Venice AI’s (VVV) bearish market channel persists, with key resistance at $12 and support near $8.87.

The 15-minute MA Ribbon shows a bullish crossover with the 20-period MA at $10.73 and the 50-period MA at $10.37.

VVV’s bullish 2025 price prediction ranges from $4 to $100, driven by post-BTC halving optimism.

Venice AI (VVV) Overview

| cryptocurrency | Venice AI |

| Ticker | VVV |

| Current Price | $10.42 |

| Price Change (7D) | -25.29% |

| Price Change (1Y) | N/A |

| Market Cap | $266.49 Million |

| Circulating Supply | 25.58 Million |

| All-Time High | $19.38 |

| All-Time Low | $8.87 |

| Total Supply | 100.21 Million |

What is Venice AI (VVV)?

Venice AI (VVV) is a decentralized, privacy-focused AI platform designed to offer censorship-resistant and unmonitored AI services, including text generation, image creation, and coding. Unlike centralized AI providers like OpenAI, which store and monitor user interactions, Venice ensures complete anonymity by encrypting interactions and preventing data storage.

Source: Venice AI

The platform leverages decentralized GPU processing via Akash Network, making it a game-changer in the AI and blockchain sectors. Founded in May 2024 by Erik Voorhees, a well-known crypto innovator and former CEO of ShapeShift, Venice AI aims to disrupt the AI industry by eliminating corporate control over user data.

The platform operates on a permissionless model, allowing developers, creators, and businesses to access AI services without restrictions. A defining moment for Venice came on January 27, 2025, with the launch of its native token, VVV, and a massive airdrop of 50% of its 100 million total supply to early users and AI projects within the Base ecosystem.

Venice’s mission is to provide permissionless access to private and uncensored machine intelligence

Since launch in May 2024

• 400,000 registered users

• 50,000 DAU

• 15,000 inference requests per hour

Today, we open our API to the public for AI agents, devs, and 3rd party… pic.twitter.com/75V8ePC2tO — Venice (@AskVenice) January 27, 2025

This move solidified Venice’s decentralized vision while attracting a growing community eager to explore its staking-based inference model. For instance, by staking VVV tokens, holders gain access to AI inference capacity, allowing them to utilize AI processing power in proportion to their stake share. Additionally, VVV stakers benefit from token emissions, creating a sustainable and profitable ecosystem for early adopters.

Venice AI Price History

The Venice Token (VVV) entered the market with a splash, debuting at $13.32 before climbing to $19.38, according to CoinMarketCap data, marking its highest price to date. The debut sparked excitement, but the euphoria was fleeting as the token faced a swift and dramatic sell-off.

What began as a promising start quickly turned into a cascade of profit-taking and market corrections, dragging VVV into a sharp downtrend. After reaching its peak, the token steadily lost ground, breaching crucial psychological levels and carving out a clear bearish channel.

Support zones crumbled under persistent selling pressure, ultimately driving VVV to an all-time low of $8.87—a 62% drop from its launch price. This steep decline highlighted a shift in market sentiment, leaving many questioning whether recovery was possible.

Source: TradingView

Amid the decline, the token attempted to stage a comeback, climbing toward the $12 resistance zone—an area that once held as a consolidation point. Yet, the recovery lacked the momentum and trading volume needed to sustain a meaningful breakout. The $12 level remains a formidable obstacle, a line in the sand separating bullish optimism from continued bearish dominance.

VVV trades at $10.47 at press time, reflecting a 30% dip in the last 24 hours. Moreover, the cryptocurrency’s price hovers near the upper edge of its bearish channel, hinting at potential accumulation by buyers or perhaps exhaustion among sellers. The key level to watch is the 50% Fibonacci retracement at $16.16, a pivotal threshold that could signal a reversal if breached.

But without a convincing break above this level, the token risks retesting its $8.87 low. The question remains: Will VVV defy the odds and reclaim lost territory, or is further decline on the horizon? The answer lies in whether the bulls can break free from the resistance zones that continue to keep them at bay.

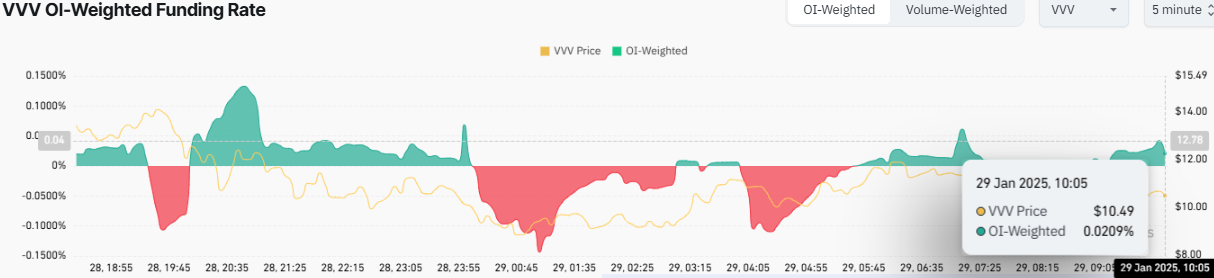

VVV’s OI Funding Rate Hints at a Bull-Bear Tug of War

According to a 5-minute funding rate chart, the VVV price reflects a minor uptick from its previous level, while the Open Interest (OI)-Weighted Funding Rate remains green at 0.0209%. This positive funding rate indicates that long positions are marginally paying short positions, signifying that bullish traders are currently dominating the market, albeit without overwhelming momentum.

Source: CoinGlass

The chart further highlights periods of green funding rates earlier in the session that suggest intervals of speculative optimism, where traders attempted to capitalize on small price bounces. However, these were interspersed with red zones—moments when bearish sentiment prevailed, pushing the price downward. This volatility underscores the ongoing tug-of-war between buyers and sellers, with neither side achieving a decisive edge.

Yearly Highs and Lows of Venice AI

| Year | Venice AI Price | |

| High | Low | |

| 2025 | $19.38 | $8.87 |

Venice AI Technical Analysis

The MACD indicator on the 15-minute chart for VVV shows a marginally bullish crossover, with the MACD line at 0.04, slightly above the signal line at -0.03, indicating a likely shift in momentum toward buyers. Moreover, the histogram is expanding further into the green zone, signaling growing bullish momentum that could support a breakout above the $12 resistance, provided buying volume continues to rise.

Source: TradingView

This aligns with the token’s price action, which is currently attempting to edge higher. Similarly, the RSI, currently at 55.38, suggests neutral to slightly bullish sentiment. The indicator has risen from an oversold level below 30, following the token’s recovery from its all-time low of $8.87.

This upward RSI trajectory supports the token’s recent consolidation above $10, indicating buyers are gradually regaining control. However, the RSI remains below the overbought threshold of 70, signaling room for further upside if momentum strengthens.

Venice AI (VVV) Price Forecast Based on Fair Value Gap

The Fair Value Gap (FVG) on the 4-hour chart indicates a critical region between $11.35 and $12.50, aligning closely with the established resistance zone. This gap highlights a price imbalance caused by strong downward momentum, where minimal trading activity occurred. Such gaps often act as magnets for price action as the market seeks to “fill” them, creating a possible retracement target for the Venice Token (VVV).

Source: TradingView

Currently, VVV remains below the lower boundary of the FVG. For the token to reclaim bullish momentum, it must close above the $11 level and move through the gap past the $12.50 mark. However, this region also aligns with significant resistance, making it a challenging hurdle for buyers.

Regardless, if the FVG is filled and the token breaks above $12.50, the next major target would be the 50% Fibonacci retracement level at $16.16, signaling a trend reversal. Conversely, failure to reclaim the FVG could result in further bearish momentum, with the token likely retesting its all-time low or even deeper lows.

Venice AI (VVV) Price Forecast Based on MA Ribbon Analysis

The MA Ribbon indicators on the 15-minute chart reveal that the Venice Token (VVV) attempts to break out of its bearish structure. This is evident as the token trades at $11.07, with the 20-period MA positioned at $10.73 and the 50-period MA at $10.37.

Source: TradingView

This mild-bullish crossover, as the shorter moving average crosses above the mid-term one, suggests a shift in momentum toward the bulls and the possibility of upward movement. However, the 100-period MA, currently at $12.01, aligns with the critical resistance zone, which could act as a formidable barrier.

If VVV can sustain its position above the 20 and 50 MAs while breaking past the 100 MA and $12 resistance, it could pave the way for a trend reversal toward the 50% Fibonacci retracement at $16.16. Failing to do so may lead to further consolidation or a retest of its all-time low.

Venice AI (VVV) Price Forecast Based on Fib Analysis

The Fibonacci retracement tool on the 15-minute chart highlights critical levels for the Venice Token as it attempts to recover from its all-time low. According to the chart, the 23.6% retracement level at $12.27 is the nearest resistance, aligning closely with the broader $12 resistance zone. This suggests that breaking this level is crucial for initiating a meaningful bullish recovery.

Source: TradingView

The next significant target is the 38.2% level at $14.42, which aligns with prior price consolidation and represents a pivotal area where bullish momentum could gain traction. Beyond this, the 50% retracement level at $16.16 serves as a key psychological milestone and a probable confirmation of a trend reversal if achieved.

This level is particularly critical as it represents the midpoint of the token’s descent from its all-time high. On the higher end, the 61.8% retracement at $17.89 and 78.6% retracement at $20.36 are longer-term resistance levels, likely requiring substantial buying volume and sentiment shifts.

Venice AI (VVV) Price Prediction 2025

Per CryptoTales’ projections, VVV is expected to benefit from post-BTC halving hype, potentially reaching $4–$100, exceeding its current ATH of $19.38. Strong community support and market euphoria may push prices higher, followed by volatility and correction.

Venice AI (VVV) Price Prediction 2026

Our price forecast shows VVV could experience a bearish market phase, dipping to $25–$60. This decline reflects the crypto market’s typical recession after a peak year, with selling pressure and reduced investor enthusiasm dominating trends.

Venice AI (VVV) Price Prediction 2027

As the market enters a recovery phase, VVV might stabilize between $16 and $40. This year, investors may begin accumulating VVV tokens in anticipation of the next BTC halving, with gradual optimism returning as prices show resilience after the prior year’s market trough.

Venice AI (VVV) Price Prediction 2028

With BTC halving sparking market-wide optimism, VVV could rally to $30–$150, fueled by renewed investor interest, increased adoption, and bullish momentum. Blockchain advancements and expanding utility for Venice AI services may further support this growth.

Venice AI (VVV) Price Prediction 2029

During the post-halving bull market, VVV could reach $80–$350, riding on heightened investor euphoria and strong market sentiment. Expanded ecosystem partnerships and staking benefits may act as additional catalysts for sustained upward momentum.

Venice AI (VVV) Price Prediction 2030

As market overvaluation sets in, VVV could correct to $50–$280, reflecting the typical downturn after a peak cycle. Despite corrections, Venice AI’s core fundamentals could ensure the token maintains value above prior bear market lows.

Venice AI (VVV) Price Prediction 2031

CryptoTale predicts VVV may consolidate within $35–$200 during this stabilization phase. Accumulation by long-term holders and growing AI adoption may build a solid foundation for future growth as the next halving approaches.

Venice AI (VVV) Price Prediction 2032

Renewed optimism post-halving could propel VVV to $100–$450. Innovations in AI and blockchain, alongside increased privacy concerns, may draw users and investors, solidifying Venice AI’s position as a leader in decentralized AI technology.

Venice AI (VVV) Price Prediction 2033

During the post-halving peak, VVV might surge to $180–$650, reflecting a culmination of market euphoria, increased staking, and demand for privacy-focused AI services. Significant bullish momentum could push the token to new all-time highs.

Venice AI (VVV) Price Prediction 2034

The token may experience a correction, trading within $120–$590 as the market resets from overvaluation. Despite the downturn, Venice AI’s established ecosystem and growing adoption could limit losses compared to earlier bear market cycles.

Venice AI (VVV) Price Prediction 2035

According to our projections, VVV could stabilize between $150 and $600, supported by ongoing AI integration and mainstream blockchain adoption. The token’s growing utility and continued decentralization trends position it as a long-term contender in the crypto space.