Bitcoin price action through 2025 reflected a subtle but meaningful shift in institutional behavior. While BTC remained the market anchor, large investors gradually reduced exposure and rotated capital into select altcoins.

This redistribution suggested institutions favored spreading risk across multiple assets. However, the key question now is what pushed institutions away from Bitcoin, and whether that trend can persist into 2026, given BTC’s historical four-year cycle dynamics.

Institutions Pick Altcoins Over Bitcoin

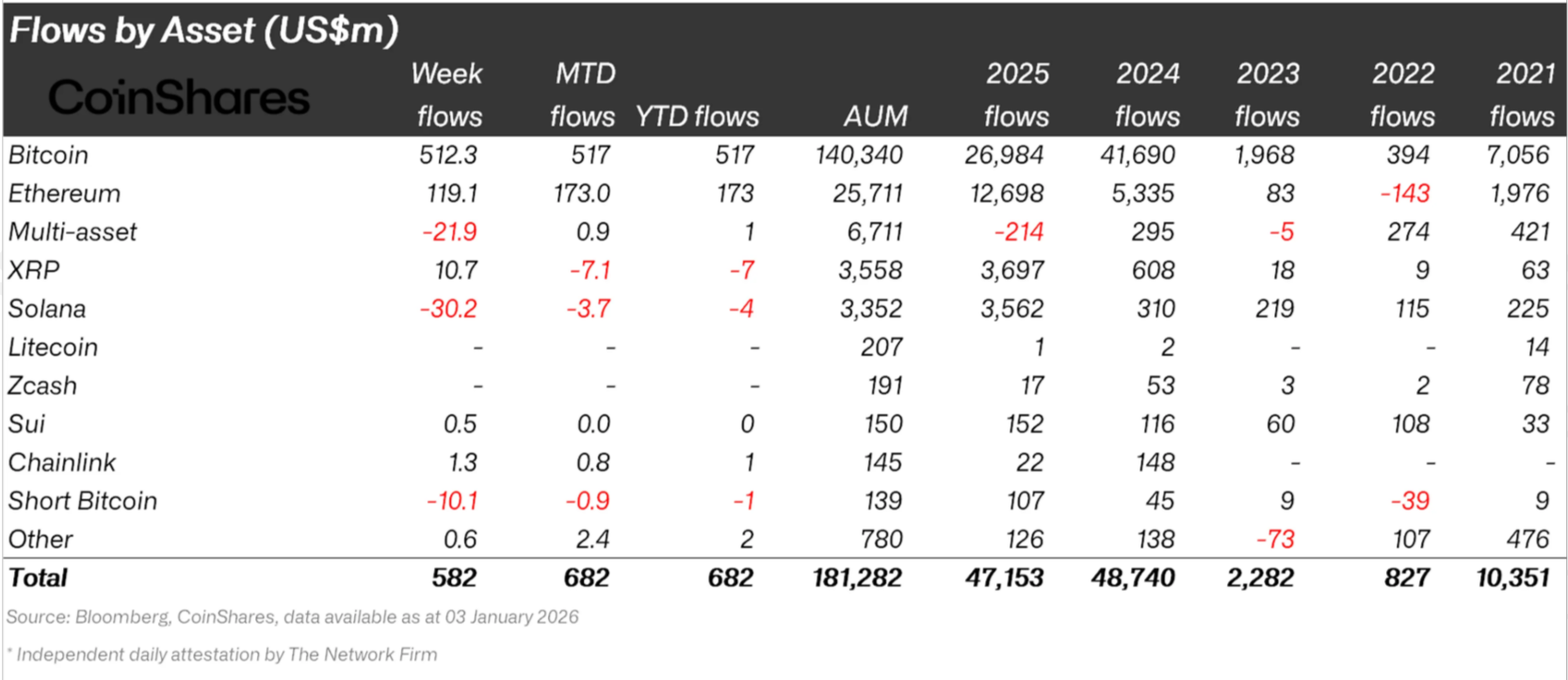

The institutions have heavily divested from Bitcoin between January 2025 and December 2025 (year 2025). CoinShares data shows that in 2024, institutions poured about $41.69 billion into BTC (netflows). Interestingly, in the same duration, altcoins suffered with Ethereum, XRP, and Solana, noting $5.3 billion, $608 million, and $310 million, respectively.

This changed in the year 2025 when Bitcoin noted $26.98 billion inflows while ETH, XRP, and SOL recorded $12.69 billion, $3.69 billion, and $3.65 billion in inflows, respectively.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Institutional Flows In 2025. Source: CoinShares

The shift from 2024 to 2025 marks a 31% drop in institutional interest for Bitcoin, while Ethereum noted a 137% increase. Solana and XRP, on the other hand, observed a 500% and 1,066% rise in institutional interest.

This brings up the question of what exactly drove institutions to switch to altcoins.

Was It DeFI? It Was Not DeFi

Decentralized finance should have been a core driver separating Bitcoin from leading altcoin ecosystems. In practice, DeFi activity stalled during 2025. Total value locked across DeFi protocols grew sharply in 2024, rising 121% from $52 billion to $115 billion. That expansion created expectations for continued acceleration.

Those expectations were not met. In 2025, DeFi TVL increased by just 1.73%, reaching $117 billion. Growth slowed dramatically despite new protocols and upgrades. This stagnation suggests that DeFi failed to deliver fresh utility capable of driving sustained institutional interest.

DeFi TVL. Source: DeFiLlama

The data undermines the argument that DeFi fundamentals pushed institutions toward altcoins. If DeFi were the catalyst, capital deployment would have followed usage growth. Instead, activity plateaued, indicating that something other than on-chain utility influenced institutional allocation decisions during the year.

What Actually Led To The Shift

Exchange-traded funds were the primary force behind institutional rotation into altcoins. The shift, however, was driven by narrative momentum rather than measurable fundamentals. Altcoin ETFs gained approval amid claims that DeFi utility justified broader exposure, despite limited growth.

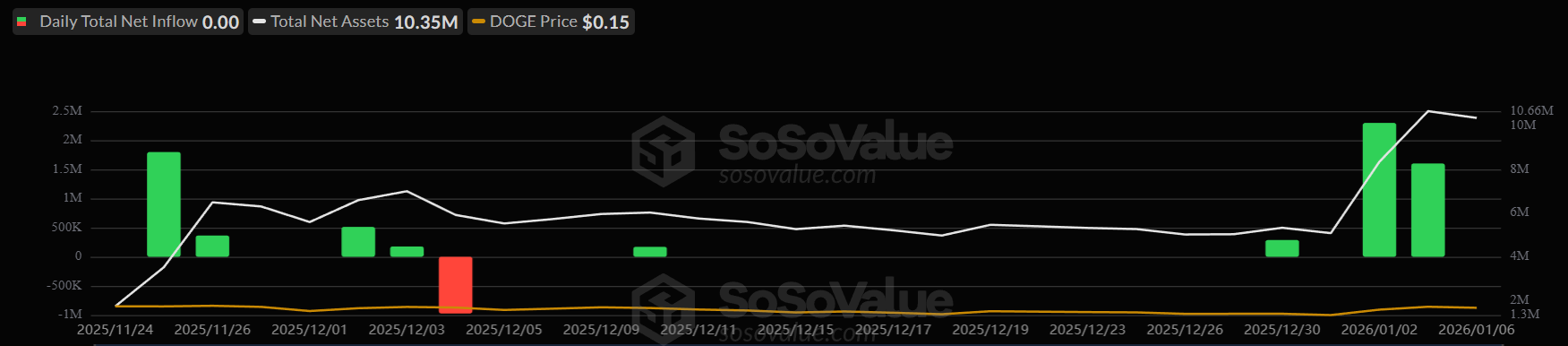

ETF launches for XRP, Solana, Dogecoin, and Hedera followed quickly. Initial enthusiasm fueled inflows, but demand faded for most products. Outside of Solana and XRP, activity remained muted. Dogecoin ETFs recorded near-zero net inflows across most sessions.

DOGE ETF Flows. Source: SoSoValue

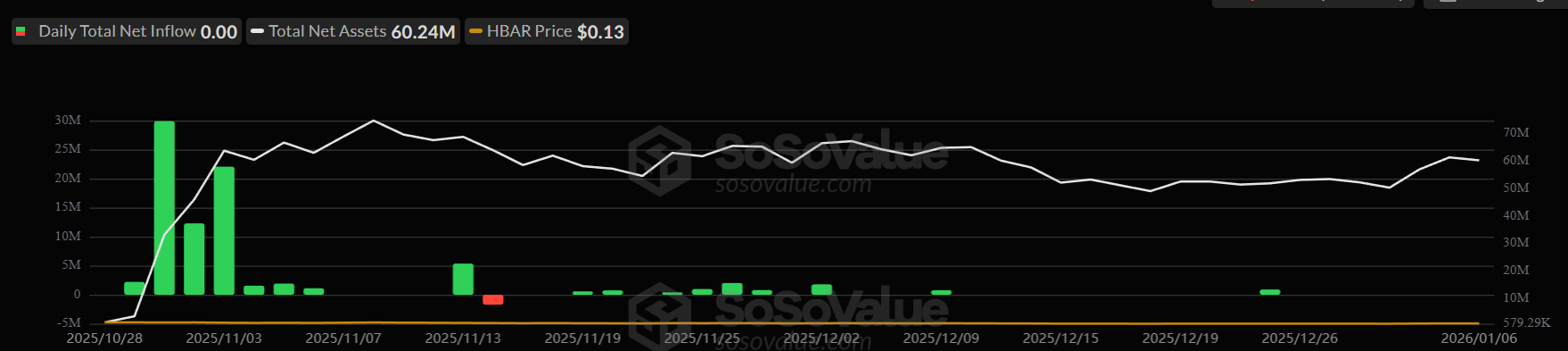

HBAR ETFs experienced similar outcomes. Inflows were minimal and often nonexistent. These patterns suggest that institutional appetite for altcoin ETFs lacked depth. The products attracted attention, but not sustained capital. This reinforces the view that hype, not utility, drove the shift away from Bitcoin.

HBAR ETF Flows. Source: SoSoValue

What Does Bitcoin’s Past Say About The Future?

The optimism that defined 2025 may face a sharp correction in 2026. Two structural factors point toward a reassessment. The first is a lack of utility/demand, and the second is Bitcoin’s four-year cycle. Historically, this cycle includes a cooling phase following peak enthusiasm.

Fidelity’s director of global macro, Jurrien Timmer, described 2026 as an “off year” in December 2025. That assessment aligns with prior cycles, where consolidation or mild bearishness followed strong runs. Institutions often reduce risk during such periods.

“…my concern is that Bitcoin may well have ended another 4-year cycle halving phase, both in price and time. If we visually line up all the bull markets (green) we can see that the October high of $125k after 145 months of rallying fits pretty well with what one might expect. Bitcoin winters have lasted about a year, so my sense is that 2026 could be a “year off” (or “off year”) for Bitcoin,” Timer stated.

Price performance across assets supports this view. Bitcoin price declined 6.3% in 2025. Ethereum fell 11%, XRP dropped 11.5%, and Solana slid 34%. The synchronized weakness shows that altcoins did not outperform on fundamentals. Outside of ETF exposure, institutions had little incentive to favor altcoins over Bitcoin.

<img alt="Bitcoin Lost Institutional Share in 2025 as Altcoins Took the Spotlight" title="Bitcoin Lost Institutional Share in 2025 as Altcoins Took the Spotlight" src="/d/file/articles/uploads/2026-01-09/5ff2mvafhfe_2500.png" Price Analysis. " style="width:1017px;height:auto">Bitcoin and Altcoins’ Price Analysis. Source: TradingView

When Bitcoin enters consolidation, altcoins historically follow. The transition from 2021 to 2022 demonstrated this clearly. As BTC weakened, institutional capital retreated across the market (ref. Institutional Flows in 2025). A similar pattern may emerge in 2026, reducing appetite for speculative diversification and refocusing attention on liquidity and risk management.

The institutional shift away from Bitcoin in 2025 appears less structural than cyclical. ETF-driven narratives filled the gap left by slowing DeFi growth, but demand proved shallow. As cycle dynamics reassert themselves, institutions may reconsider whether altcoins truly offer advantages over Bitcoin.