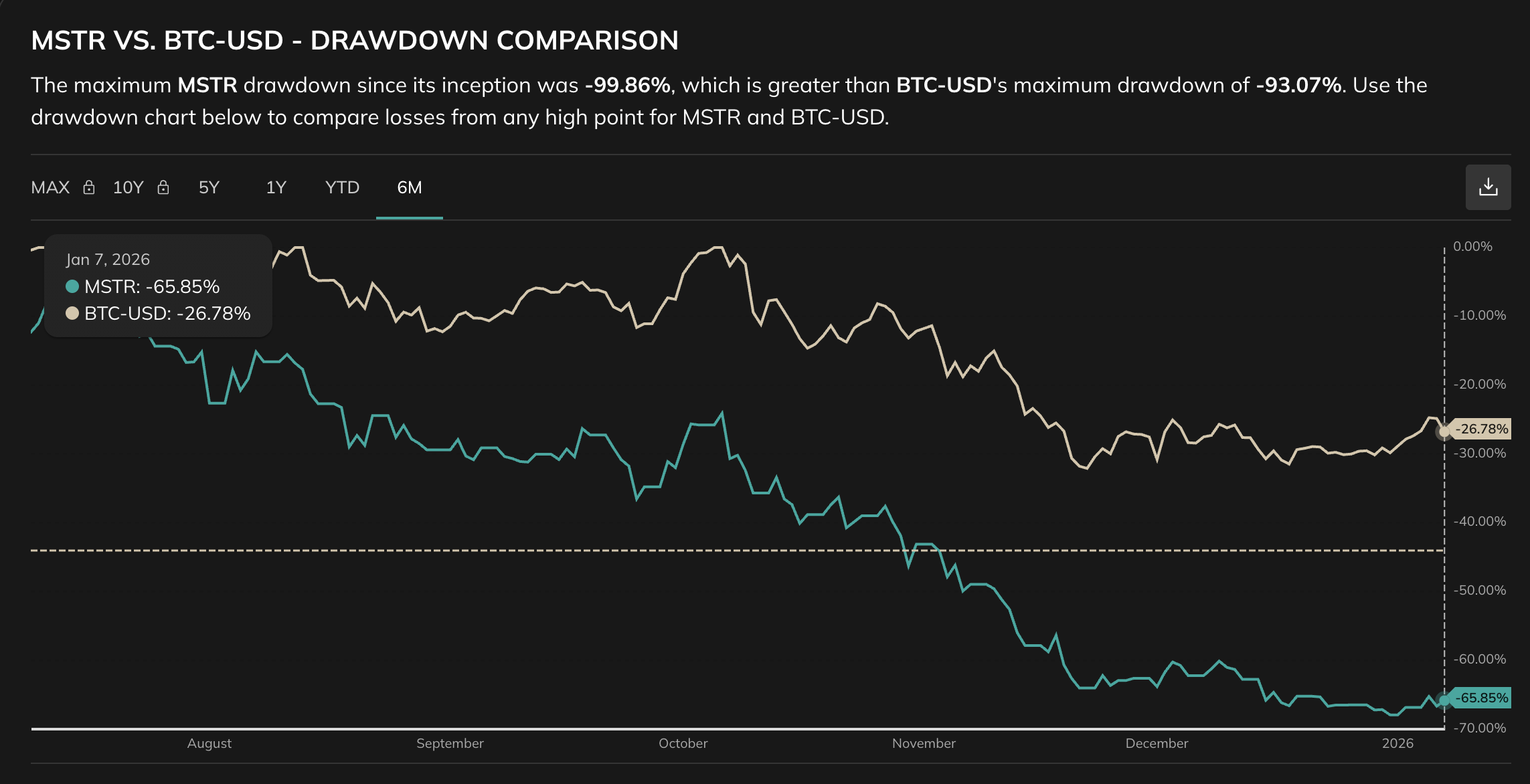

The weak CMF also reflects drawdown risk. Over the past six months, MSTR has fallen roughly 66%, compared to Bitcoin’s 27% decline. Another reason why big money continues to leave the MicroStrategy stock could now be the lack of conviction.

MSTR Drawdown Risk: Portfolio Slab

This is where the risk compounds. Dip buying exists, but it is cautious rather than aggressive. MSTR’s weak correlation with Bitcoin means BTC strength does not guarantee upside. At the same time, CMF outflows show large capital is still exiting, likely due to fears that even a modest Bitcoin pullback could trigger a much larger MSTR drawdown, which has often been the case historically.

This double-whammy explains why dip buying alone may not be enough. Without large capital returning, rebounds risk stalling or reversing.

MSTR Stock Price Levels Could Test The Dip Buying Strategy

The MSTR price action brings these signals together. For strength to build, MSTR needs to reclaim $184 and then $198. A clean move above $198 would signal that dip buyers are gaining control and open the path toward higher recovery levels.

Until that happens, downside risk remains active. The $162 zone is already under pressure. If selling resumes, MSTR could slide toward $139, representing a potential 13% drop from current levels.

MSTR Price Analysis: TradingView

This is why dip buying may not be the safest strategy right now. Momentum buyers are present, but capital confirmation is missing. As long as CMF stays weak and large money remains cautious, rallies face friction.

MicroStrategy’s long-term narrative remains tied to Bitcoin and balance-sheet leverage. But in the short term, the stock is caught between improving dip buying and persistent capital outflows. Until those forces align, the MSTR stock rebound remains vulnerable to another pullback.