Polyhedra Network, a promising project in the blockchain space, has experienced significant price volatility recently. After recovering 118% in value, the ZKJ token crashed by over 80%, leaving investors in shock and undermining confidence in the asset.

Despite the crash, some traders remain bullish, betting on a potential recovery as Polyhedra Network plans to take corrective action.

Polyhedra Network Was Attacked

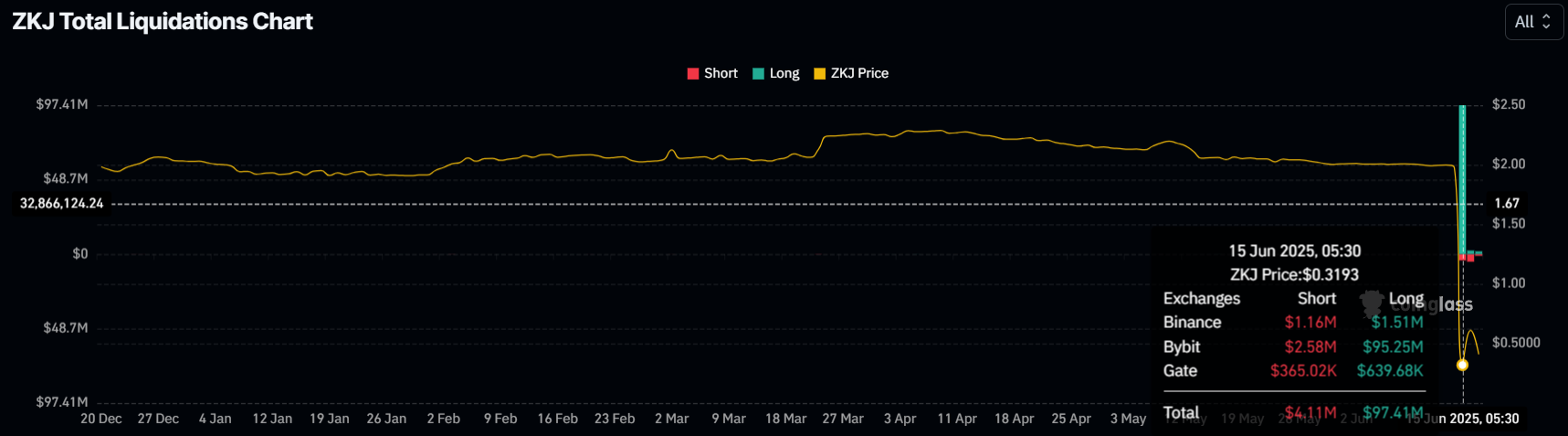

The crash of ZKJ triggered over $97.4 million worth of long liquidations on Sunday, further exacerbating the situation. Polyhedra Network’s crash report highlighted that a liquidity attack caused the massive drop.

“Several key addresses executed a sequence of large liquidity withdrawals from the PancakeSwap ZKJ/KOGE V3 pool… We suspect the aforementioned addresses coordinated a liquidity attack with an egregious malicious attempt. These actions removed critical market depth, particularly in a pool with fragile, concentrated liquidity provisioning.”

ZKJ Liquidations. Source: Coinglass

In response, the company’s co-founder stated that they would buy back ZKJ tokens to restore the token’s value and regain market confidence. This move shows Polyhedra Network’s commitment to stabilizing the token’s price and addressing liquidity issues.

Despite the crash, the market sentiment surrounding ZKJ remains relatively positive. Many traders are hopeful for a recovery, especially with the buyback plan in place. While the recent drop has shaken investor confidence, the backing of the network’s team is seen as a stabilizing force that could lead to an eventual rebound.

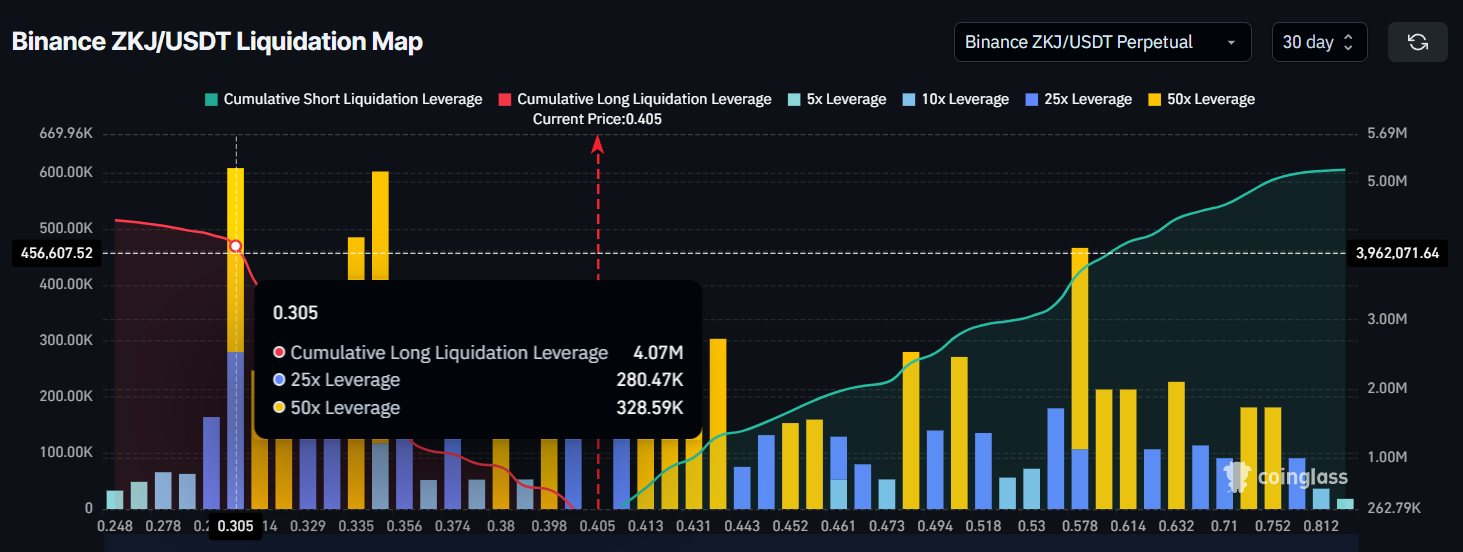

The liquidation map reveals a significant amount of bullish sentiment still surrounding ZKJ. Even after the price crash, traders are placing long positions, anticipating a bounce back. The liquidation map suggests that a drop to $0.30 would result in $4 million in long liquidations, indicating that many traders are confident that the price will recover from its current lows.

ZKJ Liquidation Map. Source: Coinglass

While market conditions remain volatile, the willingness of traders to continue placing long contracts on ZKJ signals that they believe the token’s price will rise again.

ZKJ Price Has A Long Way To Go

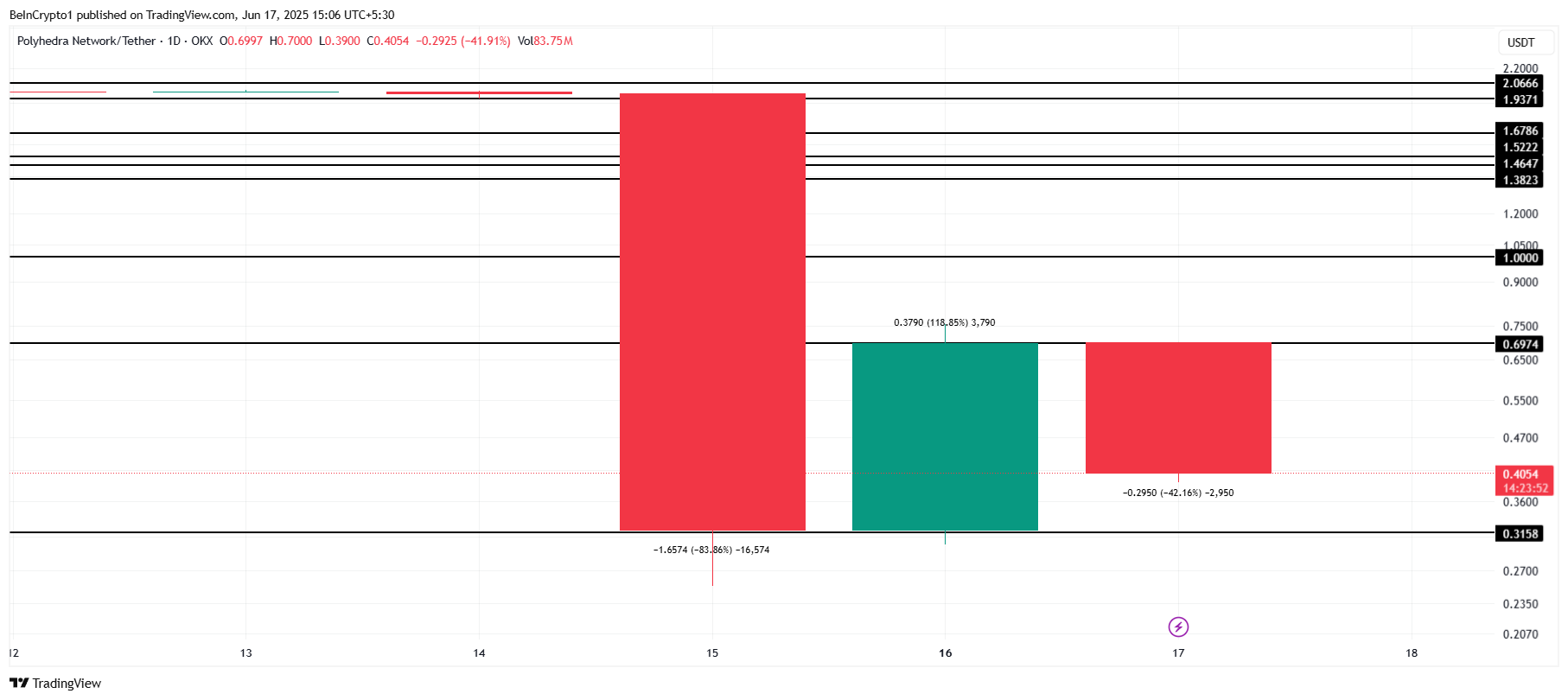

ZKJ has already shown signs of volatility, experiencing a dramatic 118% surge on Monday, only to crash 42% today. The altcoin is currently trading at $0.40, still recovering from the 83% drop observed on Sunday. Traders who remain bullish believe that ZKJ will regain value in the coming weeks.

For ZKJ to continue its recovery, it will need to secure the $0.69 support level and break past the $1.00 resistance. This psychological threshold is critical, as flipping it into support would restore investor confidence and encourage further inflows into the token.

ZKJ Price Analysis. Source: TradingView

However, if traders’ sentiment shifts in the coming days, ZKJ’s price could face difficulties in recovering. A sustained bearish outlook could push the altcoin below $0.31, making further declines a real possibility. Should the price continue to fall, it would signal a prolonged downturn, invalidating the bullish thesis. This would leave ZKJ vulnerable to more significant losses.